Machinery Equipment-Construction

Packaging Machinery Market

Packaging Machinery Market Size, Share, Growth & Industry Analysis, By Machine Type (Filling, Labeling, Form Fill & Seal, Cartoning, Wrapping Palletizing, Others), By Application (Food & Beverages, Chemicals, Personal Care, Pharmaceuticals, Others), and Regional Analysis, 2024 - 2031

Pages : 140

Base Year : 2023

Release : January 2025

Report ID: KR1273

Market Definition

The packaging machinery industry encompasses equipment and technology used for automating and enhancing packaging processes across various industries. This includes machines for filling, sealing, labeling, and wrapping products in sectors such as food, pharmaceuticals, and consumer goods. The market is driven by the rising demand for efficiency, automation, and sustainable packaging solutions.

Packaging Machinery Market Overview

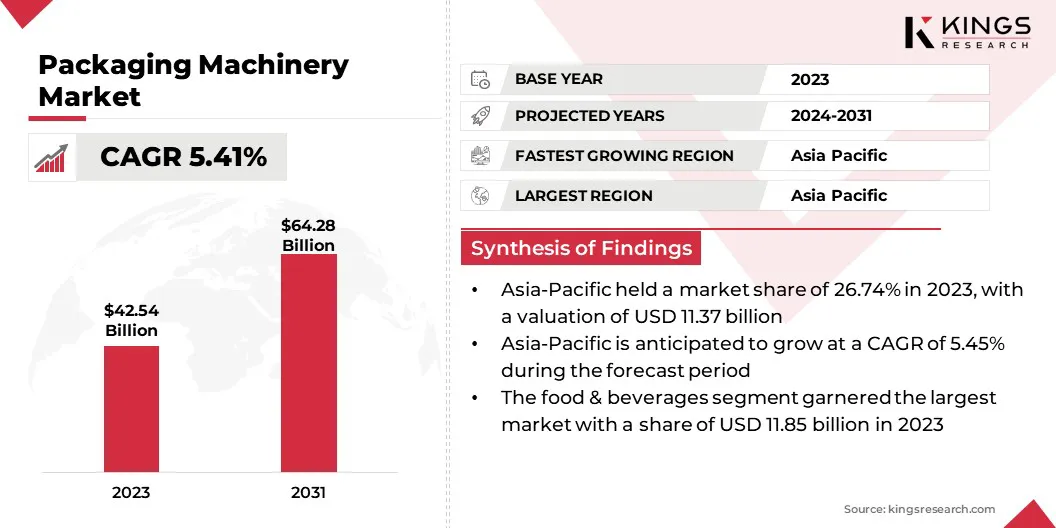

The global packaging machinery market size was valued at USD 42.54 billion in 2023 and is projected to grow from USD 44.45 billion in 2024 to USD 64.28 billion by 2031, exhibiting a CAGR of 5.41% during the forecast period.

The global market is driven by the increasing demand for automation, technological advancements such as AI integration, rising consumer demand for packaged goods, and a shift toward sustainable and eco-friendly packaging solutions across various industries.

Major companies operating in the packaging machinery market are KHS GmbH, SIG, Tetra Pak International S.A., Marchesini Group S.p.A., Syntegon Technology GmbH, GEA Group Aktiengesellschaft, SACMI IMOLA S.C., Langley Holdings plc, Douglas Machine Inc., Coesia S.p.A., MAILLIS GROUP, Duravant., Nichrome Packaging Solutions, MULTIVAC Sepp Haggenmüller SE & Co. KG, and Sealed Air.

- In February 2024, ALPS HOLDING S.P.A. MANAGEMENT AND COORDINATION (I.M.A.) announced the introduction of IMA Sandbox and IMA AlgoMarket, which accelerates its digital transformation in packaging machinery and leverages AI to enhance service efficiency, automation, and innovation. These solutions reflect IMA’s commitment to driving technological advancements and improving packaging processes across multiple industries.

Key Highlights:

- The packaging machinery industry size was valued at USD 42.54 billion in 2023.

- The market is projected to grow at a CAGR of 5.41% from 2024 to 2031.

- North America held a market share of 22.85% in 2023, with a valuation of USD 9.72 billion.

- The filling segment garnered USD 9.28 billion in revenue in 2023.

- The chemicals segment is expected to reach USD 15.83 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 5.45% over the forecast period.

Market Driver

"Rising Demand for Automation and Customized Packaging"

The packaging machinery market is primarily driven by the increasing demand for automation, which improves operational efficiency and reduces labor costs. As industries face growing competition, automation aids companies to meet production targets faster while maintaining high quality.

The growing demand and consumption of packaged goods, especially in food, beverages, and pharmaceuticals, is another major driver accelerating the market, as these sectors heavily depend on efficient packaging solutions for mass production and distribution. The demand for more customized packaging to cater to changing consumer preferences is also aiding the market growth.

- In September 2024, Premier Tech announced the launch of its TOMA product line, aimed at transforming packaging automation. The new line accelerates packaging automation projects by offering a comprehensive and intuitive do-it-yourself (DIY) experience, providing businesses with efficient, user-friendly solutions to streamline packaging processes in industries.

Market Challenge

"Strict Regulatory Standards and Heavy Investments"

Major factors affecting the packaging machinery market include the increasing shift to greener and more sustainable packaging solutions without compromising on high efficiency and cost-effectiveness. In addition, the adoption of higher technologies like AI and IoT demands heavy investment in infrastructure and skilled labor, which may be inaccessible to certain manufacturers.

Moreover, the constant need for accommodating changing regulatory standards and consumer preferences further adds to the complexities in the development and customization of packaging machinery.

Market Trend

"Flexible Packaging and Digital Integration"

The packaging machinery industry is evolving with a shift to advanced packaging formats such as flexible and smart packaging, which provide increased convenience, sustainability, and enhanced product protection.

The rise of e-commerce drives the demand for packaging solutions that support smaller batch sizes, faster production cycles, and minimalistic yet protective packaging.

Additionally, Industry 4.0 trends are influencing the market, with manufacturers integrating digital technologies for real-time data exchange, predictive maintenance, and improved supply chain visibility. The focus on adaptable machinery capable of handling diverse materials is growing, aligning with sustainability goals and evolving consumer preferences.

- For instance, in February 2023, Volpak launched the new Enflex PHS Series, which focuses on developing flexible packaging, specifically stick-pack formats, for the healthcare and pharmaceutical industries. The Enflex PHS Series is offered in multiple-lane configurations and is tailored to particular customer requirements.

Packaging Machinery Market Report Snapshot

| Segmentation | Details |

| By Machine Type | Filling, Labeling, Form Fill & Seal, Cartoning, Wrapping, Palletizing, Others |

| By Application | Food & Beverages, Chemicals, Personal Care, Pharmaceuticals, Others |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Machine Type (Filling, Labeling, Form Fill & Seal, Cartoning, Wrapping, Palletizing, Others): The filling segment earned USD 9.28 billion in 2023, due to its widespread application in various industries, particularly in food, beverage, and pharmaceuticals, where accurate and high-speed filling is crucial for efficient production and product integrity.

- By Application (Food & Beverages, Chemicals, Personal Care, Pharmaceuticals, Others): The food & beverages segment held 27.85% share of the marketin 2023, due to the consistent demand for packaged food & beverages, along with a growing preference for convenient, ready-to-eat, and sustainably packaged products among consumers, driving innovation and expansion in packaging machinery.

Packaging Machinery Market Regional Analysis

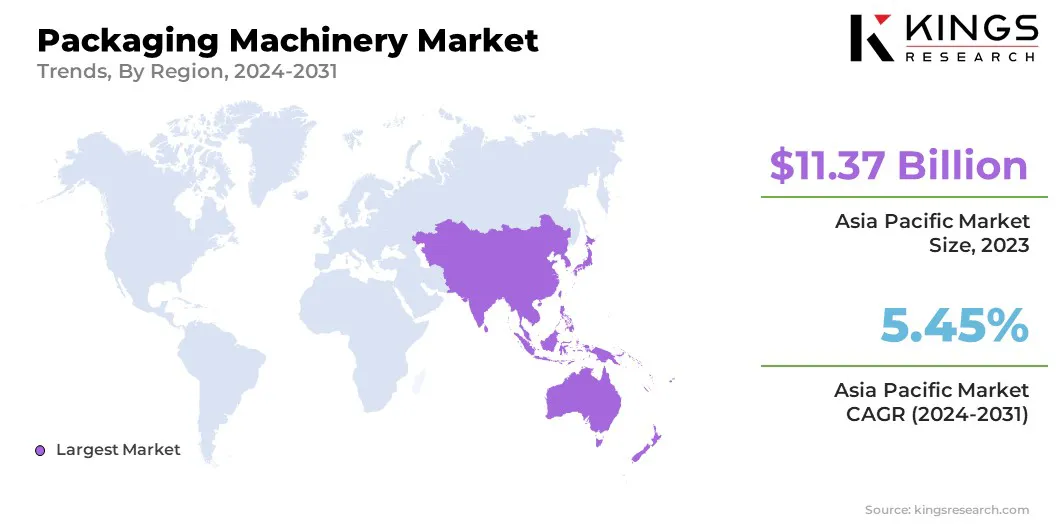

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for around 26.74% share of the packaging machinery market in 2023, with a valuation of USD 11.37 billion and is anticipated to register the fastest growth, at a projected CAGR of 5.45%.

This growth is driven by factors such as rapid industrialization, increasing demand for packaged goods, expanding e-commerce, and a growing focus on automation and advanced packaging solutions in key industries like food, beverages, and pharmaceuticals.

Additionally, the region benefits from a large manufacturing base, cost-effective production capabilities, and favorable government policies supporting infrastructure development.

- In January 2025, Siegwerk introduced an NC-free toolbox consolidating its nitrocellulose-free ink solutions for flexible packaging. This comprehensive portfolio includes lamination and surface application solutions for gravure and flexo printing. Targeting the EMEA region, it empowers customers and brands to achieve recyclable flexible packaging across diverse segments, combining new innovations with Siegwerk's proven NC-free technologies.

The market in Europe is poised for significant growth at a robust CAGR of 5.44% over the forecast period. This is attributed to the strong demand for innovative and sustainable packaging solutions, particularly in the food & beverage, pharmaceutical, and consumer goods industries.

Furthermore, Europe's focus on environmental regulations and sustainability is driving the adoption of eco-friendly packaging technologies, contributing to the market expansion.

- For instance, in May 2024, Amcor strengthened its global packaging innovation network with the launch of the Amcor Innovation Center Europe (AICE) in Ghent, Belgium. Complementing hubs in the U.S., South America, and Asia Pacific, AICE will drive advancements in sustainable materials, enhance packaging performance, and deliver consumer-centric designs. This investment underscores Amcor’s commitment to circular, innovative packaging solutions.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the Occupational Safety and Health Administration (OSHA) ensures that packaging machinery meets workplace safety standards, while the FDA regulates machinery used in food, beverage, and pharmaceutical packaging, focusing on safety, labeling, and materials in contact with consumables.

- In Europe, the European Commission (EC) sets policies for packaging machinery, while the EU Packaging and Packaging Waste Directive promotes sustainability. The CE Marking certifies compliance with health, safety, and environmental standards, supported by ISO and EN standards for quality and safety.

- In Japan, the packaging machinery industry is regulated by several key organizations to ensure safety, quality, and environmental compliance. The Ministry of Economy, Trade and Industry (METI) oversees industrial standards and ensures that machinery meets safety and performance requirements. The Japan Industrial Standards Committee (JISC) develops and implements national standards for packaging machinery, covering design, safety, and operational performance.

Competitive Landscape:

The packaging machinery market is characterized by a wide range of participants, including both established players and emerging companies. Organizations are adopting various strategic initiatives aimed at strengthening their market position and driving growth to stay competitive in this rapidly evolving market.

Key strategies include the development and launch of innovative packaging solutions, forming strategic partnerships and collaborations with industry leaders, expanding into new geographic regions, and pursuing mergers and acquisitions to enhance capabilities, broaden product offerings, and achieve economies of scale.

- For instance, in March 2024, Ishida Europe Limited expanded its footprint in the African market by acquiring National Packaging Systems (NPS). This acquisition merges Ishida’s global expertise with NPS’s local market knowledge, facilitating the development of integrated weighing, packing, and quality control systems. The partnership enhances the delivery of advanced packaging solutions and technical expertise, specifically tailored to meet the diverse needs of industries such as grains, pulses, and granular products across the region.

List of Key Companies in Packaging Machinery Market:

- KHS GmbH

- SIG

- Tetra Pak International S.A.

- Marchesini Group S.p.A.

- Syntegon Technology GmbH

- GEA Group Aktiengesellschaft

- SACMI IMOLA S.C.

- Langley Holdings plc

- Douglas Machine Inc.

- Coesia S.p.A.

- MAILLIS GROUP

- Duravant.

- Nichrome Packaging Solutions

- MULTIVAC Sepp Haggenmüller SE & Co. KG

- Sealed Air

- Others

Recent Developments:

- In October 2024, ProMach Inc. announced the acquisition of HMC Products, a prominent manufacturer and service provider of horizontal form fill seal (HFFS) machines. This acquisition, ProMach’s fourth of the year, significantly enhances its flexible packaging solutions portfolio, further strengthening its position in the global market.

- In August 2024, Duravant LLC acquired T-TEK Material Handling LLC which specializes in innovative palletizers, depalletizers, conveyors, and automated systems for blue-chip packaged food, beverage, and consumer goods producers.

- In May 2024, ATS Corporation announced a definitive deal to buy Paxiom Group, a provider of the primary, secondary, and end-of-line packaging machinery for the food & beverage and pharmaceutical industries. The acquisition is consistent with ATS's objective of expanding its footprint in regulated markets, leveraging Paxiom's strong reputation and advanced solutions to provide growth prospects and improve profit profiles in both organic and synergistic areas.

- In January 2023, Massman Companies announced the acquisition of Ultra Packaging Inc. (UPI). This acquisition expands Massman’s portfolio by adding UPI’s cartoning products, enabling the company to offer comprehensive full-line solutions from carton or bottle to pallet. The integration of UPI’s offerings simplifies the design, layout, purchase, service, and warranty processes for customers seeking connected packaging equipment.

- In November 2024, Amcor plc entered into a definitive merger agreement. This merger aims to position the combined company as a global leader in consumer and healthcare packaging machinery solutions, focusing on flexible films, containers, and closures. By leveraging its expanded scale, the new company will enhance its capabilities in high-growth sectors such as healthcare, protein, pet food, and beauty products, while prioritizing sustainability and delivering increased value to shareholders.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)