Machinery Equipment-Construction

Vibration Sensor Market

Vibration Sensor Market Size, Share, Growth & Industry Analysis, By Material (Doped Silicon, Piezoelectric Ceramics, Quartz), By Type (Accelerometers, Velocity Sensor, Displacement Sensor), By Technology (Piezoresistive, Strain Gauge, Variable capacitance & Others), By End Use Industry, and Regional Analysis, 2024-2031

Pages : 150

Base Year : 2023

Release : January 2025

Report ID: KR1221

Market Definition

A vibration sensor is a device designed to measure and monitor oscillatory motion in machines, structures, or systems. Vibration sensors are commonly used in industries for predictive maintenance, fault detection, and condition monitoring of equipment, including motors, pumps, turbines, and bearings.

These sensors help identify irregularities and potential failures, ensuring the reliability and efficiency of mechanical systems. Types of vibration sensors include accelerometers, velocity sensors, and displacement sensors, each suited for specific applications.

Vibration Sensor Market Overview

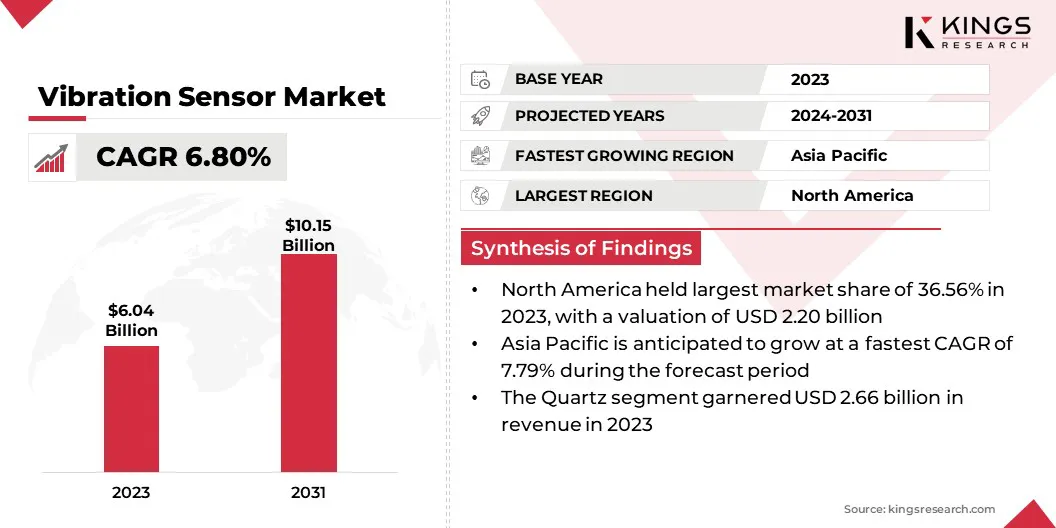

The global vibration sensor market size was valued at USD 6.04 billion in 2023 and is projected to grow from USD 6.40 billion in 2024 to USD 10.15 billion by 2031, exhibiting a CAGR of 6.80% during the forecast period.

The growth of the market is driven by increasing adoption across industrial applications, including predictive maintenance and condition monitoring in manufacturing and energy sectors. Rising demand for automation in industries and the integration of IoT technologies have further enhanced the utility of vibration sensors.

Major companies operating in the global vibration sensor market are Honeywell International Inc., SKF Group, Siemens, Emerson Electric Co., Bosch Sensortec GmbH, Texas Instruments Incorporated, NATIONAL INSTRUMENTS CORP, Rockwell Automation, NXP Semiconductors, TE Connectivity, Parker Hannifin, Endress+Hauser Group Services AG, PCB Piezotronics, Inc, Brüel & Kjær, Worldsensing, and others.

Vibration sensors provide valuable data on machine health, enabling predictive maintenance strategies that lower repair costs and extend asset life. This proactive approach to maintenance has gained traction across industries, including manufacturing, oil and gas, and utilities. The growing awareness of the benefits of condition monitoring further boosts the adoption of advanced vibration sensors.

- In June 2024, Baker Hughes, a leading energy technology company, introduced three advanced sensor technologies for gas, flow, and moisture measurement, aimed at enhancing safety performance. These innovative vibration sensor solutions are tailored for applications across sectors, including hydrogen, oil and gas, metals, chemicals, biogas, power generation, carbon capture, utilization, and storage (CCUS), among others.

Key Highlights:

- The global vibration sensor market size was recorded at USD 6.04 billion in 2023.

- The market is projected to grow at a CAGR of 6.80% from 2024 to 2031.

- North America held a revenue share of 36.56% in 2023, with a valuation of USD 2.21 billion.

- The accelerometers segment garnered a revenue of USD 2,634.3 billion in 2023.

- The piezoelectric ceramics segment is expected to reach USD 3,065.2 billion by 2031.

- The piezoresistive segment secured the largest revenue share of 24.19% in 2023.

- The aerospace & defense segment is poised to witness significant growth at a robust CAGR of 8.28% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 7.79% through the projection period.

Market Driver

"Growth in Industrial Automation"

The rising adoption of industrial automation is fueling the growth of the vibration sensor market. Manufacturing and process industries increasingly prioritize predictive maintenance to enhance efficiency and reduce operational downtime. Vibration sensors provide critical insights by identifying irregularities in machinery performance, ensuring timely interventions.

With Industry 4.0 advancing smart factories, the demand for advanced sensors has surged. These sensors support real-time condition monitoring, enabling businesses to maintain continuous operations and achieve cost savings.

- In April 2024, Murata Manufacturing introduced the PKGM-200D-R, a surface-mounted vibration sensor device for predictive maintenance. This sensor features an integrated temperature sensor to detect abnormal heat produced by equipment. Utilizing piezoelectric PZT ceramic vibration detection technology, it accurately measures vibration acceleration caused by metal friction, unaffected by noise interference.

Market Challenge

"Difficulty in Integration of Advanced Sensor Technologies with Traditional Systems"

A major challenge hindering the growth of the vibration sensor market is the difficulty of integrating advanced sensor technologies with outdated legacy systems prevalent in numerous industries. These older systems often lack the infrastructure or interfaces required for seamless connectivity, limiting the ability to collect and analyze real-time vibration data effectively.

To overcome this hurdle, companies are focusing on the development of retrofit solutions that allow modern sensors to be incorporated into existing machinery without extensive modifications. Plug-and-play devices are being designed to simplify installation and minimize downtime.

In addition, businesses are offering software tools that enable compatibility between modern sensors and older systems, ensuring seamless data acquisition and integration.

Market Trend

"Rising Adoption of Wireless Vibration Sensors"

The growing adoption of wireless vibration sensors is transforming the vibration sensor market. These sensors offer the advantage of simplified installation, reduced maintenance costs, and enhanced flexibility in monitoring remote or hard-to-reach locations.

- In March 2024, Swedish chemical manufacturer Perstorp Specialty Chemicals announced a substantial investment in Airius wireless vibration sensors from SPM Instrument. These Wi-Fi-enabled sensors are set to monitor process-critical equipment at Perstorp's facilities, enhancing vibration issue detection, minimizing machinery damage risks, and reducing operational costs.

Industries adopting wireless technology benefit from seamless data integration with cloud platforms, enabling advanced analytics and predictive insights. This shift toward wireless solutions aligns with the broader trend of digitization and connectivity, contributing to the growing demand for vibration sensors across sectors.

- In January 2024, Worldsensing introduced a wireless sensor to automate data collection for long-term, continuous vibration monitoring projects. This device assists engineering service providers in meeting regulations related to building integrity and vibration impact on individuals.

Vibration Sensor Market Report Snapshot

| Segmentation | Details |

| By Material | Doped Silicon, Piezoelectric Ceramics, Quartz |

| By Type | Accelerometers, Velocity Sensor, Displacement Sensor |

| By Technology | Piezoresistive, Strain Gauge, Variable Capacitance, Hand Probe, Optical, Tri-Axial, Others |

| By End Use Industry | Automobile, Consumer Electronics, Healthcare, Aerospace & Defense, Oil & Gas, Others |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Material (Doped Silicon, Piezoelectric Ceramics, Quartz): The quartz segment secured USD 2,663.0 billion in 2023 due to its high sensitivity, stability, and durability, which make it ideal for precision applications across various industries.

- By Type (Accelerometers, Velocity Sensor, Displacement Sensor): The accelerometers segment held a share of 43.61% in 2023, attributed to their high accuracy in measuring dynamic vibrations and widespread adoption across industries for monitoring machinery performance.

- By Technology (Piezoresistive, Strain Gauge, Variable capacitance, Hand probe, Optical, Tri-axial, and Others): The piezoresistive segment is projected to reach USD 2,663.7 billion by 2031, owing to due to its high accuracy, sensitivity, and cost-effectiveness in detecting small vibrations, making it ideal for a wide range of industrial applications.

- By End Use Industry (Automobile, Consumer Electronics, Healthcare, Aerospace & Defense, Oil & Gas, and Others): The aerospace & defense segment is likely to grow a robust CAGR of 8.28% during the forecast period, propelled by its high accuracy, sensitivity, and cost-effectiveness in detecting small vibrations, making it ideal for a wide range of industrial applications.

Vibration Sensor Market Regional Analysis

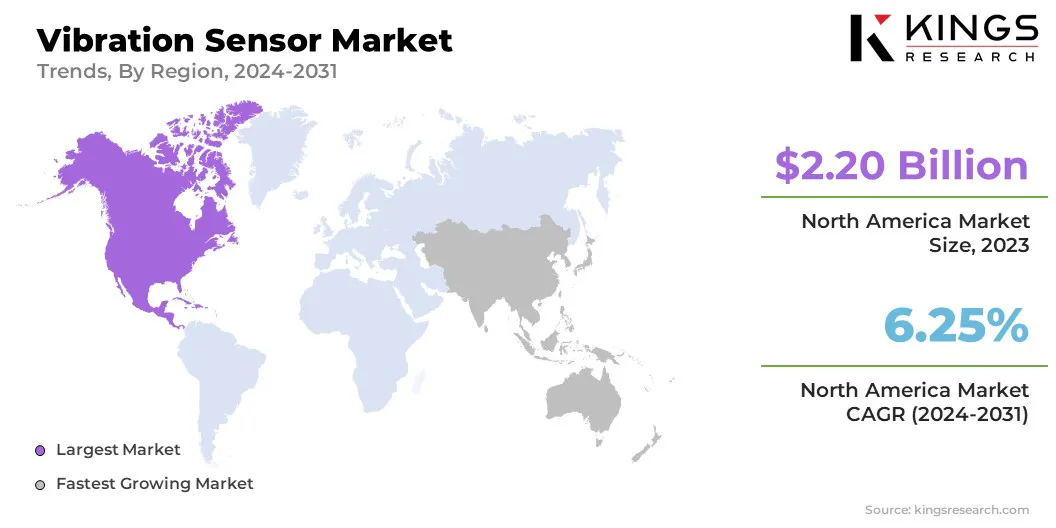

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America vibration sensor market secured a substantial share of around 36.56% in 2023, valued at USD 2.20 billion. The rapid integration of Industry 4.0 technologies, such as IoT and automation, is boosting the demand for advanced vibration monitoring systems.

Vibration sensors are being increasingly used in smart factories and automated processes, providing real-time data for more efficient and reliable operations. The growing adoption of connected devices and data-driven insights is further highlighting the need for sophisticated vibration sensing technologies across North America.

Additionally, in North America, stringent workplace safety regulations, such as OSHA standards, are prompting industries to adopt vibration sensors to comply with health and safety guidelines.

By monitoring vibration exposure, companies can mitigate risks such as hand-arm vibration syndrome (HAVS) and whole-body vibration (WBV), ensuring safer working conditions. The increasing emphasis on employee health and safety is promoting the widespread adoption of vibration sensors in various sectors.

Asia Pacific is set to grow at a CAGR of 7.79% over the forecast period. This growth is largely attributed to the growing oil and gas sector in the region. As exploration and production activities increase, the demand for advanced sensor technologies to monitor equipment health and ensure operational efficiency grows.

- In 2024, Global Energy Monitor reports that Asia accounts for 82% of global gas transmission pipeline construction, with China and India contributing 65% of the total construction value, estimated at USD 117.2 billion. This substantial share highlights Asia's critical role in the growth of gas infrastructure.

The expansion of offshore and onshore oil and gas operations is contributing to the increased demand for reliable vibration monitoring solutions across the region.

Region’s Regulatory Framework Also Plays a Significant Role in Shaping the Market

- OSHA Standards in the United States establish guidelines for vibration exposure limits, which can vary by state and industry. OSHA sets maximum exposure limits for vibration to reduce health risks, providing a valid representation of the regulations.

- The Control of Vibration at Work Regulations 2005 sets the exposure action values (EAV) and exposure limit values (ELV) for vibration. These values help employers manage risks related to vibration exposure, particularly in preventing health issues such as hand-arm vibration syndrome (HAVS).

- In India, the Factories Act of 1948 regulates industrial safety and health, including aspects related to vibration exposure. While specific vibration regulations are less detailed than those in some Western countries, guidelines from organizations like the Bureau of Indian Standards (BIS) provide general recommendations for managing vibration exposure in industrial settings. Additionally, The Indian National Occupational Safety and Health Standards provide further insights into workplace vibration risks.

- South Korea follows guidelines set by the KOSHA (Korea Occupational Safety and Health Agency), which provides regulations for managing health risks from workplace vibration. These standards are designed to protect workers from excessive vibration exposure, similar to those in Europe and North America.

- The ISO standards, namely ISO 5349 and ISO 10816, are critical for measuring hand-arm vibration and machine vibration, respectively. These standards help ensure accurate vibration assessments, particularly in industrial machinery and human exposure scenarios.

Competitive Landscape

The global vibration sensor market is characterized by a large number of participants, including both established corporations and rising organizations.

Key market participants include Honeywell International Inc., SKF Group, Siemens, Emerson Electric Co., Bosch Sensortec GmbH, Texas Instruments Incorporated, NATIONAL INSTRUMENTS CORP, Rockwell Automation, NXP Semiconductors, TE Connectivity, Parker Hannifin, Endress+Hauser Group Services AG, PCB Piezotronics, Inc, Brüel & Kjær, Worldsensing, and others.

To meet the increasing demand for advanced monitoring solutions, industry players are introducing new products that leverage cutting-edge technologies, such as IoT integration and AI-powered analytics, for real-time monitoring and predictive maintenance. These companies are aligning with strict regulatory standards to ensure safety, efficiency, and environmental protection.

By aligning with these standards and continually innovating, these companies are enhancing their competitive edge, fostering market growth, and contributing to the advancement of vibration sensor technology across industries such as manufacturing, energy, and transportation.

- In November 2023, Worldsensing introduced its latest wireless sensor, the Vibration Meter, specifically designed for long-term vibration monitoring projects. The device features a tri-axial MEMS accelerometer that offers extended battery life, an expanded communication range, and a more competitive price point compared to existing vibration technologies. Additionally, it complies with key industry regulations, making it an effective solution for continuous vibration monitoring across various applications.

List of Key Companies in Vibration Sensor Market

- Honeywell International Inc.

- SKF Group

- Siemens

- Emerson Electric Co.

- Bosch Sensortec GmbH

- Texas Instruments Incorporated

- NATIONAL INSTRUMENTS CORP

- Rockwell Automation

- NXP Semiconductors

- TE Connectivity

- Parker Hannifin

- Endress+Hauser Group Services AG

- PCB Piezotronics, Inc

- Brüel & Kjær

- Worldsensing

- Others

Recent Developments

- In March 2023, Honeywell unveiled its Versatilis Transmitters for condition-based monitoring of rotating equipment such as pumps, motors, compressors, fans, blowers, and gearboxes. These transmitters provide critical measurements of equipment performance, delivering insights that enhance safety, availability, and reliability across various industries.

- In August 2023, A. Hock launched the LoRaWAN easybox, a versatile solution for monitoring plant components using LoRaWAN technology. It supports vibration measurements of rotating equipment, pressure monitoring, and condition tracking of manually operated valves, offering a range of applications for efficient plant management.

- In January 2023, Kyocera Corporation unveiled a contactless intelligent millimeter-vibration sensing system. This system features a high-precision, low-noise sensor capable of detecting minute vibrations (measured in microns) without physical contact, along with various AI-based software modules. These advancements make it suitable for a range of applications requiring precise vibration measurement and intelligent analysis.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership