Energy and Power

Wood Pellets Market

Wood Pellets Market Size, Share, Growth & Industry Analysis, By Application (Heating, Power Generation, Combined Heat & Power), By End User (Residential, Commercial, Industrial), and Regional Analysis, 2024-2031

Pages : 160

Base Year : 2023

Release : February 2025

Report ID: KR393

Market Definition

The market encompasses the production and distribution of compressed pellets made primarily from wood-based biomass, including sawdust and wood chips. These pellets serve as a renewable energy source, used mainly for heating and power generation.

The market is expanding due to the growing demand for sustainable energy solutions and the increasing shift toward eco-friendly alternatives in both residential and industrial sectors.

Wood Pellets Market Overview

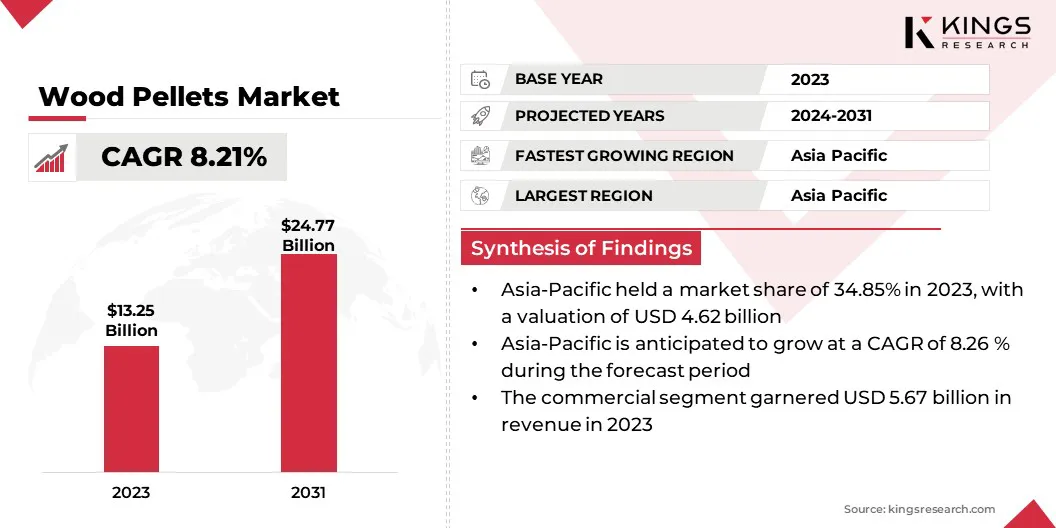

The global wood pellets market size was valued at USD 13.25 billion in 2023 and is projected to grow from USD 14.26 billion in 2024 to USD 24.77 billion by 2031, exhibiting a CAGR of 8.21% during the forecast period.

The global market is growing due to rising demand for renewable energy and emissions reduction. Made from compressed biomass, wood pellets offer a sustainable alternative to fossil fuels for heating and power. Market growth is fueled by environmental awareness, government incentives, and increasing adoption across sectors.

Major companies operating in the wood pellets industry are Wood Pellet Energy UK (LTD), Premium Pellets Ltd, Graanul Invest, Highland Pellets, LLC, Savoie, I.C.S. (Lacroix) Lumber Inc., Vermont Wood Pellet Company, Enviva, Drax Global, Energex, Sinclar Group Forest Products, WismarPellets GmbH, The United Company, Wood & Sons, Valfei Products Inc. and other.

- In January 2024, Drax partnered with Molpus Woodlands Group to source sustainably managed forestry in the Southeastern U.S. for its Bioenergy with Carbon Capture and Storage (BECCS) operations. This collaboration ensures a reliable biomass supply for Drax's power generation while advancing carbon-negative energy solutions. The partnership aligns with Drax’s goal of achieving carbon negativity by 2030 through renewable biomass and carbon capture technology.

Key Highlights:

Key Highlights:

- The wood pellets industry size was recorded at USD 13.25 billion in 2023.

- The market is projected to grow at a CAGR of 8.21% from 2024 to 2031.

- Asia Pacific held a share of 34.85% in 2023, valued at USD 4.62 billion.

- The power generation segment garnered USD 5.20 billion in revenue in 2023.

- The commercial segment is expected to reach USD 10.58 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 8.26% during the forecast period.

Market Driver

“Government Policies and Incentives”

Government Policies and Incentives are contributing significantly to the expansion of the wood pellets market. Subsidies, tax credits, and renewable energy mandates enhance the economic viability of biomass energy, encouraging adoption across industries, utilities, and households.

Several countries and regions have implemented regulatory frameworks, financial incentives, and renewable energy targets to support this transition as part of carbon reduction strategies.

- The Renewable Energy Directive (RED II) mandates a 32% renewable energy consumption in the EU by 2030. It establishes strict sustainability and greenhouse gas (GHG) criteria for biomass fuels, including wood pellets, to ensure environmental responsibility. The directive also limits high indirect land-use change (ILUC) biofuels and mandates an increasing share of advanced biofuels. Additionally, it enforces stricter regulations on forestry feedstocks and biomass power generation.

Market Challenge

“Concerns Pertaining to Prices of Raw Materials”

A major challenge hampering the growth of the wood pellets market is raw material price volatility. The cost of feedstock, such as sawdust and wood shavings, fluctuates due to factors including deforestation regulations, competition with other wood-based industries, and supply chain disruptions.

Furthermore, the growing demand for biomass energy has raised concerns about resource sustainability, impacting both availability and pricing. These uncertainties pose financial risks for producers and may hinder market growth by reducing the cost competitiveness of wood pellets compared to other renewable energy sources.

To mitigate these challenges, companies can adopt strategic measures such as diversifying feedstock sources by incorporating agricultural residues and alternative biomass materials. Establishing long-term supply agreements with multiple suppliers can enhance price stability and supply security.

Investing in sustainable forestry and reforestation initiatives ensures a consistent raw material supply while complying with environmental regulations. Optimizing logistics, transportation, and storage infrastructure further helps reduce costs and mitigate disruptions, strengthening market resilience against price fluctuations.

Market Trend

“Rising Demand for Biomass Energy”

A major trend in the wood pellets market is the increasing demand for biomass energy as a sustainable alternative to fossil fuels. Governments globally are implementing incentives and policies to support biomass-based power generation, particularly in Europe, North America, and Asia.

Power plants are increasingly co-firing wood pellets with coal to reduce carbon emissions, while residential heating systems are shifting toward biomass solutions. This growing reliance on wood pellets aligns with global decarbonization goals, fostering market expansion and advancements in biomass energy technology.

- IOP Science highlights the critical role of feed-in tariffs (FIT) in sustaining Japan’s biomass power sector. It examines cost-benefit factors, including electricity generation and environmental impacts such as emissions from feedstock transportation. Findings indicate that imported pellets significantly raise costs, though sourcing from Vietnam or Canada has minimal impact. The analysis underscores FIT policies as the primary driver of economic viability, suggesting a reassessment to balance fuel costs, local industry benefits, and land-use trade-offs.

Wood Pellets Market Report Snapshot

|

Segmentation |

Details |

|

By Application |

Heating, Power Generation, Combined Heat & Power |

|

By End User |

Residential, Commercial, Industrial |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Application (Heating, Power Generation, and Combined Heat & Power): The power generation segment earned USD 5.20 billion in 2023, mainly propelled by the increasing adoption of renewable energy sources and the transition to eco-friendly alternatives in power plants.

- By End User (Residential, Commercial, and Industrial): The commercial segment held a share of 42.77% in 2023, supported by a growing demand for energy-efficient heating solutions in commercial buildings and industries seeking to reduce their carbon footprint.

Wood Pellets Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific wood pellets market captured a share of around 34.85% in 2023, valued at USD 4.62 billion. This growth is attributed to the region's increasing adoption of renewable energy sources, with a focus on sustainable heating solutions in both residential and commercial sectors.

.webp) The expanding shift toward eco-friendly alternatives, coupled with favorable government policies and environmental awareness, has fueled this expansion.

The expanding shift toward eco-friendly alternatives, coupled with favorable government policies and environmental awareness, has fueled this expansion.

- In March 2024, RENOVA acquired a majority stake (51%) in Ishinomaki Hibarino Biomass Energy G.K., a biomass power generation company in Japan. This acquisition strengthens RENOVA’s renewable energy portfolio, emphasizing its commitment to sustainable power solutions. The Ishinomaki plant, with a capacity of 74.95 MW, is part of Japan’s growing biomass energy sector. The move aligns with government policies promoting renewable energy and highlights the increasing role of biomass in the Asia-Pacific market.

North America wood pellets industry is set to grow at a robust CAGR of 8.20% over the forecast period. This rapid growth is stimulated by the rising demand for renewable energy, particularly in residential and industrial heating applications.

Government incentives, including renewable energy policies and carbon reduction initiatives, further support this expansion. The region's abundant biomass resources, coupled with advancements in pellet production technology, contribute significantly to this growth.

Regulatory Frameworks:

- The EU Regulation on Deforestation-Free Products (EUDR) aims to ensure that products sold in the region, including wood pellets, do not contribute to deforestation or forest degradation. It requires companies to provide due diligence statements proving that their supply chains are sustainable and compliant with environmental standards. The regulation replaces the EU Timber Regulation (EUTR) and applies to various commodities linked to deforestation.

- The Sustainable Biomass Program (SBP) is a certification scheme ensuring the legal and sustainable sourcing of biomass, including wood pellets. It provides traceability, regulatory compliance (such as with RED II and EUDR), and supports responsible biomass trade. SBP certification enables producers to meet international sustainability standards and maintain market access in regulated regions such as the EU.

- India's Carbon Market Program, led by the Bureau of Energy Efficiency (BEE), aligns with the country's Paris Agreement commitments. It includes a cap-and-trade system to reduce emissions intensity by 45% by 2030 from 2005 levels. The program integrates the Perform, Achieve, and Trade (PAT) scheme and is expanding to include additional sectors, including biomass-based energy such as wood pellets.

- ISO 17225-1 specifies general requirements for solid biofuels, including classification, quality specifications, and sustainability criteria. It ensures consistency in biomass fuel properties such as moisture content, calorific value, and ash content for various applications. The standard supports international trade and compliance with environmental regulations.

- BS EN ISO 17225-2:2021 defines fuel specifications and classes for graded wood pellets used in residential, commercial, and industrial applications. It ensures standardization in moisture content, ash levels, calorific value, and sustainability criteria, supporting compliance with international regulations such as EU RED II and SBP certification.

Competitive Landscape

The wood pellets industry is characterized by a number of participants, including both established corporations and emerging players. To gain a competitive edge, companies are focusing on several key strategies, including expansion of production capacity, technological advancements, strategic partnerships, and sustainability initiatives.

Leading players are investing in new production facilities or upgrading existing ones to meet the growing demand, particularly in Europe and Asia. Technological innovations in pellet processing and quality improvement are helping companies enhance efficiency and product performance.

- In February 2024, Graanul Invest launched a new premium wood pellet brand, g Graanul, targeting Baltic customers as a part of the company’s strategy to strengthen its regional market presence. The brand introduces a new design and aims to offer high-quality, affordable renewable energy solutions. Additionally, the company expanded its e-commerce offerings in Lithuania and improved transportation solutions in Latvia.

List of Key Companies in Wood Pellets Market:

- Wood Pellet Energy UK (LTD)

- Premium Pellets Ltd

- Graanul Invest

- Highland Pellets, LLC

- Savoie

- C.S. (Lacroix) Lumber Inc.

- Vermont Wood Pellet Company

- Enviva

- Drax Group plc

- Energex

- Sinclar Group Forest Products

- WismarPellets GmbH

- The United Company

- Wood & Sons

- Valfei Products Inc.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In December 2024, Canfor Corporation increased its ownership in Sweden’s VIDA AB from 70% to 77% by acquiring additional shares from minority shareholders. This move is part of Canfor’s long-term investment strategy in the European market. VIDA AB is Sweden’s largest privately owned sawmill company, and the acquisition strengthens Canfor’s position in sustainable wood products, including lumber, engineered wood, and biomass energy.

- In May 2024, Brown Gibbons Lang & Company (BGL) announced the recapitalization of Musser Biomass and Wood Products by Watermill Group. Musser, based in Virginia, specializes in ESG-certified reclaimed biomass products, including wood fiber, biochar, pellets, and briquettes. The initiative aims to support Musser's expansion in sustainable markets, leveraging consumer demand for eco-friendly materials. The deal aligns with trends in green technology and energy transition.

- In September 2023, VIDA AB acquired Ingarp Träskydd, further expanding its sawmill operations in Sweden. The acquisition strengthens VIDA’s presence in the wood processing industry, particularly around its existing sawmills in Hjältevad and Vimmerby. The move is expected to create synergies and enhance VIDA’s ability to deliver high-quality wood products in Sweden and Denmark.

- In May 2023, SymEnergy and BioEnergie Wegscheid (BEW) signed a contract for a 900 kW biomass gasification combined heat and power plant in Japan. The project, located in Hyogo Prefecture, ensures project stability through a performance guarantee and fixed maintenance cost services. Furthermore, BEW will merge with ENTRENCO to form WegscheidEntrenco, strengthening its biomass energy capabilities.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership