Energy and Power

Warehouse Management System Market

Warehouse Management System Market Size, Share, Growth & Industry Analysis, By Component (Software, Hardware, Services), By Deployment (Cloud-based, On-premises), By End-Use Industry (Retail & Consumer Goods, Manufacturing, Healthcare & Pharmaceuticals, Transportation & Logistics, E-commerce, Others), and Regional Analysis, 2024-2031

Pages : 190

Base Year : 2023

Release : January 2025

Report ID: KR1252

Market Definition

A warehouse management system (WMS) is a software solution designed to optimize and streamline warehouse operations by managing the storage, movement, and tracking of inventory within a facility. It provides tools for efficiently handling tasks such as inventory control, order fulfillment, picking, packing, shipping, and real-time tracking of stock levels.

A WMS helps improve accuracy, efficiency, and productivity by integrating with other systems like Enterprise Resource Planning (ERP) and Transportation Management Systems (TMS), ensuring seamless coordination across supply chain processes.

Warehouse Management System Market Overview

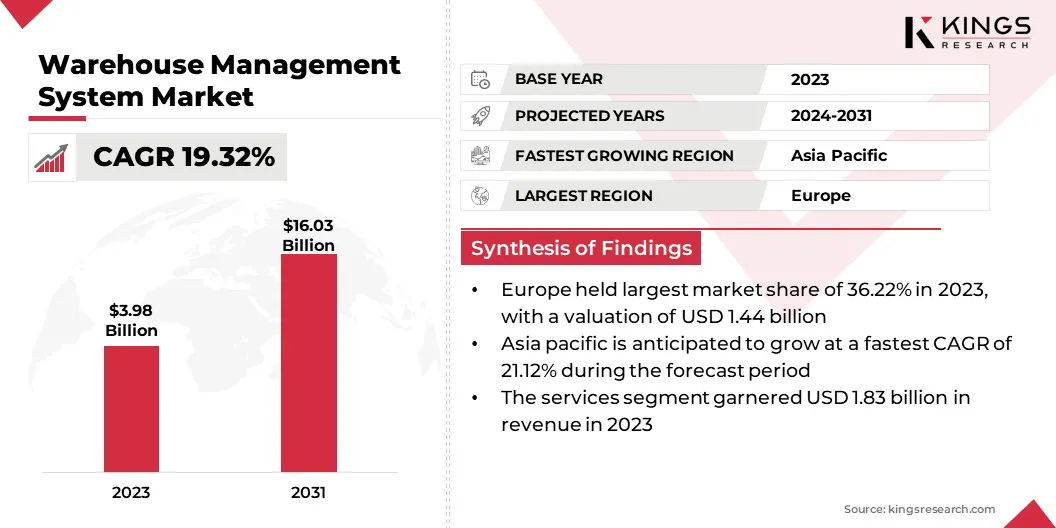

The global warehouse management system market size was valued at USD 3.98 billion in 2023, which is estimated to be valued at USD 4.66 billion in 2024 and reach USD 16.03 billion by 2031, growing at a CAGR of 19.32% from 2024 to 2031.

The growth of the market is driven by the rapid expansion of e-commerce, increasing adoption of automation technologies, and rising demand for real-time inventory tracking.

The shift to omnichannel retailing and cloud-based WMS solutions further accelerates adoption. Additionally, the need for enhanced supply chain resilience, operational efficiency, and compliance with regulatory requirements fosters market growth.

Major companies operating in the global warehouse management system market are Körber AG, Manhattan Associates, Oracle, SAP, Synergy Logistics Ltd., Blue Yonder Group, Inc., IBM, PSI Software SE, Telco S.r.l., Softeon, NEC Corporation, Cisco Systems Inc., Infor, Tecsys Inc., Fishbowl, and others.

The rapid expansion of third-party logistics (3PL) providers is driving the market. 3PL companies manage warehousing, distribution, and transportation activities for multiple clients, requiring highly scalable and efficient solutions to handle diverse operational needs.

WMS enables 3PL providers to ensure accurate inventory management, optimize warehouse space, and enhance client-specific workflows. The ability to offer value-added services such as real-time tracking and customized reporting has further fueled the adoption of WMS among 3PL providers.

- In September 2024, Made4net, a global leader in cloud-based WMS and supply chain execution software, announced that Arctic Logistics, a prominent third-party public refrigerated warehouse based in Canton, Michigan, enhanced its operations by adopting Made4net's Synapse 3PLExpert WMS. This 3PL-focused WMS solution is enabling the company to address the growing needs of its diverse client base effectively.

Key Highlights:

- The global warehouse management system market size was recorded at USD 3.98 billion in 2023.

- The market is projected to grow at a CAGR of 19.32% from 2024 to 2031.

- Europe held a market share of 36.22% in 2023, with a valuation of USD 1,441.6 billion.

- The services segment garnered USD 1,831.2 billion in revenue in 2023.

- The cloud-based segment is expected to reach USD 9,222.6 billion by 2031.

- The e-commerce segment is poised for a robust CAGR of 23.47% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 21.12% during the forecast period.

Market Driver

"Global E-commerce expansion"

The rise of e-commerce has significantly fueled the warehouse management system market. Businesses are increasingly focusing on streamlining their warehouse operations to handle high order volumes, manage diverse inventories, and fulfill orders within shorter timelines.

WMS solutions enable real-time tracking, efficient picking, and precise inventory control, ensuring seamless order fulfillment for online retailers. Additionally, the growing consumer preference for faster delivery options and seamless return processes has further accelerated the adoption of WMS.

- The International Trade Administration's 2024 report projects global B2C e-commerce revenue to reach USD 5.5 trillion by 2027, growing at a steady compound annual growth rate (CAGR) of 14.4%. The leading B2C e-commerce segments, ranked in order, include consumer electronics, fashion, furniture, toys and hobbies, biohealth pharmaceuticals, media and entertainment, beverages, and food.

Market Challenge

"High implementation cost associated with advanced WMS solutions"

A significant challenge hindering the growth of the warehouse management system market is the high implementation cost associated with advanced WMS solutions. The initial expenses for hardware, software, and system integration can be substantial, especially for small and medium-sized enterprises (SMEs).

Companies are increasingly offering flexible pricing models, such as subscription-based and cloud-hosted solutions, which reduce upfront costs. Additionally, vendors are providing scalable systems tailored to business size and needs, enabling gradual adoption.

Collaborative partnerships with technology providers and government incentives are also helping businesses overcome financial barriers to adopt WMS solutions effectively.

Market Trend

"Automation and digitalization"

The growing integration of automation technologies and digitalization in warehouses is driving the warehouse management system market. Advanced technologies such as robotics, IoT, and artificial intelligence (AI) have transformed traditional warehousing by enhancing speed, accuracy, and productivity.

WMS plays a pivotal role in managing these automated workflows, enabling businesses to optimize processes such as order picking, sorting, and inventory tracking. The increasing focus on reducing labor dependency, minimizing errors, and achieving cost efficiency has led companies to adopt WMS solutions that align with automated operations.

- In December 2024, Körber Supply Chain Software announced a partnership with Dexory to enhance warehouse visibility and operational efficiency. This collaboration integrates Körber’s Warehouse Management Systems with DexoryView, a platform powered by autonomous mobile robots that scan warehouses and deliver real-time inventory insights.

Warehouse Management System Market Report Snapshot

| Segmentation | Details |

| By Deployment | Cloud-based, On-premises |

| By End Use Industry | Retail & Consumer Goods, Manufacturing, Healthcare & Pharmaceuticals, Transportation & Logistics, E-commerce, Others |

| By Component | Software (Core WMS, Warehouse Execution System (WES), Transportation Management System (TMS), Labor Management System (LMS), Others), Hardware (Bar code scanners, RFID readers, Pick-to-light systems, Others), Services (Consulting, Implementation, Integration, Support & Maintenance, Training) |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Component (Software, Hardware, Services): The services segment earned USD 1.83 billion in 2023, due to the growing demand for system integration, customization, and ongoing technical support, which are essential for optimizing WMS deployment and ensuring seamless operations.

- By Deployment (Cloud-based, On-premises): The cloud-based segment held 56.75% of the market in 2023, due to its scalability, cost-efficiency, and seamless integration capabilities, allowing businesses to access real-time data and improve operational flexibility without the need for extensive upfront infrastructure investments.

- By End-Use Industry (Retail & Consumer Goods, Manufacturing, Healthcare & Pharmaceuticals, Transportation & Logistics, E-commerce, Others): The e-commerce segment is projected to reach USD 6.90 billion by 2031, owing to its need for efficient inventory management, real-time tracking, and fast order fulfillment to meet the increasing demand for quick and accurate deliveries in a highly competitive environment.

Warehouse Management System Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

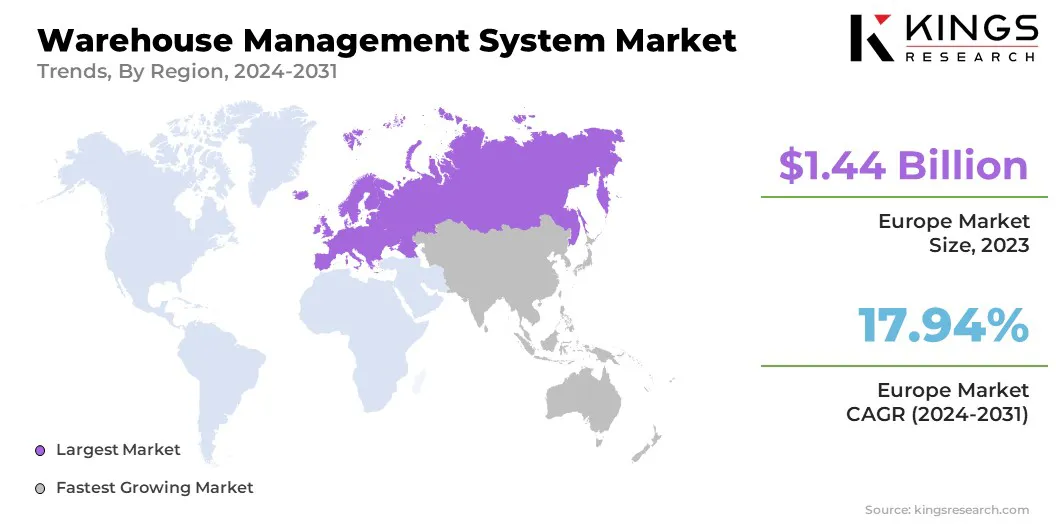

Europe accounted for around 36.22% share of the warehouse management system market in 2023, with a valuation of USD 1.44 billion. The growing use of automation and AI technologies in European warehouses is fueling the demand for sophisticated WMS solutions. These technologies enhance operational efficiency, reduce manual errors, and improve real-time decision-making, driving the market.

- In March 2024, UK-based robotics and data intelligence firm Dexory is launching an innovative, AI-powered logistics engine designed to help warehouses improve operational efficiency, optimize inventory management, and boost overall agility and responsiveness.

Additionally, Europe’s strong emphasis on sustainability is propelling the demand for WMS solutions that optimize warehouse operations and reduce energy consumption. Companies are increasingly adopting WMS to achieve higher efficiency and reduce their carbon footprints, aligning with regional environmental goals.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 21.12% over the forecast period. The rapid growth of e-commerce in Asia Pacific region is a major driver of the warehouse management system market.

With the surge in online shopping, businesses need more efficient and scalable solutions to manage inventory, optimize order fulfillment, and ensure faster deliveries. This trend is fueling the demand for advanced WMS solutions across the region.

- Based on data from the International Trade Administration (ITA), India is expected to lead global retail e-commerce development from 2023 to 2027, with a compound annual growth rate of 14.1%, ranking first among 20 countries.

Furthermore, the growing industrialization and expansion of the manufacturing sector in Asia Pacific are contributing significantly to the market growth. As supply chains become more complex, businesses are adopting WMS solutions to streamline operations, manage large inventories, and improve supply chain efficiency, particularly in countries like China and India.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the FDA's FSMA Final Rule on Requirements for Additional Traceability Records for Certain Foods, implemented in November 2022, is a critical regulation impacting the warehouse management systems market, particularly in the food supply chain. This rule mandates comprehensive recordkeeping for high-risk foods to enhance traceability and mitigate risks during foodborne illness outbreaks. Warehouses managing food storage and distribution must implement advanced WMS solutions to comply with these stringent requirements.

- The EPA has approved the Warehouse Indirect Source Rule (ISR) as part of California's air plan, enabling communities to hold warehouse owners accountable for pollution from truck traffic. This rule mandates large warehouses to implement measures to limit tailpipe emissions, such as electrifying vehicle fleets or installing EV chargers.

- The European Green Deal mandates stricter environmental standards, encouraging warehouses to adopt energy-efficient technologies and sustainable practices. WMS providers in Europe are increasingly required to integrate solutions that support carbon-neutral operations, efficient inventory management, and optimized transportation to align with these regulations.

- In India, the Warehousing (Development and Regulation) Act, 2007 mandates the registration of warehouses and the issuance of negotiable warehouse receipts to ensure accountability and standardization within the warehousing sector. This legislation aims to create a regulated environment for warehousing, promote the use of standardized systems, and enhance transparency in warehouse operations.

- On the international stage, the International Organization for Standardization (ISO) provides management system standards such as ISO 9001 for quality management, ISO 14001 for environmental management, and ISO 50001 for energy management. These standards help organizations ensure efficiency, environmental responsibility, and energy efficiency in warehouse operations.

Competitive Landscape:

The market is characterized by a number of participants, including established corporations and rising organizations.

Companies are adopting strategies such as introducing innovative solutions and implementing cloud-based software technologies to drive the market. These approaches enable enhanced scalability, real-time data access, and seamless integration, allowing businesses to optimize warehouse operations and improve overall efficiency.

By leveraging cloud-based platforms, organizations can reduce infrastructure costs and adapt to dynamic market demands, further contributing to the expansion of the warehouse management system market.

- In March 2023, Maersk implemented advanced technology solutions to enhance warehouse fulfillment operations and delivery speed to customers. By utilizing cloud-based software integrated with industrial scanning technology, the company deployed a fleet of U.S.-manufactured mobile units that work collaboratively with warehouse staff. This system enables instant item scanning while reducing the need for excessive walking, significantly improving efficiency and productivity.

List of Key Companies in Warehouse Management System Market:

- Körber AG

- Manhattan Associates

- Oracle

- SAP

- Synergy Logistics Ltd.

- Blue Yonder Group, Inc.

- IBM

- PSI Software SE

- Telco S.r.l.

- Softeon

- NEC Corporation

- Cisco Systems Inc.

- Infor

- Tecsys Inc.

- Fishbowl

Recent Developments:

- In December 2024, Manhattan Associates announced that Lamps Plus, the nation’s leading specialty lighting retailer, has implemented Manhattan’s Demand Forecasting and Inventory Optimization (DFIO) solution. This implementation aims to enhance forecast accuracy, improve visibility into replenishment cycles, and effectively meet high customer expectations.

- In May 2024, Manhattan Associates partnered with Schneider Electric, a global leader in energy management and industrial automation, to implement Manhattan Active Warehouse Management and Manhattan Active Transportation Management. This collaboration aims to enhance Schneider Electric’s global distribution and transportation network as part of its ongoing business transformation strategy.

- In February 2024, Vantiva, a global supply chain services provider, entered into an agreement with Softeon to implement its warehouse management system (WMS) solution. This collaboration aims to optimize Vantiva's fulfillment performance across channels, facilitating faster customer onboarding and improved fulfillment times.

- In February 2024, Prysmian, a global leader in the energy and telecom cable industry, collaborated with Blue Yonder to implement its SaaS-based Warehouse Management System (WMS) at Prysmian's Canadian warehouse. This partnership aims to promote a more sustainable and customer-focused supply chain.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership