Consumer Goods

Sports Nutrition Market

Sports Nutrition Market Size, Share, Growth & Industry Analysis, By Product Type (Protein Supplements, Energy Drinks, Energy Bars, Others), By Formulation (Tablets/Capsules, Powder, Liquid), By Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Fitness Centres), and Regional Analysis, 2024-2031

Pages : 170

Base Year : 2023

Release : January 2025

Report ID: KR1257

Market Definition

Sports nutrition is a field of sports medicine that assists athletes engaging in physical activities to reach peak performance, enhance recovery, and maintain overall health through proper nutrition and tailored diet. These products are formulated to provide the right balance of vitamins, proteins, minerals, amino acids, and hydration to meet the energy demands of athletes.

Key products include protein powders, energy bars, sports drinks, supplements, ready-to-drink (RDT) protein beverages, and isotonic drinks powders, designed to optimize performance, reduce injury risk, and support recovery during and after physical activities.

Sports Nutrition Market Overview

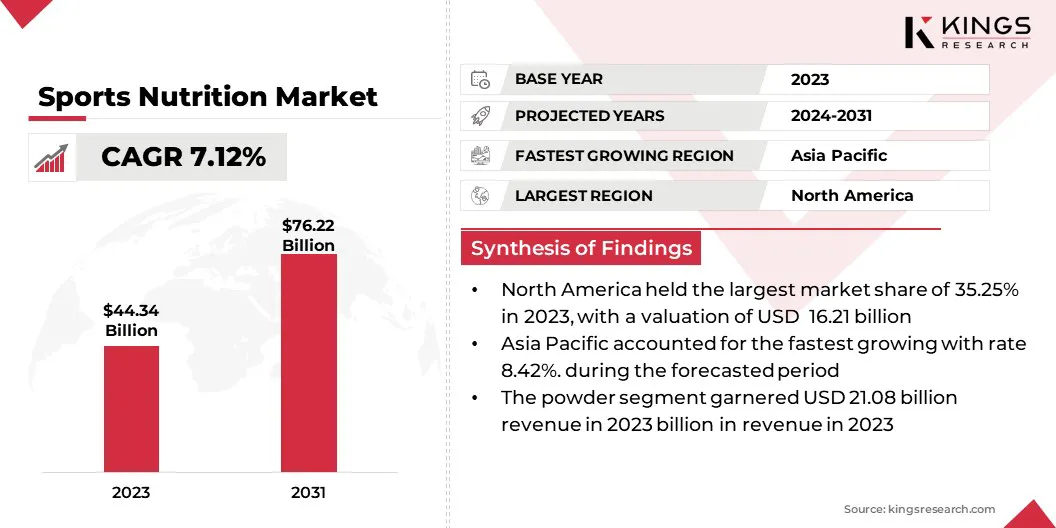

Global sports nutrition market size was valued at USD 44.34 billion in 2023, which is estimated to be valued at USD 47.09 billion in 2024 and reach USD 76.22 billion by 2031, growing at a CAGR of 7.12% from 2024 to 2031.

The market is experiencing significant growth, mainly due to the increasing awareness of diseases such as heart conditions, obesity, cancer, hypertension, and diabetes, which are often linked to sedentary lifestylea. Health-conscious individuals are increasingly seeking products that align with their fitness goals and promote overall well-being.

Major market participants include Glanbia Plc, PepsiCo Inc., Post Holdings Inc., Abbott Laboratories, Otsuka Pharmaceutical Co. Ltd., GNC Holdings Inc., The Coca-Cola Company, Nestle SA, Clif Bar & Company, MusclePharm Corporation, Yakult, Quest Nutrition, Reckitt Benckiser Group plc, Hormel Foods Corp., and Z-Konzept.

With the growing adoption of fitness-centric lifestyles, particularly among millennials and Gen Z, who are increasingly prioritizing physical well-being, the demand for sports supplements is likely to grow. The surging consumer demand for nutritional products containing plant-based ingredients and immunity-boosting advantages is further contributing to this growth.

Regulatory frameworks, such as the FDA's Dietary Supplement Health and Education Act (DSHEA) in the United States and the European Food Safety Authority (EFSA) guidelines, support innovation by ensuring that products meet safety and labelling requirements.

Key Highlights:

- The sports nutrition industry size was valued at USD 44.34 billion in 2023.

- The market is projected to grow at a CAGR of 7.12% from 2024 to 2031.

- North America held a share of 36.55% in 2023, valued at USD 16.21 billion.

- The powder segment garnered USD 21.08 billion in revenue in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 8.42% over the forecast period.

Market Driver

"Rising Sports Participation"

Rising sports participation is expected to propel the growth of the sports nutrition market, as an increasing number of individuals are engaging in physical activities recreationally and professionally. This trend has increased demand for products that enhance performance, recovery, and overall health.

Sports nutrition focuses on improving athletes' skills, strength, speed, endurance, and power, which requires a combination of physical training and proper nutrition to optimize results.

The growing participation of individuals, from beginners to fitness enthusiasts, has led to a higher demand for nutritional supplements, protein powders, energy bars, and hydration products.

As awareness of the importance of nutrition for optimal athletic performance grows, sports nutrition brands are capatalizing on opportunities to cater to a wider consumer base seeking to enhance their athletic performance and maintain an active lifestyle.

- In Jan 2024, Applied Nutrition, a Liverpool-based sports nutrition company, reported a 76.11% increase in annual sales over the past three years. Catering to fitness enthusiasts and professional athletes, the company is exploring a potential stock market listing valued at over USD 621.4 million.

Market Challenge

"Consumer Sensitivity to Highly Priced Products"

A major challenge impeding the growth of the sports nutrition industry is consumer sensitivity to high-priced products. Premium sports nutrition products, despite offering superior quality, innovative formulations, or specialized benefits, are often perceived as unaffordable by several consumers.

Price-conscious buyers frequently choose cost-effective alternatives, even at the expense of quality, impacting premium brand sales. This sensitivity is particularly pronounced in developing markets, where disposable incomes are lower and consumers prioritize affordability over perceived value.

To address this challenge, balancing quality and cost by offering smaller packaging sizes, affordable product lines, or subscription discounts can appeal to price-sensitive segments. Additionally, aligning pricing strategies with product differentiation and targeted marketing can effectively address diverse consumer preferences.

Market Trend

"Demand for Vegan-Based Products"

The demand for vegan-based products has emerged as a significant trend in the sports nutrition market, supported by the growing adoption of plant-based diets for ethical, environmental, and health reasons. This trend is expected to continue as consumers increasingly prioritize sustainable, cruelty-free and ethical choices for their health and fitness goals.

With the rising popularity of veganism, plant-based nutrition is becoming a key focus within sports nutrition, prompting manufacturers to introduce plant-based versions of protein bars, powders, and ready-to-drink (RTD) beverages.

To address concerns over soy-related allergies and genetically modified organisms (GMOs), manufacturers are increasingly using alternative plant-based proteins such as pea, hemp, and rice. These innovations cater to a broader, health-conscious consumer base, positioning the sports nutrition industry for sustained growth.

- For instance, in January 2023, Osage Food Products, a US-based leader in protein and dairy, launched SolvPro Vegan Plant Protein Blends. This new line combines various plant proteins to deliver targeted nutritional and functional properties for a wide range of end-use applications.

Sports Nutrition Market Snapshot

|

Segmentation |

Details |

|

By Product Type |

Protein Supplements |

|

Energy Drinks |

|

|

Energy Bars |

|

|

Others |

|

|

By Formulation |

Tablets/Capsules |

|

Powder |

|

|

Liquid |

|

|

By Distribution Channel |

Specialty Stores |

|

Supermarkets/Hypermarkets |

|

|

Convenience Stores |

|

|

Online Stores |

|

|

Fitness Centers |

|

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

|

|

Companies Profiled |

Glanbia Plc, PepsiCo Inc., Post Holdings Inc., Abbott Laboratories, Otsuka Pharmaceutical Co. Ltd., GNC Holdings Inc., The Coca-Cola Company, Nestle SA, Clif Bar & Company, MusclePharm Corporation, Yakult, Quest Nutrition, Reckitt Benckiser Group plc, Hormel Foods Corp., and Z-Konzept. |

Market Segmentation:

- By Product Type: (Protein Supplements, Energy Drinks, Energy Bars, and Others): The protein supplements segment accounted for a major share of 40.92% in 2023, primarily due to its adaptability, convenience, ease of use, and high-quality protein content.

- By Formulation (Tablets/Capsules, Powder, and Liquid): The powder segment held the largest share of 47.54% in 2023, fueled by its ease of consumption, stable ingredients, and extended shelf life.

- By Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, Convenience Stores, Online Stores, and Fitness Centers): The supermarkets/hypermarkets segment secured a largest share of 37.81% in 2023, attributed to their widespread accessibility, consumer convenience, and the availability of a diverse range of sports nutrition products under one roof..

Sports Nutrition Market Regional Analysis

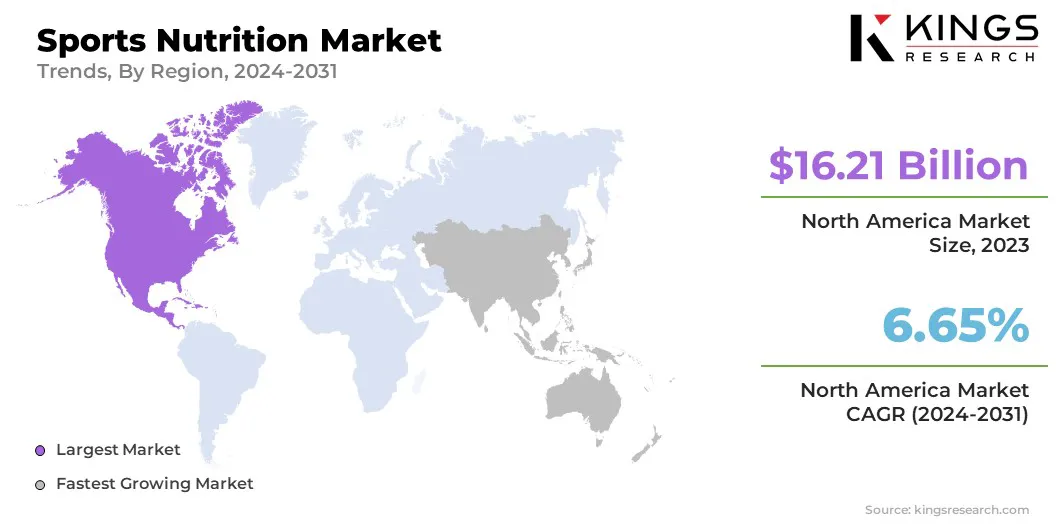

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America sports nutrition market accounted for a significant share of around 36.55% in 2023, valued at USD 16.21 billion. This dominance is reinforced by the strong fitness culture, a high prevalence of health-conscious consumers, and increasing awareness of active lifestyles.

Furthermore, higher disposable income contributes to the growing demand for nutritional supplements. The presence of key market players as Glanbia plc, Mondelēz International, Inc., The Coca-Cola Company, and Abbott Nutrition Inc, along with continuous innovation in product formulations, solidifies the position of the North America market.

Asia Pacific sports nuitrition market is poised to grow at a CAGR of 8.42% through the projection period. The increasing awareness of health and wellbeing, coupled withgovernment initiatives promoting sports activities, has boosted demand for sports nutrition in the region.

The Indian market has witnessed significant growth, largely attributed to the rising fitness consciousness among the youth and the growing popularity of sports as a viable career option.

- In October 2023, Steadfast Nutrition, a sports and wellness company, launched ‘Make India Protein Efficient’ campaign to address the nation’s protein deficit. This initiative has led to the introduction of several products in the Indian market.

- In September 2023, Nippon Sangyo Suishin Kiko acquired the Japanese sports nutrition brand DNS to expand its customer base and product offerings.

Japan is contributing significantly to this growth, supported by high consumer engagement and a growing interest in fitness and wellness. The demand for protein supplements, sports drinks, and ready-to-drink protein beverages is particularly strong, driven by an active lifestyle trend and increased awareness of the benefits of sports nutrition.

Additionally, the region is witnessing a notable shift toward natural and organic products, with consumers prioritizing clean labels and functional ingredients. Collaborations between local and international brands and endorsements by prominent athletes are further propelling regional market growth, positioning Asia Pacific as a lucrative opportunity for sports nutrition businesses.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the United States, the Food and Drug Administration (FDA) oversees sports nutrition products under the Dietary Supplement Health and Education Act (DSHEA). Like other dietary supplements, these products are not subject to pre-market approval but must meet safety and quality standards, including good manufacturing practices (GMPs). The FDA ensures accurate labeling to prevent misleading claims and conducts post-market surveillance to address safety concerns, recalling products with harmful substances such as certain stimulants or steroids.

- In the European Union, sports nutrition products must comply with EU Food Safety Regulations, overssen by the European Food Safety Authority (EFSA). Performance claims, nutritional profiles, and health benefits are scientifically evaluated for accuracy. Novel ingredients, including those derived from genetically modified organisms (GMOs), require pre-market notification. The EU enforces strict labeling requirements, particularly for allergens, nutrient levels, and additives or stimulants, with market surveillance coordinated across member states to ensure compliance and product recalls when necessary.

- In Australia, the Therapeutic Goods Administration (TGA) regulates sports nutrition products under the Therapeutic Goods Act of 1989. Depending on the nature of the claims, products are either registered or listed on the Australian Register of Therapeutic Goods (ARTG). High-level performance claims, such as "enhances muscle recovery" or "improves athletic performance," undergo rigorous pre-market assessments for scientific substantiation. GMP standards ensure product quality, and the TGA monitors advertising to prevent misleading claims. Safety is maintained through reviews of adverse event reports and recalls of unsafe products.

- In India, the Food Safety and Standards Authority of India (FSSAI) regulates sports nutrition products under the Food Safety and Standards Act of 2006. Pre-market approval is required for nutraceuticals and sports supplements, focusing on performance-enhancing ingredients. Regulations mandate clear labeling of ingredients, usage directions, and performance claims, while permissible limits for active ingredients and nutrients are set to prevent health risks. Compliance with contaminant standards, including heavy metals and banned substances, is enforced through regular inspections and testing.

Competitive Landscape:

The global sports nutrition market is characterized by a number of participants, including both established corporations and rising organisations. Major companies, such as Nestlé, PepsiCo and Herbalife, dominate the market with their extensive product portfolios, expanded global reach, and strong brand recognition.

These companies invest heavily in research and development to stay ahead of trends such as plant-based nutrition, clean-label products, and functional foods, which align with evolving consumer demands for health, sustainability, and convenience.

Smaller, niche brands are targeting specific consumer segments such as vegan, organic, and allergen-free products. These companies leverage online platforms and direct-to-consumer models to build a loyal customer base and compete with larger players.

Brands constantly introduce new formulations, flavors, and delivery formats such as ready-to-drink products and protein snacks. Additionally, partnerships with athletes, fitness influencers, and sports organizations help boost brand visibility and credibility.

As consumer preferences evolve, competition in the sports nutrition industry remains fierce, with companies striving to offer products that meet diverse health, fitness, and lifestyle needs.

- In April 2024, Arla Foods Group, a Denmark-based food company, acquired Volac Whey Nutrition Ltd., a US-based company specializing in whey protein and derivatives for food, beverage and sports nutrition. With this acquisition, Arla Foods Ingredients aims to enhance its product offerings in the sports nutrition industry by expanding its capacity for whey protein production and leveraging manufacturing capabilities to meet the growing demand for protein-based products.

- In June 2024, dsm-firmenich collaborated with the Team dsm-firmenich PostNL cycling develop the up4 sports nutrition line. These products are designed to optimize gut health, performance, and recovery, advancing sports nutrition to support enhanced athletic performance.

List of Key Companies in Sports Nutrition Market:

- Glanbia Plc

- PepsiCo Inc

- Post Holdings Inc

- Abbott Laboratories

- Otsuka Pharmaceutical Co. Ltd

- GNC Holdings Inc.

- The Coca-Cola Company

- Nestle SA

- Clif Bar & Company

- MusclePharm Corporation

- Yakult

- Quest Nutrition

- Reckitt Benckiser Group plc

- Hormel Foods Corp.

- Z-Konzept

Recent Developments:

- In January 2024, Abbott Laboratories introduced a new brand Protality, which includes a high-protein nutrition shake targeting the growing demand for GLP-1 (Glucagon-like peptide-1) class weight-loss drugs while preserving muscle mass. With GLP-1 medications such as Wegovy, Ozempic, Mounjaro, and Zepbound experiencing substantial demand recently, it is projected that the GLP-1 drug class will exceed USD 100 billion in annual sales by the end of the decade.

- In March 2023, PepsiCo launched Gatorade Fast Twitch, an innovative non-carbonated energy drink tailored for athletes. This product marks a strategic shift within PepsiCo's sports nutrition portfolio, integrating elements from its acquisition of CytoSport, known for Muscle Milk. Positioned in the performance energy drink category, Gatorade Fast Twitch includes 200mg of caffeine, B vitamins, and electrolytes, appealing to consumers seeking pre-workout solutions without carbonation. This initiative reflects PepsiCo's strategy to expand its "All G" portfolio, aimed at enhancing Gatorade's presence in sports nutrition while potentially merging brands such as Evolve and Muscle Milk for broader market appeal.

- In November 2022, Coca-Cola acquired the remaining 85% stake in BODYARMOR, a sports performance and hydration beverage brand, for USD 5.6 billion in cash. Coca-Cola had initially acquired a 15% stake in 2018 and supported BODYARMOR's growth within the North American division. As the second-largest sports drink in measured retail channels, BODYARMOR aims to leverage Coca-Cola's distribution network for further expansion in the health and wellness beverage market.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)