Advanced Materials and Chemicals

Packaging Coatings Market

Packaging Coatings Market Size, Share, Growth & Industry Analysis, By Resin Type (Epoxy, Polyester, Acrylic, Polyurethane, Vinyl, Alkyd, Others), By Substrate (Metal, Plastic, Glass, Paperboard), By Coating Type (Water-Based, Solvent-Based, UV-Cured), By Application, and Regional Analysis, 2024-2031

Pages : 200

Base Year : 2023

Release : February 2025

Report ID: KR1373

Market Definition

Packaging coatings are specialized coatings applied to packaging materials such as metal, plastic, paper, and glass to enhance their durability, appearance, and functionality.

These coatings provide essential properties such as corrosion resistance, chemical protection, barrier performance, and adhesion for printing and labeling. Packaging coatings also play a crucial role in extending shelf life, preventing contamination, and enhancing the overall sustainability of packaging by reducing material degradation and waste.

Packaging Coatings Market Overview

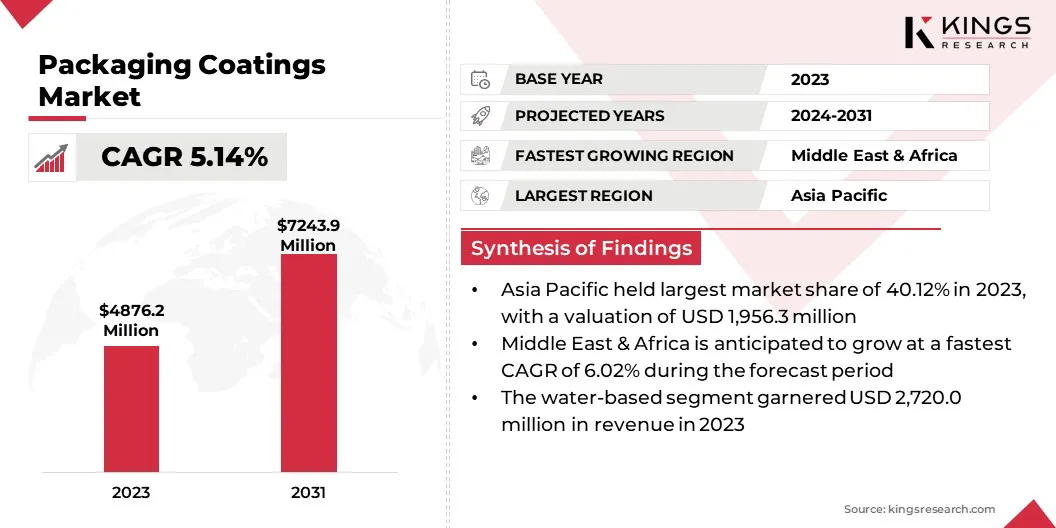

The global packaging coatings market size was valued at USD 4,876.2 million in 2023 and is projected to grow from USD 5,101.7 million in 2024 to USD 7,243.9 million by 2031, exhibiting a CAGR of 5.14% during the forecast period.

This market is experiencing steady growth, driven by increasing demand for durable, sustainable, and high-performance packaging solutions across various industries, including food and beverage, pharmaceuticals, personal care, and consumer goods. These coatings enhance packaging by providing barrier protection, corrosion resistance, and improved aesthetics, ensuring product safety and longevity.

Major companies operating in the packaging coatings industry are The Sherwin-Williams Company, PPG Industries, Inc., Akzo Nobel N.V., Axalta Coating Systems, LLC, BASF, Arkema Group, Jotun A/S, Nippon Paint Holdings Co., Ltd., Asian Paints, DIC CORPORATION, RAG-Stiftung, Henkel AG & Co. KGaA, U. K. Paints India Private Limited, ALTANA AG, and B.C. Jindal Group.

Additionally, advancements in nanotechnology and smart coatings are fostering innovation, offering enhanced functionalities such as antimicrobial properties and improved recyclability.

With the expansion of the e-commerce sector and the growing preference for lightweight, sustainable packaging materials, the demand for advanced packaging coatings is expected to rise significantly in the coming years.

- In November 2024, ACTEGA launched ACTExact ShrinkFlex UV Inks at Expografica 2024, introducing an advanced packaging and coatings solution with superior adhesion for shrink sleeve applications and high-speed printing.

Key Highlights:

- The packaging coatings industry size was valued at USD 4,876.2 million in 2023.

- The market is projected to grow at a CAGR of 5.14% from 2024 to 2031.

- Asia Pacific held a share of 40.12% in 2023, valued at USD 1,956.3 million.

- The polyester segment garnered USD 1,711.1 million in revenue in 2023.

- The metal segment is expected to reach USD 2,982.2 million by 2031.

- The water-based segment is projected to generate a revenue of USD 3,829.5 million by 2031.

- The food & beverage packaging segment is likely to reach USD 4,061.6 million by 2031.

- Europe is anticipated to grow at a CAGR of 4.95% through the forecast period.

Market Driver

"Sustainability and Industry Growth"

The packaging coatings market is growing rapidly due to a notable shift toward sustainability and eco-friendly solutions. Governments and regulatory bodies worldwide are imposing stricter environmental laws to reduce pollution and promote the use of biodegradable and non-toxic materials in packaging.

Furthermore, consumers are becoming more conscious of food safety and environmental impact, prompting manufacturers to develop coatings that are water-based, PFAS free (per- and polyfluoroalkyl substances), and recyclable. Additionally, the rapidly growing food and beverage industry, a major consumer of packaging coatings, is boosting demand for high-performance coatings.

Urbanization and fast-paced lifestyles are propelling the demand for ready-to-eat and packaged foods. This growth has increased the need for high-performance coatings that can protect food from contamination, improve shelf life, and maintain freshness.

- In February 2025, PPG launched PPG Hoba Pro 2848, a non-BPA internal coating for aluminum bottles, catering to the growing demand for aluminum bottle packaging in water, wine, and other beverages.

Market Challenge

"Strict Environmental Regulations and Rising Costs of Raw Materials"

The packaging coatings market faces significant challenges, particularly in meeting stringent environmental regulations and managing the rising costs of raw materials.

Governments and environmental agencies worldwide are enforcing stricter rules to limit hazardous chemicals, such as PFAS and VOCs, in packaging coatings. This requires manufacturers to reformulate their products while maintaining essential properties such as adhesion, durability, and barrier protection.

In response, companies are investing in research and development to create water-based, bio-based, and other sustainable alternatives that comply with evolving regulations without compromising performance.

Another pressing issue is the fluctuating cost of raw materials, which can significantly impact production expenses and overall profitability. The prices of essential components, such as resins, pigments, and additives, are influenced by factors such as supply chain disruptions, geopolitical instability, and increased demand from other industries.

These fluctuations make it challenging for manufacturers to maintain consistent pricing and profitability. To mitigate this issue, businesses are diversifying their supplier base, optimizing production processes for cost efficiency, and exploring alternative materials that offer high performance at a lower cost.

Market Trend

"Innovative and Sustainable Advancements in Packaging Coatings"

The packaging coatings market is experiencing a strong shift toward water-based and UV-curable coatings, which help manufacturers reduce volatile organic compound (VOC) emissions while ensuring durability and adhesion. With stricter environmental regulations and sustainability goals, these coatings are becoming a preferred choice across packaging applications.

Another key development is the increased adoption of smart and functional coatings, such as antimicrobial, oxygen barrier, and moisture-resistant solutions. These coatings enhance product protection by preventing bacterial growth, preserving food freshness, and shielding items from humidity and spoilage.

Industries such as food, pharmaceuticals, and e-commerce are increasingly relying on these advanced coatings to ensure extended shelf life and improved packaging performance, fueling market expansion.

- For instance, in July 2024, AkzoNobel introduced the Securshield 500 series, a next-generation range of metal packaging coatings that are free of bisphenols and PVC. Designed for easy open end coatings, it improves performance over traditional organosol-based alternatives while ensuring compliance with current and future regulations.

Packaging Coatings Market Report Snapshot

|

Segmentation |

Details |

|

By Resin Type |

Epoxy, Polyester, Acrylic, Polyurethane, Vinyl, Alkyd, Others |

|

By Substrate |

Metal, Plastic, Glass, Paperboard |

|

By Coating Type |

Water-Based, Solvent-Based, UV-Cured |

|

By Application |

Food & Beverage Packaging, Pharmaceutical Packaging, Personal Care & Cosmetic Packaging, Industrial Packaging, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Resin Type (Epoxy, Polyester, Acrylic, Polyurethane, and Vinyl, Alkyd, and Others): The polyester segment earned USD 1,711.1 million in 2023, primarily due to its excellent flexibility, chemical resistance, and widespread use in food and beverage packaging.

- By Substrate (Metal, Plastic, Glass, and Paperboard): The metal segment held a share of 41.17% in 2023, largely attributed to its high durability, superior barrier properties, and extensive use in beverage cans and food containers.

- By Coating Type (Water-Based, Solvent-Based, and UV-Cured): The water-based segment is projected to reach USD 3,829.5 million by 2031, as a result of its low VOC emissions, environmental compliance, and growing use in sustainable packaging solutions.

- By Application (Food & Beverage Packaging, Pharmaceutical Packaging, Personal Care & Cosmetic Packaging, Industrial Packaging, and Others): The food & beverage packaging segment is anticipated to generate a revenue of USD 4,061.6 million by 2031, propelled by increasing demand for safe, long-lasting, and regulatory-compliant packaging coatings.

Packaging Coatings Market Regional Analysis

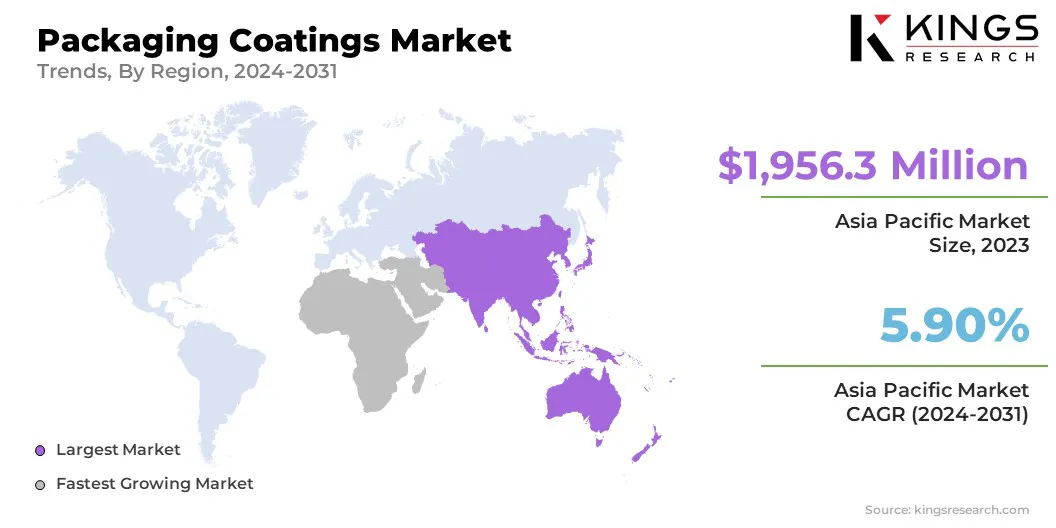

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific packaging coatings market accounted for a substantial share of 40.12% in 2023, valued at USD 1,956.3 million. This growth is reinforced by rapid industrialization, expanding food and beverage sectors, and increasing demand for sustainable packaging solutions.

The region’s dominance is attributed to the strong presence of manufacturing hubs in China, India, and Japan, where rising disposable incomes and urbanization are highlighting the rising need for high-performance packaging materials.

Additionally, stringent regulations on food safety and environmental sustainability are prompting manufacturers to adopt eco-friendly and BPA-free coatings, thereby fostering regional market growth.

The Middle East & Africa packaging coatings industry is expected to register the fastest growth at a CAGR of 6.02% over the forecast period. The expansion is fueled by increasing industrialization, a growing consumer base, and rising investments in food and beverage packaging.

Countries such as the UAE, Saudi Arabia, and South Africa are witnessing a surge in demand for packaged food and pharmaceutical products, boosting the need for high-performance protective coatings. Additionally, government initiatives promoting sustainable and eco-friendly packaging solutions, coupled with the expansion of retail and logistics sectors, are contributing to domestic market growth.

As packaging standards become more stringent and awareness of food safety regulations rises, the adoption of advanced packaging coatings in the Middle East & Africa is expected to increase significantly.

- In June 2024, Azelis acquired 100% of the shares of CPS Chemicals (Coatings) Pty Ltd. The acquisition strengthens Azelis’ presence in South Africa, enhancing its lateral value chain in the Coatings, Adhesives, Sealants, and Elastomers (CASE) segment and supporting growth in the broader EMEA region.

Regulatory Frameworks:

- In the U.S., the Food and Drug Administration (FDA) regulates packaging coatings. The FDA's regulations cover the safety of substances that come into contact with food, including packaging materials.

- In Europe, the European Chemicals Agency (ECHA) oversees the safety of packaging coatings under the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulation, ensuring that chemicals used in coatings do not pose risks to human health and the environment. Additionally, the European Food Safety Authority (EFSA) assesses the safety of food-contact coatings

- In China, the National Medical Products Administration (NMPA) and the State Administration for Market Regulation (SAMR) regulate packaging coatings in China, ensuring compliance with national standards. Environmental regulations enforced by the Ministry of Ecology and Environment (MEE) also control VOC emissions and chemical safety in coatings production.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) oversees food-contact packaging coatings under the Food Sanitation Act, ensuring that coatings meet safety and hygiene standards. Additionally, the Japan Environment Association (JEA) and Japan Industrial Standards (JIS) set guidelines for environmental sustainability, including VOC content limits and eco-friendly coating formulations.

- In India, the Food Safety and Standards Authority of India (FSSAI) regulate food-contact packaging coatings under the Food Safety and Standards (Packaging) Regulations to ensure safety. The Central Pollution Control Board (CPCB) enforces environmental regulations, including restrictions on VOC emissions and hazardous chemicals in packaging coatings, to promote sustainable manufacturing practices.

Competitive Landscape

The packaging coatings industry is characterized by a large number of participants, including both established corporations and emerging players. Key participants compete based on factors such as product innovation, sustainability, regulatory compliance, performance attributes, and cost-effectiveness.

The industry is witnessing a growing emphasis on eco-friendly coatings, such as water-based, BPA-free, and bio-based formulations, in response to stringent environmental regulations and increasing consumer demand for sustainable packaging.

Prominent companies are investing in research and development to introduce advanced coatings with enhanced barrier properties, improved adhesion, and resistance to chemicals and corrosion. The development of multifunctional coatings, including antimicrobial coatings and smart coatings, is further intensifying competition, as companies strive to differentiate their offerings and cater to evolving industry requirements.

- In October 2024, Henkel Adhesive Technologies collaborated with Panverta CPP to develop an innovative packaging solution that improves oxygen barrier performance while reducing material usage. The partnership introduced advanced metallized cast polypropylene and aluminum oxide-coated films, enabling a shift from multi-material packaging to recyclable mono-material polypropylene solutions.

List of Key Companies in Packaging Coatings Market:

- The Sherwin-Williams Company

- PPG Industries, Inc.

- Akzo Nobel N.V.

- Axalta Coating Systems, LLC

- BASF

- Arkema Group

- Jotun A/S

- Nippon Paint Holdings Co., Ltd.

- Asian Paints

- DIC CORPORATION

- RAG-Stiftung

- Henkel AG & Co. KGaA

- U. K. Paints India Private Limited

- ALTANA AG

- B.C. Jindal Group

Recent Developments (Acquisitions/New Product Launch)

- In December 2024, Arkema acquired Dow’s flexible packaging laminating adhesives business, significantly expanding its portfolio in the flexible packaging market. Dow’s laminating adhesives business provides high-quality solutions for food, medical, and industrial applications, with operations across five production sites in North America and Europe.

- In August 2024, Stahl strengthened its packaging coatings business by acquiring WEILBURGER Graphics GmbH, a German-based manufacturer of water-based and energy-cured coatings. The acquisition, part of Stahl’s strategy to expand its franchise for flexible materials, enhances its global presence in packaging coatings.

- In June 2024, Constantia Flexibles launched EcoTwistPaper, a sustainable packaging and coatings solution for confectionery, offering a fully recyclable, wax-free paper twist-wrap for candy and chocolate.

- In March 2024, Archroma introduced Cartaseal OGB F10, a PFAS-free barrier coating for packaging, setting a new standard in oil and grease resistance. This innovative solution enhances sustainability while maintaining high performance, helping businesses meet evolving consumer and regulatory demands.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)