Advanced Materials and Chemicals

Polyurethane Market

Polyurethane Market Size, Share, Growth & Industry Analysis, By Product Type (Rigid Foam, Flexible Foam, Coatings, Elastomers, Adhesives & Sealants, other), By End-Use Industry (Construction, Automotive, Furniture, Footwear, Appliances & Electronics, others), and Regional Analysis, 2024-2031

Pages : 180

Base Year : 2023

Release : January 2025

Report ID: KR1279

Market Definition

Polyurethane (PU or PUR) is an organic polymer formed from organic units linked by urethane molecules, primarily classified as thermosetting polymers that do not melt upon heating.

The polyurethane industry involves a diverse range of plastic polymers that are durable, lightweight, and versatile, allowing for the creation of numerous consumer and industrial products across various applications. PU holds great promise for applications in furniture, automotive, construction, coatings, and textiles.

Polyurethane Market Overview

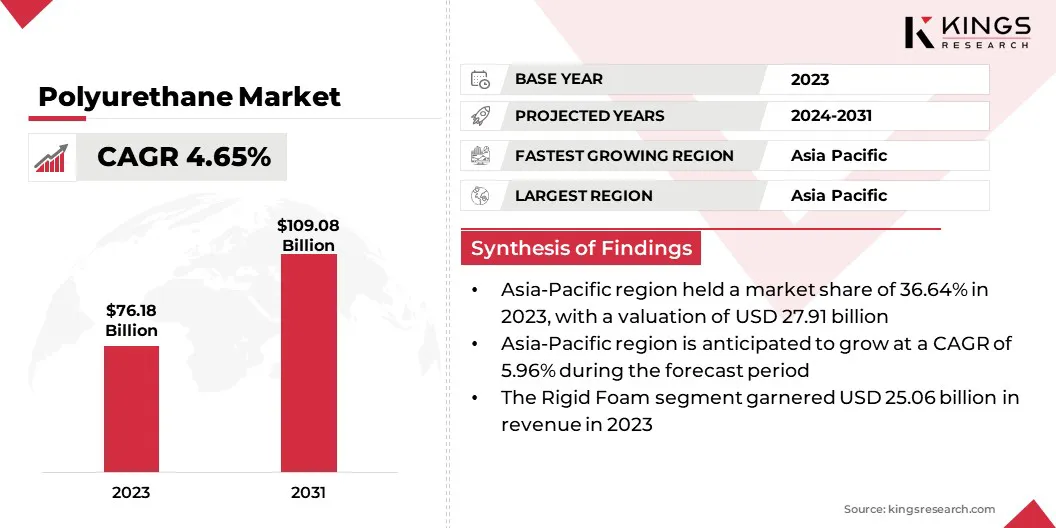

The polyurethane market size was valued at USD 76.18 billion in 2023 and is projected to grow from USD 79.37 billion in 2024 to USD 109.08 billion by 2031, exhibiting a CAGR of 4.65% during the forecast period.

The market is expanding, due to its increasing demand in the automotive, construction, and furniture industries. The market is becoming more efficient through advancements in bio-based materials, green chemistry, and recycling methods.

PU Europe actively supports and collaborates with raw material suppliers to develop exposure scenarios and safety data sheets for PU insulation, aiming to provide downstream users with transparent information on its high safety features in line with the REACH Regulation.

Major companies operating in the polyurethane market are BASF, Dow, Covestro AG, Huntsman International LLC, Eastman Chemical Company, Mitsui Chemicals, Inc., DIC CORPORATION, Recticel , Woodbridge, RTP Company, LANXESS, The Lubrizol Corporation, Tosoh Asia Pte.Ltd., 3M, Arkema, and Sika.

The market is being further driven by technological innovations, particularly with the development of lightweight, energy-efficient, and multifunctional PU products. As sustainability and regulatory pressures grow, polyurethane manufacturers are increasingly adopting eco-friendly practices and developing alternative materials to meet both consumer and regulatory demands.

These innovations are enhancing the material's performance, which is contributing to a more sustainable future, aligning with the growing focus on reducing environmental impact across various industries.

Key Highlights:

- The global polyurethane market size was recorded at USD 76.18 billion in 2023.

- The market is projected to grow at a CAGR of 4.65% from 2024 to 2031.

- Asia Pacific held a market share of 36.64% in 2023, with a valuation of USD 27.91 billion.

- The construction segment garnered USD 25.50 billion in revenue in 2023.

- The rigid foam segment is expected to reach USD 31.79 billion by 2031.

- The polyurethane industry in Asia Pacific is anticipated to grow at a CAGR of 5.96% during the forecast period.

Market Driver

"Demand for Energy Efficiency and Insulation"

The demand for energy-efficient building materials is rising significantly with the growing global emphasis on reducing energy consumption and carbon emissions. PU, particularly in the form of rigid foams, is highly sought after for its superior thermal insulation properties.

These products are used extensively in construction, including for walls, roofs, and floors, to improve energy efficiency in both residential and commercial buildings.

- In 2023, The U.S. Department of Energy (DOE) highlighted the importance of energy-efficient materials such as rigid PU foam in various initiatives, particularly through the Energy Efficiency and Renewable Energy (EERE) program.

The DOE’s “Energy Efficiency and Renewable Energy” program emphasizes the importance of materials that improve thermal performance, noting that the use of PU in insulation systems helps to reduce heating and cooling costs, contributing to overall energy savings. This aligns with the department's goals to reduce carbon emissions and enhance energy efficiency in the construction sector.

Market Challenge

"Concerns Pertaining to Environmental Impact"

The polyurethane market encounters significant challenges, due to environmental concerns, such as the carbon footprint, resource depletion, and environmental impact during production and disposal.

The growing demand for more sustainable and eco-friendly alternatives is driving the industry to invest in bio-based PU and improve recycling processes, but the transition to greener solutions remains complex and costly.

Thus, key market players are developing bio-based PU from renewable resources, investing in recycling technologies, and adopting greener manufacturing processes using sustainable blowing agents. Additionally, incorporating recycled content into products helps reduce waste, supporting a more sustainable and energy-efficient approach

Market Trend

"Shift toward Sustainability and Bio-based Polyurethanes"

The demand for PU products made from renewable resources rather than traditional petroleum-based feedstocks is increasing amid growing environmental concerns. This trend is driven by both consumer preferences for eco-friendly products and stricter environmental regulations.

- In March 2024, Dow announced the launch of two new sustainable varieties of propylene glycol (PG) solutions in North America, featuring bio-circular and circular feedstocks. These solutions, suitable for a wide range of applications, enable customers to offer high-performance products with externally verified sustainability benefits

The growing use of bio-based PU is driven by the demand for sustainable materials that reduce reliance on petroleum and lower carbon emissions. Stricter regulations, consumer preferences for eco-friendly products, and advancements in production technology are further boosting its adoption across industries like construction and automotive.

Polyurethane Market Report Snapshot

| Segmentation | Details |

| By Product Type | Rigid Foam, Flexible Foam, Coatings, Elastomers, Adhesives & Sealants, Others |

| By End-use Industry | Construction, Automotive, Furniture, Footwear, Appliances & Electronics, Others |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Product Type (Rigid Foam, Flexible Foam, Coatings, Elastomers, Adhesives & Sealants, Others): The rigid foam segment earned USD 25.06 billion in 2023, due to its widespread use in energy-efficient insulation applications, particularly in the construction and automotive industries, where its superior thermal resistance and lightweight properties make it an ideal choice for reducing energy consumption and improving overall performance.

- By End-use Industry (Construction, Automotive, Furniture, Footwear, Appliances & Electronics, Others): The construction segment held 33.48% share of the market in 2023, due to the growing demand for energy-efficient building materials, where the superior insulation properties of PU help meet stricter energy regulations and enhance the thermal performance of residential, commercial, and industrial buildings.

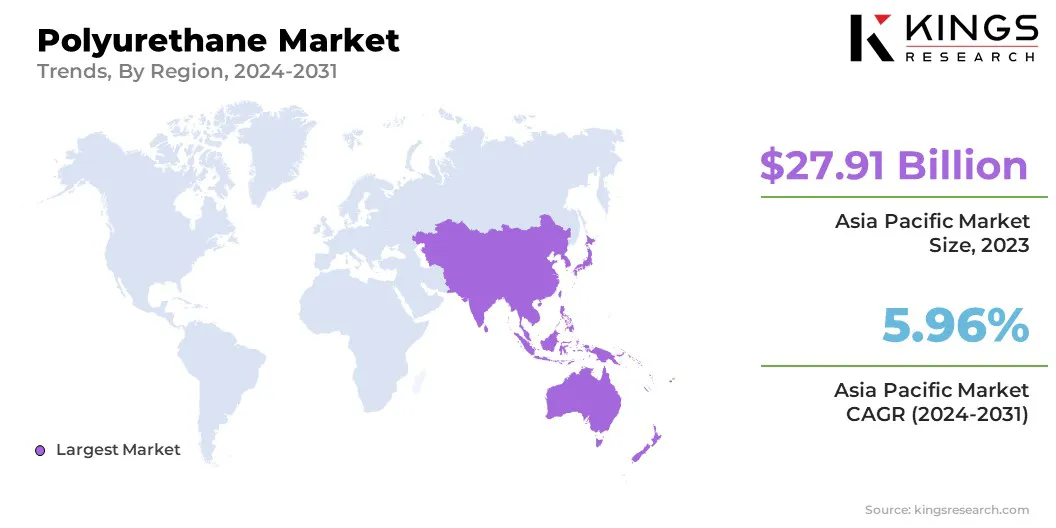

Polyurethane Market Regional Analysis

Asia Pacific accounted for a significant share of around 36.64% of the polyurethane market in 2023, valued at USD 27.91 billion. Asia Pacific dominates the market, driven by a rapid industrialization, urbanization, and strong demand for PU products in construction, automotive, and packaging industries.

Countries like China, India, and Japan are key drivers of this growth, with the booming construction, automotive, and packaging industries fueling the demand for PU products.

The region’s strong manufacturing base and availability of raw materials, along with supportive government policies promoting infrastructure development and sustainable building practices, further contribute to the growth of the polyurethane industry.

China is the largest rigid foam producer, accounting for 74% of regional output in 2022. South Korea and India rank as the second and third largest, respectively. The production of rigid foam saw significant growth in South and Southeast Asia, particularly in Indonesia, the Philippines, India, Bangladesh, and Vietnam.

The polyurethane market in North America is poised to grow at a CAGR of 3.63% through the projection period, driven by its increasing demand for energy-efficient building materials, advancements in PU applications, and growing environmental awareness, particularly in the construction and automotive sectors.

The fastest-growing countries in the North American market are the U.S. and Canada. The market in the U.S. registers high growth, driven by the demand for energy-efficient building materials, automotive applications, and sustainability initiatives, while Canada benefits from infrastructure development, green building trends, and advancements in the automotive sector.

The use of insulation in U.S. homes and businesses saves energy by reducing the heating and cooling loads of buildings, therefore, reducing heating and cooling costs for home and business owners. In addition, by saving energy, the use of insulation helps reduce greenhouse gas (GHG) emissions otherwise associated with the heating and cooling of buildings.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The National Emission Standards for Hazardous Air Pollutants (NESHAP) prohibits the use of methylene chloride at foam fabrication operations. Area sources of flexible PU foam fabrication cut or bond flexible PU foam pieces together or to other substrates, and these pieces are then used in upholstered products such as furniture, cars & trucks, and some appliances.

- The Food and Drug Administration (FDA) (U.S.) regulates certain PU products used in food packaging, medical devices, and consumer goods to ensure that they are safe for human use and do not cause harm when in contact with food or the human body.

- The Department of Energy (DOE) sets energy efficiency standards and promotes sustainable building practices, influencing the demand for PU in insulation applications to improve energy efficiency and reduce carbon footprints.

- The Olsen Lab at MIT focuses on developing sustainable materials, including bio-based polymers and coatings, to reduce environmental impact. Their research aims to create recyclable materials, reduce reliance on petrochemicals, and promote a circular economy to enhance sustainability and lower carbon footprints.

- The European Chemicals Agency (ECHA) enforces REACH regulations, ensuring the safe use of PU by evaluating chemicals for human health and environmental safety. Manufacturers must comply with these regulations to meet safety standards in PU production and minimize potential risks.

Competitive Landscape:

The polyurethane market is characterized by a large number of participants, including both established corporations and rising organizations. Key players in the market must focus on innovation, cost efficiency, and sustainability to achieve a competitive landscape.

This involves investing in research and development (R&D) to create high-performance, eco-friendly products, such as bio-based PU, to meet evolving consumer and regulatory demands. Optimizing production processes and supply chain management is crucial for reducing costs and improving product quality, while compliance with global environmental regulations ensures long-term market viability.

Arkema SA focuses on sustainable solutions for the automotive, construction, and coatings industries. Its focus on innovation has led to the development of bio-based polyols and eco-friendly PU formulations that meet growing environmental regulations.

Additionally, strategic partnerships, geographic expansion, and a customer-centric approach can help players tap into new markets, particularly in regions like Asia Pacific. Embracing technological advancements, such as automation and data analytics, will also enable companies to enhance manufacturing processes and product offerings, securing a strong position in the competitive market.

List of Key Companies in Polyurethane Market:

- BASF

- Dow

- Covestro AG

- Huntsman International LLC

- Eastman Chemical Company

- Mitsui Chemicals, Inc.

- DIC CORPORATION

- Recticel

- Woodbridge

- RTP Company

- LANXESS

- The Lubrizol Corporation

- Tosoh Asia Pte.Ltd.

- 3M

- Arkema

- Sika

Recent Developments:

- In September 2024, Covestro introduced a new performance waterborne polyurethane adhesive solution (PU-based product) designed for the automotive and footwear industries. This innovative product aligns with sustainabiliy trends, offering an environmentally friendly alternative to solvent-based adhesives. The new adhesive provides strong bonding performance while meeting the growing demand for eco-conscious solutions, enhancing both efficiency and sustainability in manufacturing processes for these industries

- In August 2024, BASF and Stockmeier Urethanes USA announced a partnership to offer more sustainable PU solutions for playground and recreational surfacing products. The collaboration aims to develop eco-friendly materials using bio-based polyols from BASF, improving the environmental footprint of PU products used in outdoor and recreational applications. This partnership combines BASF's expertise in sustainable materials with Stockmeier's market presence to meet the growing demand for environmentally responsible products in the polyurethane industry.

- In December 2023, BASF announced the launch of its new bio-based polyol product, which is designed to enhance the sustainability of PU production. The polyol, derived from renewable resources, is aimed at reducing the carbon footprint of PU products used in various applications such as construction and automotive. This launch aligns with BASF’s commitment to sustainability and meeting the increasing demand for eco-friendly materials. The bio-based polyol will support manufacturers in meeting regulatory requirements and consumer preferences for greener alternatives.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)