Automotive and Transportation

Vessel Traffic Management Market

Vessel Traffic Management Market Size, Share, Growth & Industry Analysis, By System Type (Port Management Information Systems, Global Maritime Distress Safety Systems), By Component (Hardware, Software, Services), By End User (Commercial Ports, Defense & Coast Guard Agencies), and Regional Analysis, 2024-2031

Pages : 190

Base Year : 2023

Release : February 2025

Report ID: KR1375

Market Definition

The market encompasses systems designed to monitor and regulate marine traffic, ensuring safe and efficient navigation. These systems integrate radar, automatic identification systems (AIS), sensors, communication networks, and software to assist ports, harbors, and coastal authorities in optimizing vessel movements, minimizing congestion, and enhancing security.

Vessel Traffic Management Market Overview

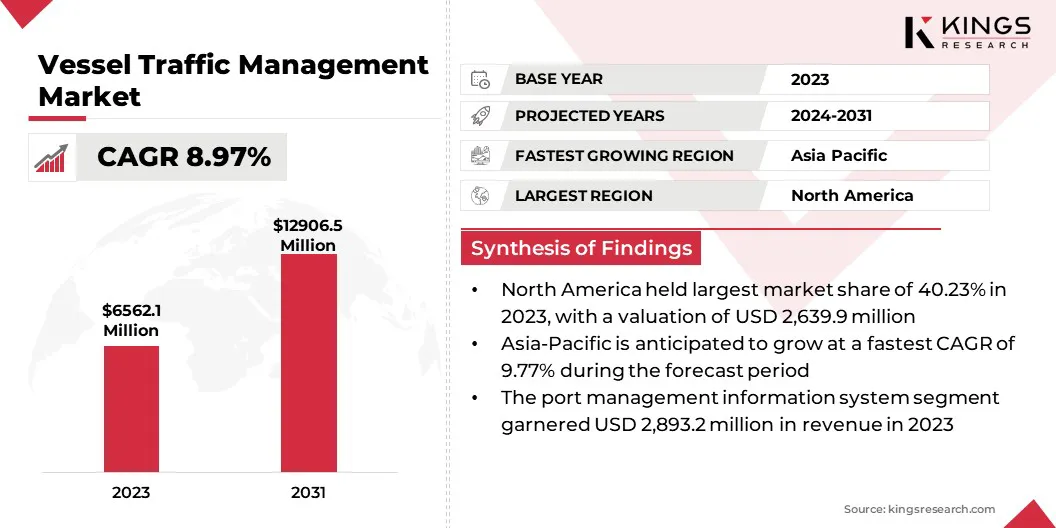

The global vessel traffic management market size was valued at USD 6,562.1 million in 2023 and is projected to grow from USD 7,073.8 million in 2024 to USD 12,906.5 million by 2031, exhibiting a CAGR of 8.97% during the forecast period.

The market is registering consistent growth, driven by the expansion of maritime trade, increasing emphasis on navigational safety, and advancements in digitalization & automation.

The adoption of vessel traffic management systems is enhancing port efficiency, security, and environmental sustainability across both commercial and defense sectors. Furthermore, stringent regulatory requirements for maritime safety and the integration of AI-driven technologies are accelerating market expansion.

The demand for advanced vessel traffic management solutions continues to rise as ports and coastal authorities strive to optimize vessel movements and mitigate congestion, contributing to the overall modernization of global maritime operations.

Major companies operating in the vessel traffic management industry are Marlan Maritime Technologies, Elcome International LLC, Xanatos Marine Ltd., KONGSBERG, TOKYO KEIKI, Thales, TERMA, Northrop Grumman, L3Harris Technologies, Inc, Hensoldt AG, Rohde & Schwarz, Hanwha Systems Co., Japan Radio Co, Wärtsilä, and Vissim AS.

- In January 2025, Kongsberg Maritime secured a contract to supply advanced propulsion and maneuvering technology for two KCR-70 Fast Attack Craft for the Indonesian Navy, currently under construction at Sefine Shipyard in Türkiye. The vessels will feature a Combined Diesel and Gas Turbine (CODAG) propulsion system, integrating twin controllable pitch propellers and a high-powered waterjet for enhanced speed and efficiency. Capable of speeds over 40 knots, the KCR-70 is designed for intelligence, surveillance, and combat missions.

Key Highlights:

- The vessel traffic management industry size was valued at USD 6,562.1 million in 2023.

- The market is projected to grow at a CAGR of 8.97% from 2024 to 2031.

- North America held a market share of 40.23% in 2023, with a valuation of USD 2,639.9 million.

- The commercial ports segment garnered USD 4,205.7 million in revenue in 2023.

- The port management information systems segment is expected to reach USD 6,135.4 million by 2031.

- The software segment is anticipated to register the fastest CAGR of 9.33% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 9.77% during the forecast period.

Market Driver

"Rising Maritime Trade and Technological Advancements Propel the Market"

One of the primary drivers of the vessel traffic management market is the increasing volume of maritime trade. The number of vessels navigating international waters has grown significantly as global trade expands, resulting in congestion at major ports and shipping lanes.

Efficient traffic management systems are crucial for ensuring seamless operations, minimizing delays, and enhancing port efficiency. Advanced vessel traffic management solutions integrating AI, automation, and real-time monitoring are being adopted to optimize vessel movements, enhance safety, and ensure compliance with international maritime regulations.

- In December 2024, the Maritime and Port Authority of Singapore (MPA) and MISC Berhad announced a strategic partnership to drive innovation and digital transformation in the maritime industry. The collaboration aims to enhance smart port solutions, decarbonization efforts, and workforce development through research and pilot projects. This initiative aligns with Singapore’s goal of becoming a leading global maritime hub by leveraging advanced technologies and sustainability-driven solutions.

Market Challenge

"Growing Threat of Cybersecurity Risks"

A major challenge in the vessel traffic management market is the growing threat of cybersecurity risks. Ports and maritime authorities are increasingly adopting digitalization, automation, and AI-driven technologies, becoming susceptible to cyber threats such as hacking, data breaches, and ransomware attacks.

A successful cyberattack could severely disrupt port operations, compromise navigational safety, and cause significant financial losses.

Maritime organizations should implement comprehensive cybersecurity frameworks incorporating firewalls, encryption, and intrusion detection systems to mitigate cybersecurity risks in vessel traffic management. Regular security audits and vulnerability assessments are essential for identifying and addressing potential threats.

Employee training programs should be conducted to enhance awareness of cyber risks and best practices. Adhering to international cybersecurity regulations, such as IMO guidelines, ensures compliance and strengthens security measures.

Market Trend

"Integration of AI-powered Predictive Analytics"

A significant trend in the vessel traffic management market is the increasing use of AI-driven predictive analytics to enhance operational efficiency and safety. Ports and maritime authorities are leveraging Artificial Intelligence (AI) and Machine Learning (ML) for real-time vessel tracking, traffic forecasting, and risk assessment.

These technologies enable predictive maintenance, automated congestion management, and optimized route planning, supporting smart port initiatives through seamless integration with IoT sensors and digital twin technology. This advancement enhances decision-making, improves situational awareness, and minimizes operational disruptions.

- In April 2024, the Maritime and Port Authority of Singapore (MPA) announced a collaboration with Amazon Web Services (AWS), Bureau Veritas, DNV, Google Cloud, Lloyd’s Register, Microsoft, and Wärtsilä to accelerate maritime digital transformation. The partnership focuses on AI-driven analytics, smart port solutions, and cybersecurity advancements to enhance efficiency and sustainability in the maritime sector.

Vessel Traffic Management Market Report Snapshot

|

Segmentation |

Details |

|

By System Type |

Port Management Information Systems (PMIS), Global Maritime Distress Safety Systems (GMDSS), River Information Systems (RIS), Ashore Traffic Management Systems (ATMS) |

|

By Component |

Hardware (Radars, Automatic Identification System (AIS), Sensors, Communication Systems, CCTV Surveillance), Software (Traffic Management Information System (TMIS), Port Management Information System (PMIS), Surveillance & Monitoring Software), Services (Installation & Integration, Consulting & Training, Maintenance & Support) |

|

By End User |

Commercial Ports, Defense & Coast Guard Agencies, Offshore Platforms |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By System Type (Port Management Information Systems (PMIS), Global Maritime Distress Safety Systems (GMDSS), River Information Systems (RIS), Ashore Traffic Management Systems (ATMS)): The port management information systems segment earned USD 2,893.2 million in 2023, due to the increasing need for efficient port operations, digitalization of maritime logistics, and the integration of smart technologies.

- By Component (Hardware (Radars, Automatic Identification System (AIS), Sensors, Communication Systems, CCTV Surveillance), Software (Traffic Management Information System (TMIS), Port Management Information System (PMIS), Surveillance & Monitoring Software), Services (Installation & Integration, Consulting & Training, Maintenance & Support)): The hardware segment held 48.12% share of the market in 2023, due to the increasing demand for advanced surveillance and monitoring equipment to enhance maritime safety and security.

- By End User (Commercial Ports, Defense & Coast Guard Agencies, Offshore Platforms): The commercial ports segment is projected to reach USD 8,106.4 million by 2031, owing to increasing global trade activities, heightened maritime security concerns, and the growing adoption of digitalization in port operations.

Vessel Traffic Management Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a vessel traffic management market share of around 40.23% in 2023, with a valuation of USD 2,639.9 million. This strong market presence is attributed to the well-established maritime infrastructure, high investments in port modernization, and stringent maritime safety regulations in the region.

The U.S. and Canada have been at the forefront of adopting advanced vessel traffic management systems to enhance port security, streamline operations, and mitigate risks associated with high maritime traffic.

Growing trade activities, increasing offshore exploration projects, and rising concerns over maritime security have fueled the demand for advanced monitoring and traffic management solutions in the region.

- In November 2024, UCLA and the Port of Los Angeles signed a Memorandum of Understanding (MOU) to advance sustainability, research, and community health. This partnership aims to foster collaborations with local neighborhoods, such as San Pedro and Wilmington, creating new learning, research, and workforce opportunities. The agreement focuses on integrating the latest maritime innovations, supply-chain management approaches, clean technologies, and ocean sciences into port operations.

The vessel traffic management industry in Asia Pacific is poised for significant growth at a robust CAGR of 9.77% over the forecast period, driven by the rapid expansion of maritime trade, substantial investments in port modernization, and an increasing emphasis on maritime safety.

Countries such as China, India, Japan, and South Korea are making significant investments in smart port infrastructure, automation, and digital vessel tracking technologies to enhance operational efficiency and strengthen security measures.

Regulatory Frameworks:

- The International Maritime Organization (IMO) mandates the establishment of Vessel Traffic Services (VTS) under SOLAS Regulation V/12, requiring coastal states to implement VTS where maritime traffic volume or the degree of navigational risk justifies such services. These services are designed to enhance the safety of life at sea, navigational efficiency, and environmental protection by providing real-time vessel monitoring, traffic management, and navigational assistance.

- The Convention on the International Regulations for Preventing Collisions at Sea, 1972 (COLREGs), adopted by the IMO, sets forth internationally recognized "rules of the road" for maritime navigation. It outlines right-of-way, light and sound signals, and steering rules to prevent collisions at sea.

- The IMO enforces the International Convention for the Safety of Life at Sea (SOLAS), the most significant treaty ensuring maritime safety. SOLAS sets minimum safety standards for ship construction, equipment, and operation. It includes regulations on navigation, fire protection, life-saving appliances, cargo handling, and maritime security to prevent accidents and enhance vessel safety.

- The IMO enforces the International Convention for the Prevention of Pollution from Ships (MARPOL), the primary global treaty aimed at preventing marine pollution caused by ships due to operational or accidental causes. MARPOL addresses various pollution sources, including oil, noxious liquid substances, harmful substances in packaged form, sewage, garbage, and air emissions.

- The International Labour Organization (ILO) established the Maritime Labour Convention, 2006 (MLC, 2006) to provide comprehensive rights and protection for more than 1.2 million seafarers in the world.

Competitive Landscape:

The vessel traffic management industry is characterized by several participants, including established corporations and rising organizations. Companies are focusing on technological advancements, strategic partnerships, and service expansions to gain a competitive edge in the market.

Key players are investing in AI-driven analytics, automation, and digital twin technology to enhance real-time vessel tracking and traffic optimization. Mergers, acquisitions, and collaborations with port authorities and maritime agencies are also key strategies to strengthen market presence and expand global reach.

Firms are prioritizing cybersecurity measures and compliance with international maritime regulations to ensure secure and efficient operations.

- In September 2023, the Port of Rotterdam Authority and inland shipping operator PortLiner formalized an agreement to construct a charging and storage pontoon for flow batteries in the Hartelkanaal. This facility will enable the supply of flow batteries to electrically powered inland vessels, marking the Netherlands' inaugural electrolyte bunkering station.

List of Key Companies in Vessel Traffic Management Market:

- Marlan Maritime Technologies

- Elcome International LLC

- Xanatos Marine Ltd.

- KONGSBERG

- TOKYO KEIKI

- Thales

- TERMA.

- Northrop Grumman

- L3Harris Technologies, Inc

- Hensoldt AG

- Rohde & Schwarz

- Hanwha Systems Co.

- Japan Radio Co

- Wärtsilä

- Vissim AS

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In January 2025, GSB Tankers and Asahi Tanker Co., Ltd. announced the formation of a joint venture aimed at expanding chemical tanker operations across Asia. Initially, the venture will manage four chemical tankers, with plans to increase the fleet to ten within the next two years. This collaboration seeks to leverage the strengths of both companies to enhance service offerings and operational efficiency in the region.

- In January 2024, Maersk A/S and Hapag-Lloyd AG announced a long-term operational collaboration named the Gemini Cooperation, set to commence in February 2025. This partnership aims to deliver a flexible and interconnected ocean network with industry-leading schedule reliability.

- In August 2024, NoTraffic and SWARCO McCain announced a partnership to deliver intelligent transportation systems. This collaboration aims to integrate NoTraffic's AI-driven traffic management platform with SWARCO McCain's traffic control solutions, enhancing urban mobility through optimized traffic flow and reduced congestion.

- In April 2024, Transporeon, a Trimble company, announced a collaboration with MODE Global, a leading third-party logistics platform. This partnership aims to leverage automation to tender both spot and dedicated freight using Transporeon's Autonomous Procurement solution. The platform will be customized for MODE Global as the "MODE Global Marketplace," enhancing efficiency in freight tendering processes.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)