Energy and Power

Power Plant Performance Test Market

Power Plant Performance Test Market Size, Share, Growth & Industry Analysis, By Type of Test (Thermal Performance Test, Mechanical Performance Test, Environmental Performance Test, Hydraulic Performance Test, Control System Testing), By Plant Type, By Test Location, and Regional Analysis, 2024-2031

Pages : 190

Base Year : 2023

Release : February 2025

Report ID: KR1381

Market Definition

A power plant performance test is a structured evaluation process conducted to assess the efficiency, reliability, and operational capabilities of a power plant under specific conditions.

It involves measuring key performance parameters such as heat rate, thermal efficiency, power output, fuel consumption, and emissions to ensure compliance with design specifications, regulatory standards, and contractual obligations. These tests help identify potential performance issues, optimize plant operations, and verify the effectiveness of upgrades or modifications.

Performance tests are typically conducted during commissioning, after major maintenance, or periodically to ensure sustained efficiency and reliability.

Power Plant Performance Test Market Overview

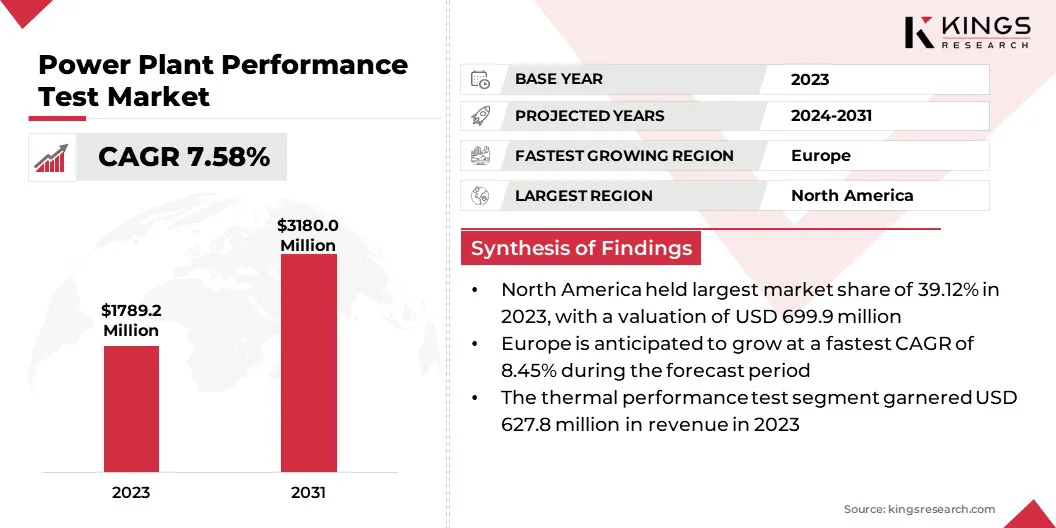

The global power plant performance test market size was valued at USD 1,789.2 million in 2023 and is projected to grow from USD 1,906.9 million in 2024 to USD 3,180.0 million by 2031, exhibiting a CAGR of 7.58% during the forecast period.

The market is driven by the increasing demand for energy efficiency and regulatory compliance. Advancements in testing technologies, such as innovations in emissions monitoring, help power plants meet stringent environmental standards.

Additionally, the rising integration of renewable energy sources into power grids necessitates continuous performance testing to ensure grid stability and reliability, further boosting market demand.

Major companies operating in the power plant performance test industry are Siemens AG, GE Vernova, MITSUBISHI HEAVY INDUSTRIES, LTD., ABB, Emerson Electric Co., Schneider Electric, Honeywell International Inc., Toshiba Corporation, Eaton, Bechtel Corporation, SMS group GmbH, CerTa Veritas BV, Thermogen Power Services Inc., CleanAir Engineering, and SysEne.

Rising electricity consumption across residential, commercial, and industrial sectors is driving the market. Utilities and independent power producers are under increasing pressure to ensure stable power generation while minimizing unplanned outages. Performance tests help assess the reliability of power plants, identify potential system failures, and enhance operational stability.

Countries with rapidly expanding industrial sectors are investing in performance testing solutions to maintain consistent energy output. This growing emphasis on uninterrupted power supply is increasing the adoption of testing services to enhance plant efficiency and grid reliability.

- The International Energy Agency's 2024 report states that global electricity demand increased by 2.2% in 2023. Projections indicate a faster growth rate, with demand expected to rise at an average annual rate of 3.4% through 2026.

Key Highlights:

- The power plant performance test industry size was valued at USD 1,789.2 million in 2023.

- The market is projected to grow at a CAGR of 7.58% from 2024 to 2031.

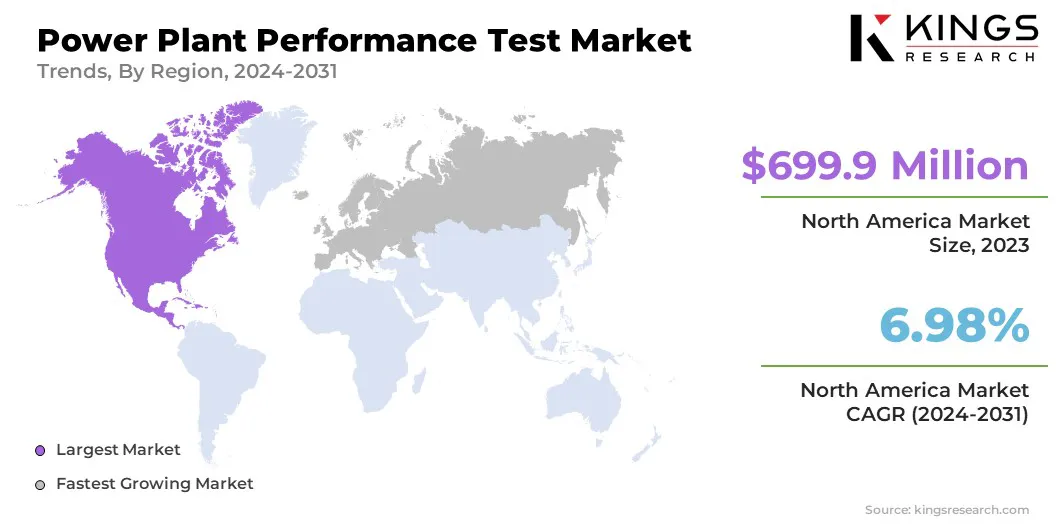

- North America held a market share of 39.12% in 2023, with a valuation of USD 699.9 million.

- The thermal performance test segment garnered USD 627.8 million in revenue in 2023.

- The thermal power plants segment is expected to reach USD 1,309.4 million by 2031.

- The Off-site Testing segment is poised for a robust CAGR of 8.36% through the forecast period.

- The market in Europe is anticipated to grow at a CAGR of 8.45% during the forecast period.

Market Driver

"Rising Investments in Renewable Energy and Hybrid Power Plants Boosts Market"

Expanding investments in renewable energy projects are supporting the growth of the power plant performance test market. The transition toward wind, solar, and hybrid power plants requires rigorous performance evaluations to assess energy output, efficiency, and grid stability.

Developers and utilities are conducting performance tests to validate power generation capacity and ensure seamless integration into the grid. Hybrid power plants, combining conventional and renewable energy sources, require comprehensive testing to optimize power flow and operational reliability.

This surge in renewable energy installations is driving the demand for advanced testing methodologies that enhance the efficiency and reliability of sustainable power generation.

- In October 2024, TotalEnergies and the Technical University of Denmark (DTU) officially launched their Hybrid Power Plant. This pilot project integrates wind and solar energy with a battery-based storage system to enhance renewable energy utilization. The initiative aims to test, refine, and validate dynamic models developed by DTU and TotalEnergies researchers, facilitating the safe, cost-effective, and sustainable integration of renewables into the power grid.

Market Challenge

"High Capital Investment and Maintenance Costs Poses Challenge"

A key challenge for the growth of the power plant performance test market is the high capital investment and ongoing maintenance costs associated with advanced testing equipment and technologies. Implementing sophisticated validation testing systems requires substantial financial resources, which can be a barrier for smaller operators or those in regions with limited budgets.

Companies are adopting strategies like partnering with technology providers to share the financial burden and investing in predictive maintenance tools to reduce operational costs. Additionally, companies are focusing on modular and scalable solutions, allowing for phased implementation and better cost management over time.

Market Trend

"Increasing Adoption of Combined Cycle Power Plants Fuels Adoption"

The shift toward combined cycle power plants is accelerating the growth of the power plant performance test market. These plants, which utilize both gas and steam turbines, offer higher efficiency and lower emissions compared to traditional thermal power plants.

Performance testing is crucial to optimizing fuel utilization, turbine efficiency, and overall plant output. Governments and utilities are investing in combined cycle plants to meet sustainability goals while reducing operational costs.

Performance assessments help ensure seamless integration of gas and steam cycles, making them essential for improving efficiency and long-term reliability. The increasing deployment of combined cycle plants is boosting the demand for performance testing solutions.

- In September 2024, the Yelahanka Combined Cycle Power Plant (CCPP), Karnataka’s inaugural gas-based facility with a 370 MW capacity, was commissioned. Developed by Karnataka Power Corporation Limited (KPCL), the plant will generate 236.825 MW using a gas turbine generator and 133.225 MW from a steam turbine generator, totaling 370.05 MW. The pilot production phase of the combined cycle has been successfully completed.

Power Plant Performance Test Market Report Snapshot

|

Segmentation |

Details |

|

By Type of Test |

Thermal Performance Test, Mechanical Performance Test, Environmental Performance Test, Hydraulic Performance Test, Control System Testing |

|

By Plant Type |

Thermal Power Plants, Hydropower Plants, Renewable Energy Plants, Combined Cycle Power Plants |

|

By Test Location |

On-site Testing, Off-site Testing |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type of Test (Thermal Performance Test, Mechanical Performance Test, Environmental Performance Test, Hydraulic Performance Test, and Control System Testing): The thermal performance test segment earned USD 627.8 million in 2023, due to its critical role in ensuring optimal efficiency and compliance with stringent energy output standards, which are essential for improving plant operations and reducing fuel consumption.

- By Plant Type (Thermal Power Plants, Hydropower Plants, Renewable Energy Plants, and Combined Cycle Power Plants): The thermal power plants segment held 42.09% share of the market in 2023, due to their established infrastructure, large-scale operations, and the critical need for performance optimization to meet stringent environmental regulations and improve energy efficiency.

- By Test Location (On-site Testing and Off-site Testing): The On-site Testing segment is projected to reach USD 2,304.5 million by 2031, owing to its ability to provide real-time, accurate performance assessments directly at the power plant, ensuring optimized operations and compliance with regulatory standards without the need for plant shutdowns.

Power Plant Performance Test Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for around 39.12% power plant performance test market share in 2023, with a valuation of USD 699.9 million. Aging power plants across North America require frequent performance evaluations to maintain operational efficiency and meet modern energy standards. Many of the region's power plants are over 40 years old, necessitating upgrades to enhance their performance and prolong their lifespan.

Performance testing helps identify areas of inefficiency and degradation, guiding necessary refurbishments and ensuring the plants remain competitive. This drive for modernization and refurbishment is increasing the demand for performance testing services as utilities seek to optimize and extend the life of existing plants.

- In December 2024, GE Vernova received an order from Dominion Energy South Carolina for the modernization of two hydropower units at the Saluda Hydropower Plant, situated on the Saluda River in the Southeastern U.S., about 10 miles west of Columbia, South Carolina. This modernization initiative aims to enhance the plant's lifespan, reliability, performance, and operational flexibility, ensuring continued power generation for the nearly century-old facility.

Additionally, the U.S. and Canadian governments are offering incentives and funding to modernize and upgrade existing infrastructure, further encouraging the adoption of performance testing solutions. These regulations and financial supports are driving the market by pushing for compliance, optimization, and sustainability in power generation.

The power plant performance test industry in Europe is poised for significant growth at a robust CAGR of 8.45% over the forecast period. Europe has some of the world’s most stringent environmental regulations, including the European Union Emissions Trading System (EU ETS) and national-level environmental standards.

These regulations require power plants to regularly undergo performance tests to ensure that they meet emissions limits, energy efficiency requirements, and other operational standards.

The growing emphasis on regulatory compliance is driving utilities and energy producers in Europe to invest in performance testing services to ensure that their plants meet the required standards and avoid penalties. This legal framework is significantly boosting the market in the region.

Furthermore, Europe is placing greater emphasis on enhancing the reliability and resilience of its power generation infrastructure in response to geopolitical uncertainties and the growing threat of energy supply disruptions. Performance testing is essential to ensuring that power plants can withstand disruptions and provide consistent energy.

The region focuses on strengthening energy security and reducing dependence on external energy sources, which is increasing the demand for performance testing services that can ensure reliable and uninterrupted power supply, particularly from critical plants such as nuclear and hydroelectric facilities.

Regulatory Frameworks:

- In the U.S., the Federal Energy Regulatory Commission (FERC) oversees the reliability and performance of the nation's power plants. FERC's regulations require utilities to conduct performance tests to ensure compliance with reliability standards and maintain grid stability. Additionally, the Environmental Protection Agency (EPA) enforces regulations related to emissions and environmental performance, necessitating regular performance assessments to meet environmental standards.

- In the UK, the Office of Gas and Electricity Markets (Ofgem) regulates electricity and gas markets, including the performance of power plants. Ofgem mandates performance testing to ensure that power plants meet efficiency and reliability standards, contributing to the overall stability of the UK's energy supply.

- In Germany, the Federal Network Agency (Bundesnetzagentur) oversees the performance of power plants, ensuring that they meet technical and operational standards. Germany's commitment to renewable energy integration requires performance testing to assess the efficiency and reliability of both conventional and renewable power plants.

- In China, the National Energy Administration (NEA) regulates the performance of power plants, focusing on efficiency and environmental compliance. Rapid expansion of renewable energy sources in China necessitates performance testing to ensure that new and existing plants operate effectively within the grid.

- In India, the Central Electricity Authority (CEA) sets performance standards for power plants, including requirements for performance testing to ensure efficient and reliable operation. The growing energy demand and renewable energy integration efforts in India highlight the importance of performance testing in maintaining grid stability.

Competitive Landscape:

The power plant performance test industry is characterized by a large number of participants, including established corporations and rising organizations. Market players are increasingly adopting strategies focused on innovation in validation testing, significantly contributing to the growth of the market.

Companies are enhancing the accuracy, efficiency, and reliability of power plant performance assessments by advancing testing methodologies and incorporating cutting-edge technologies. These innovations not only improve operational efficiency but also support compliance with stricter environmental regulations.

Market players are facilitating the integration of renewable energy sources, optimizing plant operations, and ensuring the long-term sustainability of power plants through continuous Research and Development (R&D) in testing solutions, driving overall market expansion.

- In January 2025, GE Vernova successfully completed a validation test campaign for an advanced Dry Low NOx (DLN) hydrogen combustion technology designed for B- and E-class gas turbines at the Global Technology Center in Greenville, South Carolina. The testing, which was conducted using natural gas and hydrogen blends as well as 100% hydrogen, achieved dry emissions of nitrogen oxide (NOx) below 25 parts per million (ppm). GE Vernova plans to make the new DLN system available for both new and existing B- and E-class gas turbines by 2026.

List of Key Companies in Power Plant Performance Test Market:

- Siemens AG

- GE Vernova

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- ABB

- Emerson Electric Co.

- Schneider Electric

- Honeywell International Inc.

- Toshiba Corporation

- Eaton

- Bechtel Corporation

- SMS group GmbH

- CerTa Veritas BV

- Thermogen Power Services Inc.

- CleanAir Engineering

- SysEne

Recent Developments

- In November 2023, Mitsubishi Heavy Industries, Ltd. (MHI) successfully conducted a combustion test of an ammonia single-fuel burner while developing ammonia utilization technology for thermal power generation boilers. The test was carried out using combustion equipment at the Nagasaki District Research & Innovation Center in Nagasaki.

- In April 2024, Mitsubishi Heavy Industries, Ltd. (MHI) commenced operations of a test module for the Solid Oxide Electrolysis Cell (SOEC), a next-generation, high-efficiency hydrogen production technology. MHI’s proprietary tubular cell stack enables the development of this technology, allowing it to operate at high pressures, distinguishing it from other competing systems.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership