Acetonitrile Market

Acetonitrile Market Size, Share, Growth & Industry Analysis, By Type (Derivative, Solvent), By End User Industry & Application (Pharmaceutical Industry, Analytical Industry, Agrochemical Industry & Others), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR1016

Acetonitrile Market Size

The global Acetonitrile Market size was valued at USD 305.9 million in 2023 and is projected to grow from USD 321.2 million in 2024 to USD 455.8 million by 2031, exhibiting a CAGR of 5.13% during the forecast period. The market is witnessing substantial growth due to its expanding use across diverse industries such as electronics and agrochemicals, where it serves as a crucial solvent and reagent.

Additionally, the market is benefiting from innovations in acetonitrile recovery and recycling technologies, which improve sustainability and reduce production costs. As demand for advanced chemical processes increases, the market is projected to experience notable expansion, supported by these technological advancements.

In the scope of work, the report includes solutions offered by companies such as INEOS, Honeywell International Inc, Asahi Kasei Corporation, Alkyl Amines Chemicals Limited, Henan GP Chemicals Co.,Ltd, Shandong Xinhua Pharma, Zhengzhou Meiya Chemical Products Co., Ltd., Jindal Speciality Chemical, Merck KGaA, Nova Molecular Technologies, and others.

The acetonitrile market is experiencing robust growth, mainly due to its critical role as a solvent in pharmaceutical manufacturing, high-performance liquid chromatography (HPLC), and analytical applications.

Its high purity and low water content make it essential for drug development and quality control, while its expanding use in emerging sectors, such as battery manufacturing and agrochemicals, further bolster its demand. Additionally, the market is witnessing increased investment by key players, which is further expected to contribute to the growth of the market.

- For instance, in April 2022, Ineos revealed its plans to invest in a large-scale acetonitrile production facility at its main site in Köln, Germany.

Acetonitrile, chemically known as methyl cyanide, is a colorless, volatile liquid with a distinctive odor, widely used in both industrial and laboratory settings. It is characterized by its high purity and low water content, making it an essential solvent in pharmaceuticals, where it facilitates drug synthesis and purification.

Additionally, acetonitrile plays a crucial role in high-performance liquid chromatography (HPLC) for separating and analyzing compounds. Its applications extend to the electronics industry for the production of synthetic fibers, as well as to to agrochemicals sector where it serves as a reagent. Acetonitrile’s versatility and effectiveness in various chemical processes make it a valuable component in multiple sectors.

Analyst’s Review

The expansion of acetonitrile production facilities and increased investments by key industry players are fueling market growth.

- In May 2023, Jindal Speciality Chemicals Private Limited, a prominent chemical manufacturer in India, allocated USD 12 million to establish a new acetonitrile production facility in Kheda, Gujarat. This facility is projected to have an annual production capacity of 10,000 tonnes.

Key players are aiding market growth by expanding production capacities and investing heavily in new facilities, thereby increasing supply and meeting the rising demand for acetonitrile. These strategic investments facilitate the scaling of operations and improve market dynamics, thereby contributing to industry development.

Acetonitrile Market Growth Factors

The rising use of acetonitrile as a solvent in pharmaceutical manufacturing and drug development is supporting market growth. Acetonitrile's high purity and low water content make it an essential solvent for various pharmaceutical applications, including synthesis, purification, and analysis of drugs.

Its role in high-performance liquid chromatography (HPLC) enables precise separation and analysis of compounds, which is crucial for drug discovery and quality control. As pharmaceutical companies continue to focus on developing new medications and improving existing formulations, the demand for acetonitrile in these processes is expected to increase, thereby propelling the expansion of the market.

The acetonitrile market faces challenges such as fluctuating raw material prices and stringent environmental regulations. Volatility in the cost of raw materials may lead to increased production expenses, which impacts profitability. Additionally, compliance with strict regulations on emissions and waste management adds to operational costs.

These issues hinder market growth by increasing production costs and complicating regulatory adherence. To mitigate these challenges, key players are investing heavily in advanced, cost-effective production technologies and implementing sustainable practices.

Innovations in recycling processes and strategic raw material sourcing are helping companies reduce costs and ensure regulatory compliance, thereby stabilizing the market and supporting growth.

Acetonitrile Market Trends

Emerging applications of acetonitrile in sectors such as battery manufacturing and agrochemicals are creating lucrative market growth opportunities. In battery manufacturing, acetonitrile is used as a solvent in the production of lithium-ion batteries, where it plays a crucial role in synthesizing electrolytes and improving battery performance.

In the agrochemical sector, acetonitrile functions as a solvent for formulating pesticides and herbicides, contributing to the enhanced efficacy and stability of these chemicals. The emergence of these new applications are generating a strong demand for acetonitrile beyond its traditional uses, leading to market expansion as industries increasingly seek advanced materials and formulations. This diversification of use cases is fostering growth and innovation within the acetonitrile market.

The expanding applications of acetonitrile in high-performance liquid chromatography (HPLC) and other analytical techniques are boosting market expansion. Acetonitrile is highly valued for its ability to provide high-purity solvents, which are critical for accurate and reliable separation and analysis in HPLC.

Its low viscosity and high dielectric constant make it an ideal choice for mobile phases in chromatographic processes, thereby enhancing both the resolution and sensitivity of analyses. As laboratories and research institutions increasingly rely on advanced analytical methods for quality control, drug testing, and environmental monitoring, the demand for acetonitrile is growing, resulting in market expansion.

Segmentation Analysis

The global market is segmented based on type, end user industry & application, and geography.

By Type

Based on type, the market is categorized into derivative and solvent. The derivative segment led the acetonitrile market in 2023, reaching a valuation of USD 180.2 million. The derivative segment is further divided into acetic acid, acetone, acrylonitrile, and others. The rise in demand for these derivatives is facilitated by their critical roles in manufacturing processes, including the production of agrochemicals, pharmaceuticals and polymers.

As industries seek advanced chemical solutions and expand their production capacities, the demand for acetonitrile derivatives is increasing. Innovations in chemical synthesis and applications further boost the growth of the segment.

By End User Industry & Application

Based on end user industry & application, the market is categorized into pharmaceutical industry, analytical industry, agrochemical industry, chemical processing industry, and other industries and applications. The pharmaceutical industry segment captured the largest acetonitrile market share of 38.91% in 2023.

The pharmaceutical industry segment is further divided into API synthesis, drug extraction, and purification. Acetonitrile is used as a solvent in the synthesis of active pharmaceutical ingredients (APIs) and is utilized in high-performance liquid chromatography (HPLC) for drug analysis. The increasing focus on new drug discovery, coupled with advancements in analytical techniques, fosters the demand for high-purity acetonitrile.

Additionally, rising investments in pharmaceutical R&D and the growth of the global pharmaceutical market stimulate segmental expansion. As pharmaceutical companies continue to innovate and expand, the need for acetonitrile in their processes is expected to grow.

Acetonitrile Market Regional Analysis

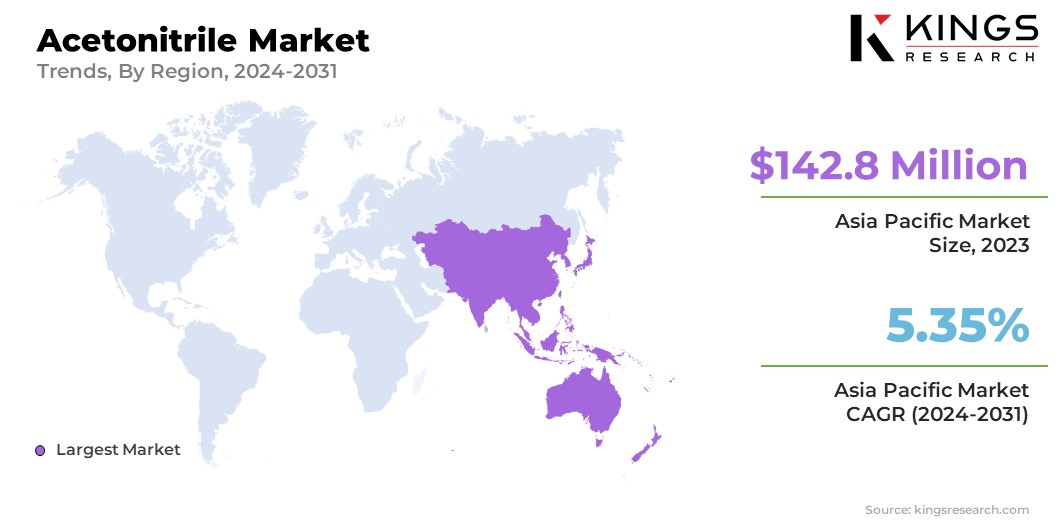

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific acetonitrile market share stood around 46.7% in 2023 in the global market, with a valuation of USD 142.8 million, mainly attributed to rapid industrialization and increasing demand in pharmaceuticals and agrochemicals. Countries such as China and India are expanding their chemical manufacturing capabilities, highlighting the rising need for high-purity solvents.

Additionally, the utilization of acetonitrile in petrochemical processes is propelling regional market growth, as it serves as a critical solvent in refining and production.

- For instance, in July 2022, PetroChina initiated a project valued at USD 4.52 billion to convert a refinery in southern China into a fully integrated petrochemicals facility.

With ongoing investments in infrastructure and technology, the region is witnessing significant development in acetonitrile production and application, positioning it as a major market for acetonitrile. North America is anticipated to witness significant growth at a CAGR of 5.08% over the forecast period. The region's advanced research facilities and stringent regulatory standards for pharmaceutical and analytical applications necessitate the use of high-purity acetonitrile.

Moreover, increasing utilization of acetonitrile in the production of specialty chemicals and agrochemicals contributes to domestic market expansion. Investments in innovative chemical technologies and a growing focus on sustainability are enhancing production capabilities. The region's rising emphasis on high-quality manufacturing and technological advancements establishes it as a significant market for acetonitrile.

Competitive Landscape

The global acetonitrile market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Acetonitrile Market

- INEOS

- Honeywell International Inc

- Asahi Kasei Corporation

- Alkyl Amines Chemicals Limited

- Henan GP Chemicals Co.,Ltd

- Shandong Xinhua Pharma

- Zhengzhou Meiya Chemical Products Co.,Ltd

- Jindal Speciality Chemical

- Merck KGaA

- Nova Molecular Technologies

Key Industry Development

- June 2023 (Product Launch): INEOS Nitriles launched its first bio-attributed product line for Acrylonitrile under the InvireoTM brand. InvireoTM represents a major innovation in the global acrylonitrile market, offering a more climate-friendly and sustainable alternative to existing acrylonitrile.

The global acetonitrile market is segmented as:

By Type

- Derivative

- Acetic Acid

- Acetone

- Acrylonitrile

- Others

- Solvent

- HPLC Grade

- GPC Grade

- Pharmaceutical Grade

- Others

By End User Industry & Application

- Pharmaceutical Industry

- API Synthesis

- Drug Extraction

- Purification

- Analytical Industry

- High-Performance Liquid Chromatography (HPLC)

- Gas Chromatography (GC)

- Nuclear Magnetic Resonance (NMR)

- Agrochemical Industry

- Pesticides

- Herbicides

- Fungicides

- Chemical Processing Industry

- Acetophenone Production

- Butadiene

- Other Organic Chemicals

- Other Industries and Applications

- DNA Synthesis

- Textile Dyeing

- Battery Applications

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership