Automotive and Transportation

Food Logistics Market

Food Logistics Market Size, Share & Industry Analysis, By Product Type (Perishable Food, Non-Perishable Food), By Mode of Transportation (Roadways, Railways, Airways, Waterways), By Technology (Conventional Logistics, Smart Logistics), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR1099

Food Logistics Market Size

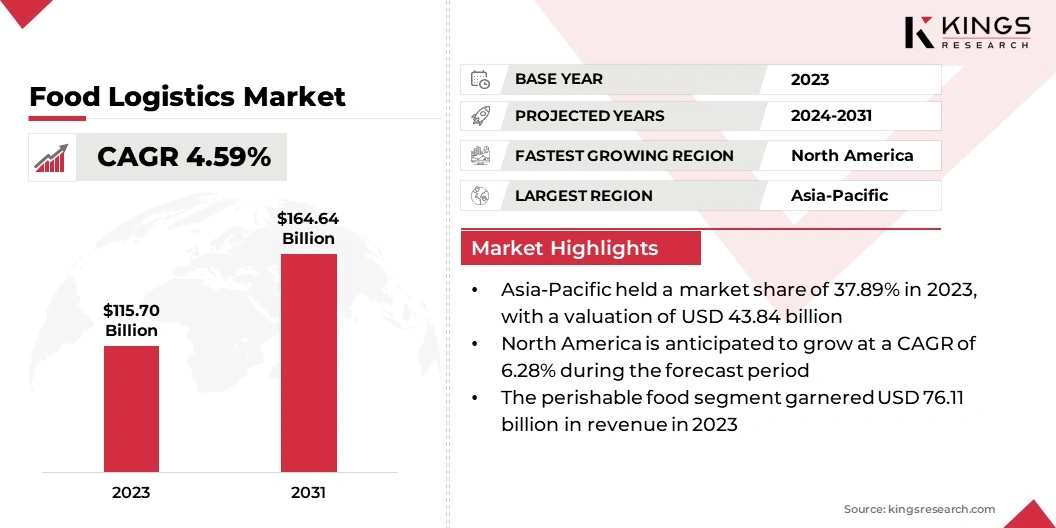

The global Food Logistics Market size was valued at USD 115.70 billion in 2023 and is projected to grow from USD 120.27 billion in 2024 to USD 164.64 billion by 2031, exhibiting a CAGR of 4.59% during the forecast period. The increasing demand for fresh produce, dairy, meat, and seafood is significantly boosting the expansion of market.

The growing processed food industry, driven by hectic lifestyles and need for convenience, is further elevating the demand for specialized logistics solutions that ensure timely and safe transportation of both fresh and processed foods.

In the scope of work, the report includes services offered by companies such as C.H. Robinson Worldwide, Inc., Kuehne + Nagel International AG, XPO Logistics, Inc., Americold Logistics, LLC, DHL Group, Lineage Logistics, LLC, AGRO Merchants Group, LLC, UPS Supply Chain Solutions, Inc., A.P. Moller - Maersk Group, Deutsche Bahn (DB) Schenker AG, and others.

Moreover, the increasing reliance on third-party logistics (3PL) providers for food distribution is boosting the food logistics market. Many food manufacturers and retailers are outsourcing their logistics operations to specialized 3PL providers to reduce costs and increase focus on core business activities. These providers offer comprehensive logistics solutions, including transportation, warehousing, and inventory management, helping companies improve efficiency and scalability.

Food logistics a specialized branch of logistics that focuses on the efficient management of the supply chain for food products. It encompasses the planning, implementation, and control of the movement and storage of food items, from production to consumption, while ensuring compliance with safety regulations and maintaining the quality and freshness of perishable goods.

Food logistics includes various activities such as transportation, warehousing, inventory management, and distribution, all tailored to meet the unique requirements of food products, including temperature control and on-time delivery.

Analyst’s Review

The growing adoption of green logistics practices is emerging as a key factor contributing to the expansion of the food logistics market. Companies are increasingly focusing on reducing their carbon footprint by investing in energy-efficient transportation, eco-friendly packaging, and route optimization to minimize their fuel consumption.

- In July 2024, Scan Global Logistics (SGL) launched Asia's first electric cross-border truck, as part of its zero-emissions partnership with HTH Corporation. This initiativewas a significant step toward reducing CO2 emissions from road transport along one of the region’s busiest trade routes.

Additionally, of electric and hybrid vehicles for food transportation is becoming more common due to environmental regulations and consumer demand for sustainable business practices. This shift toward greener logistics is driving market growth by enabling companies to meet environmental goals while maintaining operational efficiency.

As the global supply chain continues to evolve, the adoption of green logistics is expected to accelerate, with further innovation in renewable energy use, carbon offset programs, and digitization of logistics processes driving long-term growth in the market.

- In July 2024, logistics leader, DHL, and green technology innovator, Envision Group, unveiled a new partnership focused on driving sustainability advancements in logistics and energy. Under this collaboration, Envision will providesustainable aviation fuel (SAF) for DHL. The partnership is expected to explore renewable feedstock sources and technological pathways to further progress decarbonization efforts.

Food Logistics Market Growth Factors

The development of multimodal transportation solutions is enhancing the efficiency of food logistics by combining various transport methods, such as road, rail, air, and sea. Multimodal logistics enable faster and more cost-effective movement of food products across long distances and international borders.

Moreover, the adoption of technology like Internet of Things (IoT), Artificial Intelligence (AI), and blockchain is also transforming food logistics. These technologies provide real-time tracking, predictive maintenance, and supply chain transparency, which help minimize food spoilage and optimize delivery times.

RFID systems and automated transportation management systems are also becoming essential for managing large-scale food distribution, improving efficiency, ensuring transparency and food safety throughout the supply chain.

- According to a survey conducted by the Food Marketing Institute, 75% of consumers consider transparency and traceability as important factors in their food purchasing decisions.

TraceX's blockchain traceability solutions provide a robust framework for tackling the challenges faced by food businesses. By utilizing blockchain technology, TraceX delivers transparency, immutability, and data integrity across the entire food supply chain, ensuring compliance with stringent food safety regulations.

The platform securely records critical information, such as certifications, testing results, and supplier details, on the blockchain. This enables food businesses to access accurate, real-time data, meet regulatory standards, and maintain supply chain transparency.

However, the food logistics market faces several challenges with substantial operational costs, including investments in temperature-controlled storage, specialized transportation, and regulatory compliance. The financial burden associated with maintaining and upgrading cold chain infrastructure and technology represents a significant barrier to market growth.

To address these challenges, companies are investing in advanced technologies, such as energy-efficient cooling systems and automated logistics solutions, to optimize resource use and lower long-term expenses. Collaborative partnerships and shared infrastructure models are also being adopted to spread costs and improve efficiency, which is expected to drive the market growth over the forecast period.

Food Logistics Industry Trends

Direct-to-consumer food channels constitutes a major market trend. These channels are becoming a significant growth driver for the food logistics market. With the rise of farm-to-table initiatives, meal kit delivery services, pet food supplements, and food subscription boxes, logistics providers are engaging in delivering fresh and specialty food products directly to consumers. This shift toward more personalized and direct food distribution channels is accelerating the demand for efficient logistics networks.

- In February 2024, ButcherBox, a direct-to-consumer brand specializing in meat and seafood, announced its expansion into the pet market with the launch of ButcherBox For Pets. This new line offers dry food, treats, and hip and joint supplements for dogs. A Dry food is initially available through subscription, while treats and supplements is available as add-on items.

The growing consumer demand for plant-based foods and alternative proteins, such as meat substitutes and cultured meat, is transforming food logistics. These products often require specific storage and handling conditions to preserve their texture and nutritional value.

The rise of alternative proteins is pushing logistics providers to adapt their supply chains to accommodate the unique requirements of these new food categories, creating new growth opportunities within the logistics market.

Segmentation Analysis

The global market has been segmented based on product type, mode of transportation, technology, and geography.

By Product Type

Based on product type, the market has been segmented into perishable food and non-perishable food. The perishable food segment led the food logistics market in 2023, reaching the valuation of USD 76.11 billion, due to the high demand for fresh and quality-controlled products.

Perishable food segment has been further classified into fruits and vegetables, meat, poultry, & seafood, dairy products, and frozen food. The non-perishable food segment has been further categorized into packaged & processed food, beverages, canned food, and dry food. Consumers seek fresh produce, dairy, meat, and seafood, which is driving significant growth in this sector.

Perishable foods require specialized handling, including temperature-controlled storage and faster transportation, to maintain freshness and safety. Thishas led logistics providers to invest in advanced cold chain infrastructure and technology. Additionally, regulatory standards for food safety and quality further elevate the need for efficient perishable food logistics.

By Mode of Transportation

Based on mode of transportation, the food logistics market has been classified into roadways, railways, airways, and waterways. The roadways segment secured the largest revenue share of 48.44% in 2023 due to its flexibility, efficiency, and extensive network coverage. Road transport offers the advantage of direct, door-to-door delivery, crucial for perishable food items that require precise handling.

A well-developed road infrastructure in many regions enables seamless integration with other logistics modes and facilitates the efficient distribution of goods over short to medium distances. Additionally, advancements in vehicle technology, including temperature-controlled trucks, enhance the capability of road transport to handle diverse food products while maintaining quality and safety.

By Technology

Based on technology, the market has been divided into conventional logistics and smart logistics. The smart logistics segment is poised for significant growth at a robust CAGR of 6.55% over the forecast period. The integration of advanced technologies such as IoT, AI, and blockchain is revolutionizing supply chain management by enhancing visibility, efficiency, and accuracy.

Real-time tracking and monitoring technologies enable better control over temperature and location, crucial for maintaining the quality of perishable goods. Additionally, AI-driven analytics optimize route planning and inventory management, reducing costs and improving delivery performance.

Food Logistics Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific food logistics market share stood around 37.89% in 2023 in the global market, with a valuation of USD 43.84 billion. The rapid growth of e-commerce in Asia-Pacific is transforming food logistics. Online grocery shopping is becoming increasingly popular due to the need for convenience, competitive pricing, and the rise of mobile technology.

This shift is pushing food logistics providers to enhance last-mile delivery solutions, improve cold chain infrastructure, and develop real-time tracking systems to meet consumer expectations for fast, reliable delivery of fresh and perishable goods.

- According to the International Trade Administration the e-commerce market in the Asia-Pacificwas valued at USD 19.30 trillion in 2023 and is projected to exceed USD 28.90 trillion by 2026.

North America is poised for significant growth at a robust CAGR of 6.28% over the forecast period. The expanding trade of food and food products is a leading factor fueling the growth of the food logistics market in North America. This region is a major importer and exporter of agricultural products, processed foods, and specialty items.

With increasing consumer demand for diverse, high-quality, and global food options, the need for efficient cross-border logistics solutions is rising.

- In September 2024, data from the U.S. Census Bureau and the U.S. Bureau of Economic Analysis reported that U.S. exports of foods, feeds, and beverages totaled USD 161.88 billion, while imports in the same category reached USD 200.20 billion.

Trade agreements between North America and other regions, such as the USMCA, are further facilitating the exchange of food products. This growing trade volume is creating higher demand for sophisticated logistics networks, including temperature-controlled transportation, warehousing, and distribution systems to ensure the safe and timely delivery of goods across borders.

Competitive Landscape

The global market report provides valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for the market growth.

List of Key Companies in Food Logistics Market

- C.H. Robinson Worldwide, Inc.

- Kuehne + Nagel International AG

- XPO Logistics, Inc.

- Americold Logistics, LLC

- DHL Group

- Lineage Logistics, LLC

- AGRO Merchants Group, LLC

- UPS Supply Chain Solutions, Inc.

- P. Moller - Maersk Group

- Deutsche Bahn (DB) Schenker AG

Key Industry Developments

- September 2024 (Business Expansion): DHL inaugurated a new facility at Francisco Sá Carneiro Airport in Portugal, with an investment of over USD 26 million. This significant expansion triples DHL's operational capacity, allowing it to process up to 6,500 pieces per hour for imports and 5,000 pieces per hour for exports.

- May 2024 (Business Expansion): Kuehne+Nagel opened a new 363,000 square foot facility in El Paso, Texas, to meet the growing demand for cross-border logistics driven by the nearshoring trend. This modern site consolidates four warehouses into one, enhancing operational efficiency for customers moving goods between the U.S. and Mexico.

The global food logistics market has been segmented:

By Product Type

- Perishable Food

- Fruits and Vegetables

- Meat, Poultry, and Seafood

- Dairy Products

- Frozen Food

- Non-Perishable Food

- Packaged and Processed Food

- Beverages

- Canned Food

- Dry Food

By Mode of Transportation

- Roadways

- Railways

- Airways

- Waterways

By Technology

- Conventional Logistics

- Smart Logistics

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership