Semiconductor and Electronics

3D Display Market

3D Display Market Size, Share, Growth & Industry Analysis, By Product (Volumetric Display, Stereoscopic Display, Holographic Display), By Technology Type (Digital Light Processing (DLP), Organic Light-emitting Diode (OLED), Light Emitting Diode (LED)), By Application, By End Use, and Regional Analysis, 2024-2031

Pages : 210

Base Year : 2023

Release : February 2025

Report ID: KR1344

Market Definition

A 3D display is a visualization technology that creates the illusion of depth, enabling viewers to perceive images or videos in three dimensions. These displays achieve this effect by using various techniques such as stereoscopic imaging, autostereoscopic technology, holography, or volumetric projection.

Unlike conventional 2D screens, 3D displays present separate images to each eye, simulating natural depth perception. They are widely used in applications such as gaming, medical imaging, virtual reality (VR), augmented reality (AR), and entertainment to enhance realism and user engagement.

3D Display Market Overview

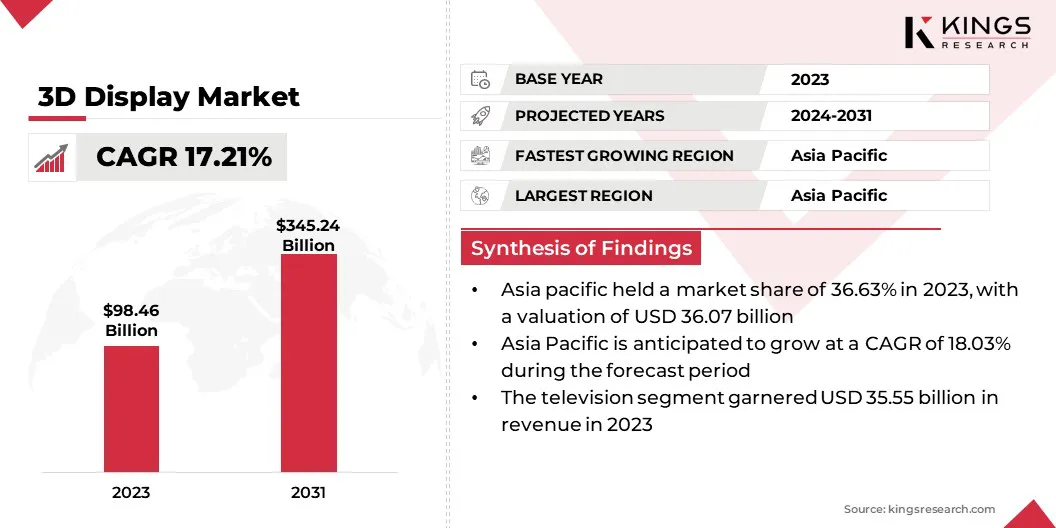

The global 3D display market size was valued at USD 98.46 billion in 2023, which is estimated to be valued at USD 113.62 billion in 2024 and reach USD 345.24 billion by 2031, growing at a CAGR of 17.21% from 2024 to 2031.

The market is driven by advancements in glasses-free 3D technology, enhancing user experience in gaming, entertainment, and advertising. Increasing demand for medical imaging solutions utilizing 3D visualization is accelerating adoption in healthcare applications.

Additionally, rising investments in augmented reality (AR) and virtual reality (VR) technologies are fueling innovation, expanding the use of 3D displays across various industries.

Major companies operating in the global 3D display Industry are SAMSUNG, SONY ELECTRONICS INC., LG Electronics, Panasonic Holdings Corporation, SHARP CORPORATION, AUO Corporation, TOSHIBA CORPORATION, BOE Technology Group Co., Ltd., Innolux Corporation, Seiko Epson Corporation, Leyard, Xiaomi, Koninklijke Philips N.V., Huawei Technologies Co., Ltd., and Mitsubishi Electric Corporation.

The entertainment industry is undergoing a transformation with the increasing adoption of 3D display technology in gaming, cinema, and virtual reality. Consumers seek highly immersive visual experiences, prompting gaming companies and content creators to invest in autostereoscopic and holographic displays.

The transition toward 4K and 8K resolutions in 3D screens enhances depth perception and clarity, creating realistic visuals. Major streaming platforms and film studios are incorporating 3D content to differentiate offerings, contributing to the growth of the market.

- In December 2024, JetX by Smartsoft collaborated with Parimatch News, a sports fan community in India, to unveil a striking 3D billboard at Garuda Mall in Bangalore. Through this, the partners aim to create an immersive experience that captures the excitement of gaming, sparking curiosity and engagement among gamers and sports enthusiasts.

Key Highlights:

- The global 3D display market size was valued at USD 98.46 billion in 2023.

- The market is projected to grow at a CAGR of 17.21% from 2024 to 2031.

- Asia Pacific held a market share of 36.63% in 2023, with a valuation of USD 36.07 billion, and is anticipated to grow at a CAGR of 18.03% during the forecast period.

- The stereoscopic display segment garnered USD 45.80 billion in revenue in 2023.

- The Light Emitting Diode (LED) segment is expected to reach USD 163.09 billion by 2031.

- The television segment secured the largest revenue share of 36.10% in 2023.

- The consumer electronics segment is poised for a robust CAGR of 18.11% through the forecast period.

Market Driver

"Advancements in Medical Imaging and Healthcare Applications"

The healthcare sector is integrating 3D display technology into diagnostic imaging, surgical planning, and medical training, accelerating the growth of the 3D display market.

Surgeons rely on high-resolution 3D visualization for minimally invasive procedures, improving precision and reducing risks. Medical imaging technologies, including CT scans, MRIs, and ultrasound, benefit from 3D-enabled screens, enhancing depth perception for accurate diagnosis.

- In 2023, a research team from Stanford University showcased a laser-plasma volumetric display capable of projecting high-resolution 3D images in mid-air. This innovation holds significant potential for medical imaging, enabling doctors to visualize and interact with 3D models of patient anatomy without relying on VR headsets or external devices.

Moreover, the rise in robotic-assisted surgeries and telemedicine solutions is increasing the demand for advanced 3D displays. Furthermore, healthcare institutions and research centers are investing in next-generation medical imaging systems, strengthening the market across diagnostic and surgical applications.

Market Challenge

"High Production Costs and Complex Manufacturing Processes"

The growth of the 3D display market faces challenges, due to high production costs and the complexity of manufacturing advanced 3D display technologies. Developing glasses-free 3D displays, holographic screens, and high-resolution light field technology requires sophisticated components and precision engineering, increasing production expenses.

Companies are investing in cost-efficient manufacturing techniques, including micro-LED and quantum dot technology, to enhance scalability. Strategic partnerships with semiconductor firms and research institutions are driving innovations in nanomaterials and AI-driven display optimization, reducing costs while improving efficiency. Additionally, firms are exploring modular display architectures to streamline production and enhance affordability.

Market Trend

"Technological Advancements in Display Technologies"

Continuous innovations in OLED, LED, and holographic display technologies are improving image clarity, refresh rates, and color accuracy in 3D screens, boosting the 3D display market. The introduction of glasses-free 3D displays enhances user convenience, leading to widespread adoption across consumer electronics, gaming, and automotive sectors.

- In August 2024, Samsung Electronics introduced its latest gaming monitors at Gamescom 2024 in Cologne, Germany, with a strong emphasis on the revolutionary Odyssey 3D, which delivers glasses-free 3D viewing. Featuring advanced light field display (LFD) technology, the Odyssey 3D transforms 2D content into lifelike 3D visuals using a lenticular lens on the front panel.

Manufacturers are focusing on micro-LED and quantum dot displays to deliver superior brightness, contrast, and depth perception. Investments in AI-driven 3D rendering and real-time content optimization are reshaping the capabilities of 3D displays, expanding applications in advertising, healthcare, and industrial visualization.

3D Display Market Report Snapshot

|

Segmentation |

Details |

|

By Product |

Volumetric Display, Stereoscopic Display, Holographic Display |

|

By Technology Type |

Digital Light Processing (DLP), Organic Light-emitting Diode (OLED), Light Emitting Diode (LED) |

|

By Application |

Television, Smartphones, Mobile Computing Devices, Others |

|

By End Use |

Consumer Electronics, Automotive, Medical, Aerospace & Defense, Industrial, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product (Volumetric Display, Stereoscopic Display, Holographic Display): The stereoscopic display segment earned USD 45.80 billion in 2023, due to its high-quality depth perception, cost-effectiveness, and widespread use in gaming, entertainment, and medical imaging.

- By Technology Type (Digital Light Processing (DLP), Organic Light-emitting Diode (OLED), Light Emitting Diode (LED)): The light emitting diode (LED) segment held 42.16% share of the market in 2023, due to its superior brightness, energy efficiency, and enhanced color accuracy, making it the preferred choice for applications in gaming, entertainment, automotive, and digital signage.

- By Application (Television, Smartphones, Projectors, Mobile Computing Devices, and Others): The TV segment is projected to reach USD 117.10 billion by 2031, owing to the increasing consumer demand for immersive home entertainment experiences and the widespread adoption of high-resolution OLED and LED panels, enhancing visual depth and realism.

- By End Use (Consumer Electronics, Automotive, Medical, Aerospace & Defense, Industrial, and Others): The consumer electronics segment is poised for significant growth at a CAGR of 18.11% through the forecast period, due to the rising demand for glasses-free 3D televisions, gaming monitors, smartphones, and AR/VR devices, driven by advancements in OLED, micro-LED, and holographic display technologies.

3D Display Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a 3D display market share of around 36.63% in 2023, with a valuation of USD 36.07 billion. Asia Pacific is home to major display technology manufacturers, including Samsung, LG, Sony, and BOE Technology, fueling the market.

Companies are scaling up production capacities and investing in R&D for advanced 3D visualization technologies. The presence of a robust semiconductor and display panel manufacturing ecosystem supports cost-efficient production of high-resolution 3D displays.

Additionally, the healthcare sector is registering a surge in demand for 3D medical imaging and surgical visualization solutions, enabling precise diagnosis and minimally invasive procedures. Government-backed investments in smart healthcare technologies and advancements in AI-driven 3D medical imaging are further expanding market opportunities across the region.

- In 2023, the Chinese government invested USD 1.5 billion to support the adoption of advanced medical technologies, including volumetric displays, AI-powered diagnostics, and telemedicine platforms.

The 3D display Industry in Europe is poised for significant growth at a robust CAGR of 12.85% over the forecast period. The market in Europe is significantly driven by the increasing integration of advanced 3D visualization technologies in automotive and aerospace applications.

Leading automakers such as BMW, Mercedes-Benz, and Volkswagen are incorporating holographic and autostereoscopic 3D displays into heads-up displays (HUDs) and infotainment systems to enhance driving safety and navigation. In the aerospace sector, Airbus and Rolls-Royce are leveraging 3D visualization for cockpit displays, pilot training, and aircraft design simulations.

- The European Union’s (EU) Horizon Europe program, which allocated USD 99.12 billion for research and innovation from 2021 to 2027, is further supporting advancements in immersive display technologies, accelerating market expansion.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the Federal Communications Commission (FCC) regulates electronic devices, including 3D displays, under Title 47 CFR Part 15, which addresses radio frequency emissions to prevent harmful interference. Additionally, the Consumer Product Safety Commission (CPSC) enforces standards to ensure the safety of electronic products.

- The EU mandates compliance with the Conformité Européene (CE) marking, indicating conformity with health, safety, and environmental protection standards. The Electromagnetic Compatibility (EMC) Directive (2014/30/EU) ensures that electronic equipment does not generate or is not affected by electromagnetic disturbance.

- In China, the China Compulsory Certificate (CCC) regulates electronic products, certifying compliance with safety and EMC standards. The Administrative Measures for the Restriction of the Use of Hazardous Substances in Electrical and Electronic Products align with global RoHS directives, restricting hazardous substances in electronics.

- In Japan, The Electrical Appliance and Material Safety Act (DENAN) regulates the safety of electronic devices, including 3D displays. Manufacturers must ensure compliance with technical standards and undergo product testing. The VCCI (Voluntary Control Council for Interference by Information Technology Equipment) mark indicates compliance with EMC standards.

- In India, The Bureau of Indian Standards (BIS) certification is mandatory for electronic products under the Compulsory Registration Scheme (CRS), ensuring conformity with safety standards. The Electronics and Information Technology Goods (Requirements for Compulsory Registration) Order, 2012 lists products requiring mandatory registration, including display devices.

- In South Korea, the Korea Certification (KC) mark is required for electronic products, indicating compliance with safety and EMC standards as outlined by the National Radio Research Agency (RRA). The Electrical Appliances and Consumer Products Safety Control Act mandates safety certifications and inspections for electronic devices.

Competitive Landscape:

The global 3D display market is characterized by a number of participants, including both established corporations and rising organizations. Major market players are focusing on technological innovations to develop compact and efficient 3D display devices.

Advancements in materials, optics, and processing technologies are enabling the creation of lightweight, energy-efficient, and portable 3D displays that cater to a wide range of applications, including consumer electronics, medical imaging, and automotive displays.

- In August 2024, researchers at Dartmouth College in the U.S. developed a 3D display medium using a single solid-state polymer. This innovative material enables the creation of a compact, handheld device where images can be printed, erased, and even animated.

Manufacturers are integrating features such as high-resolution imaging, enhanced depth perception, and glasses-free 3D viewing to improve user experience. These innovations are expanding market opportunities by making 3D display technology more accessible, versatile, and suitable for various commercial and consumer applications.

List of Key Companies:

- SAMSUNG

- SONY ELECTRONICS INC.

- LG Electronics

- Panasonic Holdings Corporation

- SHARP CORPORATION

- AUO Corporation

- TOSHIBA CORPORATION

- BOE Technology Group Co., Ltd.

- Innolux Corporation

- Seiko Epson Corporation

- Leyard

- Xiaomi

- Koninklijke Philips N.V.

- Huawei Technologies Co., Ltd.

- Mitsubishi Electric Corporation

Recent Developments (Expansion/New Product Launch)

- In May 2024, LG Display showcased a wide range of next-generation OLED and advanced display technologies at SID Display Week 2024 in San Jose, California. Among the highlights was OLEDoS for smartwatches, featuring glasses-free 3D technology known as light field technology, which creates holographic-like effects.

- In April 2024, Sharp announced plans to invest between USD 3 billion and USD 5 billion to establish a display fabrication semiconductor facility in India. This facility will be dedicated to producing digital screens for televisions and other display applications.

- In April 2024, AUO highlighted the diverse applications of Micro LED display technology in daily life at Touch Taiwan, under the theme “Beyond Display. See the Possibilities,”. Showcasing innovations ranging from large-size to high-transparency Micro LED displays, the company demonstrated its potential across sectors such as smart mobility, retail, and healthcare.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership