Advanced Materials and Chemicals

Acetic Acid Market

Acetic Acid Market Size, Share, Growth & Industry Analysis, By Application (Vinyl Acetate Monomer, Acetic Anhydride, Acetate Esters, Purified Terepthalic Acid, Others), By End-Use (Plastic and Polymers, Food and Beverages, Adhesives, Paints and Coatings, Textile, Others), and Regional Analysis, 2024-2031

Pages : 150

Base Year : 2023

Release : January 2025

Report ID: KR1194

Acetic Acid Market Size

The global acetic acid market size was valued at USD 16.40 billion in 2023, and is projected to grow from USD 17.39 billion in 2024 to USD 27.10 billion by 2031, exhibiting a CAGR of 6.55% during the forecast period. The growing consumption of vinegar across the food & beverage industry is driving the market.

Vinegar, which contains 4-8% acetic acid, is extensively used in food preservation, flavor enhancement, and as a condiment. In the scope of work, the report includes products offered by companies such as Celanese Corporation, LyondellBasell Industries Holdings B.V., SABIC, HELM AG, Eastman Chemical Company, Dow, INEOS, Mitsubishi Chemical Group Corporation, Daicel Corporation, Jiangsu Sopo (Group) Co. Ltd., and others.

Acetic acid is a key ingredient in the production of various chemicals like acetic anhydride, acetate esters, and vinyl acetate monomer, driving significant growth in the acetic acid market. These chemicals are integral to the textiles, plastics, automotive, and pharmaceuticals sectors.

Additionally, the increasing demand for high-quality synthetic fibers in textiles and the growing adoption of plastics in packaging are boosting the consumption of acetic acid. The pharmaceuticals sector's reliance on acetic acid in the synthesis of medicinal compounds is further bolstering market growth.

Acetic acid, often referred to as ethanoic acid, is a colorless liquid organic compound with a pungent odor and a strong acidic taste. It is the key component of vinegar, constituting 4-8% of its content. Acetic acid has a molecular formula of C₂H₄O₂ and is characterized by its corrosive properties. It is widely used in the chemical industry for producing acetic anhydride, acetate esters, and other chemicals.

Acetic acid also plays a vital role in food preservation, acting as a preservative and flavoring agent. Its industrial applications span the textiles, plastics, and pharmaceuticals sectors.

Analyst’s Review

The growing interest in green chemistry and eco-friendly industrial practices is driving innovation in acetic acid production. Companies are investing in the development of bio-based acetic acid, derived from renewable resources such as biomass or natural gas, rather than from traditional petrochemical processes.

This sustainable alternative is environmentally friendly and aligns with global regulatory trends that emphasize reducing reliance on fossil fuels. The shift toward bio-based acetic acid is expected to attract more investment and generate market opportunities, further propelling the acetic acid market.

- In May 2023, Sekab expanded he production of bio-based acetic acid. Sekab can now offer faster and larger deliveries. The product is fully bio-based, allowing businesses to reduce their carbon dioxide emissions by an impressive 50 percent.

Acetic acid aids in the production of renewable energy sources like biofuels, including ethanol. Governments and industries are focusing on reducing carbon emissions. Thus, biofuels derived from renewable sources are gaining prominence.

- In July 2024, Global Bioenergies modified its process for converting plant resources into Sustainable Aviation Fuels (SAF) to produce e-SAF, utilizing acetic acid as a key resource. e-SAFs are created through the combination of CO2 and hydrogen, which are generated from renewable electricity.

This trend is leading to a rise in the demand for acetic acid, which is used in the production and processing of biofuels, particularly in the context of sustainable energy solutions and low-carbon technologies.

Acetic Acid Market Growth Factors

The expansion of acetic acid production facilities is driving the acetic acid market. Increased production capacity allows for a more consistent and abundant supply of acetic acid, meeting the growing demand across the chemicals, packaging, pharmaceuticals, food processing, and other industries. By scaling up production, manufacturers achieve economies of scale, reduce production costs, and offer competitive pricing, thereby attracting a larger customer base.

Furthermore, new facilities often incorporate advanced technologies that enhance production efficiency and sustainability, addressing environmental concerns while ensuring a reliable supply.

- In September 2023, INEOS revealed that it had reached an agreement with Eastman Chemical Company to acquire the Eastman Texas City site, which includes the 600kt acetic acid plant and all related third-party operations, for approximately USD 500 million. Additionally, Eastman and INEOS signed a Memorandum of Understanding (MoU) to explore the potential for a long-term supply agreement for vinyl acetate monomer.

The expansion of the global automotive industry is boosting the acetic acid industry. Acetic acid is used in the production of coatings, adhesives, and lubricants, which are integral to vehicle manufacturing. Growing production in the automotive sector and the increasing consumer demand for vehicles, particularly in emerging economies, are increasing the consumption of acetic acid.

However, the volatility in raw material prices, particularly methanol and carbon monoxide, which are essential feedstocks for acetic acid production, is limiting the market growth. Fluctuations in the supply of these materials, driven by geopolitical issues and market uncertainties, impact production costs and pricing strategies, limiting profitability for manufacturers.

Companies are increasingly investing in backward integration to secure a steady supply of raw materials. Additionally, adopting advanced production technologies that improve feedstock efficiency and exploring alternative bio-based production methods help manufacturers mitigate cost volatility and ensure sustainable growth.

Acetic Acid Market Trends

Advancements in acetic acid production technologies have significantly impacted the growth of the acetic acid market. Technological developments have led to an increase in production efficiency, enabling manufacturers to meet the growing demand across multiple industries.

- In May 2023, chemical engineers at Monash University developed an industrial process for producing acetic acid by utilizing excess carbon dioxide (CO2) from the atmosphere, with the potential to generate negative carbon emissions. Researchers are currently working on commercializing the process in collaboration with industry partners, as part of the Australian Research Council (ARC) Research Hub for Carbon Utilization and Recycling.

The acetic acid industry is poised for sustained growth in the coming years, due to lower production costs and improved supply chain management.

Furthermore, the packaging industry, particularly the demand for plastic packaging, has registered substantial growth, driving up the need for acetic acid. Acetic acid is crucial in the production of various types of plastics, such as polyethylene terephthalate (PET), used in packaging materials for beverages, food, and consumer goods.

The rising consumption of packaged goods, driven by urbanization and changing lifestyles, continues to propel the demand for plastics and, in turn, acetic acid. This packaging sector's rapid expansion in both developed and developing regions is a key contributor to the acetic acid market's growth.

Segmentation Analysis

The global market has been segmented based on application, end-use, and geography.

By Application

Based on application, the market has been segmented into vinyl acetate monomer, acetic anhydride, acetate esters, purified terepthalic acid, and others. The vinyl acetate monomer segment led the acetic acid industry in 2023, reaching the valuation of USD 6.67 billion. Vinyl acetate monomer (VAM) is a critical raw material in producing adhesives, paints, coatings, and films, which are widely utilized across the packaging, construction, and automotive industries.

The growing demand for high-performance adhesives and water-based coatings, driven by expanding infrastructure projects and environmental regulations, has further bolstered the segment’s prominence.

By End-Use

Based on end-use, the market has been classified into plastic and polymers, food and beverages, adhesives, paints and coatings, textile, and others. The adhesives, paints and coatings segment is poised for significant growth at a robust CAGR of 9.11% through the forecast period. Acetic acid serves as a critical raw material in the production of VAM, a key component in adhesives and coatings.

The growing demand for high-performance adhesives in construction projects and packaging materials drives this segment. Acetic acid derivatives enhance the durability, resistance, and esthetic appeal of paints & coatings, meeting the rising need for protective and decorative solutions. The segment's dominance is further supported by infrastructure development and growing industrial activities globally, boosting the demand for acetic acid-based products.

Acetic Acid Market Regional Analysis

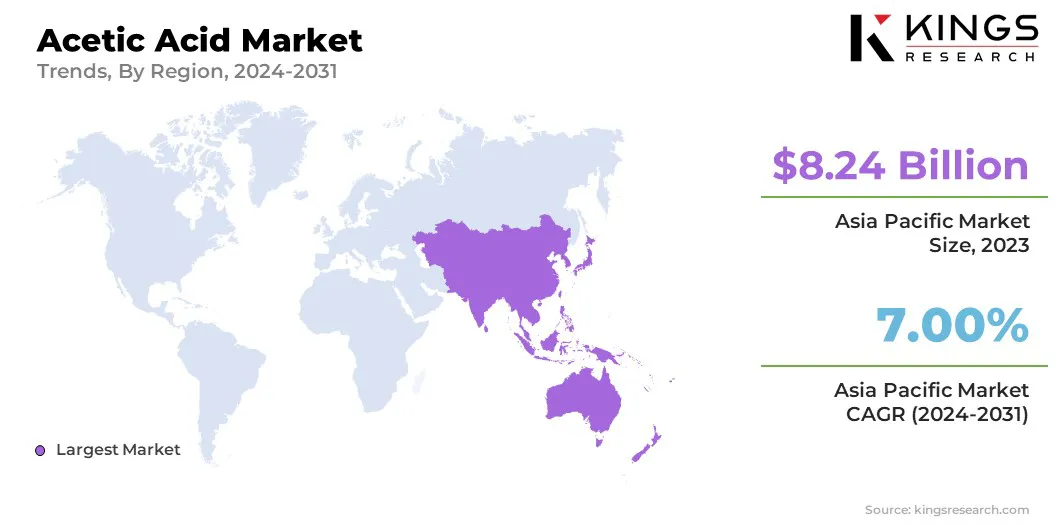

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounts for 50.23% share of the global acetic acid market in 2023, with a valuation of USD 8.24 billion. The accelerated industrialization and urbanization in Asia Pacific are contributing to the growth of the market. Countries such as China, India, and others in Southeast Asia are developing their manufacturing sectors, leading to the rising demand for acetic acid in various industries, including chemicals, textiles, and packaging.

Urbanization leads to greater consumption of goods, which, in turn, boosts the demand for plastics, synthetic fibers, and other acetic acid derivatives, contributing to market expansion in the region.

- In November 2024, INEOS Acetyls and Gujarat Narmada Valley Fertilizers & Chemicals Ltd (GNFC) entered into an MOU to assess the feasibility of constructing a world-scale acetic acid plant with a capacity of 600kt at GNFC's facility in Gujarat, India. The domestic production of acetic acid will meet the existing demand and provide a significant boost to emerging downstream sectors.

Furthermore, the increasing healthcare spending, aging population, and rise in chronic diseases are contributing to the growth of the pharmaceutical industry, which, in turn, drives the need for acetic acid in the region.

The market in Europe is poised for significant growth at a robust CAGR of 6.51% over the forecast period. Europe is home to a well-established chemical manufacturing industry, driving significant demand for acetic acid. Europe's advanced infrastructure and strong regulatory frameworks supporting chemical production ensure a steady demand, thus supporting the overall growth of the acetic acid market in the region.

Additionally, Europe's textile and fashion industry, particularly in countries like Italy, France, and the UK, is boosting the consumption of acetic acid. With growing consumer demand for high-quality fabrics and eco-friendly materials, the demand for synthetic fibers, including acetate, continues to rise. As the textile industry in Europe continues to innovate with sustainable and luxury fabrics, acetic acid consumption is expected to grow, further boosting the market in the region.

Competitive Landscape

The global acetic acid market report will provide valuable insights with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create opportunities for market growth.

List of Key Companies in Acetic Acid Market

- Celanese Corporation

- LyondellBasell Industries Holdings B.V.

- SABIC

- HELM AG

- Eastman Chemical Company

- Dow

- INEOS

- Mitsubishi Chemical Group Corporation

- Daicel Corporation

- Jiangsu Sopo (Group) Co. Ltd.

Key Industry Developments

- April 2024 (Expansion): Celanese Corporation announced the extension of its CO Phase II contract with Nanjing Chengzhi Clean Energy Co., Ltd., ensuring a stable long-term supply of carbon monoxide for its Nanjing facility. As a vital feedstock for acetic acid production, this agreement supports the operations of Celanese’s 1,200 kt acetic acid plant while providing increased operational flexibility.

- December 2023 (Expansion): Jiangsu SOPO Chemical announced plans to invest in an integrated vinyl acetate and EVA project located in the Zhenjiang New District New Materials Park. The project involves an investment of approximately USD 960 million, surpassing the company’s total asset level.

The global acetic acid market has been segmented as:

By Application

- Vinyl Acetate Monomer

- Acetic Anhydride

- Acetate Esters

- Purified Terepthalic Acid

- Others

By End-Use

- Plastic and Polymers

- Food and Beverages

- Adhesives, Paints and Coatings

- Textile

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership