Healthcare Medical Devices Biotechnology

Patient Engagement Solutions Market

Patient Engagement Solutions Market Size, Share, Growth & Industry Analysis, By Component (Hardware, Software, Services), By Application (Social Management, Health Management, Others), By Therapeutic area (Chronic diseases, Womens Health, Others), By Delivery Model, By End User, and Regional Analysis, 2024-2031

Pages : 230

Base Year : 2023

Release : January 2025

Report ID: KR1258

Market Definition

Patient engagement solutions (PES) refers to a set of tools, technologies, and strategies designed to encourage and facilitate active participation by patients in their healthcare.

These solutions aim to improve communication between patients and healthcare providers, enhance patient knowledge about their conditions, and promote healthier behaviours, ultimately leading to better health outcomes.

Patient Engagement Solutions Market Overview

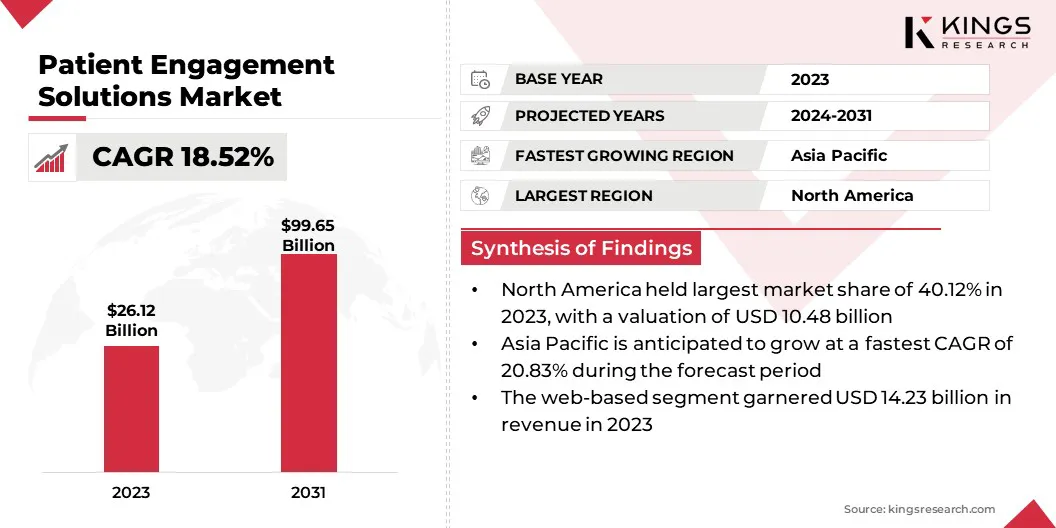

The global patient engagement solutions market size was valued at USD 26.12 billion in 2023 and is projected to grow from USD 30.34 billion in 2024 to USD 99.65 billion by 2031, exhibiting a CAGR of 18.52% during the forecast period.

The market is registering rapid growth, driven by various factors including the increasing emphasis on patient-centered care, technological advancements, and the need for healthcare systems to improve outcomes while managing costs.

PES aims to improve communication between patients and healthcare providers, encourage self-management of health, and enhance the overall patient experience.

Major companies operating in the patient engagement solutions market are Oracle, Veradigm LLC, Tebra Technologies, Inc, MCKESSON CORPORATION, Medical Information Technology, Inc., Koninklijke Philips N.V., Epic Systems Corporation, athenahealth, Inc., CureMD Healthcare, GetWellNetwork, Inc., Lincor Inc., eClinicalWorks, N. Harris Computer Corporation (MEDHOST), Health Care Service Corporation (Medecision), and Health Catalyst.

The demand for solutions that help manage chronic conditions, promote healthier lifestyles, and improve patient education is growing as the healthcare industry shifts its focus from reactive to preventative care.

Chronic diseases like diabetes and cardiovascular diseases are on the rise, and PES tools are increasingly being used to support continuous care and disease management. By improving patient engagement, healthcare organizations can reduce readmissions, lower costs, and improve treatment adherence.

- In October 2024, Oracle Health launched its second-generation Clinical AI Agent, leveraging generative AI to automate clinical workflows, improve documentation, and enhance patient-provider interactions. Integrated with electronic health records (EHR), it provides quick access to patient data, generates draft notes, and automates tasks like coding and follow-ups. The solution, running on Oracle Cloud Infrastructure, aims to reduce clinician burnout and improve patient care.

Key Highlights:

- The global patient engagement solutions market size was recorded at USD 26.12 billion in 2023.

- The market is projected to grow at a CAGR of 18.52% from 2024 to 2031.

- North America held a market share of 40.12% in 2023, with a valuation of USD 10.48 billion.

- The hardware component segment garnered USD 9.43 billion in revenue in 2023.

- The health management segment is expected to reach USD 18.44 billion by 2031.

- The chronic diseases segment is expected to reach USD 42.42 billion by 2031.

- The web-based segment is expected to reach USD 59.36 billion by 2031.

- The providers segment is expected to reach USD 63.75 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 20.83% during the forecast period.

Market Driver

"Real-time Data Analytics and Integration of AI"

Real-time data integration from diverse sources such as wearable devices, mobile apps, and EHRs enables healthcare providers to gain actionable insights, fostering more personalized and timely patient care.

Additionally, the widespread adoption of health tools like patient portals and telemedicine platforms enhances communication between patients and providers, improving engagement and adherence to care plans.

AI’s predictive capabilities further drive the market by analyzing vast amounts of data to forecast health outcomes, enabling proactive interventions that enhance patient outcomes while optimizing operational efficiency. Together, these innovations are reshaping patient engagement, enhancing both the quality of care and overall healthcare delivery.

- For instance, in November 2024, ModMed launched ModMed Scribe, an AI-driven ambient listening solution. This technology helps specialty-specific providers capture clinical information in real-time, automating tasks like visit notes, patient education, and prescription management. ModMed is committed to responsible AI practices and plans to expand its AI capabilities across its platform, with future innovations focused on improving patient engagement, practice management, and operational efficiency.

Market Challenge

"Fragmented Patient Data and Low Digital Literacy Among Patients"

A significant challenge in the Patient Engagement Solutions market is the fragmentation of patient data across various systems, leading to data silos.

This fragmentation makes it difficult for healthcare providers to access a comprehensive view of a patient's health, hindering personalized care and reducing patient engagement.

To address this, healthcare organizations can implement interoperable health IT systems that facilitate seamless data exchange across platforms, adopt FHIR (Fast Healthcare Interoperability Resources) standards to ensure compatibility, and leverage cloud-based integrated data platforms for centralized access.

- For instance, in November 2022, Twilio launched Twilio Segment for Healthcare & Life Sciences, a HIPAA-eligible customer data platform designed to break down data silos and improve patient engagement & health outcomes. By integrating offline and online Protected Health Information (PHI) data, the platform enables healthcare organizations to deliver personalized, proactive care.

Additionally, patients are experiencing engagement fatigue due to the overwhelming influx of reminders, notifications, and digital communications, which leads to disengagement and lower adherence to care plans. The issue is exacerbated by the growing number of apps and platforms, making consistent interaction with healthcare services more challenging.

Furthermore, low digital literacy, particularly among older adults and underserved populations, limits the ability of patients to effectively use digital health tools, preventing them from accessing crucial healthcare information.

A solution is to include user-friendly interfaces, multilingual support, digital literacy programs, and human-assisted navigation options to enhance accessibility for older adults and underserved populations.

Market Trend

"Adoption of Voice Health Assistants and Multidimensional Engagement Strategies"

Significant trends in the patient engagement solutions market are integration of blockchain technology to enhance data security. Blockchain’s decentralized and immutable nature provides a secure, transparent way to store and share sensitive patient information, ensuring compliance with privacy regulations like HIPAA and boosting patient trust.

Another notable trend is the adoption of voice-activated health assistants, which leverage AI to facilitate natural language interactions between patients and healthcare systems. These assistants simplify access to services such as appointment scheduling, medication management, and answering health-related queries, improving accessibility and patient experience, especially for those with disabilities.

- For instance, in August 2024, SoundHound AI announced that MUSC Health deployed its Amelia Patient Engagement solution. The AI agent, Emily, integrated with Epic, offers 24/7 personalized self-service for managing appointments and non-clinical queries, aiming to enhance patient satisfaction and efficiency by reducing call volumes and wait times. The Amelia platform automates tasks like scheduling, pre-registration, and medication refill.

Additionally, there is a growing emphasis on cross-platform, multidimensional engagement strategies, where healthcare providers leverage multiple communication channels, including mobile apps, web portals, and text messages, to engage with patients. This approach ensures seamless, personalized interactions, enhancing patient satisfaction, care coordination, and overall healthcare outcomes.

Patient Engagement Solutions Market Report Snapshot

| Segmentation | Details |

| By Component | Hardware, Software, Services |

| By Application | Social Management, Health Management, Home Healthcare Management, Financial Health Management |

| By Therapeutic area | Chronic diseases(Diabetes, Cardiovascular diseases, Obesity), Women’s Health, Mental Health, Fitness, Others |

| By Delivery Model | Web-based, Cloud-based, On-premises |

| By End User | Payers, Providers, Patients |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Component (Hardware, Software, and Services): The hardware segment earned USD 9.43 billion in 2023, due to the growing demand for advanced medical devices, healthcare solutions, and telemedicine technologies.

- By Application (Social Management, Health Management, Home Healthcare Management, and Financial Health Management): The home healthcare management segment held 23.08% share of the market in 2023, due to the increasing demand for remote patient monitoring and the growing preference for in-home care over hospital visits.

- By Therapeutic area (Chronic diseases, Women’s Health, Mental Health, and Fitness): The chronic diseases segment is projected to reach USD 42.42 billion by 2031, owing to the rising global prevalence of chronic conditions and an aging population.

- By Delivery Model (Web-based, Cloud-based, and On-premises): The web-based segment is projected to reach USD 59.36 billion by 2031, owing to the growing adoption of digital healthcare solutions, increasing internet penetration, and the rising demand for accessible and convenient patient engagement platforms.

- By End User (Payers, Providers, and Patients): The providers segment is projected to reach USD 63.75 billion by 2031, owing to the increasing need for healthcare organizations to improve patient outcomes and enhance operational efficiency.

Patient Engagement Solutions Market Regional Analysis

North America accounted for a substantial patient engagement solutions market share of 40.12% and was valued at USD 10.48 billion in 2023. This growth is driven by the increasing adoption of digital health technologies, government initiatives promoting healthcare digitization, and the rising demand for efficient healthcare management systems.

With the region’s strong healthcare infrastructure and high healthcare expenditure, North America is expected to continue leading the market, with advancements in EHRs and telehealth solutions further driving the expansion. The integration of AI and ML in patient engagement platforms is also contributing to enhancing patient care and operational efficiencies.

- In March 2024, the North West London Integrated Care System (ICS) partnered with Oracle Health to implement a shared EHR across 12 acute care facilities, covering 2.4 million patients. This collaboration, the first of its kind among four NHS Trusts, aims to improve care coordination, reduce administrative tasks, and enhance clinical decision-making, ultimately leading to better patient outcomes.

Asia Pacific is expected to register the fastest growth in the patient engagement solutions market, with a projected CAGR of 20.83%. This significant growth is primarily driven by the expanding healthcare infrastructure, increasing adoption of digital health technologies, and rising demand for improved healthcare delivery systems in emerging economies.

Countries such as China, India, and Japan are investing heavily in healthcare digitization to address the growing patient population and improve care management. The region’s diverse healthcare needs, coupled with the increasing focus on chronic disease management, are boosting the demand for patient engagement solutions.

Additionally, government support for telemedicine and mobile health applications is expected to further fuel the market, making Asia Pacific a key area for innovation and expansion in patient engagement solutions.

- In October 2024, Flatiron Health and Lifebit Biotech expanded their collaboration into Japan, integrating Lifebit's Trusted Research Environment (TRE) technology with Flatiron's oncology data. These partnerships allow researchers to securely access and analyze real-world cancer data, focusing on gastric, colorectal, and breast cancer, to accelerate research and improve treatments.

Region’s Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the FDA is the primary regulatory authority that governs patient engagement solutions in North America. The FDA promotes patient engagement through initiatives like the Patient Engagement Collaborative (PEC).

- The European Medicines Agency (EMA) is the regulatory authority in the European Union (EU) that governs patient engagement in medicines. The EMA works with the FDA through the FDA/EMA Patient Engagement Cluster to share best practices.

- In APAC, the National Medical Products Administration (NMPA) and the National Health Commission (NHC) are the main regulatory authorities that govern patient engagement solutions in China.

- In India, the Ministry of Health and Family Welfare (MoHFW) is the primary legislative body that governs patient engagement solutions. The MoHFW is responsible for creating health policies, and other government bodies implement these policies.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) and the Ministry of Health, Labour, and Welfare (MHLW) are the primary regulatory authorities in Japan that govern medical devices and pharmaceuticals.

- On the international stage, the WHO provides global governance frameworks and recommendations for digital health technologies, including patient engagement solutions. It offers guidance on best practices, ethical concerns, and international cooperation in the development and use of such solutions, particularly around privacy, security, and equity in healthcare access.

Competitive Landscape:

The patient engagement solutions market is characterized by a large number of participants, including both established corporations and rising organizations. AI-powered solutions are becoming a central focus of the patient engagement market. Key players leverage AI to create personalized experiences for patients, offering health monitoring, real-time support, and data analytics.

These solutions use ML to provide tailored health recommendations that enhance patient compliance and boost satisfaction levels, which is increasingly important as healthcare providers look to improve patient outcomes.

Strategic partnerships play a pivotal role in shaping the competitive landscape for patient engagement solutions. These alliances enable companies to enhance their capabilities, expand their reach, and offer integrated solutions that address the growing demand for more personalized, efficient, and data-driven care.

- For instance, in April 2024, Greenway Health and Nabla announced a strategic partnership to launch Greenway Clinical Assist, an AI-powered solution designed to reduce provider burnout by streamlining clinical documentation. The integration of Nabla’s AI assistant with Greenway’s EHR solutions helps providers save up to two hours daily by quickly generating structured clinical notes.

List of Key Companies in Patient Engagement Solutions Market:

- Oracle

- Veradigm LLC

- Tebra Technologies, Inc

- MCKESSON CORPORATION

- Medical Information Technology, Inc.

- Koninklijke Philips N.V.,

- Epic Systems Corporation.

- athenahealth, Inc.

- CureMD Healthcare

- GetWellNetwork, Inc.

- Lincor Inc.

- eClinicalWorks

- Harris Computer Corporation (MEDHOST)

- Health Care Service Corporation (Medecision)

- Health Catalyst

Recent Developments:

- In January 2025, Swoop acquired MyHealthTeam, to enhance its AI-driven healthcare marketing. This acquisition expands Swoop’s ability to provide privacy-compliant, condition-specific patient engagement across 62+ communities. By integrating MyHealthTeam's patient data with Swoop's AI and claims data, the partnership aims to improve patient outcomes and refine marketing strategies for pharmaceutical brands, creating deeper connections between patients, healthcare providers, and brands.

- In October 2024, Oracle Health launched two cloud applications: Oracle Health Patient Portal and Oracle Health Patient Administration. These solutions empower patients to manage their healthcare with self-service tools, while reducing administrative tasks for providers by automating scheduling and intake processes. Powered by Oracle Cloud Infrastructure, they aim to enhance patient engagement and improve operational efficiency.

- On October 31, 2024, athenahealth launched athenaOne for Orthopedics, a specialized EHR, practice management solution for orthopedic practices. The platform offers features such as ambient listening for easy documentation, mobile access for on-the-go use, and optimized billing workflows to improve financial performance. Additionally, athenahealth provides dedicated customer support teams with expertise in orthopedics, ensuring tailored assistance for practices.

- In September 2024, CureAlign launched the Carengage workflow solution to enhance care coordination and patient outreach within value-based programs. Carengage provides risk-bearing providers with tools to address individual patient needs, supporting success in evolving payment models. The CureAlign platform also aids in program design, contract modeling, and managing hierarchical relationships necessary for risk-bearing contracts.

- In August 2024, Epilog Health launched Cyngular, an AI-based patient engagement and retention solution designed to improve patient monitoring and capture health data. The platform provides easy, secure access for patients via PC, Mac, and smartphones, with no specific monitoring devices required.

- In February 2024, WebMD Health Corp. acquired Healthwise, Incorporated’s operating assets to enhance WebMD Ignite, its healthcare growth and engagement division. The acquisition strengthens WebMD Ignite’s patient and member engagement solutions by integrating Healthwise’s health content, technology, and client relationships, serving over 650 healthcare organizations.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)