Energy and Power

Waste to Energy Market

Waste to Energy Market Size, Share, Growth & Industry Analysis, By Waste Type (Municipal Waste, Industrial Waste, Others), By Technology (Thermal, Biological, Others) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : May 2024

Report ID: KR710

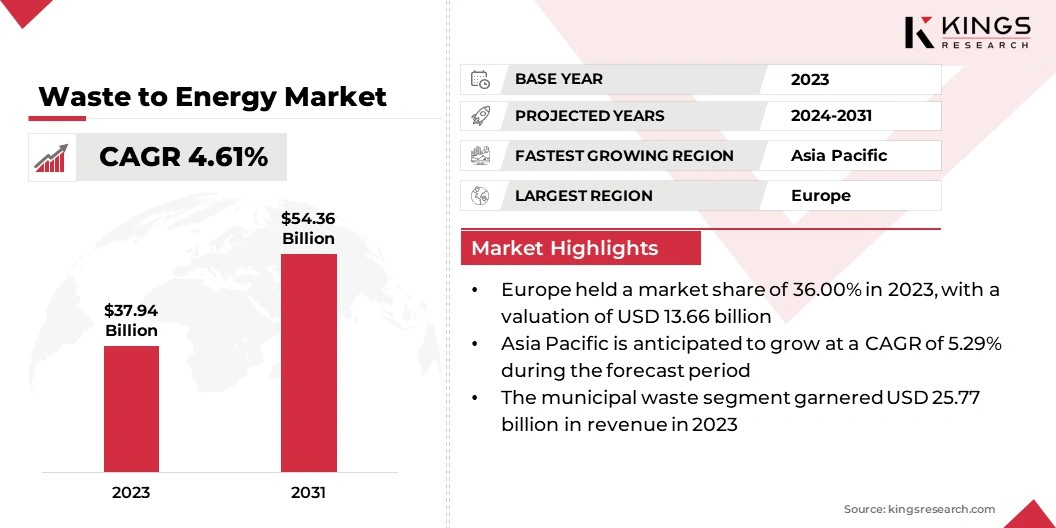

Waste to Energy Market Size

The global Waste to Energy Market size was valued at USD 37.94 billion in 2023 and is projected to reach USD 54.36 billion by 2031, growing at a CAGR of 4.61% from 2024 to 2031. The market is experiencing significant growth mainly due to ever-increasing energy demand, along with the implementation of stringent environmental regulations to combat climate change. In the scope of work, the report includes products offered by companies such as Veolia, SUEZ Group, Covanta Holding Corporation, Babcock & Wilcox Enterprises, Inc., Hitachi Zosen Inova AG, Fortum, MVV Energie AG, Attero, Viridor, ACCIONA and others.

Moreover, the growing interest in circular economy initiatives and resource recovery strategies is driving market expansion. As global awareness of resource scarcity and environmental degradation is increasing, there is a paradigm shift toward viewing waste as a valuable resource rather than solely a problem. This shift is driving the adoption of waste to energy technologies as part of comprehensive waste management strategies. Furthermore, the increasing emphasis on waste minimization and recycling, which complements waste-to-energy solutions by diverting non-recyclable waste from landfills, is propelling market growth.

Additionally, the emergence of decentralized waste-to-energy systems is presenting new opportunities for key players, especially in remote or off-grid areas. These systems offer localized solutions for waste management and energy generation, thereby reducing reliance on centralized infrastructure and mitigating transportation costs. Moreover, the integration of waste-to-energy facilities with industrial complexes and urban infrastructure is enhancing resource efficiency and fostering resilience against supply chain disruptions.

The waste to energy market encompasses the conversion of non-recyclable waste materials into usable energy forms, such as electricity or heat, through various technological processes, including incineration, gasification, and anaerobic digestion. It involves the integration of waste management and energy production, offering solutions for both environmental sustainability and energy security. Key components of the market include waste collection and segregation, processing facilities, energy generation infrastructure, and regulatory frameworks governing waste disposal and emissions.

Analyst’s Review

The waste to energy market is witnessing steady growth driven by rapid urbanization, stringent environmental regulations, and growing demand for renewable energy sources. Key players in the market are strategically focusing on technological innovation, broadening their energy source portfolio, and fostering strategic alliances to seize burgeoning opportunities.

Moreover, significant investments in research and development initiatives are underway to bolster operational efficiency and bolster sustainability practices, expand geographic presence to tap into new markets and forge strategic alliances with waste management companies and government agencies to secure long-term contracts and regulatory support.

Waste to Energy Market Growth Factors

The waste to energy market is experiencing notable growth due to rising global waste generation, propelled by rapid urbanization and economic expansion, particularly in developing countries. Traditional waste management systems are increasingly facing strain as landfills approach capacity limits. Waste to energy technologies have emerged as a sustainable alternative, converting non-recyclable waste into energy and alleviating pressure on landfills. For instance, China's rapid urbanization has spurred investments in waste to energy infrastructure to efficiently manage increasing waste volumes.

Furthermore, with the global shift toward a circular economy and waste hierarchy, the significance of waste to energy becomes paramount. It involves converting residual waste that cannot be recycled or composted into usable energy. While waste reduction and recycling remain priorities, waste to energy ensures the responsible management of residual waste, thereby contributing significantly to waste-to-energy solutions.

- For instance, in countries such as Sweden and Denmark, where circular economy principles are prominent, waste to energy plants play a vital role in converting residual waste into energy, thereby complementing recycling efforts and providing cleaner energy.

Additionally, policy initiatives advocating for renewable energy and waste diversion are supporting the growth of the waste to energy market. Governments globally are enacting stricter landfill bans and setting ambitious renewable energy targets, thereby fostering the adoption of waste to energy technologies. By diverting waste from landfills and integrating renewable energy, waste to energy process aligns with these policy objectives.

- For instance, Germany's Renewable Energy Sources Act incentivizes energy production from cleaner energy sources, including waste to energy plants.

However, high capital costs associated with building and operating waste to energy plants pose a notable challenge, especially for regions with limited financial resources. The substantial upfront investments required for infrastructure development and advanced pollution control systems hinder the widespread adoption of waste to energy technologies. Key players are addressing these capital constraints through innovative financing mechanisms, public-private partnerships, and international collaborations to overcome barriers to entry and promote the sustainable development of the waste-to-energy sector globally.

Waste to Energy Market Trends

Diversification of waste streams utilized in waste to energy facilities is projected to drive market expansion. While municipal solid waste remains a predominant source, there is a growing exploration of alternative feedstocks, including industrial waste, agricultural waste, and construction debris. This diversification is demanding advancements in pre-treatment technologies to effectively handle the varying compositions of these waste streams, thereby enhancing the flexibility and efficiency of waste to energy operations.

Furthermore, a notable shift toward the adoption of advanced waste-to-fuel technologies such as pyrolysis and gasification is propelling the demand. These technologies offer cleaner conversion processes and the potential to produce valuable byproducts such as syngas or biofuels, which are presenting new revenue streams and enhancing the overall sustainability of waste to energy operations.

Additionally, the rising emphasis on integrating waste to energy plants with smart city initiatives is augmenting the growth of the market. Due to smart city infrastructure, waste to energy facilities optimize waste collection, transportation, and energy generation processes, leading to improved efficiency and a more sustainable waste management system. This integration enhances the overall effectiveness of waste to energy operations while contributing to broader smart city objectives of resource optimization and sustainability.

Segmentation Analysis

The global waste to energy market is segmented based on waste type, technology, and geography.

By Waste Type

Based on waste type, the market is categorized into municipal waste, industrial waste, and others. The municipal waste segment generated the highest revenue of USD 25.77 billion in 2023. The rapid global urbanization has led to a significant surge in municipal waste generation, particularly in densely populated areas. This segment benefits from consistent waste streams and regulatory pressures to reduce landfilling, thus driving demand for waste to energy solutions.

Additionally, the rising environmental awareness among urban populations underscores the importance of sustainable waste management practices, which is boosting the adoption of waste to energy technologies in municipal waste treatment facilities.

By Technology

Based on technology, the market is divided into thermal, biological, and others. The thermal segment captured the largest market share of 71.73% in 2023. Thermal waste to energy technologies, such as incineration and gasification, offer efficient means of converting waste into energy. These methods have garnered widespread adoption due to their proven reliability and scalability.

The thermal technologies exhibit efficiency in converting diverse waste streams, including municipal solid waste and industrial waste while maintaining high energy recovery rates. Moreover, advancements in thermal waste to energy technologies, such as improved combustion efficiency and emission control systems, have enhanced their attractiveness, thereby contributing to their widespread deployment in the market.

Waste to Energy Market Regional Analysis

Based on region, the global waste to energy market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Europe Waste to Energy Market share stood around 36.00% in 2023 in the global market, with a valuation of USD 13.66 billion. The region boasts stringent environmental regulations, which are driving innovation in cleaner technologies and efficient plant operations. With some of the stringent regulations on waste disposal and air emissions, Europe fosters a culture of continuous improvement in waste to energy processes to meet regulatory standards.

Moreover, European countries' heavy investments in renewable energy targets are supporting the expansion of the waste to energy sector. This positions it as a reliable source of baseload power and a significant contributor to waste diversion from landfills, thus aligning with sustainability objectives. Additionally, the region benefits from well-established public-private partnerships (PPPs) structure in waste to energy projects, facilitating efficient project financing and risk-sharing between government entities and private investors. This collaborative approach fosters a favorable environment for sustainable development and growth of the European waste to energy market.

Asia-Pacific is projected to witness the highest growth at a CAGR of 5.29% between 2024 and 2031. Rapid urbanization and surging economic growth have led to a substantial expansion of industrial sectors and cities in emerging countries within the region, thereby increasing waste generation and driving demand for waste to energy solutions.

Governments across the region are actively supporting the adoption of waste to energy technologies as a vital component of their waste management strategies. This support includes financial incentives and streamlined permitting processes tailored for waste to energy projects, thereby facilitating investment and development in the sector. With a growing focus on addressing environmental challenges and ensuring sustainable energy production, the Asia-Pacific region presents significant opportunities for the expansion of the waste to energy market.

Competitive Landscape

The global waste to energy market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Companies are implementing impactful strategic initiatives, such as expanding service offerings, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Waste to Energy Market

- Veolia

- SUEZ Group

- Covanta Holding Corporation

- Babcock & Wilcox Enterprises, Inc.

- Hitachi Zosen Inova AG

- Fortum

- MVV Energie AG

- Attero

- Viridor

- ACCIONA

Key Industry Developments

- February 2024 (Acquisition): Blue Planet, a global company specializing in waste management, acquired Mahindra Waste to Energy Solutions Limited, a subsidiary of the Mahindra Group. This collaboration represents a significant milestone in the advancement of sustainability and circular economy initiatives.

The Global Waste to Energy Market is Segmented as:

By Waste Type

- Municipal Waste

- Industrial Waste

- Others

By Technology

- Thermal

- Biological

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership