Small Molecule API Market

Small Molecule API Market Size, Share, Growth & Industry Analysis, By Type (Synthetic and Biotech), By Manufacturer (In-house and Outsourced), By Application (Cardiology, Oncology, CNS & Neurology, Endocrinology, Gastroenterology, and Others), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : July 2024

Report ID: KR898

Small Molecule API Market Size

The global Small Molecule API Market size was valued at USD 163.32 billion in 2023 and is projected to grow from USD 170.45 billion in 2024 to USD 253.64 billion by 2031, exhibiting a CAGR of 5.84% during the forecast period. The market is witnessing significant growth due to increasing demand for generic drugs driven by patent expirations of major pharmaceuticals.

This trend is creating opportunities for API manufacturers, particularly in emerging economies where healthcare access is improving and regulatory environments are evolving. In the scope of work, the report includes products offered by companies such as Johnson Matthey, Pfizer Inc., Nanjing King-Friend Biochemical Pharmaceutical Co. Ltd., Sanofi S.A, Bristol-Myers Squibb, GlaxoSmithKline PLC, GILEAD Sciences Inc., AstraZeneca, Merck & Co. Inc., Teva Pharmaceuticals, and others.

The small molecule API market is experiencing robust growth, propelled by significant advancements in technology and increased investments in research and development by pharmaceutical companies.

- For instance, in 2022, the FDA approved 32 new molecular entities and therapeutic biologics, underscoring the industry's innovative shift and commitment to expanding treatment options.

These FDA approvals are contributing to market growth by enhancing drug discovery processes and improving success rates. Pharmaceutical companies are increasingly investing in the research and development activities, leading to a steady stream of new molecular entities and therapeutic biologics gaining regulatory approval. This ongoing innovation highlights the pivotal role of small molecule APIs in advancing pharmaceutical innovation and expanding treatment options across diverse therapeutic fields.

A small molecule active pharmaceutical ingredient (API) is a fundamental component of pharmaceutical drugs, characterized by its low molecular weight and organic composition. These compounds, synthesized through chemical processes, serve as the active substance in medications. Small molecule APIs are highly valued for their stability, bioavailability, and ability to interact with specific biological targets, which are essential for therapeutic efficacy.

They form the basis of numerous pharmaceutical formulations, including common over-the-counter medications and complex prescription drugs. Their versatility and effectiveness in targeting disease mechanisms make small molecule APIs pivotal in modern medicine, thus fostering innovation and expanding treatment options across various therapeutic areas.

Analyst’s Review

The small molecule API market is witnessing substantial growth due to technological advancements and increased R&D investments from pharmaceutical companies. These factors have significantly enhanced drug discovery processes, thereby improving success rates and bolstering market growth.

- In 2022, the FDA's Center for Drug Evaluation and Research (CDER) approved 20 new small-molecule drugs, which accounted for 63% of the total new drug approvals for that year.

This underscores the critical role of small molecule APIs in advancing therapeutic options and stimulating sustained growth in the pharmaceutical sector. Furthermore, strategic collaborations, such as Remix Therapeutics' partnership with Roche, focused on developing small molecule therapeutics targeting RNA processing, exemplify the industry's commitment to leveraging specialized platforms for addressing complex disease mechanisms.

Small Molecule API Market Growth Factors

The increasing prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer is leading to a robust demand for small molecule active pharmaceutical ingredients (APIs). These diseases necessitate ongoing treatment regimens, which spurs the continuous production and consumption of medications formulated with small molecule APIs.

Drugs for diabetes, cardiovascular management, and cancer therapies heavily rely on these compounds, highlighting their pivotal role in healthcare. As populations age and lifestyles evolve, the global prevalence of chronic illnesses increases, thereby fueling API market growth. This trend underscores a major role of small molecule APIs in addressing medical needs and improving patient outcomes worldwide.

The small molecule API market is facing significant challenges due to the increasingly stringent global regulatory requirements. Regulatory agencies are continuously imposing rigorous standards to ensure pharmaceutical product safety, efficacy, and quality. Meeting these demands necessitates ongoing investments in manufacturing capabilities, quality control systems, and compliance documentation practices.

Key market players are actively navigating these challenges by enhancing their manufacturing facilities to meet current Good Manufacturing Practices (cGMP) and International Council for Harmonisation (ICH) guidelines. They are implementing robust quality control measures and maintaining meticulous documentation practices throughout the production process. Proactive engagement with regulatory authorities remains crucial for ensuring alignment on evolving requirements and maitaining compliance in the dynamic regulatory landscape.

Small Molecule API Market Trends

The small molecule API market is experiencing significant growth, primarily fueled by an increasing number of drugs entering pipelines and gaining regulatory approval for marketing. Pharmaceutical companies' intensified R&D efforts are facilitating the advancement of more drugs through clinical trials and securing regulatory approvals.

This expansion in drug development pipelines increases the demand for active pharmaceutical ingredients (APIs), which are crucial components in drug formulations across various therapeutic areas. The broadening scope of targeted therapies, from rare diseases to personalized medicine, is fueling the demand for APIs.

-

Additionally, Pfizer's recent Phase 3 TALAPRO-2 study highlights a significant advancement in oncology treatments. The study showcases the efficacy of combining TALZENNA with XTANDI for the treatment of metastatic castration-resistant prostate cancer (mCRPC).

These advancements underscore ongoing industry efforts to enhance treatment options and outcomes through sophisticated therapies, thereby fostering market expansion.

Advancements in technology are revolutionizing the discovery and development of new small molecule APIs, leading to substantial market growth. Increased knowledge of genomics, biological mechanisms, and disease pathways is shifting drug discovery from empirical methods to targeted approaches. This transformation enables pharmaceutical companies to identify and develop drugs that specifically target disease-causing molecules, thereby enhancing efficiency and success rates in clinical trials.

By leveraging precision-based methodologies, researchers are advancing the development of safer and more effective therapies. These technological advancements are broadening the scope of treatable diseases and streamlining drug development processes, thereby fostering continuous innovation and stimulating market expansion.

Segmentation Analysis

The global market is segmented based on type, manufacturer, application, and geography.

By Type

Based on type, the small molecule API market is categorized into synthetic and biotech. The synthetic segment garnered the highest revenue of USD 121.96 billion in 2023. Synthetic APIs are manufactured through chemical synthesis processes, allowing for precise control over molecular structure and purity. This method enables pharmaceutical companies to produce APIs in large quantities, thereby efficiently meeting global demand.

Moreover, advancements in synthetic chemistry and process optimization have reduced production costs and enhanced scalability. As a result, synthetic materials meet the growing demands of the pharmaceutical market and also drive innovation by enabling the development of new drug formulations and therapies. These factors collectively propel segmental growth by providing reliable and scalable solutions for drug manufacturing across diverse therapeutic areas.

By Manufacturer

Based on manufacturer, the market is divided into in-house and outsourced. The outsourced segment captured the largest small molecule API market share of 59.68% in 2023. Outsourcing allows pharmaceutical firms to focus on core competencies such as drug development and marketing while leveraging external partners for API production. This strategic approach reduces capital expenditures and overhead costs associated with in-house manufacturing, thereby enhancing operational efficiency.

Moreover, outsourcing enables access to specialized technologies and manufacturing capabilities that may not be feasible or economical to develop in-house. As pharmaceutical pipelines expand and global demand for medications grows, outsourcing provides scalability and agility, supporting rapid market entry and bolstering product innovation.

By Application

Based on application, the market is categorized into cardiology, oncology, CNS & neurology, endocrinology, gastroenterology, and others. The oncology segment is expected to garner the highest revenue of USD 81.47 billion by 2031. Small molecule APIs play a pivotal role in oncology treatments by targeting specific molecular pathways involved in cancer progression. As pharmaceutical companies increasingly focus on developing innovative therapies for various types of cancer, the demand for small molecule APIs tailored to these specific targets continues to rise.

Moreover, advancements in genomic research and personalized medicine have enabled the discovery of new oncology targets, thereby boosting the development of novel small molecule APIs. The growth of the segment is further augmented by ongoing clinical trials and regulatory approvals, which validate the efficacy and safety of new oncology treatments.

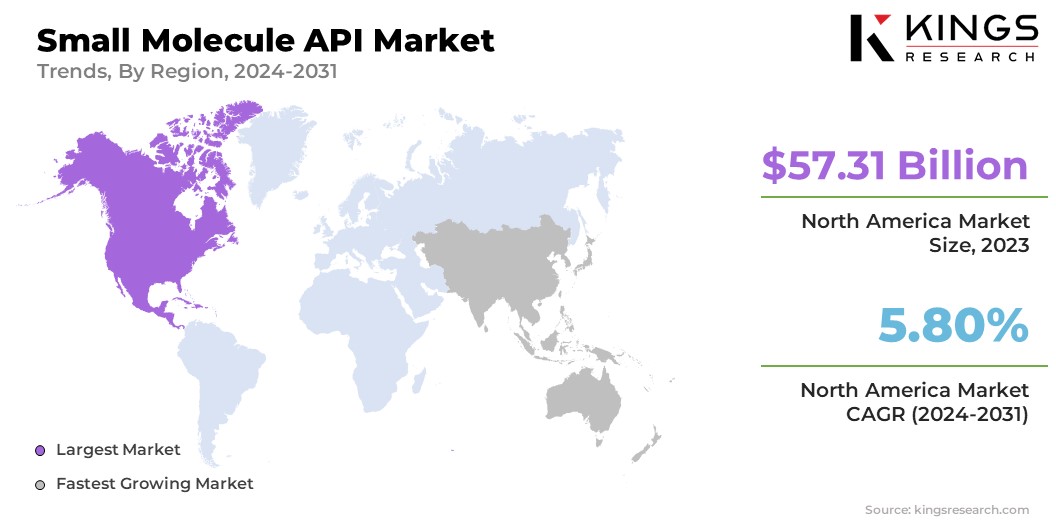

Small Molecule API Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America small molecule API market share stood around 35.09% in 2023 in the global market, with a valuation of USD 57.31 billion. This notable expansion is attributed to the region's advanced pharmaceutical research capabilities, stringent regulatory standards, and robust healthcare infrastructure. The region serves as a hub for innovation in drug development, particularly in key therapeutic areas such as oncology and neurology, where small molecule APIs are integral to treatment advancements.

Strategic investments in the biotechnology and pharmaceutical sectors, coupled with a supportive regulatory environment, foster regional market expansion. Additionally, North America's prominence in clinical trials and research validates the efficacy and safety of new APIs, reinforcing its pivotal role in shaping global trends within the market.

Asia-Pacific is anticipated to witness substantial growth at a robust CAGR of 7.81% over the forecast period. Rising healthcare expenditures, increasing prevalence of chronic diseases, and expanding pharmaceutical manufacturing capabilities are pivotal factors contributing to this considerable expansion. Countries such as China and India are emerging as major production hubs due to their cost-effective manufacturing processes and skilled workforce.

Additionally, growing investments in healthcare infrastructure and regulatory reforms are enhancing market access and increasing the development and production of small molecule APIs. The region's strategic importance is further underscored by its crucial role in global supply chains, catering to both domestic demand and international markets, thus propelling Asia-Pacific small molecule API market development.

Competitive Landscape

The global small molecule API market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Small Molecule API Market

- Johnson Matthey

- Pfizer Inc.

- Nanjing King-Friend Biochemical Pharmaceutical Co. Ltd.

- Sanofi S.A

- Bristol-Myers Squibb

- GlaxoSmithKline PLC

- GILEAD Sciences Inc.

- AstraZeneca

- Merck & Co. Inc.

- Teva Pharmaceuticals

Key Industry Development

- March 2023 (Partnership): CatSci Ltd announced a new partnership with AGC Pharma Chemicals, a global small molecule Contract Development and Manufacturing Organization (CDMO). This collaboration aimed to leverage AGC's expertise in GMP manufacturing, enabling CatSci's customers to scale production from kilos to tonnes for clinical phase projects. The alliance sought to streamline the path from research to commercialization, enhancing API production efficiency and compliance.

The global small molecule API market is segmented as:

By Type

- Synthetic

- Biotech

By Manufacturer

- In-house

- Outsourced

By Application

- Cardiology

- Oncology

- CNS & Neurology

- Endocrinology

- Gastroenterology

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership