ICT-IOT

Fraud Detection and Prevention Market

Fraud Detection and Prevention Market Size, Share, Growth & Industry Analysis By Component (Solution, Services), By Deployment, By Application (Insurance Claims, Money Laundering, Electronic Payment, Others), By Vertical (BFSI, IT & Telecommunication, Retail, Government, Manufacturing, Healthcare) and Regional Analysis, 2024-2031

Pages : 180

Base Year : 2023

Release : February 2025

Report ID: KR1340

Market Definition

The fraud detection and prevention industry comprises advanced technologies, solutions, and services designed to identify, mitigate, and prevent fraudulent activities across various industries. It includes AI-driven software and systems that leverage machine learning, big data analytics, biometrics, and behavioral analysis to detect anomalies and suspicious activities in real time.

Key industries driving market growth include banking, financial services, insurance (BFSI), manufacturing, healthcare, government, and IT & telecommunications. Organizations rely on fraud prevention tools to combat cyber fraud, identity theft, payment fraud, money laundering, and insider threats while ensuring compliance with stringent regulations such as GDPR, PCI-DSS, and AML laws.

Fraud Detection and Prevention Market Overview

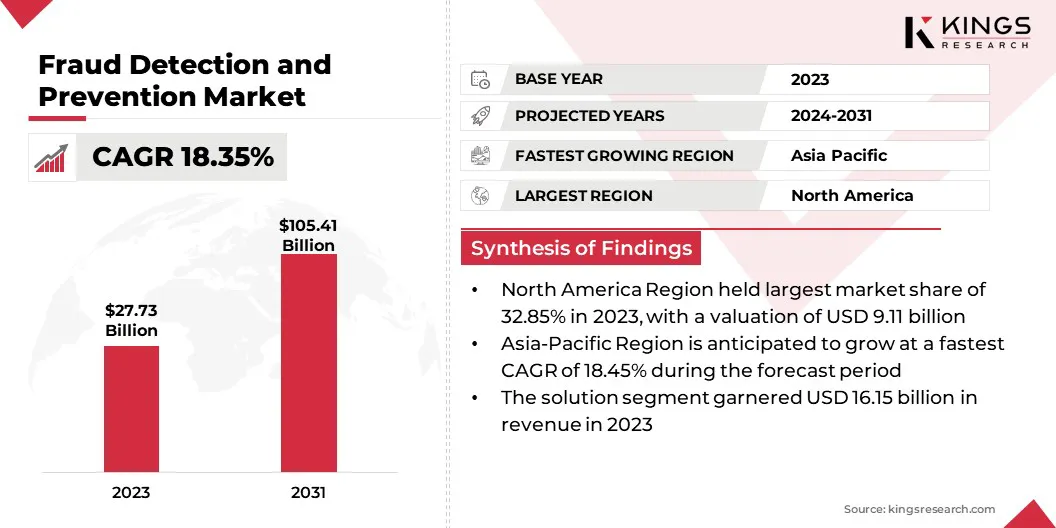

Global fraud detection and prevention market size was valued at USD 27.73 billion in 2023 and is projected to grow from USD 32.40 billion in 2024 to USD 105.41 billion by 2031, exhibiting a CAGR of 18.35% during the forecast period.

The market is growing rapidly due to the increasing frequency of fraudulent activities, advancements in AI and machine learning technologies, and the rising adoption of digital transactions globally. The growing sophostication of fraud schemes, along with the need for real-time detection, is fostering innovation and expansion in the market.

Major companies operating in the fraud detection and prevention market are Experian, IBM, LexisNexis Risk Solutions, ACI Worldwide, Equifax, Inc., FICO, PayPal Payments Private Limited, Oracle, Iovations, BAE Systems, upLexis Tecnologia LTDA, Cybersource, NICE, Fiserv, Inc, SAS Institute Inc, and others.

The market is becoming increasingly competitive, with new entrants offering innovative solutions to address the evolving threats. Companies are focusing on enhancing their technologies with AI, machine learning, and data analytics to provide more accurate, faster, and scalable fraud detection.

- In April 2024, Darktrace launched the Darktrace ActiveAI Security Platform™ to enhance cyber resilience. It integrates existing solutions with new innovations, offering comprehensive visibility, automated threat investigations, and proactive security measures to detect and mitigate risks in real time.

Key Highlights

- The fraud detection and prevention industry size was recorded at USD 27.73 billion in 2023.

- The market is projected to grow at a CAGR of 18.35% from 2024 to 2031.

- North America held a share of 32.85% in 2023, valued at USD 9.11 billion.

- The solution segment garnered USD 16.15 billion in revenue in 2023.

- The on-premises segment is expected to reach USD 56.54 billion by 2031.

- Asia-Pacific is anticipated to grow at a CAGR of 18.45% through the forecast period

Market Driver

"Expansion of Digital Transaction Networks"

The expansion of payment systems is fueling the growth of the fraud detection and prevention market. The rise of digital and mobile payments, e-commerce, and cross-border transactions introduces new vulnerabilities, inceasing the complexity of fraud detection.

The rise of cryptocurrencies and contactless payments further complicates security, while open banking and APIs increase fraud risks. These trends emphasize the need for advanced, real-time fraud prevention tools.

- In May 2024, Mastercard announced the implementation of generative AI technology to enhance its fraud detection capabilities. This advancement has enabled the company to double the speed at which it identifies potentially compromised cards, allowing banks to block them more swiftly. The AI system scans transaction data across billions of cards and millions of merchants, alerting Mastercard to new and complex fraud patterns.

The rise of cryptocurrencies and block chain technologies has introduced complex, difficult-to-trace transactions, incresing the demand for advanced fraud prevention solutions.

The widespread adoption of contactless payments and the surging use of open banking and APIs present major challenges, as they expand the attack surface for fraudsters. These trends highlight the need for more sophisticated tools to monitor and secure digital transactions in real-time.

Market Challenge

"Data Privacy Concerns"

Data privacy concerns is a major challenge hampering the expansion of the fraud detection and prevention industry, as organizations need to collect personal data such as transaction history and user behavior to identify fraud. However, regulations such as GDPR and CCPA imporse strict limitations on data collection, storage, and processing.

Companies must strike a balance between fraud prevention with privacy protection, as data mishandling or excessive collection can lead to legal issues and erode customer trust.

- In June 2024, Apple announced new privacy updates across its platforms, reinforcing its commitment to user privacy. The latest developments include the launch of Private Cloud Compute, enhancing Apple's cloud services with the iPhone's strong privacy protections. This feature enables Apple Intelligence to process complex user requests while upholding strict privacy standards.

To address these challenges, organizations should focus on data minimization by collecting only necessary information and using techniques, such as anonymization or tokenization.

They must also ensure compliance with privacy laws such as GDPR and CCPA, ensuring user consent and limiting data retention. Additionally, on-device processing enhances privacy by analyzing data locally, reducing the transfer of sensitive information to external servers.

Market Trend

"Enhanced Analytical Techniques"

Advanced analytics is influencing the fraud detection and prevention market through proactive methods such as behavioral analytics, which identifies anomalies such as unusual login locations or transaction sizes.

Predictive analytics further enhances security by analyzing past data to forecast potential fraud, enabling real-time decision-making and minimizing financial losses. This approach improves accuracy, enables real-time decision-making, strenghthens security, and reduces financial losses.

- In November 20, 2024, AppsFlyer introduced an advanced AI layer for its Protect360 fraud prevention solution, enhancing detection and mitigation of sophisticated fraud. This new AI layer utilizes multiple machine learning models to improve fraud detection and deterrence, offering enhanced accuracy and real-time mitigation against sophisticated fraudulent activities.

This allows for real-time, data-driven decisions that minimize financial losses and strengthen security.

Fraud Detection and Prevention Market Report Snapshot

|

Segmentation |

Details |

|

By Component |

Solution (Fraud Analytics: (Predictive Analytics, Customer Analytics, Behavioral Analytics, Others), Authentication: (Single-Factor Authentication, Multi-Factor Authentication, Governance, Risk, and Compliance), Services (Managed, Professional) |

|

By Deployment |

Cloud-based, On-Premises |

|

By Application |

Insurance Claims, Money Laundering, Electronic Payment, Others |

|

By Vertical |

BFSI, IT & Telecommunications, Retail, Government, Manufacturing, Healthcare, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Component (Solution and Services): The solution segment earned USD 16.15 billion in 2023, driven by the increasing adoption of advanced technologies such as artificial intelligence, machine learning, and real-time analytics. These solutions help businesses efficiently detect and prevent fraud, streamline operations, and enhance security.

- By Deployment (Cloud-based and On-Premises): The on-premises segment held a share of 53.70% in 2023, fueled by organizations' preference for maintaining control over their data and security, particularly in industries with strict regulatory requirements or concerns about data privacy.

- By Application (Insurance Claims, Money Laundering, Electronic Payment, and Others): The electronic payment segment earned USD 9.66 billion in 2023, driven by surge in digital transactions and the increasing need for secure payment systems. With the expansion of e-commerce and mobile payments, businesses are investing in fraud detection solutions to protect against unauthorized transactions and enhance security.

- By Vertical (BFSI, IT & Telecommunications, Retail, Government, Manufacturing, Healthcare, and Others): The BFSI segment held a share of 25.23% in 2023, aided by the sector's need to protect sensitive financial data, prevent cyberattacks, and ensure compliance with strict regulatory requirements amid growing digital transactions and financial fraud.

Fraud Detection and Prevention Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America fraud detection and prevention market accounted for a significant share of around 32.85% in 2023, valued at USD 9.11 billion. This dominance is reinforced by the region's rapid adoption of advanced technologies such as artificial intelligence and machine learning, coupled with the rising digital transactions and the growing need for robust security measures.

The presence of key market players and stringent regulatory frameworks, such as GDPR and CCPA, further fuel the demand for fraud prevention solutions in North America.

- In September 2023, Visa's Biannual Threats Report highlighted a notable rise in fraud schemes, particularly in retail and e-commerce. The report revealed a 91% increase in ransomware attacks and a surge in fraud targeting online merchants, with Visa preventing $30 billion in fraudulent transactions. Key fraud types included spoofed merchants and flash-fraud scams. Visa's global efforts, including cooperation with law enforcement, led to major crackdowns, such as the dismantling of the Try2Check cybercrime platform in the U.S. Through its Risk Operations Center and Payment Fraud Disruption, Visa continues to protect the global payment system.

Asia-Pacific fraud detection and prevention industry is poised to grow at a staggering CAGR of 18.45% through the projection period. The adoption of AI, machine learning, and blockchain technologies, along with stricter regulations, is creating a robust demand for advanced fraud detection systems. Countries such as China, India, and Japan are at the forefront of this growth, supported by fintech startups and expanding digital payment infrastructures.

Regulatory Framework:

- The European Data Protection Supervisor (EDPS) outlines anti-fraud procedures to ensure data protection while combating fraud. These procedures focus on preventing fraudulent activities that compromise personal data, ensuring compliance with data protection laws, and safeguarding individuals' rights. Organizations must implement robust measures to detect, investigate, and respond to fraud, while adhering to GDPR requirements and balancing security with privacy.

- The PCI Security Standards Council develops and maintains security standards for payment card transactions. Its primary standard, PCI DSS (Payment Card Industry Data Security Standard), sets requirements for businesses to protect cardholder data and ensure secure payment processing. These standards cover areas such as encryption, access control, and monitoring to prevent fraud and data breaches in the payment card industry. Compliance with PCI DSS helps organizations secure payment systems and maintain consumer trust.

- The Gramm-Leach-Bliley Act (GLBA) mandates financial institutions to protect consumers' personal financial information. It requires privacy policies, security safeguards, and provides consumers the right to opt out of third-party sharing. The regulation aims to reduce identity theft and fraud while ensuring consumer privacy.

- Anti-Money Laundering (AML) regulations, enforced by FINRA, require financial firms to implement AML programs, monitor transactions, and report suspicious activities related to money laundering, securities fraud, or market manipulation. These regulations help maintain the integrity of financial markets and prevent illicit activities.

- The General Data Protection Regulation (GDPR) regulates the processing of personal data, requiring organizations to handle it transparently and securely.It grants individuals rights ovr their data, including access, correction, deletion, and restriction, while mandating explicit consent for data collection and processing. GDPR strengthens privacy protection and enhances trust in data management across the EU.

Competitive Landscape

To gain a competitive edge in the fraud detection and prevention industry , companies should integrate AI and machine learning for more personalized and accurate search results. Cloud-native solutions with providers such as AWS or Microsoft Azure offer scalability, while strong data security ensures compliance with regulations like GDPR.

A user-friendly interface, advanced features such as natural language processing and multi-source search capabilities further enhance efficiency and user experience. These strategies are essential for maintainng a competitive edge in a rapidly evolving market.

- In April 2023, Experian launched Aidrian, a cloud-based fraud prevention solution powered by adaptive machine learning. Aidrian combines a customized machine learning model with device fingerprinting to automatically classify transactions with 99.9% accuracy, significantly reducing false positives and enhancing the customer experience. This approach enables businesses to prevent fraud without impacting legitimate transactions, thereby supporting revenue growth.

List of Key Companies in Fraud Detection and Prevention Market:

- Experian

- IBM

- LexisNexis Risk Solutions

- ACI Worldwide

- Equifax, Inc.

- FICO

- PayPal Payments Private Limited

- Oracle

- Iovations

- BAE Systems

- upLexis Tecnologia LTDA

- Cybersource

- NICE

- Fiserv, Inc

- SAS Institute Inc

Recent Developments (Partnerships/Collaborations/M&A)

- In December 2024, Experian acquired Audigent, a leading data activation and identity platfrom in the advertising industry, to enhance its capabilities. This acquisition allows Experian to leverage Audigent’s AI-powered solutions for more advanced fraud detection, enabling real-time identification of complex fraud patterns and improving security for clients across industries

- In November 2024, Finix and Sift introduced a no-code, AI-powered fraud prevention solution. This collaboration allows businesses to easily integrate advanced fraud detection capabilities into their payment systems without requiring technical expertise. The tool uses machine learning to detect fraud in real-time, helping businesses reduce chargebacks and secure transactions more efficiently.

- In March 2024, global fintech leader FIS announced that its SecurLOCK card fraud management solution will enhance fraud detection and prevention through a new collaboration with FIS Fintech Accelerator alumnus Stratyfy.

- In December 2024, Mastercard finalized its acquisition of Recorded Future, a leading threat intelligence company. This strategic move aims to enhance Mastercard's cybersecurity services by integrating Recorded Future's AI-driven threat intelligence capabilities, thereby strengthening the security of digital transactions and interactions.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)