ICT-IOT

5G Services Market

5G Services Market Size, Share, Growth & Industry Analysis, By Communication Type (Enhanced Mobile Broadband (eMBB), Ultra-Reliable and Low-Latency Communications (uRLLC), Massive Machine-Type Communications (mMTC), By End User (Individuals, Enterprises), and Regional Analysis, 2021-2031 2024-2031

Pages : 160

Base Year : 2023

Release : January 2025

Report ID: KR1239

Market Definition

5G services refer to the wide range of applications and offerings enabled by 5G technology, providing enhanced connectivity solutions to consumers and businesses.

These services offer high-speed, low-latency, and massive connectivity capabilities of 5G networks, enabling high-definition video streaming, cloud gaming, and IoT connectivity. 5G services support industries with private networks, smart cities, autonomous vehicles, and remote healthcare, driving innovation across sectors.

5G Services Market Overview

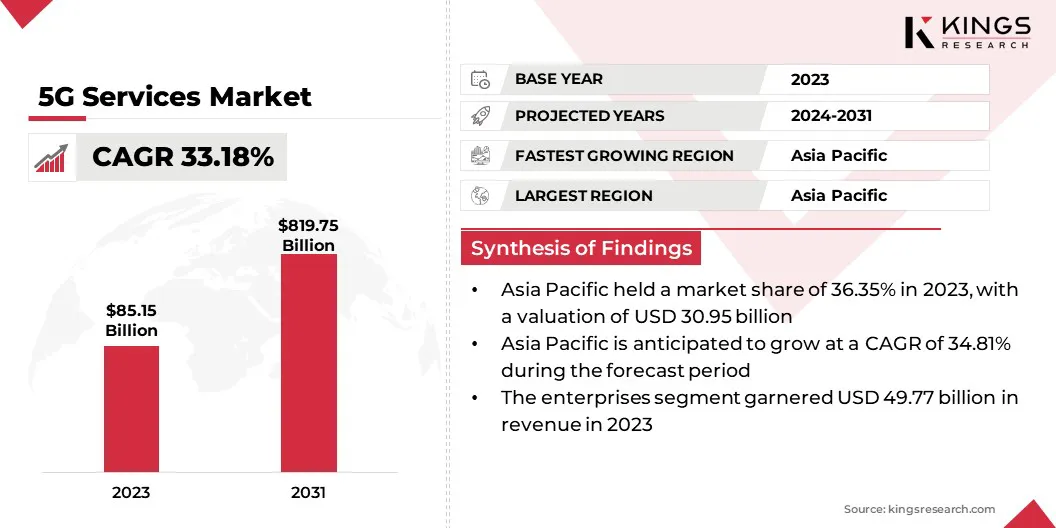

Global 5G services market size was valued at USD 85.15 billion in 2023, which is estimated to be valued at USD 110.33 billion in 2024 and reach USD 819.75 billion by 2031, growing at a CAGR of 33.18% from 2024 to 2031.

The significant growth of the market is largely driven by the need for faster internet speeds. With the increasing consumption of high-definition video content, cloud gaming, and real-time communication, users demand more bandwidth and lower latency. This surge in demand for high-speed connectivity in personal and professional settings is a critical factor propelling the rapid expansion of 5G services.

Major companies operating in the global market are China Mobile International Limited, Verizon, AT&T Inc., China Telecom Corp. Ltd., China Unicom Ltd., NTT Communications Corporation (NTT Docomo), SK Telecom Co., Ltd., KT Corp., Vodafone Group, Deutsche Telekom AG, Orange Business, Airtel India, Reliance Industries Limited (Reliance Jio Infocomm Ltd.), Telstra Enterprise International, T‑Mobile USA, Inc., and others.

The rapid expansion of 5G networks worldwide is driving the growth of the 5G services market. As network providers continue to roll out 5G infrastructure across major regions, the global coverage of high-speed, low-latency networks is increasing. This widespread deployment enables consumers and businesses to access advanced 5G services, stimulating demand for applications requiring faster data transfer and more reliable connectivity.

- In the first quarter of 2024, global 5G connections saw continued growth, nearing 2 billion with the addition of 185 million new connections, according to 5G Americas and Omdia. By 2028, global 5G connections are projected to reach 7.7 billion.

Key Highlights:

Key Highlights:

- The global 5G services market size was recorded at USD 85.15 billion in 2023.

- The market is projected to grow at a CAGR of 33.18% from 2024 to 2031.

- Asia Pacific held a 5G services market share of 36.35% in 2023, with a valuation of USD 30.95 billion, and is anticipated to grow at a CAGR of 34.81% during the forecast period

- The enhanced mobile broadband (eMBB) segment garnered USD 41.43 billion revenue in 2023.

- The enterprises segment is expected to reach USD 459.85 billion by 2031.

Market Driver

Growing adoption of 5G connected devices

The proliferation of Internet of Things (IoT) devices in healthcare, manufacturing, and smart cities significantly contributes to the growth of the 5G services market. IoT solutions require networks that can handle large volumes of connected devices, deliver ultra-reliable low-latency communications, and support vast data transmission.

5G’s capabilities align with these requirements, ensuring the effective operation of smart devices and enhancing the scalability of IoT networks. As IoT applications continue to expand globally, the demand for 5G services will increase, driving market growth.

- The 2024 report from 5G Americas revealed that the global IoT subscriptions have reached 3.3 billion, alongside 6.7 billion smartphone subscriptions. Projections indicate that IoT subscriptions are expected to grow to 5 billion, while smartphone subscriptions are set to rise to 8 billion by 2028.

Market Challenge

High cost of 5G infrastructure deployment

A significant challenge for the growth of the 5G services market is the high cost of infrastructure. The extensive investment required for constructing 5G networks, including base stations, spectrum licenses, and backhaul connectivity, is a major barrier for many operators.

To address this, companies are increasingly adopting strategies such as public-private partnerships, sharing network infrastructure, and leveraging advanced technologies like network virtualization and cloud computing to reduce operational costs.

Additionally, some operators are focusing on phased rollouts in high-demand areas, optimizing resource allocation, and leveraging 4G networks as complementary infrastructures to accelerate 5G adoption.

Market Trend

Network slicing, paving the way for adoption of 5G network

Network slicing, a key feature of 5G technology, is playing an important role in driving the growth of the 5G services market. By enabling operators to create tailored, dedicated networks for specific applications or industries, network slicing ensures that 5G networks can efficiently support diverse use cases with varying performance requirements.

This flexibility allows manufacturing, logistics, and entertainment segments to benefit from customized connectivity solutions. The growing adoption of network slicing by operators and businesses will continue to accelerate the expansion of the market.

- In October 2024, Singtel introduced app-based network slicing for its 5G network. The technology, called User Equipment Route Selection Policy (URSP), is designed to enable enterprises to utilize 5G to prioritize specific applications that align with their business requirements.

5G Services Market Report Snapshot

|

Segmentation |

Details |

|

By Communication Type |

Enhanced Mobile Broadband (eMBB), Ultra-Reliable and Low-Latency Communications (uRLLC), Massive Machine-Type Communications (mMTC) |

|

By End User |

Individuals, Enterprises (Manufacturing, Healthcare, Transportation, Media & Entertainment, Government, and Others) |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Communication Type (Enhanced Mobile Broadband (eMBB), Ultra-Reliable and Low-Latency Communications (uRLLC), Massive Machine-Type Communications (mMTC)): The enhanced mobile broadband (eMBB) segment earned USD 41.43 billion in 2023 due to its ability to deliver high-speed, high-capacity data transfer, which meets the growing demand for seamless video streaming, cloud gaming, and other bandwidth-intensive applications.

- By End User (Individuals, Enterprises): The enterprises segment held 58.45%of the market in 2023, due to the increasing demand for high-speed, low-latency connectivity that supports digital transformation, cloud computing, and IoT-driven applications.

5G Services Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific 5G services market share stood at around 36.35% in 2023, with a valuation of USD 30.95 billion. Asia-Pacific countries, particularly China, Japan, and South Korea, are at the forefront of smart city initiatives, aiming to enhance urban infrastructure, improve sustainability, and optimize public services using advanced technologies. 5G is a vital part of smart city projects, enabling real-time data exchange between connected devices and infrastructure.

- At the 19th Asian Games, China Telecom and ZTE actively explored innovative 5G-Advanced (5G-A) technology to ensure the security of major events and support innovative business initiatives across various sectors. By focusing on providing an exceptional event experience and enhancing urban infrastructure, they successfully established a smart city in Hangzhou powered by 5G-A technology.

Furthermore, with a rapidly growing population, increasing urbanization, and a robust middle class, the demand for high-speed, reliable internet is soaring across the region.

This demand is being driven by a tech-savvy population, an increase in connected devices, and the growing dependence on digital services such as online education, e-commerce, and telemedicine. The need for faster, more reliable internet connections, which 5G provides, is thus propelling the growth of the market in Asia-Pacific.

Europe is poised for significant growth at a robust CAGR of 33.87% over the forecast period. European governments are strongly supporting the deployment of 5G networks through favorable regulatory policies and strategic investments. Initiatives such as the European Commission’s Digital Decade plan and national 5G strategies are accelerating the rollout of 5G infrastructure, providing a robust foundation for the growth of the 5G services market.

- In December 2024, the European Commission revealed grant agreements amounting to USD 134.8 million to fund 31 new 5G infrastructure projects as part of the third call for proposals under the Connecting Europe Facility (CEF Digital). This investment was added to the USD 95.7 million previously allocated to 35 projects through the first two CEF Digital calls, bringing the total funding to USD 230.5 million for the co-financing of 66 5G infrastructure deployment initiatives.

The increasing popularity of mobile gaming, augmented reality (AR), and virtual reality (VR) in Europe is driving the demand for 5G services. The high-speed, low-latency nature of 5G networks is crucial for providing seamless and immersive digital experiences, making it a key enabler for the growth of the digital entertainment sector in the region.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In U.S., under the Communications Act, the Federal Communications Commission (FCC) regulates 5G services. In October 2023, the FCC proposed reinstating net neutrality by reclassifying fixed broadband under Title II. This regulatory move was aimed at enhancing consumer protection, improving network security, and safeguarding public safety, particularly during emergencies.

- The Canadian Radio-television and Telecommunications Commission (CRTC) oversees telecommunications regulation, including 5G. Canada’s regulatory framework includes the Telecommunications Act, which governs licensing and service quality standards.

- The EU's regulatory framework for 5G is outlined in the 5G Action Plan, which sets strategic objectives for member states regarding spectrum allocation, infrastructure investment, and service quality. The European Electronic Communications Code (EECC) provides a legal framework to enhance competition and consumer protection in telecommunications.

- In China, the Ministry of Industry and Information Technology (MIIT) regulates telecommunications, including 5G services. The regulatory framework emphasizes spectrum allocation across various bands, with policies designed to support rapid deployment and innovation in technology.

- The Ministry of Science and ICT (MSIT) in South Korea regulates 5G services, including private 5G networks and frequency allocation. Under its regulations, mobile network operators (MNOs) are restricted from entering the private 5G operator market to prevent monopolistic practices. The Telecommunications Business Act mandates that mobile operators provide wholesale services to mobile virtual network operators (MVNOs).

- In January 2025, the Government of India introduced updated electromagnetic field (EMF) regulations for 5G networks, increasing the permissible power density for base tower stations (BTS) from 1 to 5 watts per square meter. These revised regulations, effective February 1, mark a strategic shift in India's 5G infrastructure policies, aiming to support more efficient network deployment and performance.

Competitive Landscape:

The global 5G services market is characterized by a large number of participants, including both established corporations and rising organizations. Companies are adopting strategies like new product launches to accelerate the growth of the market, with key advancements such as the world’s first commercial deployment of 5G Advanced (5G-A) technology playing a crucial role.

This groundbreaking launch demonstrates how companies are pushing the boundaries of 5G capabilities by introducing more advanced, high-performance solutions.

By integrating 5G-A technology into real-world applications, such as enhanced mobile broadband, low-latency communication, and support for the IoT, businesses are setting new standards. These innovations are meeting the growing demand for more robust, future-proof services, driving adoption across multiple sectors and significantly contributing to the market expansion.

- In March 2024, China Mobile Shanghai rolled out 5G-A networks in the city, marking the world’s first commercial deployment of 5G Advanced, reaching nearly 150,000 households. The operator planned to expand the network to 100 cities nationwide and extend it to more than 300 cities by the end of 2024.

List of Key Companies:

- China Mobile International Limited

- Verizon

- AT&T Inc.

- China Telecom Corp. Ltd.

- China Unicom Ltd.

- NTT Communications Corporation (NTT Docomo)

- SK Telecom Co., Ltd.

- KT Corp.

- Vodafone Group

- Deutsche Telekom AG

- Orange Business

- Airtel India

- Reliance Industries Limited (Reliance Jio Infocomm Ltd.)

- Telstra Enterprise International

- T‑Mobile USA, Inc.

- Others

Recent Developments (Partnerships/Agreements/New Product Launch)

- In November 2024, China Telecom partnered with ZTE Corporation to successfully deploy the 5G-A Cluster DRS (Dynamic Radio Sharing) solution around Suzhou Yangcheng Lake. This technology introduces the innovative "Cluster" concept, transitioning the network resource allocation strategy from a "cell-centric" model to a more efficient "user-centric" model.

- In July 2024, NTT DOCOMO, INC. unveiled plans for the commercial deployment of New Radio-Dual Connectivity (NR-DC) across three frequency bands—Sub-6 (3.7GHz and 4.5GHz bands) and millimeter-wave (28GHz band). This technology enables high-speed transmissions by connecting two 5G base stations, allowing for simultaneous transmission and reception across multiple frequencies supported by these stations.

- In October 2024, KT Corporation and Samsung Electronics Co., Ltd. have been chosen to deploy a Private 5G network for the Republic of Korea (ROK) Navy's 'Smart Naval Port' project. Samsung and KT will assist in the Navy's Private 5G development by implementing smart, AI-driven connectivity solutions and enabling a range of next-generation applications.

- In November 2024, Bharti Airtel signed a multi-year, multi-billion-dollar extension agreement with Nokia to deploy 4G and 5G equipment across key cities and states in India. Under this contract, Nokia will provide equipment from its advanced 5G AirScale portfolio, including base stations, baseband units, and the latest generation of Massive MIMO radios. These solutions will enhance Airtel’s network, offering exceptional 5G capacity and coverage while supporting its ongoing network evolution.

- In November 2024, Reliance Jio announced upgrades to its "True 5G" service. These improvements are designed to provide faster speeds, lower latency, and enhanced power efficiency for devices, resulting in a 20-40% increase in battery life.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership