Automotive and Transportation

Specialty Vehicle Market

Specialty Vehicle Market Size, Share, Growth & Industry Analysis, By Vehicle Type (Emergency & Rescue Vehicles, Recreational Vehicles (RVs), Construction & Mining Vehicles, Defense & Military Vehicles, Agricultural Vehicles), By Application, By Propulsion Type, By End User, and Regional Analysis, 2024-2031

Pages : 200

Base Year : 2023

Release : March 2025

Report ID: KR1440

Market Definition

A specialty vehicle is a customized or purpose-built vehicle designed for specific applications beyond standard transportation. These vehicles are engineered to meet specialized needs of industries, including emergency services, construction, recreation, and commercial operations.

Specialty vehicles often feature unique modifications, advanced equipment, and structural enhancements tailored to ensure optimal performance, safety, and efficiency in specialized environments.

Specialty Vehicle Market Overview

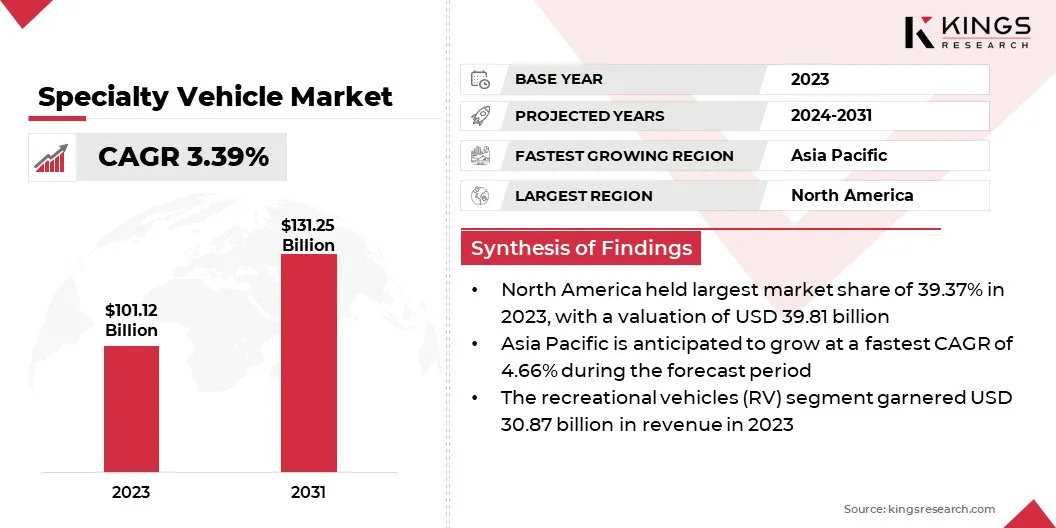

The global specialty vehicle market size was valued at USD 101.12 billion in 2023 and is projected to grow from USD 104.00 billion in 2024 to USD 131.35 billion by 2031, exhibiting a CAGR of 3.39% during the forecast period. Advancements in electric and autonomous vehicle technologies are driving the market growth, enabling enhanced efficiency, safety, and reduced emissions.

Government incentives and regulations promoting sustainable transportation solutions are further promoting manufacturers to innovate and expand their product offerings to meet evolving industry needs.

Major companies operating in the global specialty vehicle industry are General Motors, Mercedes-Benz Group AG, AB Volvo, REV Group, Oshkosh Corporation, Force Motors Ltd., Rosenbauer International AG., MORITA HOLDINGS CORPORATION, Iveco Group N.V., Federal Signal Corporation, Matthews Specialty Vehicles, LDV INC., Alamo Group Inc., Braun Industries, Inc., ShinMaywa Industries, Ltd., and others.

The surge in infrastructure development and construction projects worldwide is boosting demand for specialty vehicles such as dump trucks, cement mixers, and crane-mounted trucks. Rapid urbanization, industrialization, and government-backed smart city initiatives are increasing the need for heavy-duty vehicles designed for material handling and site operations.

- According to the 2023 reports from the National Action Plans (NAPs) on Business and Human Rights, the global construction industry is projected to grow by USD 4.5 trillion, reaching USD 15.2 trillion over the next decade. China, India, the United States, and Indonesia are anticipated to account for 58.3% of this expansion.

Construction firms are investing in advanced specialty vehicles to enhance efficiency and minimize downtime. The adoption of fuel-efficient and technologically advanced machinery is improving operational performance. The market is benefiting from strong investments in large-scale infrastructure projects, including highways, bridges, and commercial buildings.

Key Highlights:

- The global specialty vehicle market size was recorded at USD 101.12 billion in 2023.

- The market is projected to grow at a CAGR of 3.39% from 2024 to 2031.

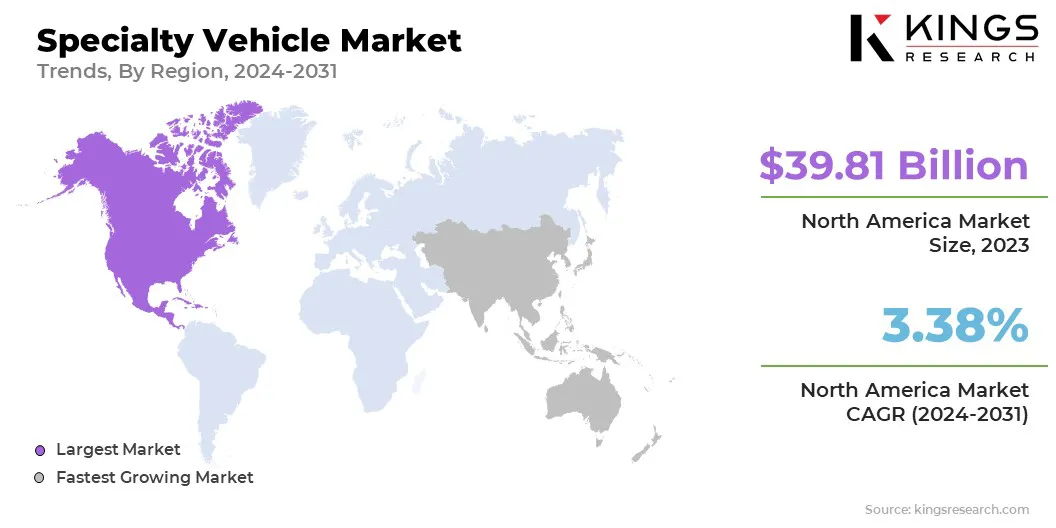

- North America held a share of 39.37% in 2023, valued at USD 39.81 billion.

- The recreational vehicles (RVs) segment garnered USD 30.87 billion in revenue in 2023.

- The recreational & tourism segment is expected to reach USD 41.83 billion by 2031.

- The internal combustion engine (ICE) vehicles segment secured the largest revenue share of 88.39% in 2023.

- The private fleet operators segment is set to grow at a CAGR of 3.98% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 4.66% through the projection period.

Market Driver

"Growth of Last-Mile Delivery Services"

The rapid expansion of e-commerce and on-demand delivery services is propelling the growth of the specialty vehicle market. Logistics providers are investing in customized delivery vans and temperature-controlled transport solutions to optimize supply chain efficiency. Rising consumer expectations for faster delivery timelines are increasing the demand for electric and automated last-mile delivery vehicles.

- The World Economic Forum indicates that global demand for last-mile delivery is rising rapidly and is expected to grow by 78% by 2030.

Companies are adopting smart fleet management technologies to enhance route optimization and reduce operational costs. Urban logistics solutions, including compact specialty vehicles for congested city areas, are gaining traction. The increasing need for efficient, sustainable, and technology-driven last-mile transportation solutions is accelerating market growth.

Market Challenge

"High Manufacturing and Operational Costs"

The expansion of the specialty vehicle market is impeded by high manufacturing and operational costs, supported by advanced engineering requirements, stringent regulatory compliance, and the integration of cutting-edge technologies. The rising costs of raw materials, such as high-strength steel and electronic components, further add to the financial burden on manufacturers.

To address this challenge, companies are investing in cost-effective production methods, such as modular vehicle design and advanced automation. Strategic partnerships and mergers are being leveraged to optimize supply chain efficiencies. Additionally, businesses are adopting sustainable materials and energy-efficient solutions to reduce long-term operational costs while enhancing profitability.

Market Trend

"Advancements in Electric and Autonomous Specialty Vehicles"

The transition to electric mobility and autonomous technologies is influencing the specialty vehicle market. Governments and businesses are focusing on sustainability by adopting electric specialty vehicles, including electric ambulances, last-mile delivery vans, and automated utility trucks.

Advances in battery technology, improved charging infrastructure, and regulatory incentives are boosting adoption. The integration of autonomous driving systems is improving efficiency and reducing labor costs across industries.

Fleet operators are investing in intelligent vehicle management systems, enhancing operational performance. Innovations in automation and electrification are accelerating the adoption of next-generation specialty vehicles across commercial, industrial, and emergency sectors.

- The 2024 World Resources Institute report highlights that policies such as the Inflation Reduction Act and the Bipartisan Infrastructure Law have facilitated over USD 154 billion in investments in electric vehicle production and component manufacturing. By 2035, EVs are expected to account for 71% of U.S. car sales, potentially reaching 80%-100% by 2050.

Specialty Vehicle Market Report Snapshot

|

Segmentation |

Details |

|

By Vehicle Type |

Emergency & Rescue Vehicles, Recreational Vehicles (RVs), Construction & Mining Vehicles, Defense & Military Vehicles, Agricultural Vehicles, Medical Mobile Units, Utility & Service Vehicles, Special-Purpose Vehicles |

|

By Application |

Transportation & Logistics, Medical & Healthcare, Emergency Response & Public Safety, Construction & Mining, Military & Defense, Recreational & Tourism, Municipal & Utility Services |

|

By Propulsion Type |

Internal Combustion Engine (ICE) Vehicles, Electric Vehicles (EVs) |

|

By End User |

Government & Municipalities, Private Fleet Operators, Defense Organizations, Hospitality & Tourism, Healthcare Institutions |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Vehicle Type (Emergency & Rescue Vehicles, Recreational Vehicles (RVs), Construction & Mining Vehicles, Defense & Military Vehicles, Agricultural Vehicles, Medical Mobile Units, Utility & Service Vehicles, and Special-Purpose Vehicles): The recreational vehicles (RVs) segment earned USD 30.87 billion in 2023 due to rising consumer demand for mobile travel solutions, increasing adoption of luxury and off-grid living experiences, and advancements in vehicle design enhancing comfort, connectivity, and fuel efficiency.

- By Application (Transportation & Logistics, Medical & Healthcare, Emergency Response & Public Safety, Construction & Mining, Military & Defense, Recreational & Tourism, and Municipal & Utility Services): The recreational & tourism segment held a share of 29.82% in 2023, propelled by the increasing demand for motorhomes, all-terrain vehicles, and specialty transport solutions, supported by rising disposable income, growing interest in outdoor leisure activities, and expanding tourism infrastructure worldwide..

- By Propulsion Type (Internal Combustion Engine (ICE) Vehicles, Electric Vehicles (EVs): The internal combustion engine (ICE) vehicles segment is projected to reach USD 113.84 billion by 2031, fueled by its established infrastructure, higher load-bearing capacity, and widespread availability of fuel, making it the preferred choice for applications requiring long-range operations and high-performance capabilities.

- By End User (Government & Municipalities, Private Fleet Operators, Defense Organizations, Hospitality & Tourism, and Healthcare Institutions): The private fleet operators segment is set to grow at a CAGR of 3.98% through the forecast period, mainly attributed to the increasing demand for customized, high-performance vehicles to optimize logistics, enhance operational efficiency, and reduce long-term costs through fleet management solutions.

Specialty Vehicle Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America specialty vehicle market captured a substantial share of around 39.37% in 2023, valued at USD 39.81 billion. The North America defense sector is contributing significantly to this growth.

Rising military budgets and ongoing modernization programs are increasing the demand for armored personnel carriers, tactical transport vehicles, and unmanned ground vehicles.

The U.S. Department of Defense is investing in next-generation specialty vehicles with hybrid powertrains, advanced surveillance systems, and autonomous capabilities to enhance mobility and operational efficiency.

The focus on enhancing homeland security and border patrol operations is further accelerating demand for ruggedized specialty vehicles optimized for high-performance defense applications.

- In October 2024, General Dynamics Land Systems (GDLS), a subsidiary of General Dynamics, supplied two TRX vehicle prototypes to the U.S. Army for mobility testing and soldier evaluations. Designed with a modular architecture, the TRX vehicle aligns with both current and future military requirements. Featuring a hybrid-electric engine, it supports the U.S. Army’s efforts to lower its carbon footprint while delivering substantial exportable power for mission command operations.

The rise in climate-related disasters, including wildfires, hurricanes, and flooding, is creating a demand for specialized emergency response vehicles in North America. Government agencies and private organizations are investing in fire suppression trucks, mobile medical units, and search-and-rescue vehicles equipped with advanced communication and tracking systems.

The need for rapid response capabilities is fueling innovations in off-road, all-terrain, and amphibious specialty vehicles designed for disaster relief and crisis management. Federal and state funding for emergency preparedness is further bolstering regional market growth by expanding fleets and modernizing vehicle capabilities.

Asia Pacific specialty vehicle industry is likely to grow at a robust CAGR of 4.66% over the forecast period. The expansion of the food, pharmaceutical, and e-commerce industries is increasing the demand for specialized logistics vehicles in Asia Pacific.

The rise in temperature-sensitive product transportation is fueling investments in refrigerated trucks, insulated delivery vans, and pharmaceutical transport vehicles. Governments are expanding cold chain infrastructure to support vaccine distribution and perishable goods supply chains.

Logistics companies are integrating IoT-enabled real-time tracking and energy-efficient cooling systems in specialty transport vehicles to enhance operational reliability and meet regulatory standards for temperature-controlled logistics.

- In January 2025, Eicher Trucks and Buses, a division of VE Commercial Vehicles, unveiled its electric-first range of Small Commercial Vehicles (SCVs), the Eicher Pro X Series, at the Bharat Mobility Global Expo 2025. This launch signifies Eicher’s strategic entry into the rapidly expanding 2-3.5T segment, underscoring the company’s commitment to transforming last-mile logistics and supporting India’s growth agenda.

Furthermore, the increasing focus on military modernization across Asia Pacific is boosting regional market expansion. Countries such as India, China, and South Korea are investing in next-generation defense vehicles, including armored personnel carriers, tactical transport trucks, and unmanned ground vehicles.

Rising geopolitical tensions and defense spending are driving procurement programs for high-mobility specialty vehicles engineered for border security and combat operations.

The integration of hybrid powertrains, advanced surveillance systems, and autonomous capabilities is further enhancing the efficiency and operational readiness of military specialty vehicles in the region.

Regulatory Frameworks

- In the U.S., specialty vehicles are regulated by the National Highway Traffic Safety Administration (NHTSA) under the Department of Transportation. The Federal Motor Vehicle Safety Standards (FMVSS) establish minimum safety performance requirements for motor vehicles and motor vehicle equipment. These standards address various aspects, including crash avoidance, crashworthiness, and post-crash survivability.

- The European Union (EU) enforces uniform vehicle regulations to ensure safety and environmental protection across member states. The EU's Whole Vehicle Type Approval (WVTA) system requires that vehicles, including specialty vehicles, meet specific technical and safety standards before narket entry. Emissions standards are defined under the Euro emissions standards, which set exhaust limits for new vehicles.

- China's specialty vehicle industry is regulated by the Ministry of Industry and Information Technology (MIIT), which sets the Guobiao (GB) standards for vehicle safety and emissions. These national standards define technical requirements for various vehicle types, including specialty vehicles. Additionally, China participtes in the UNECE 1998 Agreement, contributing to global technical regulations.

- Japan enforces vehicle regulations through its Ministry of Land, Infrastructure, Transport and Tourism (MLIT). The country adheres to both the UNECE 1958 and 1998 Agreements, implementing numerous UNECE regulations domestically. Japan's vehicle standards cover safety, emissions, and noise levels, ensuring that specialty vehicles comply with international and national requirements.

- The Automotive Industry Standards (AIS) and Bharat Stage Emission Standards (BSES) govern India's specialty vehicle regulations. The Ministry of Road Transport and Highways (MoRTH) oversees these standards, with a major focus on vehicle safety and emissions. India is also a signatory to the UNECE 1998 Agreement, participating in the formulation of global technical regulations.

- South Korea's specialty vehicle regulations are managed by the Ministry of Land, Infrastructure and Transport (MOLIT). The Korean Motor Vehicle Safety Standards (KMVSS) outline safety and emissions requirements for vehicles.

Competitive Landscape

The global specialty vehicle market is characterized by a large number of participants, including both established corporations and emerging players. Market participants are implementing strategies focused on business expansion through mergers and acquisitions to enhance their product offerings.

This approach enables companies to strengthen their market presence, facilitates access to new technologies, and expands the customer base. By integrating complementary expertise and resources, businesses can accelerate innovation and improve operational efficiency.

Additionally, these strategic intiatives enable companies to gain a competitive edge by diversifying their product portfolios and catering to evolving consumer demands. The rise in mergers and acquisitions is propelling market growth by fostering innovation, improving supply chain capabilities, and enhancing overall competitiveness.

- In May 2024, Oshkosh Corporation announced a definitive agreement to acquire AUSACORP S.L. (AUSA), a global manufacturer of wheeled dumpers, rough terrain forklifts, and telehandlers for construction, material handling, agriculture, landscaping, and specialty equipment. Upon completion, AUSA will be integrated into the Oshkosh Access segment, complementing the JLG telehandler lineup and enhancing the portfolio alongside Hinowa’s tracked dumpers and forklifts, further strengthening Oshkosh’s position in the access equipment market.

List of Key Companies in Specialty Vehicle Market:

- General Motors

- Mercedes-Benz Group AG

- AB Volvo

- REV Group

- Oshkosh Corporation

- Force Motors Ltd.

- Rosenbauer International AG.

- MORITA HOLDINGS CORPORATION

- Iveco Group N.V.

- Federal Signal Corporation

- Matthews Specialty Vehicles

- LDV INC.

- Alamo Group Inc.

- Braun Industries, Inc.

- ShinMaywa Industries, Ltd.

Recent Developments (M&A/Product Launch)

- In February 2025, General Motors acquired GM Cruise Holdings LLC following approval from the Cruise Board of Directors. Now a wholly-owned subsidiary of GM, Cruise will focus on advancing autonomous vehicle technology and driver assistance systems. GM plans to integrate Cruise’s technology into its Super Cruise platform, which enables hands-free driving across 750,000 miles of of North American roads.

- In January 2025, Mercedes-Benz introduced two flagship electric vehicles, the G580 EQ Edition One and the EQS SUV 450. The G580 retains its rugged design and off-road capabilities, featuring four electric motors for enhanced performance. it offers a water-wading depth of 850 mm, the ability to climb 45-degree inclines, and a G-TURN function enabling 720-degree on-the-spot rotations, redefining off-road mobility.

- In January 2025, Force Motors Ltd secured a contract to deliver 2,429 ambulances to the Medical Health and Family Welfare Department of Uttar Pradesh, India, with deliveries scheduled between December 2024 and March 2025.

- In June 2024, Mercedes-Benz Special Trucks expanded its product lineup by offering the Zetros truck series with a factory-built protected driver’s cab. The three-axle, all-wheel-drive Zetros (6x6) is now available as an armored vehicle, with additional variants, including the two-axle 4x4 and four-axle 8x8, to be manufactured with protective features at the Wörth truck plant starting in 2025.

- In June 2024, Mercedes-Benz Special Trucks announced the introduction of the Zetros off-road truck in a four-axle, all-wheel-drive (8x8) configuration, expanding the lineup from two-axle to four-axle models. The Zetros 8x8, set to be showcased at Eurosatory, is part of a significant contract with the Canadian Ministry of Defence, under which more than 1,500 Zetros vehicles will be delivered in the coming years.

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years