Healthcare Medical Devices Biotechnology

Healthcare Analytics Market

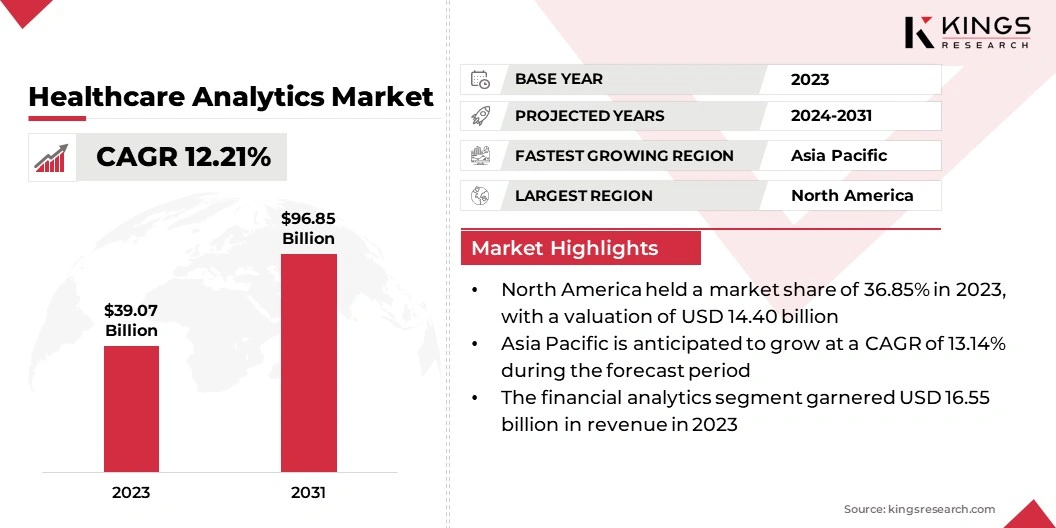

Healthcare Analytics Market Size, Share, Growth & Industry Analysis, By Application (Clinical Analytics, Financial Analytics, Operational and Administrative Analytics, and Population Health Analytics), By Type (Descriptive, Predictive, and Prescriptive), By End User (Healthcare Providers and Payers), By Deployment Model, and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : June 2024

Report ID: KR185

Healthcare Analytics Market Size

Global Healthcare Analytics Market size was valued at USD 39.07 billion in 2023 and is projected to grow from USD 43.23 billion in 2024 to USD 96.85 billion by 2031, exhibiting a CAGR of 12.21% from 2024 to 2031.

The growth of the healthcare analytics market is mainly propelled by the increasing demand for enhanced healthcare outcomes, cost management efficiencies, regulatory compliance, and advancements in data analytics technologies. These factors are boosting the adoption of analytics solutions, helping healthcare providers optimize operations, improve patient care, and enhance efficiency.

In the scope of work, the report includes solutions offered by companies such as CitiusTech Inc, Health Catalyst, Inovalon, MedeAnalytics, Inc., Optum, Inc., Oracle, Veradigm LLC, COTIVITI, INC., CVS Health, IBM, and others.

Moreover, regulatory requirements and a shift toward value-based care models compel healthcare organizations to invest in analytics to meet compliance and performance standards. The proliferation of big data in healthcare, fueled by the adoption of electronic health records and IoT devices, is boosting market growth. Additionally, the growing focus on personalized medicine and predictive analytics highlights the need for advanced data analytics capabilities in healthcare.

- In July 2024, Uppaluri K&H Personalized Medicine Clinic launched GeneConnectRx, an AI platform by developed by its diagnostic division, GenepoweRx. This platform is designed to allow tailor their treatments based on individual genetics. Ongoing efforts focus on validating drug targets for conditions such as brain cancer, Parkinson's disease, high cholesterol, monogenic diabetes and autism.

The healthcare analytics market encompasses a broad spectrum of analytics solutions tailored for the healthcare industry. These solutions range from predictive analytics for patient outcomes to operational analytics for resource optimization.

The market is characterized by a diverse vendor landscape, including large technology companies and specialized analytics providers. North America dominates the market due to early adoption of healthcare IT solutions and regulatory initiatives that promote data-driven decision-making.

The healthcare analytics market involves the use of data analytics tools and technologies to analyze healthcare data. It includes clinical analytics, financial analytics, operational analytics, and population health analytics, with the goal of extracting actionable insights from vast amounts of healthcare data to support decision-making, improve care quality, and optimize operational efficiencies.

Key functionalities include data aggregation, analysis, and visualization, often leveraging artificial intelligence and machine learning algorithms. The market caters to healthcare providers, payers, pharmaceutical companies, and government agencies, addressing challenges such as rising healthcare costs, patient management, and regulatory compliance.

As healthcare systems undergo digital transformation, the demand for advanced analytics solutions is increasing, fostering innovation and efficiency across the healthcare ecosystem.

Analyst’s Review

Analyst’s Review

The healthcare analytics market is witnessing robust growth driven by technological advancements and increasing demand for data-driven decision-making. Manufacturers are investing in AI and machine learning to enhance their analytics solutions, improving predictive accuracy and operational efficiency. New products focusing on real-time data analysis and interoperability are being introduced to the market, addressing critical needs in patient care and resource management.

To capitalize on growth, manufacturers are prioritizing cybersecurity and regulatory compliance to build trust and ensure data privacy. Additionally, expanding partnerships with healthcare providers facilitates the integration of advanced analytics tools, enhancing their utility and adoption. Continuous innovation and a focus on user-friendly solutions are key to sustaining market leadership.

- In June 2024, Microsoft Corp. launched a cybersecurity program to aid hospitals serving over 60 million rural Americans. Following a 130% increase in ransomware attacks on healthcare in 2023, the program offered free and discounted technology services, training, and security assessments to rural hospitals. This initiative, in collaboration with The White House and various healthcare associations, aims to strengthen cybersecurity and improve healthcare quality in rural areas.

Healthcare Analytics Market Growth Factors

The adoption of electronic health records (EHRs) is driving the growth of the healthcare analytics market. Healthcare providers are increasingly implementing EHR systems to digitize patient information, creating vast amounts of data. This data empowers healthcare organizations to enhance patient care, streamline operations, and reduce costs.

EHRs enhance data management, interoperability, and real-time access to patient information, which are crucial for effective analytics. By leveraging EHR data, healthcare providers are improving clinical decision-making, enhancing patient outcomes, and supporting predictive analytics efforts. The continuous expansion and integration of EHR systems are fueling the demand for sophisticated healthcare analytics solutions.

- Washington County Hospital and Clinics (WCHC) implemented the Epic electronic health record system on November 11, 2023. Epic, used by approximately 70% of patients nationwide, consolidated WCHC's medical records into a single system. This change allowed patients, families, and healthcare providers to easily access medications, test results, appointments, medical bills, and information from other local and national organizations through the MyChart patient portal.

Data privacy and security concerns present a significant challenge to the expansion of the healthcare analytics market. The sensitive nature of health data requires stringent measures to protect against breaches and unauthorized access. To overcome this challenge, healthcare organizations are implementing robust security frameworks and compliance protocols, including encryption, anonymization, and secure access controls.

Additionally, adherence to regulatory standards, such as HIPAA in the United States, ensures that data handling practices meet legal requirements. Investing in advanced cybersecurity technologies and conducting regular audits and training programs further enhances data protection. Prioritizing mitigates risks, builds patient trust, and enables healthcare organizations to leverage analytics for improved healthcare outcomes.

Healthcare Analytics Market Trends

Artificial intelligence (AI) and machine learning (ML) are increasingly transforming the healthcare analytics market. These technologies are enabling healthcare providers to analyze large datasets with improved accuracy and speed, uncovering previously inaccessible insights. AI and ML applications in predictive analytics are enhancing patient care by identifying potential health risks and enabling early interventions.

Moreover, these technologies are improving operational efficiencies by optimizing resource allocation and reducing administrative burdens. Advancements in AI and ML algorithms are transforming healthcare analytics, enabling innovations in personalized medicine, automated diagnostics, and real-time decision support systems, thereby reshaping healthcare delivery.

- In October 2024, IQVIA introduced IQVIA AI Assistant, a generative AI technology designed to deliver a timely and impactful insights to life science customers.

The integration of Internet of Things (IoT) devices in healthcare is a prominent trend impacting the healthcare analytics market. IoT devices, such as wearable health monitors and smart medical equipment, are generating a continuous stream of real-time data. This data is invaluable for healthcare analytics, providing insights into patient health, treatment efficacy, and operational performance.

The use of IoT in remote patient monitoring is increasing as it enables healthcare providers to track patient conditions beyond clinical settings. This trend is enhancing patient engagement, improving chronic disease management, and reducing hospital readmissions. The growing adoption of IoT devices is boosting the demand for advanced analytics solutions capable of handling and interpreting complex, real-time health data.

Segmentation Analysis

The global healthcare analytics market has been segmented based on application, type, end user, deployment model, and geography.

By Application

Based on application, the market has been categorized into clinical analytics, financial analytics, operational and administrative analytics, and population health analytics.

The financial analytics segment led the healthcare analytics market in 2023, reaching a valuation of USD 16.55 billion. This growth is attributed to increasing demand for cost management and efficiency in healthcare. Rising healthcare costs necessitate advanced analytics to optimize financial operations, reduce waste, and enhance profitability.

- For instance, in September 2022, McKesson Corporation announced a definitive agreement to acquire Rx Savings Solutions (RxSS), a company specializing in prescription price transparency and benefit insights. At the time, RxSS provided affordability and adherence solutions to health plans and employers, serving over 17 million patients.

Financial analytics solutions help organizations analyze revenue cycles, manage claims, and control operational expenses. Moreover, regulatory requirements and value-based care models are prompting healthcare providers to adopt financial analytics for compliance and performance tracking. Growing emphasis on data-driven decision-making is further supporting the growth of the segment as healthcare organizations seek to improve financial outcomes.

By Type

Based on type, the market has been classified into descriptive, predictive, and prescriptive. The predictive segment is set to expand substantially at a CAGR of 13.38% through the forecast period (2024-2031). This expansion is mainly stimulated by its increasing utilization in healthcare to forecast future trends and outcomes.

By leveraging big data, AI, and machine learning, predictive analytics provides insights that support proactive decision-making, improving patient care and operational efficiency.

- In March 2023, Syneos Health collaborated with KX, the developer of kdb, a leading time-series database and analytics platform. This partnership focused on leveraging data-driven predictive analytics, artificial intelligence (AI), and machine learning (ML) to enhance clinical trial efficiency and streamline operations.

Healthcare organizations are increasingly adopting predictive analytics to identify potential health risks, optimize resource allocation, and enhance patient outcomes. The growing focus on personalized medicine and preventive care is further fueling the demand for predictive analytics.

By End-User

Based on end user, the market has been segmented into healthcare providers and payers. The healthcare providers segment secured the largest revenue share of 56.31% in 2023, largely due to the critical need for analytics to improve patient care and operational efficiency. Providers are increasingly adopting analytics solutions to enhance clinical outcomes, streamline workflows, and optimize resource use.

- In March 2024, Highmark Health partnered with Epic and Google Cloud to enhance coordination between payers and providers, promoting collaboration and enhancing efficiency.

The integration of electronic health records and the shift toward value-based care models are driving segmental growth. Healthcare providers are leveraging analytics to make data-driven decisions, improve patient satisfaction, and comply with regulatory requirements. Additionally, advancements in healthcare technology and the growing volume of patient data are highlighting the need for robust analytics solutions.

Healthcare Analytics Market Regional Analysis

Based on region, the global healthcare analytics market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America healthcare analytics market held a substantial share of around 36.85% in 2023, with a valuation of USD 14.40 billion. The region boasts a well-established healthcare infrastructure and widespread adoption of advanced healthcare technologies. Government initiatives, such as the Affordable Care Act in the United States, are promoting the use of healthcare analytics to improve patient outcomes and reduce costs.

The North America healthcare analytics market held a substantial share of around 36.85% in 2023, with a valuation of USD 14.40 billion. The region boasts a well-established healthcare infrastructure and widespread adoption of advanced healthcare technologies. Government initiatives, such as the Affordable Care Act in the United States, are promoting the use of healthcare analytics to improve patient outcomes and reduce costs.

Additionally, healthcare providers and payers in the region are investing heavily in analytics solutions to enhance efficiency and compliance. The presence of leading technology companies and ongoing innovations in big data, AI, and machine learning are further bolstering regional market progress.

Asia-Pacific healthcare analytics market is poised to experience the fastest growth over the forecast period, registering a CAGR of 13.14%. This growth is facilitated by increasing healthcare investments and digital transformation initiatives. The expanding population and rising prevalence of chronic diseases in the region are increasing the demand for advanced analytics to improve healthcare delivery.

- In May 2024, Ibex Medical Analytics, a leader in AI-powered cancer diagnostics, and Kameda Medical Center, a prominent Japanese healthcare institution, reported positive results in cancer detection. Their AI platform accurately identified cancer and other pathologies in prostate and breast biopsy samples.

Governments in countries such as China and India are prioritizing healthcare reforms and implementing policies to enhance data management and analytics capabilities. The growing adoption of electronic health records and telemedicine services is further fueling regional industry development.

Additionally, the region is witnessing significant investments from international and local players in healthcare IT infrastructure, which is influencing the Asia-Pacific healthcare analytics market outlook. Too much information in this section. Please keep it concise and informative, avoiding unnecessary or redundant information. Consider adding data from 2023 or 2024 instead of 2022.

Competitive Landscape

The global healthcare analytics market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Healthcare Analytics Market

- CitiusTech Inc

- Health Catalyst

- Inovalon

- MedeAnalytics, Inc.

- Optum, Inc.

- Oracle

- Veradigm LLC

- COTIVITI, INC.

- CVS Health

- IBM

Key Industry Developments

- April 2024 (Acquisition): ABOUT Healthcare, a leading provider of SaaS-based hospital operations solutions, acquired Edgility, an AI and analytics platform, enhancing patient flow and operational efficiency through real-time monitoring and management capabilities. This acquisition integrated predictive and prescriptive analytics into ABOUT’s care orchestration technology and optimized patient progression and facility capacity with intuitive visualizations. The solution supported command center strategies, as well as improved discharge velocity, transfer management, and overall patient care coordination across healthcare settings, reinforcing ABOUT’s commitment to enhancing healthcare operational outcomes.

- March 2024 (Acquisition): Cardinal Health finalized its acquisition of Specialty Networks, bolstering its ability to create clinical and economic value for independent specialty providers across multiple specialty GPOs. Specialty Networks' PPS Analytics platform analyzed data from EMR, practice management, imaging, and dispensing systems, transforming it into actionable insights using AI and modern data analytics capabilities.

The global healthcare analytics market is segmented as:

By Application

- Clinical Analytics

- Financial Analytics

- Operational and Administrative Analytics

- Population Health Analytics

By Type

- Descriptive

- Predictive

- Prescriptive

By End User

- Healthcare Providers

- Payers

By Deployment Model

- On-premise Model

- Cloud-based Model

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership