Consumer Goods

Plastic Contract Manufacturing Market

Plastic Contract Manufacturing Market Size, Share, Growth & Industry Analysis, By Product Type (Polypropylene, Acrylonitrile Butadiene Styrene (ABS), Polyethylene, Polystyrene, Others), By Application (Medical, Aerospace & defense, Automotive, Consumer Goods and appliances, Others), and Regional Analysis, 2024-2031

Pages : 170

Base Year : 2023

Release : January 2025

Report ID: KR1233

Market Definition

Plastic contract manufacturing includes the outsourcing of plastic manufacturing to specialized service providers, offering capabilities such as injection molding, extrusion, blow molding, and thermoforming. The plastic contract manufacturing market is experiencing growth due to the increasing use of plastics in household appliances, including polystyrene, polyethylene, polyurethane, and polypropylene.

Additionally, rising demand from industries such as automotive, consumer goods, healthcare, and packaging propels market growth due to the cost-effective and reliability of plastics.

Plastic Contract Manufacturing Market Overview

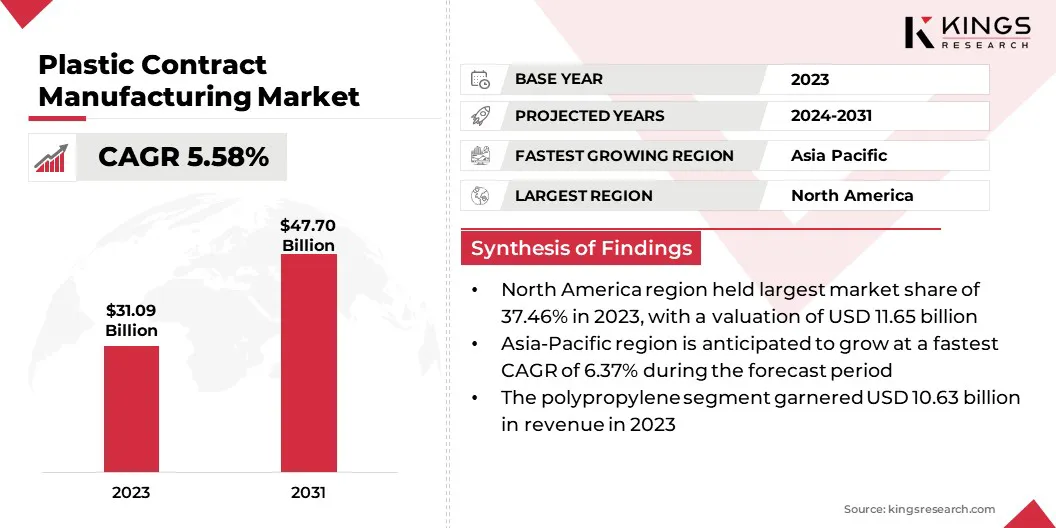

Global plastic contract manufacturing market size was valued at USD 31.09 billion in 2023 and is projected to grow from USD 32.61 billion in 2024 to USD 47.70 billion by 2031, exhibiting a CAGR of 5.58% during the forecast period. The market is witnessing significant growth, mainly fueled by the increasing demand for high-quality, cheaper plastic products across multiple industries.

The automotive, healthcare, consumer goods, and packaging sectors are key contributors to this demand, propelled by the rising need for durable and versatile plastic components.

Major companies operating in the global plastic contract manufacturing industry include Inteplast Group, Plastic Technologies Inc., C&J Industries, EVCO Plastics, RSP Inc., Mack., Vonco Products LLC (Genesis Plastics Welding), Baytech Plastics Inc., Gregstrom Corporation, Nolato AB (publ), Digital Silk., Rosti Group AB., Tessy Plastics, Plastikon Industries, Inc., McClarin Composites, and others.

Moreover, innovations in material technologies, such as bio-based plastics, biodegradable polymers, and advanced composites, are reshaping the market and creating new opportunities for sustainable production. Furthermore, regulatory constraints related to environmental sustainability are boosting the adoption of eco-friendly materials and production methods.

As manufacturers focus on improving operational performance, reducing costs, and enhancing efficiency, the plastic contract manufacturing market is evolving to meet the growing demand for reliable, high-quality, and sustainable plastic solutions across vaious industries.

Key Highlights:

- The global plastic contract manufacturing market size was recorded at USD 31.09 billion in 2023.

- The market is projected to grow at a CAGR of 5.58% from 2024 to 2031.

- North America held a share of 37.46% in 2023, valued at USD 11.65 billion.

- The polypropylene segment garnered USD 10.63 billion in revenue in 2023.

- The medical segment is expected to reach USD 14.32 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 6.37% through the forecast period.

Market Driver

"Technological Advancements and Growing Industry Demand"

The growth of the plastic contract manufacturing market is majorly driven by the increasing demand for high-performance, cheaper plastic solutions across different industries. The automotive sector further supports this growth, requiring lightweight, durable plastics for parts such as bumpers, dashboards, and interiors.

Moreover, the growing demand for plastic packaging in the consumer goods, food, and healthcare industries fuels the need for innovation and high-quality manufacturing.

Technological advancements such as the integration of automation, 3D printing, and Industry 4.0 technologies into manufacturing processes enhance production efficiency, scalability, and customization. These innovations enable manufacturers to meet diverse customer requirements, reduce production costs, and improve operational performance.

Additionally, stringent regulatory requirements related to product quality, safety, and environmental standards are driving the market toward more advanced and sustainable production methods.

- In August 2024, Parker Plastics, Inc. utilized the M4.0 grant, with guidance from Maryland MEP, to implement Industry 4.0 technologies, including a vision system and automated case packing, in its plastic bottle manufacturing process. These advancements optimize production efficiency, quality control, defect reduction, and capacity, ensuring competitive advantage and sustainability in the evolving plastics industry.

Market Challenge

"Raw Material Fluctuations and Regulatory Pressures"

The plastic contract manufacturing market faces challenges such as fluctuating raw material costs and supply chain disruptions. Volatility in the prices of polymers such as polyethylene and polypropylene affects production costs and profitability. Geopolitical factors and transportation delays hinder manufacturers' ability to meet demand promptly.

Additionally, stricter regulations on plastic waste management, recycling, and emissions compel manufacturers to invest in sustainable production methods, eco-friendly materials, and compliance with complex regulations.

To mitigate raw material fluctuations and regulatory pressures, manufacturers should diversify their supplier base, secure long-term contracts, and invest in recycling to reduce dependency on virgin materials. Strengthening supply chain resilience through local sourcing and robust inventory management is essential to navigate disruptions.

To comply with increasingly stringent regulations, companies must adopt sustainable production processes, utilize eco-friendly materials, and ensure adherence to waste management and emissions standards.

Market Trend

"Rising Shift Toward Sustainability"

The rising demand for eco-friendly materials and sustainability is a major trend in the plastic contract manufacturing market. This shift is particularly evident in the packaging, automotive, and consumer goods sectors, where sustainable plastic solutions are increasingly prioritized.

Biodegradable plastics, recycled polymers, and bio-based products are gaining traction as companies face increasing pressure to lessen their environmental impact.

- For instance, in June 2024, the Hansgrohe Group, in collaboration with ImpulsTec GmbH, introduced an innovative recycling process for galvanized plastics at its Offenburg facility. This process allows chrome-plated production waste to be transformed into reusable ABS plastic, effectively closing the material cycle and advancing sustainability efforts.

The increasing demand for personalized plastics products is emerging as a notable trend in the market. With consumers increasingly seeking tailored products, manufacturers are adopting flexible production techniques to meet specific customer needs.

This trend is particularly prominent in industries such as healthcare, electronics, and consumer goods, where personalized solutions cater to niche market. Advanced technologies such as 3D printing, rapid prototyping, and small-batch production are enabling plastic manufacturers to produce recyclable and highly customized components with faster turnaround times.

- For instance, In April, 2024 Filamentive Limited introduced a free recycling scheme for PLA 3D printing waste, addressing the significant environmental challenge of plastic waste in the industry. This initiative enables customers to recycle up to 400,000 kg of waste annually at no cost, promoting sustainability and reducing landfill impact.

Plastic Contract Manufacturing Market Report Snapshot

| Segmentation | Details |

| By Product Type | Polypropylene, Acrylonitrile Butadiene Styrene (ABS), Polyethylene, Polystyrene, Others |

| By Application | Medical, Aerospace & defense, Automotive, Consumer Goods and appliances, Others |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product Type (Polypropylene, Acrylonitrile Butadiene Styrene (ABS), Polyethylene, Polystyrene, and Others): The polypropylene segment earned USD 10.63 billion in 2023, mainly driven by the widespread use of these materials across industries such as automotive, packaging, and consumer goods.

- By Application (Medical, Aerospace & defense, Automotive, and Consumer Goods, and Appliances): The consumer goods and appliances segment held a notable share of 26.78% in 2023, attributed to the surging demand for durable, lightweight plastic components.

Plastic Contract Manufacturing Market Regional Analysis

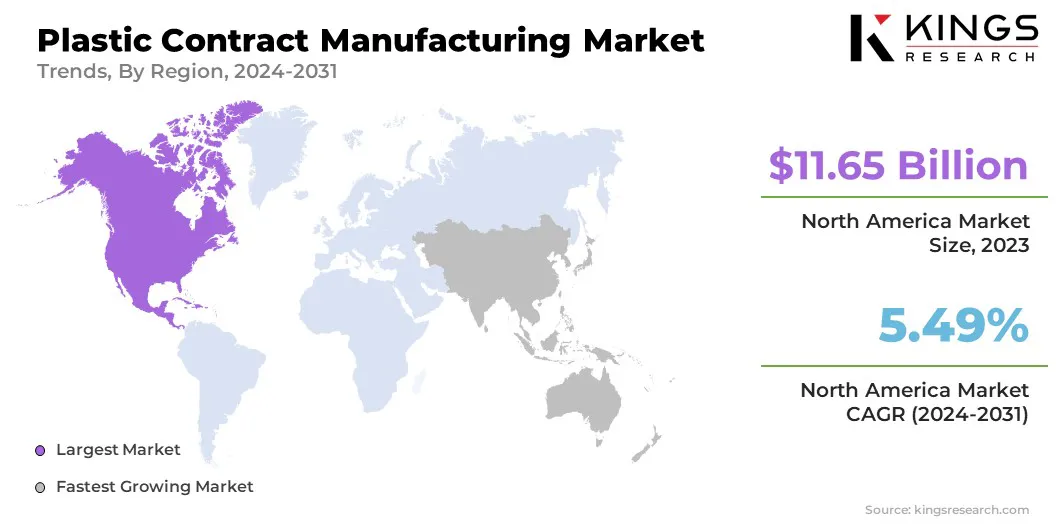

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America plastic contract manufacturing market accounted for a significant share of around 37.46% in 2023, valued at USD 11.65 billion. This dominance is reinforced by its robust manufacturing base, advanced technological infrastructure, and strict regulatory standards. This growth is further fueled by the rising demand for plastic components across the automotive, healthcare, and packaging industries.

Moreover, the expansion of the regional market is charatrized by its advanced manufacturing capabilities and strong demand from industries such as automotive, healthcare, and consumer goods. In the U.S. the advanced manufacturing infrastructure, coupled with high demand for durable and sustainable plastic solutions, boosts regional market expansion.

The Asia-Pacific plastic contract manufacturing market is anticipated to experience the fastest growth at a CAGR of 6.37% through the forecast period. Major countries such as China, India, and Japan are investing heavily in advanced manufacturing technologies, increasing their production capabilities, and addressing the rising demand for plastic components in sectors such as automotive, electronics, packaging, and consumer goods.

This expansion is further boosted by both domestic needs and export opportunities, establishing the region as a key hub for innovation and production in the global plastics industry. The region's rapid urbanization, growing middle-class population, and evolving consumer preferences for affordable plastic goods are further bolstering this expansion, solidifying the position of the Asia-Pacific market.

Each region’s regulatory framework also plays a significant role in shaping the market.

- The U.S. the Environmental Protection Agency (EPA) oversees manufacturing processes in the United States, enforcing environmental laws that impact sectors such as plastic production, with an emphasis on chemical safety, waste management, and emissions control.

- In Europe, the European Commission regulates plastics contract manufacturing, establishing and enforcing laws related to production, use, and disposal of plastics to ensure compliance with environmental and health standards.

- In APAC, China's National Development and Reform Commission (NDRC) sets policies and standards for plastic production, including restrictions on single-use plastics and promoting eco-design practices for plastic products.

Competitive Landscape

The global plastic contract manufacturing market is characterizedby a number of participants, including both established corporations and rising organizations. To gain a competitive edge in the evolving market, organizations are implementing various strategic initiatives.

Key strategies encompass new contract acquisitions, collaborations with key suppliers and manufacturers, expansion of production facilities, and mergers and acquisitions.

List of Key Companies in Plastic Contract Manufacturing Market:

- Inteplast Group

- Plastic Technologies Inc.

- C&J Industries

- EVCO Plastics

- RSP Inc.

- Mack.

- Vonco Products LLC (Genesis Plastics Welding)

- Baytech Plastics Inc.

- Gregstrom Corporation

- Nolato AB (publ)

- Digital Silk.

- Rosti Group AB.

- Tessy Plastics

- Plastikon Industries, Inc.

- McClarin Composites, and

- Others

Recent Developments

- In January 2025, PEXCO acquired Wisconsin Plastic Products, Inc., a leading supplier of custom extrusions based in Plymouth, WI. This acquisition enhances Pexco's capabilities in custom extrusion and strengthens its presence in the Midwest.

- In June 2024, DuPont completed the acquisition of Donatelle Plastics Incorporated, a leading contract manufacturer specializing in the design, development, and production of medical devices. This acquisition enhances DuPont's expertise in medical device injection molding, liquid silicone rubber processing, precision machining, device assembly, and tool manufacturing.

- In August 2024, Pexco LLC acquired Precise Aerospace Manufacturing, Inc, a provider of injection, compression, and transfer molded plastics, along with contract manufacturing. This acquisition boosts Pexco's capabilities in injection molding and material science.

- In May 2024, Ester Industries Ltd. and Loop Industries formed a joint venture agreement to produce lower carbon footprint recycled dimethyl terephthalate (rDMT) and recycled mono-ethylene glycol (rMEG) using advanced recycling technology, promoting sustainable material production.

- In November 2024, Viant acquired Knightsbridge Plastics Inc. Viant, expanding its capacity to manufacture specialized plastic injection-molded parts and complex micro-components for next-generation medical devices and advanced drug delivery systems.

- In September 2024, A.P. Moller introduced Vioneo, an initiative focused on manufacturing fossil-free plastic resins to reduce the carbon footprint of plastic production.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)