Agriculture

Agricultural Surfactants Market

Agricultural Surfactants Market Size, Share, Growth & Industry Analysis, By Type (Non-Ionic, Anionic, Cationic, Amphoteric.), By Application (Herbicides, Insecticides, Fungicides, Others.), By Substrate (Synthetic, Bio-Based.) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : February 2024

Report ID: KR494

Agricultural Surfactants Market Size

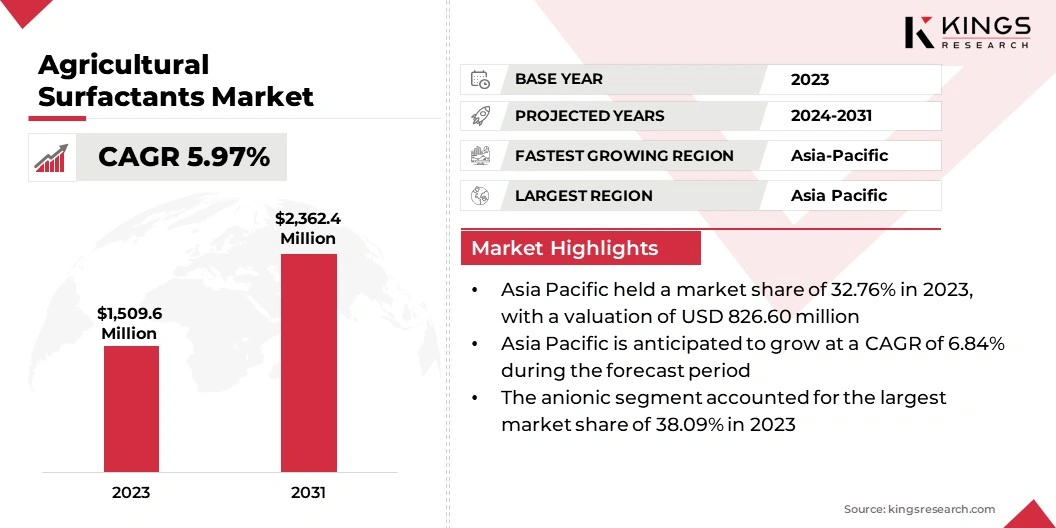

The global Agricultural Surfactants Market size was valued at USD 1,509.6 million in 2023 and is projected to reach USD 2,362.4 million by 2031, growing at a CAGR of 5.97% from 2024 to 2031. The market is experiencing steady growth, driven by the increasing demand for improved agricultural productivity and the growing adoption of advanced farming techniques worldwide.

In the scope of work, the report includes products offered by companies such as BASF SE, UPL, FMC Corporation, Syngenta Crop Protection AG, Corteva, Dow, Nufarm Australia, Croda International Plc, Evonik Industries AG, CLARIANT, Bayer AG and others.

Surfactants play a crucial role in modern agriculture by enhancing the efficacy of agrochemicals and ensuring optimal absorption by plants. This market segment is witnessing robust expansion due to the rising need for crop protection solutions in response to escalating environmental challenges and evolving pest pressures. In recent years, market players have focused on developing eco-friendly surfactant formulations to address environmental concerns and regulatory restrictions.

Moreover, technological advancements in surfactant manufacturing processes have led to the introduction of highly efficient and cost-effective products, thereby fueling market growth. Regional dynamics significantly shape the agricultural surfactants market, with varying trends and challenges across different geographic areas. For instance, in North America, stringent regulatory standards drive the adoption of environmentally friendly surfactants, while in Asia-Pacific, rapid urbanization and shrinking arable land necessitate the use of high-performance agricultural inputs to maximize yield potential.

The growth of the industry is further propelled by technological advancements, with manufacturers increasingly focusing on developing novel surfactant formulations that offer superior performance and environmental compatibility. Bio-based surfactants, derived from renewable sources, are gaining significant traction as eco-friendly alternatives, reflecting the industry's commitment to sustainability.

Analyst’s Review

Amidst rising concerns over environmental sustainability and food security, the agricultural surfactants market is witnessing significant growth, driven by the increasing adoption of precision farming techniques and bio-based formulations. With a rising focus on innovation and strategic alliances, industry players are poised to capitalize on emerging market trends and gain a competitive edge.

Furthermore, advancements in digital agriculture and data analytics are revolutionizing crop protection strategies, offering tailored solutions for enhanced efficiency and reduced environmental impact. As the industry embraces these transformative technologies, there are abundant opportunities for stakeholders to redefine agricultural practices and foster sustainable growth in the sector.

Market Definition

The market encompasses a diverse range of chemical compounds utilized in agriculture to enhance the efficacy and performance of agrochemicals such as pesticides, herbicides, and fungicides. Surfactants, short for surface-active agents, play a crucial role in modifying the surface tension of liquids, thereby facilitating their uniform distribution, adherence, and absorption on plant surfaces. These compounds serve as essential adjuvants in crop protection formulations, aiding in the penetration of active ingredients into plant tissues and improving overall spray coverage.

The agricultural surfactants market caters to various agricultural sectors, including row crops, fruits, vegetables, and specialty crops, thereby addressing the need for effective solutions to combat pests, diseases, and weed infestations. With a growing focus on optimizing agricultural inputs and minimizing environmental impact, the market plays a vital role in supporting sustainable farming practices and ensuring global food security.

Market Dynamics

The increasing global emphasis on sustainable agricultural practices is a significant factor contributing to the growth of the agricultural surfactants market. With growing environmental concerns and regulatory pressure to minimize chemical residues in food production, there is a rising demand for eco-friendly surfactant formulations derived from renewable sources. Manufacturers are responding to this trend by investing extensively in research and development to create bio-based surfactants that offer comparable performance to traditional chemical counterparts.

Additionally, consumers are increasingly seeking products labeled as environmentally friendly, thus boosting the adoption of sustainable agricultural inputs. This demand for sustainability is reshaping the market landscape, with companies striving to differentiate themselves by offering products that meet both performance and eco-conscious criteria.

Furthermore, the surging adoption of integrated pest management (IPM) practices is another key factor shaping the agricultural surfactants market. IPM emphasizes a holistic approach to pest control, incorporating various strategies such as biological control, crop rotation, and targeted pesticide application. Surfactants play a crucial role in IPM programs by improving the efficacy of biological control agents and reducing the reliance on conventional chemical pesticides.

As farmers increasingly recognize the long-term benefits of IPM in preserving ecosystem balance and minimizing pesticide resistance, the demand for surfactants as integral components of IPM solutions is expected to rise, thereby driving market growth. Despite the significant growth factors, the market experiences major challenges such as the price volatility of raw materials. Surfactant production relies heavily on a variety of raw materials, including petrochemicals and natural oils.

The prices of these materials can fluctuate due to various factors such as geopolitical tensions, supply chain disruptions, and currency fluctuations. These fluctuations can pose challenges for manufacturers in terms of production costs and profit margins. Additionally, sudden price spikes can disrupt supply chains and lead to temporary shortages, thereby impacting market stability and hindering growth.

Segmentation Analysis

The global market is segmented based on type, application, substrate, crop type, and geography.

By Type

Based on type, the market is categorized into non-ionic, anionic, cationic, and amphoteric. The anionic segment accounted for the largest market share of 38.09% in 2023 and is estimated to continue its dominance over 2024-2031. This considerable growth is mainly driven by its widespread use and effectiveness in enhancing the performance of agrochemicals. Anionic surfactants exhibit strong wetting and spreading properties, making them ideal for various agricultural applications.

Factors such as their compatibility with a wide range of pesticides and herbicides, along with their ability to improve spray coverage and adhesion, contribute to their continued dominance. With increasing demand for crop protection solutions and a growing focus on optimizing agricultural inputs, the anionic segment is expected to maintain its leading position in the market in the foreseeable future.

By Application

Based on application, the market is further divided into herbicides, insecticides, fungicides, and others. Herbicides dominated the agricultural surfactants market in 2023, generating a valuation of USD 704.7 million. This dominance is mainly attributed to the widespread use of herbicides in weed control, a critical aspect of crop protection strategies.

Surfactants play a vital role in herbicide formulations by improving their efficacy through better adhesion and penetration, ensuring targeted weed management while minimizing environmental impact. With the persistent challenge of weed infestations and the continuous demand for high-performance herbicides, the segment is poised to continue to dominate the market.

By Substrate

Based on substrate, the market is bifurcated into synthetic and bio-based. Synthetic substrates held a substantial agricultural surfactants market share of 65.55% in 2023, fueled by the widespread availability and established efficacy of synthetic surfactants in agricultural applications. Synthetic surfactants are highly favored due to their consistent performance, versatility, and cost-effectiveness compared to bio-based alternatives.

Additionally, advancements in synthetic chemistry have led to the development of surfactants with tailored properties to meet specific agricultural needs. While the demand for bio-based surfactants is rising due to environmental concerns, synthetic substrates continue to account for a majority share, driven by their proven track record and widespread adoption in the industry.

However, bio-based substrates are anticipated to experience the fastest growth rate of 8.68% over 2024-2031 owing to the increasing adoption of organic farming practices amidst rising emphasis on sustainability.

Geographical Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific Agricultural Surfactants Market share stood around 32.76% in 2023 in the global market, with a valuation of USD 826.60 million, boasting the dual distinction of being the largest and fastest-growing region in the market. With a burgeoning population and increasing urbanization, the demand for food products is increasing rapidly across the region, thereby driving the need for efficient crop protection solutions.

Moreover, the region's diverse climatic conditions and extensive agricultural landscapes present unique challenges, necessitating tailored surfactant formulations to address varying pest pressures and environmental conditions.

Furthermore, Asia-Pacific is anticipated to experience a robust CAGR of 6.84% over 2024-2031, primarily due to the presence of the largest agricultural economies in the region. Furthermore, key factors propelling domestic market growth include the rising adoption of modern farming techniques, expansion of commercial agriculture, and supportive government initiatives promoting agricultural productivity.

Countries such as China, India, and Southeast Asian nations are witnessing significant investments in agriculture infrastructure and technology, fostering the adoption of advanced surfactant-based solutions. Furthermore, the region's robust manufacturing base and competitive labor costs contribute to the production and distribution of surfactants at competitive prices, thereby stimulating market expansion. Asia-Pacific is anticipated to continue its dominance over the forecast period.

Europe is a pivotal region in the agricultural surfactants market, characterized by its established agricultural sector, stringent regulatory framework, and growing emphasis on sustainability. Europe emerged as the third-largest region in terms of revenue, generating a valuation of USD 347.8 million in 2023. Europe, with its rich history of agricultural innovation and a commitment to environmental stewardship, serves as a trendsetter in the adoption of eco-friendly farming practices and the development of sustainable crop protection solutions.

One of the major driving factors behind Europe's prominence in the market is its robust regulatory environment, which prioritizes consumer safety, environmental protection, and sustainable agriculture. Stringent regulations governing the use of agrochemicals and surfactants drive the demand for environmentally friendly formulations and promote innovation in product development.

Competitive Landscape

The agricultural surfactants market report will provide valuable insight with an emphasis on the fragmented nature of the sector. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Widely adopted strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, are positively influencing the market outlook.

List of Key Companies in Agricultural Surfactants Market

- BASF SE

- UPL

- FMC Corporation

- Syngenta Crop Protection AG

- Corteva

- Dow

- Nufarm Australia

- Croda International Plc

- Evonik Industries AG

- CLARIANT

- Bayer AG

Key Industry Developments

- January 2023 (Acquisition) - Nouryon announced the completion of its acquisition of ADOB, a prominent supplier of chelated micronutrients, foliars, and other specialty agricultural solutions based in Poland. This acquisition allows Nouryon to expand its services and product offerings in the Agriculture & Food industry. All business operations, including two manufacturing sites in Pozna and Wrocaw, Poland, have been transferred to Nouryon as part of the transaction. The financial terms of the agreement have not been disclosed.

The Global Agricultural Surfactants Market is Segmented as:

By Type

- Non-Ionic

- Anionic

- Cationic

- Amphoteric

By Application

- Herbicides

- Insecticides

- Fungicides

- Others

By Substrate

- Synthetic

- Bio-Based

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership