Food and Beverages

Algae Protein Market

Algae Protein Market Size, Share, Growth & Industry Analysis, By Application (Dietary Supplements, Food Products, Animal Feed, Others) By Source (Freshwater Algae, Marine Algae), By Type (Spirulina, Chlorella), and Regional Analysis, 2024-2031

Pages : 180

Base Year : 2023

Release : February 2025

Report ID: KR1362

Market Definition

The market encompasses the production and commercialization of protein derived from various species of algae, notably microalgae and macro algae. This market is driven by the growing demand for sustainable, plant-based protein sources that offer high nutritional value.

Algae protein is utilized in dietary supplements, food products, and functional ingredients, appealing to health-conscious consumers and those seeking environmentally friendly alternatives to traditional protein sources. Advances in cultivation and processing technologies further support market growth and accessibility.

Algae Protein Market Overview

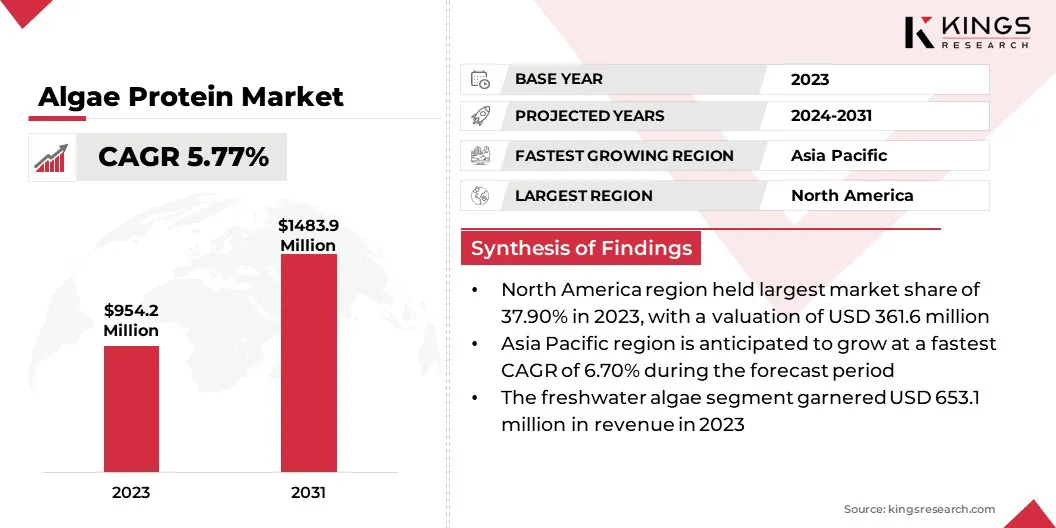

The global algae protein market size was valued at USD 954.2 million in 2023 and is projected to grow from USD 1,002.3 million in 2024 to USD 1,483.9 million by 2031, exhibiting a CAGR of 5.77% during the forecast period.

The market is growing rapidly, due to the rising demand for plant-based proteins, health benefits of algae, and the sustainability of algae cultivation which requires less land and water than traditional livestock farming. Innovations in food products and increased consumer awareness of the nutritional value of algae further boost demand.

The expansion of algae protein into applications such as pet food and pharmaceuticals, along with government support for sustainable practices, positions the market for continued growth in the coming years.

Major companies operating in the algae protein industry are Corbion, Cyanotech Corporation., ALGAMA FOODS, E.I.D. - Parry (India) Limited, Earthrise Nutritionals LLC, dsm-firmenich, BASF, International Flavors & Fragrances Inc., Cargill, Incorporated, Algatech LTD, Nutrex Hawaii, DIC CORPORATION, Algaia, Green Plains Inc., and algaeplanet.com.

- In February 2024, Euglena Co., Ltd. established a production system for Aurantiochytrium, a new material, and began commercial production. This microalga, rich in DHA and other valuable compounds, will be used in various industries, including food and cosmetics. The company aims to expand applications and strengthen its biotechnology business.

Key Highlights:

- The algae protein industry size was valued at USD 954.2 million in 2023.

- The market is projected to grow at a CAGR of 5.77% from 2024 to 2031.

- North America held a market share of 37.90% in 2023, with a valuation of USD 361.6 million.

- The dietary supplements segment garnered USD 405.7 million in revenue in 2023.

- The freshwater algae segment is expected to reach USD 906.6 million by 2031.

- The chlorella segment is anticipated to register the fastest CAGR of 7.59% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.70% during the forecast period.

Market Driver

"Growing Interest in Plant-based Proteins"

The rising demand for plant-based proteins, due to health, environmental, and ethical factors, is propelling the algae protein market. Consumers are turning to plant-based diets for their benefits like reduced risks of heart disease, obesity, and diabetes.

Algae protein stands out for its complete amino acid profile, high digestibility, and omega-3 content. Growing awareness of food allergies is driving the demand for dairy & meat alternatives.

- In July 2024, Corbion is advancing algae-based omega-3 production to support human nutrition and ocean sustainability. By cultivating microalgae, the company provides a sustainable alternative to fish-derived omega-3s, reducing pressure on marine ecosystems. This innovation aligns with Corbion’s commitment to promoting sustainable food solutions while meeting the growing demand for plant-based nutrition.

Environmentally, plant-based proteins require fewer resources, reducing land use, water consumption, and Greenhouse Gas (GHG) emissions. Algae protein can be cultivated sustainably in controlled environments, leading to an accelerated shift toward plant-based diets among health-conscious people.

Market Challenge

"Regulatory Hurdles"

Regulatory hurdles present a significant challenge for the algae protein market. Navigating complex food safety regulations can be time-consuming and varies by region, requiring manufacturers to meet stringent safety and quality standards through extensive testing and documentation.

Obtaining essential certifications, such as Generally Recognized as Safe (GRAS) status in the U.S., demands substantial resource investment and expertise.

These regulatory requirements can delay the introduction of new algae-based products, hindering innovation and limiting consumer access. Addressing these challenges is vital for building confidence in algae proteins and promoting their widespread adoption.

Stakeholders should engage proactively with regulatory agencies to overcome regulatory challenges in the market and understand evolving standards. Investing in comprehensive Research and Development (R&D) ensures that products meet safety and quality requirements.

Collaborating with industry associations can provide valuable resources, while consumer education about the benefits of algae proteins can help build public trust. These strategies will enhance the market's ability to navigate regulatory complexities and strengthen growth prospects.

Market Trend

"Heightened Awareness of Health"

Growing health consciousness among consumers is driving the demand for algae and plant-based proteins. As individuals become more aware of nutrition and preventive health, they seek nutrient-dense foods. Algae protein is appealing, due to its high protein content, low calorie count, and rich nutrient profile, including essential vitamins, minerals, and omega-3 fatty acids.

- In November 2023, Algatechnologies highlighted the benefits of beta-glucan in supporting immunity, particularly for seniors. The company explains how beta-glucan, derived from microalgae, can boost immune response and enhance overall health. Algatechnologies emphasizes the role of its microalgae-based products in promoting well-being and preventing age-related immune decline as the aging population becomes more health-conscious.

The rise of plant-based diets and the holistic wellness movement further support the algae protein market, as consumers look for proteins that accommodate dietary intolerances.

Social media and health influencers also play a role in promoting these benefits. Alternative proteins are becoming popular choices for healthier, sustainable diets as consumers read and understand nutrition labels.

Algae Protein Market Report Snapshot

|

Segmentation |

Details |

|

By Application |

Dietary Supplements, Food Products, Animal Feed, Others |

|

By Source |

Freshwater Algae, Marine Algae |

|

By Type |

Spirulina, Chlorella, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Application (Dietary Supplements, Food Products, Animal Feed, Others): The dietary supplements segment earned USD 405.7 million in 2023, due to the growing consumer demand for health-focused, sustainable, and nutrient-rich products like algae protein, particularly among health-conscious individuals seeking plant-based alternatives.

- By Source (Freshwater Algae, Marine Algae): The freshwater algae segment held 68.45% share of the market in 2023, due to its widespread availability, lower production costs, and efficient cultivation in non-arable land and controlled environments, making it a popular choice for algae protein production.

- By Type (Spirulina, Chlorella, Others): The spirulina segment is projected to reach USD 708.9 million by 2031, owing to its high protein content, rich nutrient profile, and increasing consumer demand for plant-based supplements & functional foods that support immune health, energy, and overall wellness.

Algae Protein Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for around 37.90% share of the global algae protein market in 2023, with a valuation of USD 361.6 million. This significant market presence is driven by the growing demand for plant-based protein alternatives and an increasing awareness of the health benefits associated with algae.

Key factors contributing to this growth include the rising adoption of vegetarian & vegan diets and the environmental sustainability advantages linked to algae production compared to conventional protein sources.

Advancements in algae cultivation and processing technologies are enhancing the quality and accessibility of algae protein products. Several companies are at the forefront of the market, demonstrating innovative products and applications.

- In March 2024, Nutrex Hawaii introduced its top-selling BioAstin Hawaiian Astaxanthin in a retail-ready, sugar-free, vegan gummy format. This new offering aims to provide a convenient and health-conscious way for consumers to enjoy the benefits of astaxanthin, a powerful antioxidant.

The algae protein industry in Asia Pacific is poised for significant growth at a robust CAGR of 6.70% over the forecast period. Increasing consumer demand for healthy, sustainable, and innovative protein sources is a major driver for the market. This demand positions Asia Pacific as a crucial hub for investment and development in algae-based products in the coming years.

It is poised to take a central role in the global protein landscape as it continues to evolve. Industries such as food & beverage, nutritional supplements, and aquaculture are anticipated to register particularly strong performance, with countries like China, India, and Southeast Asian nations leading the way.

- DIC Corporation produces spirulina using safe, researched strains at its factories, ensuring compliance with international standards like ISO, HACCP, and GMP. This high-quality spirulina is used in health foods, as well as fortifying products such as bread, noodles, and smoothies, catering to health-conscious consumers.

Regulatory Frameworks:

- In India, the Food Safety and Standards Authority of India (FSSAI) issued a Gazette Notification, outlining regulations for non-specified food ingredients. The notification provides guidelines for the approval and safety assessment of novel ingredients, including those derived from algae, that are not yet specifically mentioned in the Food Safety and Standards regulations. It emphasizes the need for safety data and compliance with food safety standards before these ingredients can be used in food products in India.

- The EMA supervises gene therapies in the EU with stringent oversight on human germline editing under the Oviedo Convention. Genome-edited organisms in agriculture are regulated under GMO laws, following a 2018 ECJ ruling.

- The Singapore Food Agency (SFA) provides guidelines on novel foods, including algae-based proteins, under its regulatory framework for novel foods. These guidelines detail the approval process for new food ingredients, requiring comprehensive safety assessments and scientific evidence before market approval. The SFA ensures that novel foods meet safety standards, are properly labeled, and pose no health risks to consumers in Singapore.

- The European Union Regulation (EU) No 2283/2015 governs novel foods in the EU, including algae-based proteins. It sets out the framework for the approval and safety assessment of new food ingredients, ensuring that they meet strict health and safety standards before being marketed. The regulation requires that novel foods undergo a thorough evaluation by the European Food Safety Authority (EFSA). They can be sold in EU member states only after receiving approval.

- Health Canada has approved high-oleic algae oil as a novel food ingredient, following a thorough safety assessment. The approval process ensures that the oil meets the necessary health and safety standards for human consumption in Canada. The document provides details on the evaluation, including information on its composition, nutritional value, and safety for use in food products. This approval is part of Health Canada's broader regulatory framework for novel foods, which includes genetically modified organisms and other innovative ingredients.

Competitive Landscape

The global algae protein market is characterized by several participants, including both established corporations and rising organizations. Companies should focus on innovation in product development, prioritize sustainability, and enhance their R&D efforts to gain a competitive edge in this market.

Establishing strategic partnerships, enhancing production efficiency, and adhering to regulatory requirements are essential measures for companies to differentiate themselves in the market. Furthermore, expanding market reach through effective marketing strategies and exploring emerging applications in food, beverages, and animal feed will be critical to achieving success.

- In October 2024, DSM-Firmenich expanded its Advanced Life’s portfolio with the introduction of Life’s DHA B54-0100, a naturally potent DHA algal oil. This product stands out, due to its exceptional sensory appeal, designed to enhance the consumer experience while providing high-quality omega-3 DHA from algae. DSM-Firmenich continues to innovate in algae-based products, focusing on sustainability and nutritional benefits to meet the growing demand for plant-based and functional food ingredients.

List of Key Companies in Algae Protein Market:

- Corbion

- Cyanotech Corporation.

- ALGAMA FOODS

- E.I.D. - Parry (India) Limited

- Earthrise Nutritionals LLC

- dsm-firmenich

- BASF

- International Flavors & Fragrances Inc.

- Cargill, Incorporated

- Algatech LTD

- Nutrex Hawaii

- DIC CORPORATION

- Algaia

- Green Plains Inc.

- algaeplanet.com

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In May 2023, Cyanotech announced a partnership with Symbrosia to grow its proprietary strain of seaweed for sustainable algae production. This collaboration aims to enhance the cultivation of algae for protein, omega-3, and other nutrients, supporting Cyanotech’s growth in the market. The partnership emphasizes sustainability and the development of innovative solutions for the food and nutrition industries, helping meet the increasing demand for eco-friendly protein alternatives.

- In February 2025, CH4 Global launched a commercial-scale facility for growing Asparagopsis, a type of red seaweed known for its potential to reduce methane emissions in livestock. The new facility aims to scale production and support the agriculture industry in adopting sustainable feed additives to combat climate change.

- On October 28, 2024, Cellana, Inc. and PhytoSmart Inc. announced the signing of a definitive merger agreement. This merger aims to accelerate the commercialization of sustainable algae-based products, focusing on Omega-3 supplements and plant-based proteins. PhytoSmart will become a subsidiary of Cellana, with plans to expand its offerings in the pet and human nutritional sectors. This combination brings together PhytoSmart’s modular algae production technology and Cellana’s large-scale algae biomass production expertise to create a broader product portfolio for both niche and high-volume markets.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)