Machinery Equipment-Construction

Welding Fume Extraction Equipment Market

Welding Fume Extraction Equipment Market Size, Share, Growth & Industry Analysis, By Product Type (Mobile Units, Stationary Units, Large Centralized Systems), By Industry (Aerospace, Automotive, Building & Construction, Energy, Oil & Gas, Others), and Regional Analysis, 2024-2031

Pages : 170

Base Year : 2023

Release : February 2025

Report ID: KR1354

Market Definition

Welding fume extraction equipment encompasses systems engineered to capture and filter hazardous fumes and particulates generated during welding operations, ensuring workplace safety and regulatory compliance.

These systems include fume extraction arms, advanced filtration units, and ventilation mechanisms designed to remove contaminants from the welder’s breathing zone. Product offerings range from compact, portable units for small-scale applications to robust, industrial-grade systems for high-volume environments.

Welding Fume Extraction Equipment Market Overview

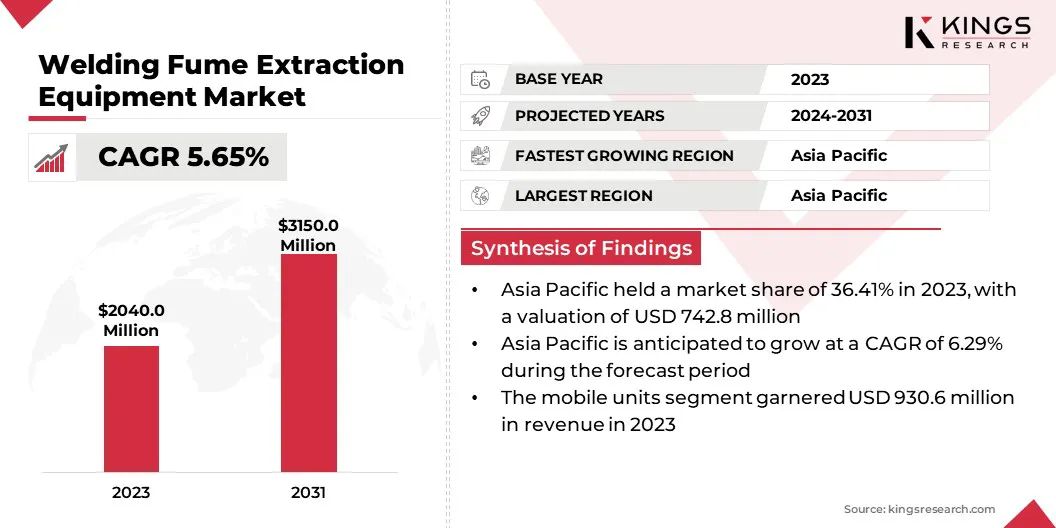

The global welding fume extraction equipment market size was valued at USD 2,040.0 million in 2023 and is projected to grow from USD 2,143.4 million in 2024 to USD 3,150.0 million by 2031, exhibiting a CAGR of 5.65% during the forecast period.

The market is rapidly evolving, driven by increasing awareness of workplace safety and stringent regulatory standards aimed at reducing occupational health hazards. Welding fumes, which contain harmful particulate matter and toxic gases, pose significant health risks to workers, including respiratory issues and long-term illnesses.

Major companies operating in the welding fume extraction equipment market are Senvac Extraction Systems, Nederman Holding AB, AQC Dust Collecting Systems inc., Nordfab, Purex International Ltd., Miller Electric Mfg. LLC, Lincoln Electric, Donaldson Company, Inc., KEMPER GmbH, Bomaksan Industrial Air Filtration Systems, Sentry Air Systems, Inc., Filcar, ABICOR BINZEL, ESTA Corporation, and Air Cleaning Specialists, Inc.

The demand for effective fume extraction solutions continues to grow as industries such as automotive, construction, and manufacturing expand. The market is characterized by the adoption of advanced technologies, such as high-efficiency filtration systems and portable extraction units, which cater to diverse industrial needs.

Additionally, the rise in automation and the integration of IoT-enabled devices in welding processes are creating opportunities for market players. Emerging economies, with their growing industrial base, present untapped potential for market expansion.

Companies that focus on innovation, sustainability, and cost-effective solutions are well-positioned to capitalize on these opportunities and drive the market.

- For instance, in September 2023, Tregaskiss and Bernard, renowned manufacturers of semi-automatic, fixed automatic, cobot, and robotic MIG welding guns, consumables, and peripherals, showcased their innovative solutions at FABTECH 2023 in Chicago. They introduced the Bernard Clean Air Fume Extraction Gun, a cutting-edge, cost-effective technology designed to enhance weld quality and productivity for manufacturers and fabricators.

Key Highlights:

- The welding fume extraction equipment industry size was valued at USD 2,040.0 million in 2023.

- The market is projected to grow at a CAGR of 5.65% from 2024 to 2031.

- North America held a market share of 26.12% in 2023, with a valuation of USD 532.8 million.

- The mobile units segment garnered USD 930.6 million in revenue in 2023.

- The automotive segment is expected to reach USD 1,086.6 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.29% during the forecast period.

Market Driver

"Expansion of the Manufacturing and Automotive Sectors"

The expansion of the manufacturing and automotive sectors is driving the welding fume extraction equipment market. The volume of welding activities increases as these sectors grow, leading to higher emissions of hazardous fumes. Governments and regulatory bodies are enforcing stricter safety standards, compelling companies to invest in advanced fume extraction systems.

The automotive sector, in particular, relies heavily on welding for vehicle assembly, while manufacturing industries use welding for machinery and equipment production. This growth is further amplified by the rise of electric vehicles (EVs) and the need for lightweight materials, which require specialized welding techniques.

As a result, the demand for efficient and scalable fume extraction solutions is surging, creating lucrative opportunities for market players to innovate and expand their product portfolios.

- In April 2023, Miller Electric Mfg. LLC launched the FILTAIR 215 fume extraction system. This high-vacuum, industrial-grade unit efficiently supports multiple fume guns, offering versatility for welding professionals. Its self-cleaning filter and optional auto start/stop function enhance operational efficiency, reduce maintenance downtime, and ensure extended filter lifespan, positioning it as a key solution in the welding fume extraction equipment market.

- Nordfab Quick-Fit ductwork was strategically implemented at welding stations within the facility, efficiently linking to external collectors. This installation optimizes airflow management and enhances the performance of welding fume extraction systems, contributing to improved air quality and compliance with safety regulations. Such integrations are pivotal in meeting industry standards and advancing operational efficiency in the market.

Market Challenge

"High Initial Investment and Maintenance Costs"

One of the primary challenges in the welding fume extraction equipment market is the high initial investment and maintenance costs associated with these systems. Advanced extraction units, particularly those with HEPA filters or IoT-enabled monitoring capabilities, require significant capital expenditure.

Additionally, regular maintenance, filter replacements, and energy consumption add to the operational costs, making it difficult for small and medium-sized enterprises (SMEs) to adopt these solutions.

This financial barrier can hinder market growth, especially in cost-sensitive regions. However, businesses can mitigate this challenge by offering flexible financing options, leasing models, or pay-per-use plans to reduce upfront costs.

Additionally, investing in durable, low-maintenance equipment and providing comprehensive after-sales support can help lower long-term expenses, making these systems more accessible to a broader customer base.

Market Trend

"Rising Adoption of Automated Welding Fume Extraction Systems"

The rising adoption of automated welding fume extraction systems is a key trend shaping the global market. Automation in welding processes, driven by Industry 4.0 and smart manufacturing, has led to the development of intelligent fume extraction systems that integrate seamlessly with robotic welding arms and other automated equipment.

These systems use sensors and real-time monitoring to optimize fume capture, ensuring maximum efficiency and minimal energy consumption. The trend is particularly prominent in high-volume manufacturing environments, where precision and consistency are critical.

Automated systems not only enhance workplace safety but also reduce labor costs and operational downtime. The demand for automated welding fume extraction solutions is expected to grow as industries continue to prioritize efficiency and sustainability, driving innovation and competition in the market.

- ESTA provides mobile, portable, and stationary systems tailored for point-source extraction of welding and soldering fumes, customized to meet specific application needs. ESTA offers welding fume filters with an optional IFA W3 certification For welding applications involving high-alloy steels, ensuring enhanced efficiency and compliance with industry standards.

Welding Fume Extraction Equipment Market Report Snapshot

|

Segmentation |

Details |

|

By Product Type |

Mobile Units, Stationary Units, Large Centralized Systems |

|

By Industry |

Aerospace, Automotive, Building & Construction, Energy, Oil & Gas, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product Type (Mobile Units, Stationary Units, Large Centralized Systems): The mobile units segment earned USD 295.8 million in 2023. This is primarily attributed to their versatility, portability, and ability to cater to diverse workspaces, including small workshops and large construction sites. Mobile units offer flexibility, allowing workers to move them as needed, which is particularly beneficial for industries with dynamic operations.

- By Industry (Aerospace, Automotive, Building & Construction, Energy, Oil & Gas, Others): The aerospace segment is poised to record a staggering CAGR of 7.32% through the forecast period. This growth is driven by the increasing production of aircraft, both commercial and military, which involves extensive welding of lightweight and high-strength materials like titanium and aluminum. These materials generate hazardous fumes, necessitating advanced extraction systems.

Welding Fume Extraction Equipment Market Regional Analysis

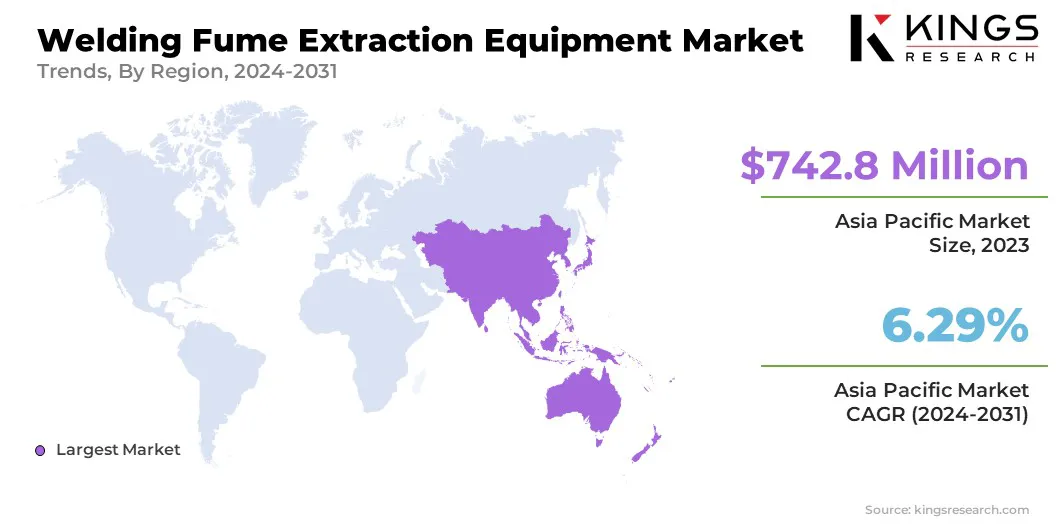

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for around 36.41% share of the welding fume extraction equipment market in 2023, with a valuation of USD 742.8 million. This dominance is attributed to the region's rapid industrialization, particularly in countries like China, India, and South Korea, where manufacturing, construction, and automotive sectors are expanding significantly.

The growing emphasis on worker safety and stringent government regulations regarding air quality in industrial environments have further fueled the demand for fume extraction systems. Additionally, the availability of cost-effective labor and raw materials has encouraged the establishment of manufacturing hubs, driving the need for efficient welding fume management solutions.

The welding fume extraction equipment industry in Europe is poised for significant growth at a robust CAGR of 5.98% over the forecast period, driven by stringent occupational health and safety regulations and the region's strong focus on sustainability. Countries like Germany, France, and the UK are leading the adoption of advanced welding fume extraction technologies, particularly in the automotive and aerospace industries.

The European Union's (EU) stringent emission norms and workplace safety standards are compelling industries to invest in high-efficiency fume extraction systems. Additionally, the rise of smart manufacturing and industry 4.0 initiatives is accelerating the integration of automated and IoT-enabled extraction solutions.

The region's commitment to reducing carbon footprints and enhancing worker safety positions it as a high-growth market, with significant opportunities for innovation and market expansion.

- In February 2024, Translas, a key provider of welding fume extraction solutions for MIG, TIG, Cobot, and Robotic applications, announced a strategic partnership with the UK Machinery Group, reinforcing its dedication to innovation and nationwide availability. This collaboration is further strengthened by its four-year relationship with Bison, a subsidiary of UK Machinery Group, highlighting a shared commitment to delivering premium products and services.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., welding fume extraction is regulated primarily by the Occupational Safety and Health Administration (OSHA) under the Permissible Exposure Limits (PELs) for airborne contaminants. OSHA mandates that employers control welding fumes to protect workers from harmful substances like hexavalent chromium, manganese, and zinc oxide. The National Institute for Occupational Safety and Health (NIOSH) also provides guidelines, recommending the use of local exhaust ventilation (LEV) systems and personal protective equipment (PPE). Additionally, the Environmental Protection Agency (EPA) enforces air quality standards under the Clean Air Act, which indirectly impacts welding operations by regulating emissions.

- In the UK, the Health and Safety Executive (HSE) enforces the Control of Substances Hazardous to Health (COSHH) regulations, which require employers to assess and control exposure to welding fumes. The HSE has classified welding fumes as a carcinogen, mandating the use of fume extraction systems and respiratory protection. The Workplace (Health, Safety, and Welfare) Regulations 1992 also emphasize adequate ventilation in workplaces.

- In China, the Ministry of Ecology and Environment (MEE) enforces air pollution control regulations under the Air Pollution Prevention and Control Law. The Occupational Disease Prevention and Control Law mandates employers to implement fume extraction systems to protect workers from hazardous substances. The China Welding Association (CWA) also provides industry-specific guidelines for welding safety.

- In India, the Factories Act, 1948, and the Occupational Safety, Health, and Working Conditions Code, 2020, mandate the use of fume extraction systems in industrial settings. The Central Pollution Control Board (CPCB) regulates air quality, and the Indian Welding Society (IWS) provides guidelines for welding safety and fume control.

Competitive Landscape:

The welding fume extraction equipment industry is characterized by a number of participants, including both established corporations and rising organizations. The global market is highly competitive, with key players adopting diverse strategies to strengthen their market position.

Companies are focusing on innovation, investing heavily in research and development to introduce advanced products such as IoT-enabled and energy-efficient extraction systems. Strategic partnerships, mergers, and acquisitions are common, enabling firms to expand their geographic reach and enhance their product portfolios.

Additionally, many players are emphasizing customization, offering tailored solutions to meet the specific needs of industries like automotive, aerospace, and construction. Companies are also prioritizing sustainability, developing eco-friendly systems that align with global environmental regulations.

Customer-centric approaches, including robust after-sales services and flexible financing options, are being employed to attract small and medium-sized enterprises. Furthermore, marketing strategies are increasingly being digitalized, leveraging online platforms to reach a broader audience.

These imperatives, such as innovation, strategic collaborations, sustainability, and customer focus, are critical for maintaining competitiveness and driving long-term growth in this dynamic market.

- In July 2024, IBG Industrie-Beteiligungs-Gesellschaft mbH & Co KG announced a strategic milestone in its corporate evolution. Starting February 2024, the Cologne-based company consolidated its cutting and welding businesses into a unified entity named ABICOR GROUP. This newly formed group will encompass IBG subsidiaries, including ABICOR BINZEL, Thermacut, HERR Industry System, PT Photonic Tools, Astaras, Cantesco, and Weldstone.

List of Key Companies in Welding Fume Extraction Equipment Market:

- Senvac Extraction Systems

- Nederman Holding AB

- AQC Dust Collecting Systems inc.

- Nordfab

- Purex International Ltd.

- Miller Electric Mfg. LLC

- Lincoln Electric

- Donaldson Company, Inc.

- KEMPER GmbH

- Bomaksan Industrial Air Filtration Systems

- Sentry Air Systems, Inc.

- Filcar

- ABICOR BINZEL

- ESTA Corporation

- Air Cleaning Specialists, Inc.

Recent Developments (Agreements/ Launch)

- In November 2024, ESAB Corporation, a leading industrial solutions provider, signed an agreement to acquire Linde Industries Private Limited (LIPL). This strategic acquisition enhances its market presence and customer reach in South Asia, unlocking significant growth opportunities for its award-winning equipment, automation, and consumables product lines across key regional industries.

- In October 2024, Miller Electric Mfg. LLC introduced the FILTAIR Purifier, an advanced fume extraction system. Engineered for enhanced air quality, regulatory compliance, and operational efficiency, it features a compact design, optimized airflow, and seamless installation, driving workplace productivity and safety in welding environments.

- In October 2024, Lincoln Electric introduced the latest advancement in the HyperFill Twin-Wire Welding Solution, incorporating HyperFill STT technology. This enhancement enables faster travel speeds in pipe welding applications, providing improved productivity and efficiency for industry professionals seeking optimized welding performance.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)