Healthcare Medical Devices Biotechnology

Electronic Health Record Market

Electronic Health Records Market Size, Share, Growth & Industry Analysis, By Deployment (Cloud-based, On-premise), By Application (Clinical, Administrative, Reporting in Healthcare System, Healthcare Financing, and Clinical Research), By End User (Hospital, Ambulatory Surgical Centers, and Specialty Centers), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : January 2025

Report ID: KR179

Market Definition

Electronic health record (EHR) is a digital system used to collect, store, and manage patient health information, such as medical history, diagnoses, medications, immunization dates, and test results. EHRs enable efficient data sharing among healthcare providers, improving patient care, coordination, and decision-making while reducing errors and facilitating secure record management.

Electronic Health Records Market Overview

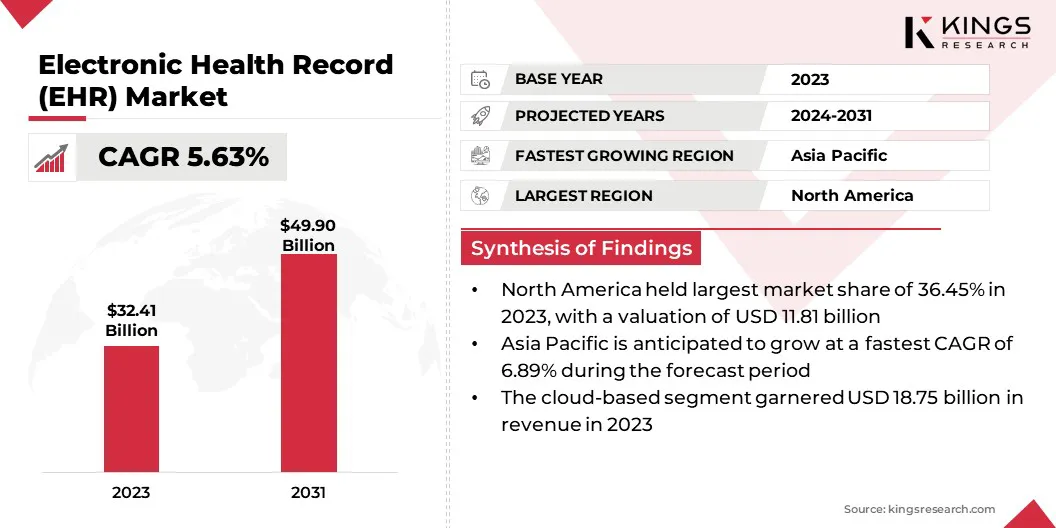

Global electronic health records market size was valued at USD 32.41 billion in 2023 and is projected to grow from USD 34.00 billion in 2024 and reach USD 49.90 billion by 2031, growing at a CAGR of 5.63% from 2024 to 2031.

The global shift toward digital transformation in healthcare has increased the demand for efficient and accessible systems to manage patient information. Government initiatives and regulations mandating the adoption of EHR further accelerate this trend, aiming to streamline healthcare processes and improve the quality of care.

Major companies operating in the global electronic health records market are Oracle, Epic Systems Corporation, Dedalus S.p.A., Medical Information Technology, Inc., MCKESSON CORPORATION, Veradigm LLC, Greenway Health, LLC, NextGen Healthcare, Inc., CureMD Healthcare, eClinicalWorks, Infor-Med Inc., TruBridge, athenahealth, Inc., CareCloud, Inc., Tebra Technologies, Inc, and others.

The growing prevalence of chronic diseases underscores the need for robust systems for managing patient data over time, while the rise of telemedicine emphasizes the importance of seamless integration between EHRs and virtual care platforms.

- For Instance, in June 2024, Michigan launched CHRONICLE, a near–real-time disease monitoring system using EHR data and HIE infrastructure. Developed through statewide collaboration, it aims to improve chronic disease surveillance, healthcare outcomes, and resource allocation through innovative public health monitoring.

EHR streamline healthcare operations by improving patient care, communication, administrative efficiency, and research. They reduce costs, enhance service delivery, and increase patient satisfaction by facilitating better decision-making and reducing errors.

Key Highlights:

Key Highlights:

- The global electronic health records market size was recorded at USD 32.41 billion in 2023.

- The market is projected to grow at a CAGR of 5.63% from 2024 to 2031.

- North America held a share of 36.45% in 2023, valued at USD 11.81 billion.

- The cloud-based segment garnered USD 18.75 billion in revenue in 2023.

- The clinical segment is expected to reach USD 16.83 billion by 2031.

- The hospital segment is estimated to generate a revenue of USD 22.65 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 6.89% during the forecast period.

Market Driver

“Growing Adoption of EHR in Clinical Trials and Integration of Social Determinants Data”

The increasing use of EHRs in clinical trials enables more efficient patient recruitment, data collection, and outcome monitoring, enhancing research accuracy and speed. Government incentives and regulations, including financial incentives for EHR adoption and compliance requirements for data security, are further accelerating the expansion of the electronic health records market.

Additionally, the rising focus on patient-centered care underscores the importance of real-time, comprehensive patient data, which EHRs facilitate, allowing for more personalized and effective treatment. These factors are fueling the demand for EHR systems, positioning them as essential tools in improving both clinical research and patient care outcomes.

- In January 2025, Veradigm integrated social determinants of health (SDoH) and mortality data into its Veradigm Network EHR (VNEHR) database. This enhancement provides researchers with deeper insights into patient health, advancing real-world evidence studies and improving care by incorporating both clinical and social factors affecting health outcomes.

Market Challenge

“Cyber Security and Interoperability Issues”

High implementation costs pose a significant barrier to the expansion of the electronic health records market, particularly for smaller healthcare providers, who face expenses related to software, infrastructure, and training.

One solution could be offering scalable, cloud-based EHR systems that reduce upfront costs by eliminating the need for extensive infrastructure and offer pay-as-you-go models to suit smaller providers' budgets.

Additionally, cyber security remains a critical concern, as EHRs store sensitive patient data vulnerable to breaches, hacking, and unauthorized access. To address the critical concern of cyber security, implementing robust encryption protocols, multi-factor authentication, and regular security updates can protect sensitive patient data.

- For instance, in February 2024, an article from the National Library of Medicine highlighted the healthcare industry's growing vulnerability to cyber-attacks, particularly targeting hospitals and their electronic health record systems. In 2022, there were 1,463 cyber-attacks per week globally.

Interoperability issues hinder seamless data exchange between different healthcare systems, leading to fragmented patient records and potential care delays. A solution could be implementing standardized data formats and application programming interface, along with promoting the adoption of common interoperability frameworks like Fast Healthcare Interoperability Resources (FHIR), to ensure smoother communication between systems.

Market Trend

“Integration of AI and Cloud-based HER”

The surging adoption of cloud-based solutions is emerging as a notable trend in the electronic health records market. Cloud-based EHR systems provide cost-efficiency, scalability, and remote accessibility, allowing healthcare providers to streamline operations and enhance collaboration. The integration of AI improves predictive analytics, optimizes clinical decision-making, and automates administrative tasks, thereby improving the efficiency and accuracy of healthcare delivery.

- For instance, in October 2024, Oracle unveiled its next-generation electronic health record (EHR) at the Oracle Health Summit. Hosted on Oracle Cloud Infrastructure, the EHR integrates AI to automate clinical workflows, deliver insights at the point of care, and streamline physician tasks. The system is designed to enhance patient recruitment, regulatory compliance, and value-based care adoption, offering a more intuitive and responsive experience for healthcare providers.

Additionally, the integration of telehealth platforms with EHRs ensures consistent, comprehensive patient records across virtual and in-person visits, fostering better care coordination and operational efficiency. These advancements are positioning EHRs as pivotal in driving the transformation of healthcare services.

Electronic Health Records Market Report Snapshot

| Segmentation | Details |

| By Deployment | Cloud-based, On-premise |

| By Application | Clinical, Administrative, Reporting in Healthcare System, Healthcare Financing, Clinical Research |

| By End User | Hospital, Ambulatory Surgical Centers, Specialty Centers |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Deployment (Cloud-based and On-premise): The cloud-based segment earned USD 18.75 billion in 2023, fueled by increased adoption of cloud-based EHR systems that offer cost-efficiency, scalability, and remote accessibility.

- By Application (Clinical, Administrative, Reporting in Healthcare System, Healthcare Financing, and Clinical Research): The clinical segment held a notable share of 35.67% in 2023, mainly due to growing demand for integrated clinical solutions in EHR systems, which allow healthcare providers to streamline clinical workflows and improve patient care.

- By End User (Hospital, Ambulatory Surgical Centers, and Specialty Centers): The hospital segment is projected to reach USD 22.65 billion by 2031, propelled by increasing adoption of EHR for enhanced patient management, improved data accuracy, and better regulatory compliance.

Electronic Health Records Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America electronic health records market accounted for a substantial share of 36.45% and was valued at USD 11.81 billion in 2023. This dominance is largely attributed to the region's advanced healthcare infrastructure, widespread EHR adoption, and government-driven initiatives aimed at improving healthcare efficiency.

The U.S., in particular, is contributing significantly to this dominance, supported by federal mandates such as the HITECH Act that promote the use of EHRs across healthcare systems.

Additionally, the increasing demand for data-driven healthcare and better patient care management fuels regional market growth, as hospitals and healthcare providers adopt more sophisticated systems to manage patient information, improve clinical decision-making, and enhance patient outcomes.

The adoption of EHRs in North America is further boosted by the rising demand for efficient patient data management systems, cost-saving opportunities, and improved clinical outcomes.

.webp) However, Asia-Pacific is anticipated to grow at the fastest CAGR of 6.89% through the forecast period. Major countries such as China, India, and Japan are heavily investing in healthcare infrastructure and digital health technologies, thereby bolstering the growth of the market.

However, Asia-Pacific is anticipated to grow at the fastest CAGR of 6.89% through the forecast period. Major countries such as China, India, and Japan are heavily investing in healthcare infrastructure and digital health technologies, thereby bolstering the growth of the market.

Government initiatives and investments in healthcare infrastructure are fostering the development of digital health solutions and advancing technological innovations. Additionally, the growing population, an increasing prevalence of chronic diseases, and demand for improved healthcare quality and outcomes are contributing significantly to the growth of the Asia-Pacific electronic health records market.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the EHR market is primarily governed by the Office of the National Coordinator for Health Information Technology (ONC), the Centers for Medicare and Medicaid Services (CMS), and the U.S. Department of Health and Human Services (HHS), which enforce regulations such as the Health Information Technology for Economic and Clinical Health (HITECH) Act and the Health Insurance Portability and Accountability Act (HIPAA).

- In Europe, the EHR market is governed by the European Medicines Agency (EMA), the European Data Protection Board (EDPB) under the General Data Protection Regulation (GDPR), and the European Commission's eHealth initiatives.

- In APAC, countries such as India, Japan, and Vietnam govern EHR systems through their Ministries of Health, establishing national standards for electronic health records, data privacy, and interoperability. These efforts ensure compliance with healthcare regulations and promote digital health initiatives to improve healthcare delivery and patient outcomes.

- In September 2024, the Indian Union Health Minister urged hospitals to adopt digital technology for patient data management during a virtual event organized by the National Accreditation Board for Hospitals (NABH). This initiative aims to enhance data security and interoperability, and streamline access to patient information across healthcare delivery points.

- In Australia, the EHR market is regulated by the Australian Digital Health Agency (ADHA), which oversees national digital health initiatives, including the My Health Record system, ensuring data privacy, security, and interoperability across the healthcare sector.

- In October 2024, Vietnam’s Prime Minister, Pham Minh Chinh, announced the country’s goal to expand the use of electronic health and criminal record certificates to 40 million people by 2025. This initiative, discussed during an online conference on the VNeID app, aims to modernize public services through a nationwide electronic health record system.

Competitive Landscape

The market is characterized by a number of participants, including both established corporations and rising organizations. To maintain or expand their market positions, these companies are focusing on a variety of strategic initiatives, including the development of advanced technologies such as AI integration, cloud-based solutions, and enhanced interoperability capabilities.

In addition to technological advancements, mergers and acquisitions (M&A) and collaborations are playing a significant role in shaping the competitive landscape of the EHR market.

By partnering with healthcare providers, research organizations, or other tech firms, leading players are expanding their product portfolios, enhancing their R&D capabilities, and broadening their market reach. These strategic alliances often result in accelerated product development cycles and the integration of cutting-edge innovations into existing solutions.

List of Key Companies in Electronic Health Records Market:

- Oracle

- Epic Systems Corporation

- Dedalus S.p.A.

- Medical Information Technology, Inc.

- MCKESSON CORPORATION

- Veradigm LLC

- Greenway Health, LLC

- NextGen Healthcare, Inc.

- CureMD Healthcare

- eClinicalWorks

- Infor-Med Inc.

- TruBridge

- athenahealth, Inc.

- CareCloud, Inc.

- Tebra Technologies, Inc

- Others

Recent Developments (M&A/Partnerships/Launch)

- In December 2024, Kareo officially merged and rebranded under the name Tebra. The transition to Tebra’s unified platform, integrates Kareo’s healthcare software with PatientPop’s features, offering an all-in-one EHR solution designed to support independent healthcare practices.

- In December 2024, MEDITECH announced that all its Ontario customers connected to the Traverse Exchange Canada network can now share patient information with any site connected to the Oracle Ontario eHub. This collaborative effort between MEDITECH and Oracle enhances data exchange across the province, improving care coordination and healthcare outcomes.

- In October 2024, Veradigm announced the complete integration of advanced natural language processing (NLP) into its electronic health record (EHR) dataset, enhancing access to valuable insights from unstructured data. This integration, derived from over 154 million patient records, creates regulatory-grade real-world data aimed at advancing healthcare research.

- In September 2024, Oracle announced new innovations for its electronic health record (EHR) system, including enhanced mobile charting capabilities and expanded features in the Oracle Health Provider Portal. Additionally, the company introduced Oracle Clinical Digital Assistant, which integrates generative AI and clinical intelligence to reduce physician burnout and save time on documentation.

- In August 2024, Epic launched the new Individual Access Services (IAS) feature, which allows patients to easily share medical records with health or wellness apps. This initiative is part of a broader effort to improve data sharing in healthcare, giving patients greater control over their health data while ensuring its security.

- In April 2024, Greenway Health partnered with Nabla to launch Greenway Clinical Assist, a solution aimed at reducing administrative burdens and improving patient engagement. The integration of Nabla’s AI technology with Greenway’s EHR solutions helps providers save up to two hours per day, addressing burnout and enhancing patient care.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)