Food and Beverages

Beta-Alanine Supplements Market

Beta-Alanine Supplements Market Size, Share, Growth & Industry Analysis, By Form (Powder, Capsules/Tablets, Chewables & Gummies, Liquid), By Sales Channel (Supermarkets/Hypermarkets, Pharmacies, Health & Wellness Store, Specialty Stores, Online Retail), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : February 2025

Report ID: KR348

Market Definition

Beta-alanine supplements are dietary products designed to enhance athletic performance and muscle endurance by increasing carnosine levels in the muscles.

Beta-alanine, a non-essential amino acid, plays a crucial role in buffering acid buildup during high-intensity exercise, helping to delay muscle fatigue and improve workout efficiency. These supplements are commonly used in sports nutrition and pre-workout formulations to support strength training, endurance activities, and overall physical performance.

Beta-Alanine Supplements Market Overview

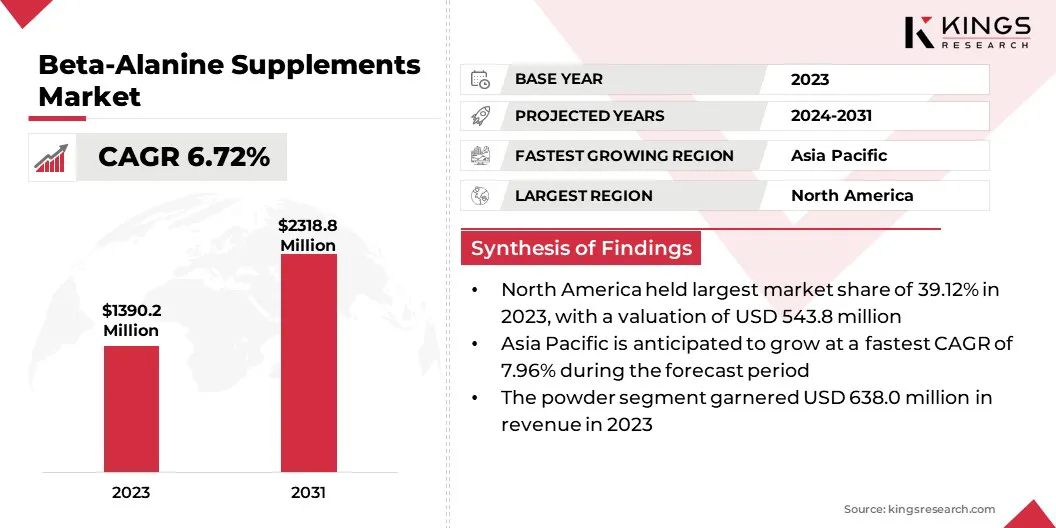

The global beta-alanine supplements market size was valued at USD 1,390.2 million in 2023 and is projected to grow from USD 1,471.2 million in 2024 to USD 2,318.8 million by 2031, exhibiting a CAGR of 6.72% during the forecast period.

The market is expanding, due to the rising demand for sports nutrition products, driven by increasing fitness awareness and athletic performance enhancement. Growing adoption of functional foods with bioactive ingredients is further accelerating the market growth, as consumers seek supplements that improve endurance and muscle recovery.

Additionally, advancements in supplement formulations, including sustained-release technologies, are enhancing beta-alanine bioavailability, making these products more effective and widely accepted.

Major companies operating in the beta-alanine supplements industry are Natural Alternatives International, Inc., Anhui Huaheng Biotechnology Co., Ltd., NOW Foods, Prinova Group LLC., Spectrum Chemical, Wuxi Jinghai Amino Acid Co., Ltd., Xinfa Pharamceuticals Co.Ltd., NutraBio Labs, Inc., Cellucor, MusclePharm, EVLUTION NUTRITION, GNC Holdings, LLC, MRM Nutrition, Hi-Tech Pharmaceuticals., and ALLMAX Nutrition.

The growing focus on sports nutrition is fueling the market. Athletes, bodybuilders, and fitness enthusiasts increasingly seek performance-enhancing supplements to improve endurance and reduce muscle fatigue.

Beta-alanine plays a crucial role in boosting carnosine levels, which helps buffer acid buildup in muscles during intense workouts. The rising consumer preference for pre-workout and intra-workout supplements has further accelerated demand.

Companies are launching scientifically formulated products tailored for professional athletes and general consumers, contributing to market expansion. The increasing awareness of nutritional supplementation in improving physical performance continues to strengthen the market.

Key Highlights:

Key Highlights:

- The beta-alanine supplements industry size was valued at USD 1,390.2 million in 2023.

- The market is projected to grow at a CAGR of 6.72% from 2024 to 2031.

- North America held a market share of 39.12% in 2023, with a valuation of USD 543.8 million.

- The powder segment garnered USD 638.0 million in revenue in 2023.

- The pharmacies segment is expected to reach USD 860.1 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.96% during the forecast period.

Market Driver

"Expansion of the Fitness and Wellness Industry Propelling Adoption"

The rapid expansion of the global fitness and wellness industry has created significant opportunities for the beta-alanine supplements market. The rising number of gyms, fitness centers, and wellness retreats has increased consumer exposure to sports nutrition products.

Fitness professionals and trainers frequently recommend beta-alanine as part of structured workout programs to enhance endurance and strength. The integration of sports supplements into mainstream wellness routines has broadened the market’s consumer base.

The influence of celebrity trainers, fitness influencers, and social media campaigns promoting performance-enhancing supplements continues to accelerate the market growth.

- The global wellness economy registered significant growth following the pandemic, reaching a record high of USD 6.3 trillion in 2023, accounting for 6.03% of the global GDP.

Market Challenge

"Regulatory Compliance and Ingredient Approval Challenges"

Strict regulatory frameworks and ingredient approval processes present a significant challenge to the growth of the beta-alanine supplements market. Varying regulations across regions, such as FDA guidelines in the U.S., EFSA requirements in Europe, and NMPA approvals in China, create barriers for market entry and product expansion.

Companies are investing in scientific research to provide clinical evidence supporting beta-alanine’s safety and efficacy. Additionally, strategic collaborations with regulatory bodies and adherence to clean-label formulations help streamline approvals and build consumer trust. Manufacturers are also focusing on transparent labeling and compliance-driven product innovation to meet global regulatory standards.

Market Trend

"Growing Adoption of Functional Foods to Boost Market"

The increasing preference for functional foods has significantly contributed to the expansion of the beta-alanine supplements market. Consumers are seeking dietary solutions that offer performance benefits beyond basic nutrition, driving demand for fortified foods enriched with endurance-enhancing ingredients.

Beta-alanine is being incorporated into protein bars, meal replacements, and sports nutrition snacks to support muscle endurance and recovery. The rise of active lifestyles and fitness-conscious diets has accelerated the shift toward functional foods with scientifically backed ingredients.

- The Global Wellness Institute in 2024 reports that a growing number of consumers are seeking healthier snack options. Around 60% of global consumers indicate increased awareness of mindful snacking, reflecting a 4% rise from the previous year, while 61% state that they consistently prioritize healthier snack choices, marking a 7% increase.

Food manufacturers are leveraging this trend by introducing innovative formulations, strengthening beta-alanine’s market presence across the broader health and wellness sector.

Beta-Alanine Supplements Market Report Snapshot

|

Segmentation |

Details |

|

By Form |

Powder, Capsules/Tablets, Chewables & Gummies, Liquid |

|

By Sales Channel |

Supermarkets/Hypermarkets, Pharmacies, Health & Wellness Store, Specialty Stores |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Form (Powder, Capsules/Tablets, Chewables & Gummies, and Liquid): The powder segment earned USD 638.0 million in 2023, due to its higher bioavailability, cost-effectiveness, and ease of mixing with other performance-enhancing ingredients, making it the preferred choice among athletes and fitness enthusiasts.

- By Sales Channel (Supermarkets/Hypermarkets, Pharmacies, Health & Wellness Store, and Specialty Stores): The pharmacies segment held 37.09% share of the market in 2023, due to strong consumer trust in pharmaceutical retail channels, which offer high-quality, certified products backed by professional guidance, ensuring reliability and compliance with regulatory standards.

Beta-Alanine Supplements Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for around 39.12% share of the beta-alanine supplements market in 2023, with a valuation of USD 543.8 million. Consumers in the region are increasingly prioritizing clean-label supplements that emphasize transparency, minimal additives, and scientifically validated ingredients.

North America accounted for around 39.12% share of the beta-alanine supplements market in 2023, with a valuation of USD 543.8 million. Consumers in the region are increasingly prioritizing clean-label supplements that emphasize transparency, minimal additives, and scientifically validated ingredients.

This trend has influenced supplement manufacturers to produce high-quality, third-party-tested beta-alanine products that cater to the demand for purity and efficacy in the region. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and Health Canada enforce stringent guidelines, ensuring product quality and safety.

The preference for clean and transparent formulations has positioned beta-alanine as a trusted and widely accepted ingredient in the expanding sports nutrition sector in the region.

Furthermore, the rising emphasis on fitness and athletic performance has strengthened the market in North America. A growing number of athletes, bodybuilders, and fitness enthusiasts seek performance-enhancing supplements that support endurance and muscle recovery.

The beta-alanine supplements industry in Asia Pacific is poised for significant growth at a robust CAGR of 7.96% over the forecast period. The increasing focus on health and fitness across Asia Pacific has fueled the demand for performance-enhancing supplements, strengthening the market.

Countries such as China, India, Japan, and Australia have registered a surge in gym memberships and participation in recreational sports, driving the adoption of beta-alanine as a key ingredient in pre-workout formulations.

Additionally, the rise of e-commerce platforms and direct-to-consumer sales channels has played a crucial role in expanding the market across Asia Pacific. Online marketplaces such as Tmall, Rakuten, and Flipkart have made it easier for consumers to access a wide range of sports nutrition products. Digital marketing strategies, including influencer promotions and targeted advertising, have increased awareness and consumer engagement.

- The 2024 International Trade Administration report indicates that e-commerce sales in Asia Pacific will continue increasing. India is projected to lead among 20 countries in terms of retail e-commerce growth from 2023 to 2027, with an estimated CAGR of 14.1%.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., beta-alanine is regulated under the Dietary Supplement Health and Education Act of 1994 (DSHEA). The FDA oversees dietary supplements but does not require pre-market approval.

- In Europe, the European Food Safety Authority (EFSA) requires a safety assessment and authorization before such ingredients can be marketed. Manufacturers must provide scientific evidence supporting the safety and intended use of beta-alanine in supplements. Labeling must comply with EU regulations, including appropriate health claims and warnings about possible side effects.

- In China, the National Medical Products Administration (NMPA) regulates dietary supplements, referred to as "health foods." Beta-alanine supplements must be registered or filed with the NMPA, depending on their classification. Manufacturers are required to provide evidence of safety and efficacy, and labeling must meet specific requirements, including health claims and usage instructions.

- Japan's Ministry of Health, Labour and Welfare (MHLW) oversees dietary supplements under the Food with Health Claims (FHC) system. Beta-alanine can be marketed as a Food with Function Claims (FFC) if scientific evidence supports its efficacy. Manufacturers must submit a notification to the Consumer Affairs Agency (CAA) and ensure proper labeling, including disclaimers about the product not being a substitute for a balanced diet.

Competitive Landscape:

The global beta-alanine supplements market is characterized by a large number of participants, including both established corporations and rising organizations. Key market players in the market are implementing strategic initiatives to strengthen their market position and drive expansion.

Companies are heavily investing in Research and Development (R&D) to introduce innovative formulations that enhance athletic performance and muscle endurance. Strategic partnerships with sports nutrition brands and fitness influencers are increasing consumer awareness and expanding product reach.

Mergers and acquisitions are helping companies diversify their product portfolios and enter new geographic markets. Additionally, major players are focusing on sustainable sourcing and clean-label formulations to align with evolving consumer preferences. These strategies are collectively contributing to the sustained growth of the market.

List of Key Companies in Beta-Alanine Supplements Market:

- Natural Alternatives International, Inc.

- Anhui Huaheng Biotechnology Co., Ltd.

- NOW Foods

- Prinova Group LLC.

- Spectrum Chemical

- Wuxi Jinghai Amino Acid Co., Ltd.

- Xinfa Pharamceuticals Co.Ltd.

- NutraBio Labs, Inc.

- Cellucor

- MusclePharm

- EVLUTION NUTRITION

- GNC Holdings, LLC

- MRM Nutrition

- Hi-Tech Pharmaceuticals.

- ALLMAX Nutrition

Recent Developments (Collaboration/New Product Launch)

- In August 2024, Natural Alternatives International, Inc. (NAI) introduced TriBsyn, an innovative carnosine booster under its CarnoSyn Brands portfolio. This advanced formulation leverages CarnoSyn beta-alanine along with patent-pending technology to enhance beta-alanine bioavailability and absorption while effectively mitigating beta-alanine-induced paresthesia.

- In September 2024, Nutrabolt collaborated with The Hershey Company to introduce Hershey’s iconic confections into the energy drink and pre-workout segments, along with launching the first-ever protein powder for both C4 and Hershey. Each energy drink formulation features CarnoSyn Beta-Alanine to enhance muscular endurance, BetaPower for muscle cell hydration, and 200 milligrams of caffeine to support performance.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership