Machinery Equipment-Construction

Port Equipment Market

Port Equipment Market Size, Share, Growth & Industry Analysis, By Type (Cranes, Forklifts, Reach Stackers, Container Handlers, Terminal Tractors, Others), By Propulsion (Diesel, Electric, Hybrid), By Technology (Conventional, Autonomous), By Application, and Regional Analysis, 2024-2031

Pages : 190

Base Year : 2023

Release : February 2025

Report ID: KR1401

Market Definition

Port equipment refers to the machinery and devices used in port terminals to facilitate the loading, unloading, and handling of cargo. This includes a variety of equipment designed to manage different types of cargo efficiently and safely.

Common types of port equipment include cranes (such as container cranes and gantry cranes), forklifts, conveyor systems, reach stackers, tugboats, and gantries, all of which assist in the movement of goods between ships, warehouses, and other transport modes like trucks or railcars. This equipment plays a crucial role in optimizing port operations, improving logistics, and ensuring the smooth functioning of global trade.

Port Equipment Market Overview

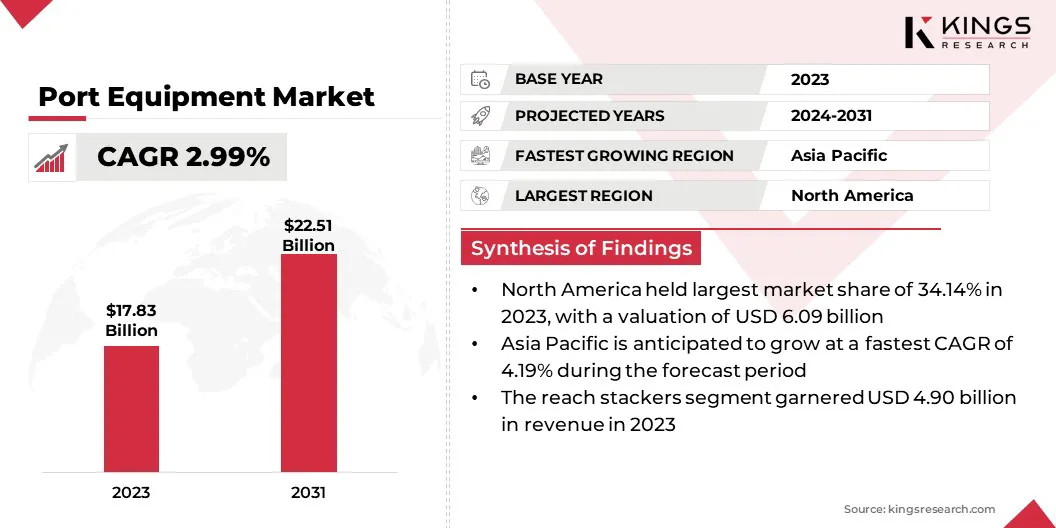

The global port equipment market size was valued at USD 17.83 billion in 2023 and is projected to grow from USD 18.31 billion in 2024 to USD 22.51 billion by 2031, exhibiting a CAGR of 2.99% during the forecast period.

The market is driven by increasing investments in port automation and digitalization, enhancing operational efficiency through AI-powered cargo handling and autonomous equipment.

Rising global trade volumes are further accelerating the demand for advanced container handling solutions, optimizing throughput capacity. Additionally, the push for sustainable port operations is driving the adoption of electrified cranes and eco-friendly equipment, reducing emissions and improving energy efficiency.

Major companies operating in the global port equipment Industry are Kalmar Corporation, Liebherr-International Deutschland GmbH, Konecranes, Sany Heavy Industry Co., Ltd., Shanghai Zhenhua Heavy Industries (ZPMC), Anhui Heli Co., Ltd., Cargotec Corporation, MITSUBISHI LOGISNEXT CO., LTD., ToyotaLift Northeast, BYD Motors, Inc., Gaussin Group, Tec Container S.A., Hyster-Yale Group, Inc., ABB, and Siemens.

The rapid expansion of international trade has significantly increased the demand for efficient cargo handling solutions, driving the market. The shift to containerized shipping, fueled by e-commerce and global supply chain integration, has heightened the need for advanced cranes, automated stacking systems, and cargo handling equipment.

Rising trade agreements and regional economic partnerships are further boosting port activities, requiring ports to invest in high-performance equipment to optimize throughput. The expansion of major global trade hubs and the increasing adoption of intermodal transport networks are reinforcing the demand for technologically advanced port equipment.

- As per UN Trade and Development, approximately 80% of global goods trade by volume is transported via sea, with developing nations accounting for the majority of the trade. In 2023, global maritime trade expanded by 2.4% to reach 12.3 billion tons, recovering from the decline observed in 2022. The sector is expected to grow by 2% in 2024, with an average annual growth rate of 2.4% projected through 2029.

Key Highlights:

- The global port equipment market size was valued at USD 17.83 billion in 2023.

- The market is projected to grow at a CAGR of 2.99% from 2024 to 2031.

- North America held a market share of 34.14% in 2023, with a valuation of USD 6.09 billion.

- The reach stackers segment garnered USD 4.90 billion in revenue in 2023.

- The diesel segment is expected to reach USD 8.17 billion by 2031.

- The conventional segment secured the largest revenue share of 58.43% in 2023.

- The ship handling segment is poised for a robust CAGR of 3.43% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 4.19% during the forecast period.

Market Driver

"Expansion of Intermodal and Smart Logistics Solutions Fuels Market"

The increasing adoption of intermodal transport networks is amplifying the demand for efficient cargo-handling equipment, fueling the port equipment market. Seamless integration between ports, rail, and road networks is enhancing supply chain efficiency, requiring ports to deploy advanced container handling systems and automated terminal equipment.

Smart logistics solutions, including AI-powered freight tracking and cloud-based port management platforms, are improving cargo flow and reducing congestion. The deployment of digital freight corridors and real-time monitoring systems is optimizing port operations, increasing productivity, and strengthening the demand for technologically advanced port equipment.

- In November 2024, DP World and SailGP unveiled a global logistics partnership, with DP World managing the transport and delivery of the global racing championship’s annual events. The company will oversee end-to-end logistics across five continents, handling sea freight, courier services, and route optimization. Additionally, its extensive network of storage facilities, trucking, rail, and barge transport services will support the seamless execution of the racing schedule.

Market Challenge

"High Initial Investment and Integration Costs Poses Challenge"

The high capital investment required for advanced port equipment, automation systems, and digital infrastructure poses a significant challenge to the market growth. Upgrading to smart port solutions, including AI-driven cargo handling and electrified cranes, demands substantial financial resources, making adoption difficult for small and mid-sized ports.

Companies are forming strategic partnerships to share investment costs, leveraging government subsidies for sustainable port initiatives, and adopting modular automation solutions that allow phased implementation.

Additionally, advancements in leasing models and equipment-as-a-service (EaaS) offerings are enabling ports to access cutting-edge technology without heavy upfront expenditure.

Market Trend

"Technological Advancements and Automation Boost Adoption"

The integration of automation and digital technologies into port operations is transforming efficiency and safety, contributing to the expansion of the port equipment market.

Automated stacking cranes, AI-driven cargo management systems, and remote-controlled terminal equipment are streamlining logistics processes while reducing labor dependency. IoT-enabled port equipment and predictive maintenance solutions are minimizing downtime and optimizing asset utilization.

- In November 2024, Sany Marine Heavy Industry Co., Ltd. made a major advancement with its H-Move2.0 intelligent system in the tire crane automation project at the Port of Tianjin. This innovation has enhanced tire crane efficiency to 20 moves per hour, establishing a new benchmark for the development of sustainable, digital, and smart ports.

The adoption of digital twin technology and blockchain-based cargo tracking is enhancing real-time monitoring, improving transparency, and increasing overall port productivity. Continuous innovation in automation and smart technologies is accelerating the demand for next-generation port equipment globally.

Port Equipment Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Cranes, Forklifts, Reach Stackers, Container Handlers, Terminal Tractors, Others |

|

By Propulsion |

Diesel, Electric, Hybrid |

|

By Technology |

Conventional, Autonomous |

|

By Application |

Ship Handling, Container Handling |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Cranes, Forklifts, Reach Stackers, Container Handlers, Terminal Tractors, and Others): The reach stackers segment earned USD 4.90 billion in 2023, due to their versatility in efficiently handling containers in tight spaces, enhancing operational flexibility and optimizing space utilization in container yards.

- By Propulsion (Diesel, Electric and Hybrid): The diesel segment held 38.30% share of the market in 2023, due to its high power output, reliability, and efficiency, making it the preferred choice for heavy-duty equipment used in port operations.

- By Technology (Conventional and Autonomous): The conventional segment is projected to reach USD 12.81 billion by 2031, owing to its established reliability, lower initial costs, and proven effectiveness in handling a wide range of cargo, making it the preferred choice for many port operators.

- By Application (Ship Handling and Container Handling): The ship handling segment is poised for significant growth at a CAGR of 3.43% through the forecast period, due to its essential role in ensuring efficient docking, undocking, and maneuvering of vessels, which is critical for maintaining smooth port operations and minimizing delays.

Port Equipment Market Regional Analysis

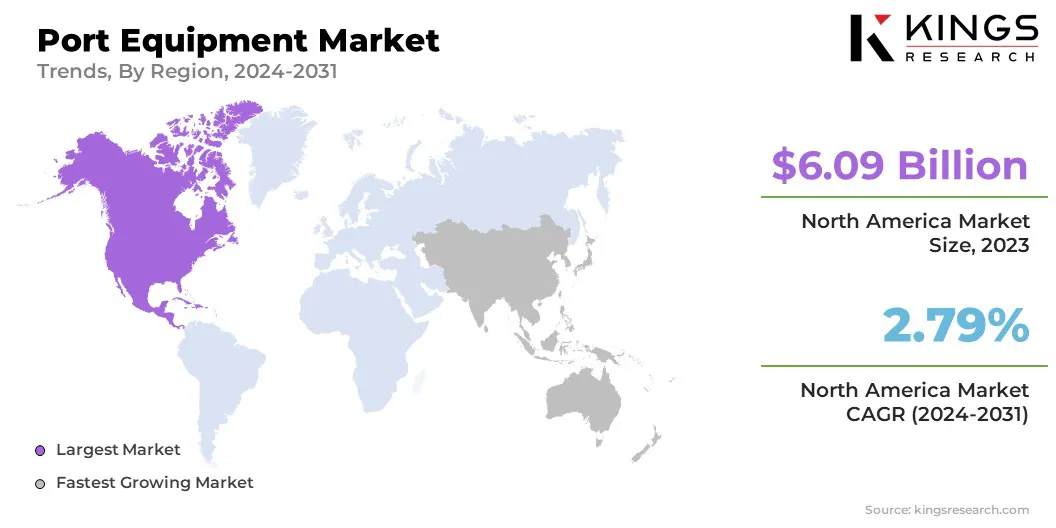

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a port equipment market share of around 34.14% in 2023, with a valuation of USD 6.09 billion. The push for sustainability and stricter environmental regulations is accelerating the adoption of energy-efficient port equipment in North America.

Ports are transitioning to electric and hybrid cranes, hydrogen-powered cargo handling vehicles, and shore power systems to reduce carbon emissions. Regulations, such as California’s zero-emission mandate for cargo handling equipment, are compelling port operators to invest in green technologies.

Additionally, the integration of renewable energy sources, such as solar and wind power, into port operations is further driving the demand for sustainable equipment solutions.

- In August 2024, the Detroit/Wayne County Port Authority revealed an ambitious plan aimed at cutting carbon emissions, with a goal of achieving net zero within 15 years. The strategy includes a significant reduction in the port’s carbon footprint by introducing biodiesel, which produces 74% fewer emissions compared to conventional diesel. The plan also involves transitioning larger ships to biodiesel, smaller vessels to battery-electric propulsion, and port equipment and trucks to electric & hydrogen power.

The port equipment Industry in Asia Pacific is poised for significant growth at a robust CAGR of 4.19% over the forecast period. The market in Asia Pacific is growing, due to surging trade volumes and large-scale port infrastructure development.

Countries like China, India, and South Korea are investing heavily in modernizing and expanding port facilities to handle increasing cargo throughput. The Belt and Road Initiative (BRI) is further driving port upgrades, enhancing connectivity and boosting the demand for advanced handling equipment. The development of smart ports with AI-driven logistics and automation is improving operational efficiency and fueling the market across the region.

Furthermore, stringent environmental regulations and sustainability goals are pushing ports in Asia Pacific to adopt greener technologies. China’s push for carbon neutrality and India’s focus on sustainable port development under the Sagarmala Program are encouraging the use of electrified cranes, hybrid cargo-handling equipment, and shore power solutions.

Countries like South Korea and Japan are investing in hydrogen-powered port machinery and LNG bunkering infrastructure to reduce emissions. These sustainability-driven initiatives are significantly boosting the demand for advanced and eco-friendly port equipment across the region.

Regulatory Frameworks

- In the U.S., port equipment regulations are primarily governed by the Occupational Safety and Health Administration (OSHA), which enforces safety standards to protect workers operating port equipment such as cranes and forklifts. The Federal Maritime Commission (FMC) regulates port operations to ensure fair competition and transparency within the maritime sector, while the Environmental Protection Agency (EPA) oversees environmental compliance, including emissions and waste management from port equipment.

- In the European Union (EU), port equipment regulations are influenced by directives like Directive 2008/106/EC, which focuses on seafarer training and certification requirements, ensuring safe operations across ports. The Directive 2014/94/EU also addresses the infrastructure for alternative fuels, impacting port equipment related to fuel handling and sustainability.

- In the UK, the Health and Safety Executive (HSE) and the Maritime and Coastguard Agency (MCA) ensure that port operations adhere to stringent safety standards for both workers and equipment.

- In China, the Ministry of Transport and the State Administration of Work Safety regulate the safe operation of port equipment, ensuring that all handling equipment meets safety, environmental, and operational standards. In Japan, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) regulates port infrastructure and equipment, focusing on safety and efficient logistics.

- India’s Ministry of Ports, Shipping and Waterways oversees port equipment, ensuring that they align with international safety and efficiency standards, while the Directorate General of Shipping enforces regulations for safe handling of cargo and equipment use.

- In South Korea, the Ministry of Oceans and Fisheries and the Korea Occupational Safety and Health Agency (KOSHA) regulate port equipment operations, focusing on maintaining high safety standards for workers and ensuring the environmental sustainability of port operations.

Competitive Landscape:

The global port equipment market is characterized by a large number of participants, including both established corporations and rising organizations. Companies are implementing strategies focused on product innovation with smart features and sustainability initiatives to drive the growth of the market.

Advanced automation, AI-driven cargo handling, and IoT-enabled monitoring systems are enhancing operational efficiency and reducing downtime. Additionally, manufacturers are investing in energy-efficient solutions, including electrified cranes, hybrid cargo-handling equipment, and hydrogen-powered port vehicles, to meet stringent environmental regulations.

The adoption of shore power systems and renewable energy integration is further helping ports reduce their carbon footprint. These advancements are improving productivity, lowering emissions, and accelerating the transition toward sustainable and technologically advanced port operations.

- In February 2025, Konecranes received an order from Terminales Marítimas de Vigo, S.L.U. (Termavi), the primary container terminal operator at Spain’s Port of Vigo on the Atlantic coast, for two hybrid Rubber-Tired Gantry (RTG) cranes. These cranes feature Konecranes' Smart Features, including Auto-Steering, Auto-Truck Guiding, Auto-Path Optimization, and Auto-Positioning, ensuring precise and efficient container handling. Additionally, they are equipped with trolley and truck lane cameras, tire pressure monitoring, fire suppression systems, and automatic greasing systems, enhancing both operational performance and safety at the terminal.

List of Key Companies in Port Equipment Market:

- Kalmar Corporation

- Liebherr-International Deutschland GmbH

- Konecranes

- Sany Heavy Industry Co., Ltd.

- Shanghai Zhenhua Heavy Industries (ZPMC)

- Anhui Heli Co., Ltd.,

- Cargotec Corporation

- MITSUBISHI LOGISNEXT CO., LTD.

- ToyotaLift Northeast

- BYD Motors, Inc.

- Gaussin Group

- Tec Container S.A.

- Hyster-Yale Group, Inc.

- ABB

- Siemens

Recent Developments (Partnerships/Agreements)

- In March 2024, ABB and crane manufacturer Kuenz secured the largest-ever single order of Automatic Stacking Cranes (ASC) by a European terminal as part of the transformative ‘Phase 2’ expansion of APM Terminals Maasvlakte II (APMT MVII) in Rotterdam, Netherlands. The project includes the delivery of 62 ASCs and one Intermodal Yard Crane, all featuring advanced electrical and automation technology, enabling APMT MVII to double its container handling capacity.

- In January 2025, Kalmar entered into an agreement with Maputo Port Development Company (MPDC) to deliver five Kalmar T2i terminal tractors, four heavy forklift trucks, and one medium forklift truck. The order, which includes MyKalmar INSIGHT coverage for all units, was recorded in Kalmar’s Q4 2024 order intake. Delivery of the equipment is expected to be completed by the third quarter of 2025.

- In November 2024, Kalmar secured a major agreement to supply APM Terminals in Tangier, Morocco, with an additional 20 hybrid straddle carriers. These units will be deployed at APM Terminals MedPort Tangier. The order was recorded in Kalmar’s Q3 2024 order intake, with deliveries scheduled to take place progressively across the second and third quarters of 2025.

- In November 2024, Liebherr supplied two ship-to-shore (STS) container cranes to Port Newark Container Terminal (PNCT), further strengthening its longstanding commitment to the U.S. maritime sector. Designed to meet PNCT’s specific operational requirements, these cranes will enhance the terminal’s ability to handle the next generation of ultra-large container vessels. The delivery is part of PNCT’s ongoing USD 500 million expansion project, aimed at increasing capacity at one of the busiest ports on the U.S. East Coast.

- In February 2025, Belgian logistics company Katoen Natie placed an order for four all-electric Konecranes Gottwald Mobile Harbor Cranes to enhance its operations at the Port of Antwerp. The order, which includes a 10-year service level agreement, was recorded in Q1 2025, with delivery set for Q1 2026. Each crane is equipped with Konecranes' all-electric drive system, combining an external power supply with rechargeable batteries to maximize energy efficiency while eliminating local tailpipe emissions.

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years