Machinery Equipment-Construction

Building and Construction Plastics Market

Building and Construction Plastics Market Size, Share, Growth & Industry Analysis, By Product (Polyvinyl Chloride (PVC), Polystyrene (PS), Polyethylene (PE), Polyurethanes (PU), Acrylics, Polypropylene (PP), Others), By Application (Roofing, Insulation, Pipes & Ducts, Doors, Windows, Others), and Regional Analysis, 2024-2031

Pages : 180

Base Year : 2023

Release : February 2025

Report ID: KR1277

Market Definition

Building and construction plastics refer to a broad category of synthetic materials that are widely used in the construction industry, due to their durability, versatility, and cost-effectiveness. These plastics, typically made from polymers like polyvinyl chloride (PVC), polyethylene (PE), polypropylene (PP), and polystyrene (PS), serve various functions, including insulation, piping, flooring, roofing, and cladding.

They are valued for their lightweight nature, resistance to corrosion, ease of installation, and ability to withstand environmental factors such as moisture and temperature variations. Building and construction plastics play a critical role in enhancing the efficiency, sustainability, and longevity of modern construction projects.

Building and Construction Plastics Market Overview

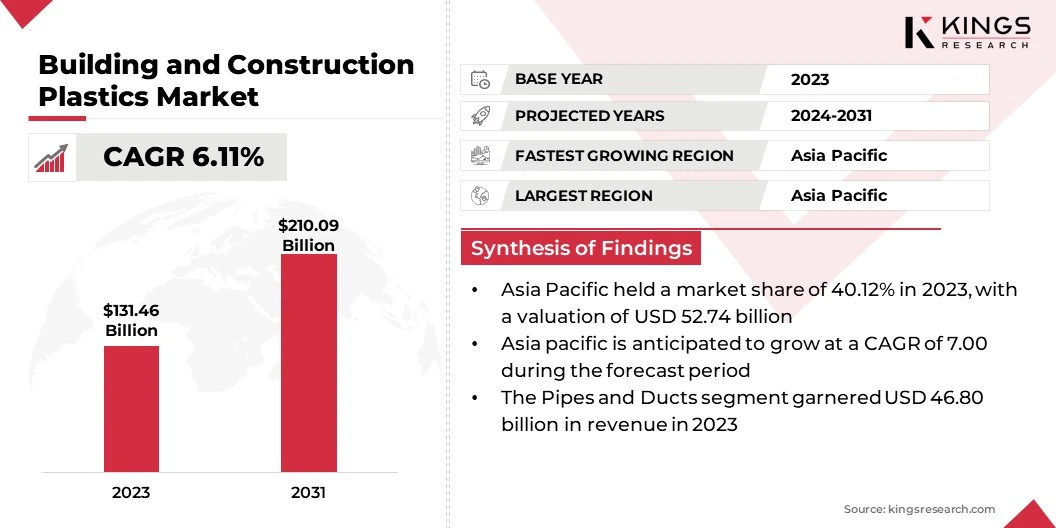

The global building and construction plastics market size was valued at USD 131.46 billion in 2023, which is estimated to be valued at USD 138.72 billion in 2024 and reach USD 210.09 billion by 2031, growing at a CAGR of 6.11% from 2024 to 2031.

The market is driven by rapid urbanization and the increasing demand for durable, cost-effective materials. Technological advancements in plastic manufacturing have led to enhanced product performance, while growing government investments in infrastructure further boost demand.

Additionally, the shift to energy-efficient and sustainable building practices, along with the rising adoption of prefabricated construction methods, are significantly contributing to the market's expansion.

Major companies operating in the global building and construction plastics market are BASF, DuPont, Dow, SABIC, Arkema, LyondellBasell Industries Holdings B.V., Evonik, Covestro AG, Clariant, Huntsman International LLC., Borealis AG, Avient Corporation, Solvay, LG Chem, and INEOS.

The rapid pace of urbanization, particularly in emerging economies, is significantly driving the market. Expanding urban populations are increasing the demand for residential, commercial, and industrial infrastructure.

Governments are heavily investing in large-scale infrastructure projects, including smart cities, roads, and housing developments, which require lightweight and durable construction materials.

- Jubail Industrial City, the world’s largest civil engineering project, is set to double its size by adding 6,200 hectares. The expansion involves residential housing for 120,000 people, educational facilities with a university for 18,000 students, and essential infrastructure development, including roads, bridges, medical centers, and utilities for power, water, and waste management. These developments present substantial opportunities for sectors such as construction materials, building and construction plastics, and energy infrastructure. By 2035, the project aims to transform Jubail into a global hub for energy and chemicals, further driving demand in industrial and commercial markets.

Key Highlights:

- The building and construction plastics industry size was valued at USD 131.46 billion in 2023.

- The market is projected to grow at a CAGR of 6.11% from 2024 to 2031.

- Asia Pacific held a market share of 40.12% in 2023, with a valuation of USD 52.74 billion and the market in the region is anticipated to grow at a CAGR of 7.00% during the forecast period.

- The polyvinyl chloride (PVC) segment garnered USD 45.75 billion in revenue in 2023.

- The pipes & ducts segment is expected to reach USD 76.27 billion by 2031.

Market Driver

"Rising Demand for Sustainable Solutions"

The growing emphasis on sustainable and energy-efficient construction practices is bolstering the building and construction plastics market. Recyclable and bio-based plastics are gaining traction as eco-friendly alternatives in construction projects.

Additionally, their use in insulation materials and energy-efficient designs supports efforts to reduce carbon emissions, aligning with global sustainability goals.

- In December 2024, BASF collaborated with Endress+Hauser, TechnoCompound, and the Universities of Bayreuth and Jena to enhance the mechanical recycling of plastics. Through the SpecReK project, the initiative focuses on accurately identifying the composition of plastic waste during the recycling process to improve the quality of recycled plastics. This advancement will be achieved by integrating advanced measurement technologies with artificial intelligence (AI).

Market Challenge

"Limited Recycling Infrastructure"

A significant challenge for the growth of the building and construction plastics market is the limited recycling infrastructure in many regions, leading to improper disposal and environmental concerns. This issue hampers the adoption of sustainable practices and increases scrutiny on the industry regarding its environmental impact.

Companies are addressing this challenge by investing in advanced recycling technologies, such as chemical recycling and AI-based sorting systems, to improve plastic waste management.

Collaborative efforts with governments and research institutions to establish efficient recycling networks and develop bio-based, recyclable plastic materials are further driving the shift toward sustainability in the market.

Market Trend

"Technological Advancements in High-performance Plastics"

Innovations in polymer technology and manufacturing processes are enhancing the quality and functionality of building plastics. High-performance plastics with improved strength, flexibility, and environmental resistance are increasingly replacing conventional materials in construction.

These advancements are expanding the scope of plastics in diverse applications, thereby driving the building and construction plastics market globally.

- In January 2025, SABIC introduced a new PP pipe solution, SABIC VESTOLEN P9421, made from a random copolymer. This product delivers enhanced performance under high pressures and temperatures, offering superior durability and reliability. Engineered with excellent thermal stability, it is specifically designed for heat-resistant applications. Its extended service life makes it an ideal material for manufacturing cold & hot water pipes and fittings used in transporting drinking water.

Building and Construction Plastics Market Report Snapshot

| Segmentation | Details |

| By Product | Polyvinyl Chloride (PVC), Polystyrene (PS), Polyethylene (PE), Polyurethanes (PU), Acrylics, Polypropylene (PP ), Others |

| By Application | Roofing, Insulation, Pipes & Ducts, Doors, Windows, Others |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product (Polyvinyl Chloride (PVC), Polystyrene (PS), Polyethylene (PE), Polyurethanes (PU), Acrylics, Polypropylene (PP), Others): The Polyvinyl Chloride (PVC) segment earned USD 45.75 billion in 2023, due to its exceptional durability, cost-effectiveness, and versatility, making it ideal for applications such as pipes, fittings, and window profiles.

- By Application (Roofing, Insulation, Pipes & Ducts, Doors, Windows, Others): The xx segment held 35.60% share of the market in 2023, due to its extensive use in water supply, drainage, and HVAC systems, driven by the demand for lightweight, durable, and cost-effective materials in infrastructure and residential projects.

Building and Construction Plastics Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for around 40.12% share of the building and construction plastics market in 2023, with a valuation of USD 52.74 billion. Countries in Asia Pacific are increasingly focusing on sustainable construction solutions to address environmental concerns.

The increasing integration of green building practices into construction projects, coupled with the adoption of recyclable and bio-based plastics, aligns with government policies promoting green building initiatives, boosting the market's growth.

- In September 2024, the Indian Green Building Council (IGBC) organized the 22nd Green Building Week, in collaboration with the World Green Building Council (WorldGBC) and its global network of Green Building Councils (GBCs). The initiative focuses on guiding the building and construction sector toward a resilient, zero-carbon future. With GBCs active in over 75 countries, covering 60% of the global building stock and 65% of global GDP, the campaign addresses 72% of emissions derived from the built environment globally.

The building and construction plastics industry in Europe is poised for significant growth at a robust CAGR of 5.84% over the forecast period. The European Union's (EU) stringent energy efficiency regulations and sustainability goals are driving the adoption of building and construction plastics.

These materials, widely used in insulation, windows, and roofing, enhance energy performance in residential and commercial buildings, aligning with directives such as the Energy Performance of Buildings Directive (EPBD).

- In December 2024, ABB’s Smart Buildings Division partnered with the WorldGBC's European Regional Network (ERN) to promote sustainable, energy-efficient building practices throughout Europe. This collaboration aims to support the achievement of key sustainability frameworks, such as the Energy Performance of Buildings Directive (EPBD), while fostering a unified approach to shaping building policies across the region.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the Environmental Protection Agency (EPA) enforces regulations under the Clean Air Act and Clean Water Act, impacting the production and disposal of plastics in construction.

- In the EU, the Construction Products Regulation (CPR) establishes harmonized conditions for the marketing of construction products, including plastics, ensuring they meet safety and performance standards.Additionally, REACH regulates the registration, evaluation, authorization, and restriction of chemicals, affecting the use of certain substances in plastics.

- Under the UK's building regulations 2010, construction plastics must meet specific criteria for fire safety, energy efficiency, and durability. These regulations ensure that materials used in construction projects are fit for purpose and do not pose a risk to human health or the environment.

- In Asia Pacific, China’s Circular Economy Promotion Law promotes recycling and reusable materials in construction, while the country’s Standardization Law ensures that construction plastics meet safety and performance standards. The Environmental Protection Law addresses the harmful impacts of plastic waste from construction projects.

- In India, the Environment Protection Act mandates eco-friendly plastics in construction, while the National Building Code of India regulates the safety, fire resistance, and energy efficiency of construction materials, including plastics.

Competitive Landscape:

The global building and construction plastics industry is characterized by a number of participants, including both established corporations and rising organizations. Companies in the market are increasingly adopting strategies such as collaboration agreements to position themselves as sustainability leaders, contributing to the growth of the market.

By partnering with other industry players, companies can combine expertise and resources to develop innovative, eco-friendly solutions that reduce the environmental impact of construction processes. These collaborations help to meet regulatory standards while aligning with the growing demand for sustainable construction materials.

Such strategic alliances accelerate the development and adoption of green technologies, enhancing competitive advantage and driving the expansion of the market.

- In December 2024, Covestro and Poland's Selena Group extended their collaboration agreement, reinforcing their positions as sustainability leaders in the construction sector. Together, they launched an innovative new product, Tytan Professional Adhesive for Bricklaying, featuring polyurethane (PU) foams. This product significantly lowers environmental impact compared to conventional cement mortars, reducing the carbon footprint by up to 90%.

List of Key Companies in Building and Construction Plastics Market:

- BASF

- DuPont

- Dow

- SABIC

- Arkema

- LyondellBasell Industries Holdings B.V.

- Evonik

- Covestro AG

- Clariant

- Huntsman International LLC.

- Borealis AG

- Avient Corporation

- Solvay

- LG Chem

- INEOS

Recent Developments:

- In May 2024, Clariant introduced its latest solution, Licolub PED 1316, aimed at enhancing safety and efficiency in the plastics industry. Licolub PED 1316 is an oxidized high-density polyethylene (HDPE) wax designed for both internal and external use in PVC processing, including applications such as the extrusion of moldings, window frames, tracks for windows and doors, pool steps and edging trims, as well as non-potable pipes.

- In December 2024, BASF completed the International Sustainability and Carbon Certification (ISCC) PLUS program at its production facility in Lemförde, Germany, enabling the production of biomass-balanced thermoplastic polyurethanes.

- In October 2024, Covestro announced an investment of approximately 100 million Euros in its global R&D infrastructure and assets. As part of this initiative, the company, in collaboration with partners, developed an innovative technology for the chemolysis of flexible PU foams from used mattresses under the Evocycle CQ mattress project.

- In December 2024, Borealis and Nexeo Plastics formed a partnership to introduce RIALTI PIR (post-industrial recycled) PP compounds to manufacturers across the EMEA region. Tailored for applications in the mobility, appliances, and building & construction sectors, these advanced materials provide manufacturers with a solution to meet rigorous performance standards while also advancing their sustainability objectives.

- In April 2024, Solvay announced the opening of its innovative Alve-One production unit in Rosignano, Italy. The unit is designed to meet the increasing demand for safer, more sustainable blowing agents that are eco-designed to revolutionize the thermoplastic foaming industry. Serving sectors such as automotive, footwear, building & construction, and consumer goods, the initiative focuses on reducing carbon footprints in foamed end-products.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership