ICT-IOT

Virtual Machine Market

Virtual Machine Market Size, Share, Growth & Industry Analysis, By Type (System Virtual Machines, Process Virtual Machines), By Organization Size (Large Enterprises, Small and Medium Enterprises), By Vertical (BFSI, Telecommunications & ITES, Government & Public Sector & Others) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : August 2024

Report ID: KR995

Virtual Machine Market Size

The global Virtual Machine Market size was valued at USD 11.56 billion in 2023 and is projected to grow from USD 13.21 billion in 2024 to USD 37.84 billion by 2031, exhibiting a CAGR of 16.22% during the forecast period. The progress of the market is driven by the increasing adoption of cloud technology, the strong demand for cost-effective IT solutions, improvements in resource management, and the growing need for robust security and disaster recovery.

In the scope of work, the report includes solutions offered by companies such as Amazon Web Services, Inc., Broadcom, Cloud Software Group, Inc., Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., Microsoft Corporation, Oracle Corporation, Parallels International GmbH, Red Hat, Inc., IBM, and others.

The growth of the virtual machine (VM) market is propelled by the increasing adoption of cloud computing solutions, as VMs offer scalable and flexible environments that are essential for cloud-based applications. The growing demand for cost-effective IT solutions and the need for efficient resource management are fueling market growth.

Additionally, the rise in remote work and the necessity for robust disaster recovery solutions are contributing to this trend. Technological advancements, such as improved virtualization technologies and enhanced security features, further support market expansion by addressing evolving business needs and regulatory requirements.

- For instance, in May 2024, Red Hat and Pure Storage announced an optimization for Portworx on Red Hat OpenShift, which enables streamlined integration and allows enterprises to concurrently run virtualized and containerized applications. This development simplified operations and reduced costs by providing a unified platform for both VMs and containers. Additionally, it offered a single control plane for application management, facilitating faster time-to-market and improved data management.

The virtual machine market is experiencing robust growth, mainly propelled by the widespread adoption across various industries. Organizations are increasingly leveraging VMs to enhance operational efficiency, reduce hardware costs, and streamline IT management. The market is characterized by a diverse range of offerings, including basic VM solutions and advanced enterprise-grade platforms.

Key industry players are focusing on innovation to meet the evolving demands for performance, scalability, and security. As businesses increasingly adopt digital transformation, the VM market is anticipated to expand, with significant investments being directed toward cloud infrastructure and virtualization technologies.

A virtual machine (VM) is a software-based simulation of a physical computer that runs an operating system and applications in the same manner as a physical computer. VMs enable multiple operating systems to run concurrently on a single physical machine, thereby optimizing hardware utilization and enhancing overall efficiency.

They are created using virtualization technology, which abstracts and allocates physical resources to multiple virtual environments. VMs are utilized for various purposes, including the development, testing, and deployment of applications. They offer significant benefits such as isolation, scalability, and flexibility, making them integral to modern IT infrastructure.

Analyst’s Review

The virtual machine market is undergoing rapid evolution, propelled by key efforts from manufacturers to enhance virtualization technologies. Companies are focusing on integrating advanced features such as improved security, scalability, and compatibility with containerization technologies.

- For instance, in October 2023, Alludo announced the general availability of Parallels RAS Version 19.3, which introduced a range of new provisioning, automation, and security features. The update included enhancements such as improved image management, FSLogix management capabilities, and compliance with advanced TLS and FIPS standards. Additionally, the Parallels Client received a modernized user interface. These improvements aimed to enhance remote work experiences, streamline IT management, and reduce operational costs across enterprises.

New product developments include hybrid virtualization platforms that cater to both VMs and containers, addressing the growing demand for versatile IT solutions. It is recommended that businesses evaluate their virtualization needs carefully and consider solutions that offer seamless integration with existing infrastructure. Additionally, staying updated on the latest innovations and security features is crucial for maintaining a competitive edge and ensuring efficient resource management in a dynamic market environment.

Virtual Machine Market Growth Factors

The increasing shift toward cloud computing is augmenting the growth of the virtual machine market. Organizations are increasingly adopting cloud solutions to gain flexibility, reduce infrastructure costs, and enhance scalability. VMs are playing a crucial role in this transition by providing virtualized resources that support a wide range of applications and workloads.

This transition to the cloud is further allowing businesses to manage resources more efficiently and respond rapidly to changing demands. As companies increasingly seek to leverage the benefits of cloud technology, the demand for VMs is rising, thereby supporting ongoing market expansion and fostering innovation in virtualization technologies.

Security concerns related to data breaches and vulnerabilities present a key challenge to the development of the industry. VMs, due to their nature, introduce additional security risks if not managed properly. To overcome this challenge, organizations are implementing advanced security measures such as multi-layered encryption, robust access controls, and regular security audits.

Utilizing security solutions specifically designed for virtual environments and ensuring that VMs are regularly updated with the latest security patches are critical measures. By adopting these strategies, businesses are mitigating security risks and protecting their virtualized infrastructure from potential threats.

Virtual Machine Market Trends

The growing adoption of hybrid cloud environments is significantly impacting the market. Organizations are increasingly combining private and public clouds to enhance flexibility and maintain greater control over their IT resources. Virtual machines are increasingly utilized to bridge the gap between on-premises infrastructure and cloud services, facilitating seamless integration and enhancing resource management efficiency.

This trend is boosting the demand for VM solutions that support multi-cloud strategies and offer interoperability between different environments. As businesses actively seek to leverage the benefits of both private and public clouds, the market is adapting to provide solutions that facilitate efficient and secure hybrid cloud operations.

The rise of containerization technology is reshaping the landscape of the virtual machine market. Containers, which provide lightweight, isolated environments for running applications, complement traditional VMs by offering greater efficiency and faster deployment. Companies are increasingly adopting container-based solutions to streamline development processes and improve scalability.

This trend is influencing the VM market by fueling the demand for more integrated solutions that support both VMs and containers. Vendors are focusing on developing hybrid platforms that enable organizations to manage and orchestrate VMs and containers seamlessly, in response to the growing need for versatile and efficient virtualization technologies.

Segmentation Analysis

The global market is segmented based on type, organization size, vertical, and geography.

By Type

Based on type, the market is categorized into system virtual machines and process virtual machines. The system virtual machine segment led the virtual machine market in 2023, reaching a valuation of USD 7.21 billion. This notable growth is attributed to its ability to provide comprehensive virtualization of hardware resources. These VMs allow multiple operating systems to run concurrently on a single physical server, thereby enhancing resource utilization and reducing infrastructure costs.

Organizations are increasingly adopting system virtual machines to support complex applications, manage large-scale IT environments, and ensure high availability. The surging demand for improved operational efficiency and the pressing need to optimize hardware investments are aiding the growth of the segment.

By Organization Size

Based on organization size, the market is classified into large enterprises and small and medium enterprises (SMEs). The small and medium enterprises (SMEs) segment is poised to witness significant growth at a staggering CAGR of 17.40% through the forecast period (2024-2031), mainly due to the increasing affordability and accessibility of virtualization technologies.

SMEs are adopting virtual machines to achieve cost savings, enhance operational flexibility, and support remote work initiatives. The scalability and ease of management offered by VMs are particularly appealing to smaller organizations with limited IT resources. As virtualization solutions become increasingly tailored to the specific needs of SMEs, the small and medium enterprises (SMEs) segment is projected to expand substantially.

By Vertical

Based on verticals, the market is segmented into BFSI, telecommunications & ITES, government & public sector, healthcare & life sciences, and others. The BFSI segment secured the largest virtual machine market share of 30.12% in 2023, mainly propelled by its critical need for robust, secure, and scalable IT infrastructure.

Financial institutions and insurance companies rely heavily on virtualization to manage large volumes of data, ensure high availability, and support complex applications. The BFSI sector's focus on regulatory compliance, data security, and efficient resource management is boosting the demand for VMs, thereby supporting segmental expansion.

Virtual Machine Market Regional Analysis

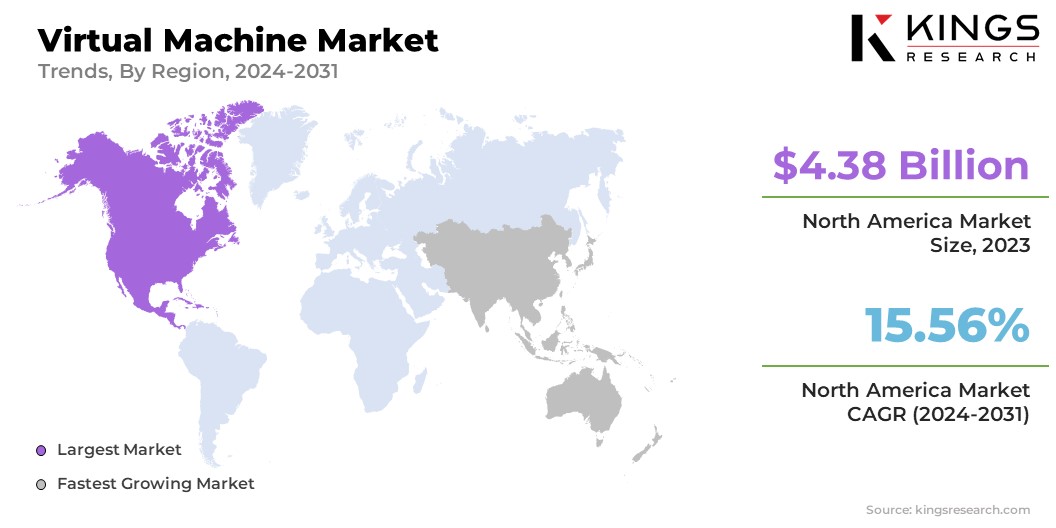

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America virtual machine market captured a substantial share of around 37.87% in 2023, with a valuation of USD 4.38 billion. This dominance is reinforced by its advanced technological infrastructure and high adoption rates of IT solutions. The region is home to numerous leading technology companies and data centers, creating a strong demand for virtualization technologies.

Businesses in North America are increasingly utilizing virtual machines to optimize resource management, enhance operational efficiency, and support digital transformation initiatives. The significant investment in IT infrastructure and the presence of a robust technology ecosystem further contribute to the development of the regional market.

Asia-Pacific is poised to experience notable growth at a staggering CAGR of 17.52% over the forecast period. Asia-Pacific is emerging as the fastest-growing region due to rapid economic development and increasing IT investments. The region's expanding digital economy, coupled with the growing adoption of cloud computing and virtualization technologies, is fostering regional market growth.

Businesses across Asia-Pacific are investing heavily in virtual machines to improve scalability, reduce costs, and support the growing demand for digital services. This rapid expansion is further fueled by the region's large and diverse market, which continuously adopts technological advancements.

Competitive Landscape

The global virtual machine market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Virtual Machine Market

- Amazon Web Services, Inc.

- Broadcom

- Cloud Software Group, Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- Microsoft Corporation

- Oracle Corporation

- Parallels International GmbH

- Red Hat, Inc.

- IBM

Key Industry Developments

- June 2024 (Partnership): ITQ announced a partnership with SUSE to transition from traditional virtual machine workloads to modern cloud-native solutions. This collaboration, unveiled at SUSECON 2024, focuses on SUSE’s Rancher Prime and Harvester platforms, aiming to enhance ITQ's capabilities to provide secure and integrated services for Hybrid Cloud and Cloud Native solutions. This partnership leverages ITQ’s extensive experience in enterprise virtual infrastructure and cloud-native platforms.

- May 2024 (Partnership): Red Hat, Inc. and Nutanix expanded their collaboration to include Red Hat Enterprise Linux in the Nutanix Cloud Platform. This integration enhanced hybrid multicloud operations by combining Nutanix's resilience and scalability with Red Hat's enterprise-grade Linux capabilities. Additionally, Nutanix committed to contributing to CentOS Stream, with a major focus on hypervisor functionality, networking, and storage performance to support emerging AI workloads on Red Hat Enterprise Linux.

The global virtual machine market is segmented as:

By Type

- System Virtual Machines

- Process Virtual Machines

By Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Vertical

- BFSI

- Telecommunications & ITES

- Government & Public Sector

- Healthcare & Life Sciences

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership